Form 4626 Alternative Minimum TaxCorporations 2023-2026

Understanding IRS Form 4626 for Alternative Minimum Tax Corporations

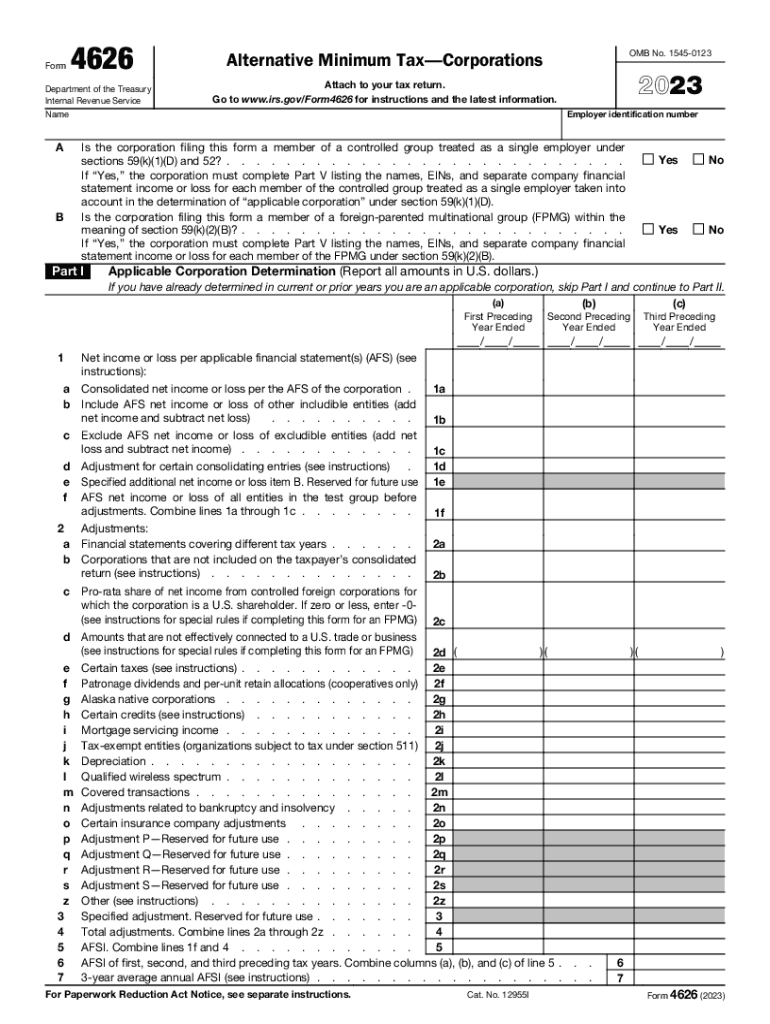

IRS Form 4626 is specifically designed for corporations to report their Alternative Minimum Tax (AMT) liabilities. This form is crucial for corporations that may be subject to AMT, which is a separate tax calculation that ensures corporations pay a minimum amount of tax, regardless of deductions and credits. The form allows businesses to calculate their AMT based on their taxable income and certain adjustments, ensuring compliance with federal tax regulations.

Steps to Complete IRS Form 4626

Completing IRS Form 4626 involves several key steps:

- Begin by gathering necessary financial documents, including income statements and tax records.

- Calculate your regular tax liability before adjustments.

- Identify and apply any adjustments required for AMT, such as ACE depreciation adjustments.

- Fill out the form by entering the calculated figures in the appropriate sections.

- Review the completed form for accuracy before submission.

Obtaining IRS Form 4626

IRS Form 4626 can be obtained directly from the IRS website in a fillable PDF format. This allows for easy completion and printing. Additionally, the form is available at various tax preparation offices and libraries. Ensure you are using the most current version of the form to comply with the latest tax regulations.

Key Elements of IRS Form 4626

Several key elements are essential when filling out Form 4626:

- Taxable Income: This is the starting point for calculating AMT.

- Adjustments: These include ACE adjustments and other modifications to taxable income.

- AMT Credit: If applicable, this credit can reduce future tax liabilities.

- Signature: The form must be signed by an authorized representative of the corporation.

IRS Guidelines for Form 4626

The IRS provides specific guidelines for completing Form 4626. These guidelines outline eligibility criteria, required documentation, and the importance of accurate reporting. Corporations must adhere to these guidelines to avoid penalties and ensure compliance with federal tax laws. It is advisable to consult IRS publications or a tax professional for detailed instructions.

Filing Deadlines for IRS Form 4626

Corporations must file IRS Form 4626 by the due date of their corporate tax return. Generally, this means the form is due on the fifteenth day of the fourth month following the end of the corporation's tax year. If the due date falls on a weekend or holiday, the deadline is extended to the next business day. Timely filing is crucial to avoid penalties.

Quick guide on how to complete form 4626 alternative minimum taxcorporations

Effortlessly Prepare Form 4626 Alternative Minimum TaxCorporations on Any Device

Digital document management has gained traction among businesses and individuals. It serves as an ideal environmentally friendly substitute for conventional printed and signed documents, allowing you to access the needed form and securely store it online. airSlate SignNow equips you with all the resources required to create, modify, and electronically sign your documents swiftly without interruptions. Manage Form 4626 Alternative Minimum TaxCorporations on any platform using airSlate SignNow's Android or iOS applications and streamline any document-related processes today.

