Form 4626 2014

What is the Form 4626

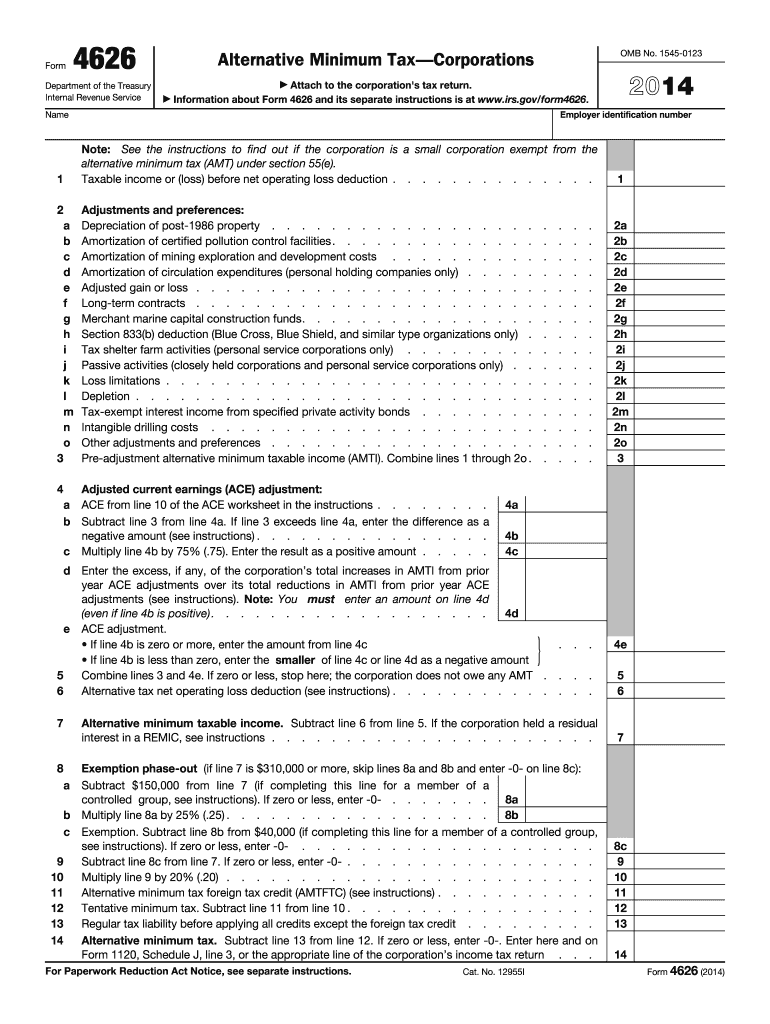

The Form 4626 is a tax form used by corporations to calculate their alternative minimum tax (AMT) liability. This form is essential for corporations that may be subject to the AMT, which is designed to ensure that all corporations pay a minimum amount of tax, regardless of deductions and credits. The form allows businesses to report their income, deductions, and credits, ultimately determining their AMT obligation. Understanding the purpose and requirements of Form 4626 is crucial for compliance with U.S. tax laws.

How to use the Form 4626

Using Form 4626 involves several key steps. First, gather all necessary financial information, including income, deductions, and credits applicable to the corporation. Next, complete the form by following the provided instructions, ensuring that all figures are accurate and reflective of the corporation's financial situation. After filling out the form, it must be submitted along with the corporation's tax return. It is important to review the form for any errors or omissions before submission to avoid potential penalties.

Steps to complete the Form 4626

Completing Form 4626 requires a systematic approach. Start by entering the corporation's name and identifying information at the top of the form. Then, proceed to calculate the alternative minimum taxable income (AMTI) by adjusting regular taxable income for specific items. Next, apply the AMT exemption amount, if applicable, and calculate the tentative minimum tax. Finally, compare the tentative minimum tax to the regular tax liability to determine if any AMT is owed. Ensure all calculations are double-checked for accuracy.

Legal use of the Form 4626

Form 4626 is legally binding when completed accurately and submitted according to IRS regulations. It is important to comply with all relevant tax laws to ensure that the form is accepted by the IRS. The form must be signed by an authorized representative of the corporation, affirming that the information provided is true and complete. Failure to adhere to legal requirements may result in penalties, including fines or additional tax liabilities.

Filing Deadlines / Important Dates

Filing deadlines for Form 4626 align with the corporation's tax return due dates. Typically, corporations must file their tax returns by the fifteenth day of the fourth month following the end of their fiscal year. For corporations operating on a calendar year, this means the deadline is April 15. It is crucial to be aware of these deadlines to avoid late filing penalties and interest on any taxes owed. Extensions may be available, but they must be requested in advance.

Required Documents

To complete Form 4626, several documents are necessary. Corporations should gather financial statements, including income statements and balance sheets, to provide accurate information on income and expenses. Additionally, any documentation related to tax credits and deductions should be included. This may consist of records of prior tax returns, schedules of depreciation, and any other relevant financial data. Having these documents on hand will facilitate a smoother completion process.