Edit and eSign Form 4626 Alternative Minimum TaxCorporations with Ease

- Obtain Form 4626 Alternative Minimum TaxCorporations and then select Get Form to commence.

- Use the tools we provide to complete your document.

- Emphasize relevant sections of your documents or obscure sensitive information with tools specifically offered by airSlate SignNow for this purpose.

- Create your signature using the Sign feature, which takes just seconds and carries the same legal significance as a conventional wet ink signature.

- Review the details and then click the Done button to preserve your changes.

- Choose your preferred method for delivering your form, whether by email, text message (SMS), invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, and mistakes that require printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device of your choice. Modify and eSign Form 4626 Alternative Minimum TaxCorporations to ensure excellent communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 4626 alternative minimum taxcorporations

Create this form in 5 minutes!

How to create an eSignature for the form 4626 alternative minimum taxcorporations

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the IRS Form 4626 and how do I use it?

The IRS Form 4626 is used to calculate the Alternative Minimum Tax (AMT) for corporations. To use it effectively, you must gather relevant financial information from your company's records. Implementing airSlate SignNow allows you to handle the eSigning and secure sharing of Form 4626 with ease, ensuring compliance with IRS requirements.

-

How can airSlate SignNow assist with the preparation of IRS Form 4626?

airSlate SignNow helps streamline the preparation of IRS Form 4626 by providing you with templates and intuitive tools. With our platform, you can fill out the form electronically and incorporate digital signatures seamlessly. This not only saves time but also enhances accuracy, reducing potential errors associated with manual entry.

-

Is there a cost associated with using airSlate SignNow for IRS Form 4626?

Yes, airSlate SignNow offers various pricing plans tailored to meet different business needs. Our cost-effective solution allows you to choose a plan that fits your budget while providing essential tools, including the capability to manage IRS Form 4626 efficiently. You'll find that the benefits greatly outweigh the costs.

-

Can I integrate airSlate SignNow with other accounting software for IRS Form 4626?

Absolutely! airSlate SignNow integrates seamlessly with popular accounting and financial software, enhancing your workflow for processes like completing IRS Form 4626. This integration ensures that all your data is synchronized, making it easier for you to prepare forms and manage your finances efficiently.

-

What are the key features of airSlate SignNow relevant to IRS Form 4626?

Key features of airSlate SignNow relevant to IRS Form 4626 include electronic signatures, document templates, and automated workflows. With these tools, you can ensure your forms are completed quickly and signed securely. Additionally, our platform provides real-time tracking, so you can monitor the status of your documents.

-

How does airSlate SignNow ensure the security of IRS Form 4626?

airSlate SignNow prioritizes the security of your documents, including IRS Form 4626, by implementing advanced encryption and security protocols. We comply with industry standards and regulations to protect sensitive information. With our platform, you can eSign and share documents without worrying about data bsignNowes.

-

What benefits does airSlate SignNow provide for handling IRS forms?

Using airSlate SignNow for IRS forms like Form 4626 offers numerous benefits, including efficiency, accuracy, and enhanced collaboration. Our user-friendly interface simplifies the signing process and reduces the chance of errors. Ultimately, this helps you save time and streamline your tax reporting process.

Get more for Form 4626 Alternative Minimum TaxCorporations

- Ozark technical community collegewhere do i send my transcripts 2014 2019 form

- Cancellation ifyoucancelbeforeapril29ththereisa100 form

- 16 scholarship 2015 2019 form

- 2019 2020 loan adjustment form

- 2018 2019 loan adjustment form

- Suburb town form

- Johnson memorial scholarship foundation inc form

- Request for permit amendmentupdate extension renewal or cancellation form

Find out other Form 4626 Alternative Minimum TaxCorporations

- Can I Sign New York Business Operations Promissory Note Template

- Sign Oklahoma Business Operations Contract Safe

- Sign Oregon Business Operations LLC Operating Agreement Now

- Sign Utah Business Operations LLC Operating Agreement Computer

- Sign West Virginia Business Operations Rental Lease Agreement Now

- How To Sign Colorado Car Dealer Arbitration Agreement

- Sign Florida Car Dealer Resignation Letter Now

- Sign Georgia Car Dealer Cease And Desist Letter Fast

- Sign Georgia Car Dealer Purchase Order Template Mobile

- Sign Delaware Car Dealer Limited Power Of Attorney Fast

- How To Sign Georgia Car Dealer Lease Agreement Form

- How To Sign Iowa Car Dealer Resignation Letter

- Sign Iowa Car Dealer Contract Safe

- Sign Iowa Car Dealer Limited Power Of Attorney Computer

- Help Me With Sign Iowa Car Dealer Limited Power Of Attorney

- Sign Kansas Car Dealer Contract Fast

- Sign Kansas Car Dealer Agreement Secure

- Sign Louisiana Car Dealer Resignation Letter Mobile

- Help Me With Sign Kansas Car Dealer POA

- How Do I Sign Massachusetts Car Dealer Warranty Deed