Penalties for Non-Compliance

Non-compliance with Form 4626 requirements can lead to significant penalties. If a corporation fails to file the form by the deadline, it may incur late filing penalties, which can accumulate over time. Additionally, inaccuracies in the form can result in audits, additional taxes owed, and further penalties. It is essential for corporations to ensure that Form 4626 is completed accurately and submitted on time to avoid these consequences.

Quick guide on how to complete 2014 form 4626

Effortlessly manage Form 4626 on any device

Digital document administration has gained traction among companies and individuals. It offers an ideal sustainable substitute to traditional printed and signed papers, as you can access the necessary form and securely store it online. airSlate SignNow equips you with all the resources required to generate, alter, and electronically sign your documents swiftly without any hold-ups. Handle Form 4626 on any device with the airSlate SignNow Android or iOS applications and streamline any document-related processes today.

How to modify and electronically sign Form 4626 with ease

- Find Form 4626 and click Get Form to begin.

- Utilize the features we offer to complete your form.

- Select important sections of your documents or conceal sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Generate your electronic signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Verify all the details and click on the Done button to preserve your modifications.

- Choose how you wish to send your form, either via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misfiled documents, laborious form searching, or mistakes that necessitate printing new copies. airSlate SignNow satisfies your document management needs with just a few clicks from any device you prefer. Modify and electronically sign Form 4626 and ensure seamless communication throughout your document preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2014 form 4626

Create this form in 5 minutes!

How to create an eSignature for the 2014 form 4626

The way to make an electronic signature for your PDF online

The way to make an electronic signature for your PDF in Google Chrome

The best way to generate an electronic signature for signing PDFs in Gmail

The best way to make an eSignature right from your smartphone

The way to generate an electronic signature for a PDF on iOS

The best way to make an eSignature for a PDF on Android

People also ask

-

What is Form 4626 and how does it relate to airSlate SignNow?

Form 4626 is a tax form used for reporting certain business income and expenses. With airSlate SignNow, users can easily eSign and manage documents related to Form 4626, ensuring compliance and streamlining the filing process.

-

How can airSlate SignNow help in filling out Form 4626?

airSlate SignNow provides an intuitive platform for filling out and eSigning Form 4626. Users can upload their documents, add necessary fields, and invite others to sign, all while maintaining a secure and efficient workflow.

-

Is airSlate SignNow cost-effective for businesses needing to submit Form 4626?

Yes, airSlate SignNow offers competitive pricing plans that cater to businesses of all sizes, ensuring a cost-effective solution for managing documents, including Form 4626. With various subscription options, teams can choose a plan that fits their budget and needs.

-

What features does airSlate SignNow offer for managing Form 4626?

airSlate SignNow includes features such as customizable templates, secure cloud storage, and automated workflows that simplify the process of managing Form 4626. These tools help users save time and reduce errors when handling important tax documents.

-

Can I integrate airSlate SignNow with other software for Form 4626 processing?

Absolutely! airSlate SignNow offers seamless integrations with various CRM and accounting software, allowing users to incorporate Form 4626 processing into their existing workflows. This enhances efficiency and ensures that all documents are easily accessible.

-

What are the security measures in place for documents like Form 4626 with airSlate SignNow?

airSlate SignNow prioritizes security with advanced encryption and compliance with industry standards. Users can trust that their Form 4626 and other sensitive documents are protected, ensuring confidentiality and integrity.

-

How can airSlate SignNow improve the efficiency of submitting Form 4626?

By using airSlate SignNow, businesses can streamline the submission of Form 4626 through its easy eSigning process and automated reminders. This reduces delays, minimizes paperwork, and enhances overall productivity in tax-related tasks.

Get more for Form 4626

- Line instructions for form d 400 individual income ncgov

- Partnership tax forms and instructions ncdor

- C corporation tax return cd 405 instructions ncgov form

- Schedule of county sales and use taxes for claims ncgov form

- Submit originals only form

- Addresses and telephone numbers can be found online at httpswww form

- Nc nc 4 certificate w 4 home form

- Motor fuels claim for refund nonprofit ncgov form

Find out other Form 4626

- Can I eSign Wisconsin Legal Warranty Deed

- eSign New Hampshire Orthodontists Medical History Online

- eSign Massachusetts Plumbing Job Offer Mobile

- How To eSign Pennsylvania Orthodontists Letter Of Intent

- eSign Rhode Island Orthodontists Last Will And Testament Secure

- eSign Nevada Plumbing Business Letter Template Later

- eSign Nevada Plumbing Lease Agreement Form Myself

- eSign Plumbing PPT New Jersey Later

- eSign New York Plumbing Rental Lease Agreement Simple

- eSign North Dakota Plumbing Emergency Contact Form Mobile

- How To eSign North Dakota Plumbing Emergency Contact Form

- eSign Utah Orthodontists Credit Memo Easy

- How To eSign Oklahoma Plumbing Business Plan Template

- eSign Vermont Orthodontists Rental Application Now

- Help Me With eSign Oregon Plumbing Business Plan Template

- eSign Pennsylvania Plumbing RFP Easy

- Can I eSign Pennsylvania Plumbing RFP

- eSign Pennsylvania Plumbing Work Order Free

- Can I eSign Pennsylvania Plumbing Purchase Order Template

- Help Me With eSign South Carolina Plumbing Promissory Note Template