Irs Form 4626 for 2011

What is the IRS Form 4626 For

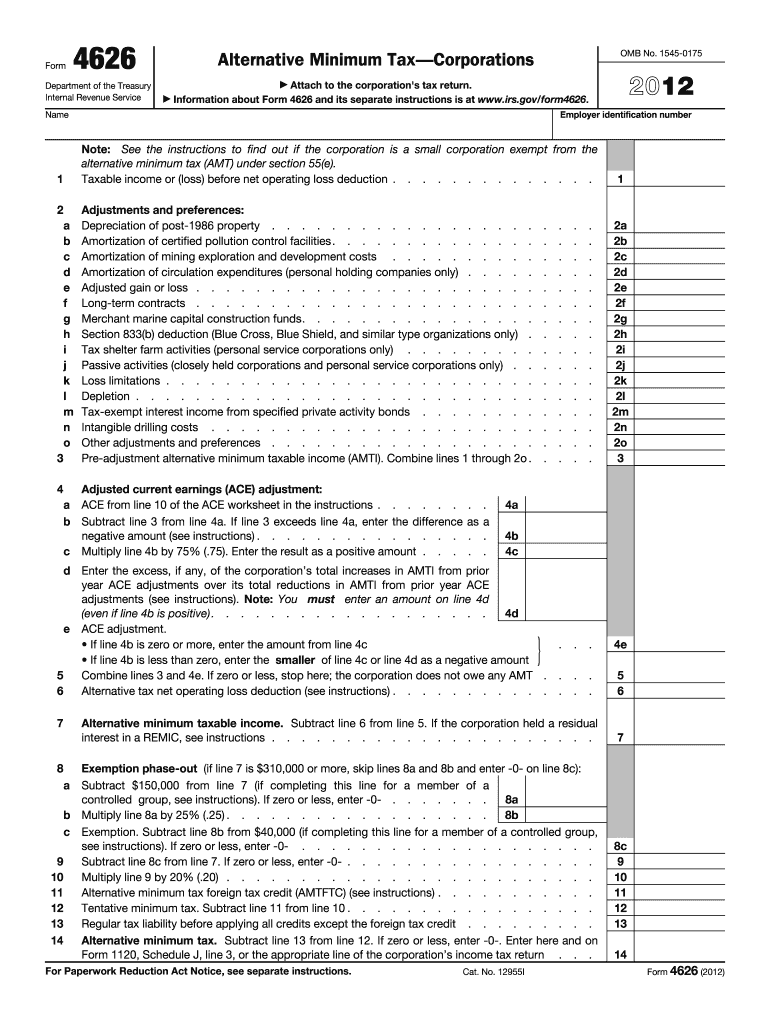

The IRS Form 4626 is utilized primarily for the purpose of calculating the Alternative Minimum Tax (AMT) for corporations. This form is essential for businesses that may be subject to AMT, ensuring they comply with tax regulations while accurately reporting their tax liabilities. The form helps in determining whether a corporation owes additional taxes beyond the standard tax calculation, which can be crucial for financial planning and compliance.

How to Obtain the IRS Form 4626

To obtain the IRS Form 4626, individuals can visit the official IRS website, where the form is available for download in PDF format. Additionally, taxpayers can request a physical copy by contacting the IRS directly or visiting local IRS offices. It is important to ensure that you are using the most current version of the form to comply with the latest tax regulations.

Steps to Complete the IRS Form 4626

Completing the IRS Form 4626 involves several key steps:

- Begin by entering your corporation's identifying information, including the name, address, and Employer Identification Number (EIN).

- Calculate your regular tax liability using the appropriate tax rates and deductions.

- Determine the adjustments and preferences that apply to your corporation, as these will affect your AMT calculation.

- Complete the AMT calculation section, which will guide you through determining if you owe any additional taxes.

- Review your entries for accuracy and ensure all required signatures are included before submission.

Legal Use of the IRS Form 4626

The IRS Form 4626 is legally binding when completed accurately and submitted in accordance with IRS guidelines. This form must be filed by corporations that meet specific criteria for AMT, ensuring compliance with federal tax laws. Using electronic signature solutions can enhance the legal validity of the form, provided they adhere to the necessary eSignature regulations.

Filing Deadlines / Important Dates

Filing deadlines for the IRS Form 4626 typically align with the corporate tax return due dates. Corporations must file their tax returns by the fifteenth day of the fourth month following the end of their tax year. If the corporation requires an extension, it is crucial to file Form 4626 by the extended deadline to avoid penalties. Keeping track of these dates is essential for maintaining compliance and avoiding interest charges.

Penalties for Non-Compliance

Failure to file the IRS Form 4626 or inaccuracies in the form can lead to significant penalties. The IRS may impose fines for late filing, and corporations may also be subject to interest on any unpaid taxes. Additionally, non-compliance can trigger audits, which can further complicate a corporation's tax situation. It is advisable for corporations to ensure timely and accurate submissions to mitigate these risks.

Quick guide on how to complete irs form 4626 for 2011

Effortlessly Prepare Irs Form 4626 For on Any Device

Digital document management has become increasingly favored by businesses and individuals alike. It serves as an excellent eco-conscious substitute for conventional printed and signed paperwork, allowing you to access the necessary form and securely store it online. airSlate SignNow equips you with all the resources required to create, modify, and electronically sign your documents swiftly without delays. Manage Irs Form 4626 For on any device using the airSlate SignNow applications for Android or iOS and streamline any document-related process today.

How to Modify and Electronically Sign Irs Form 4626 For with Ease

- Find Irs Form 4626 For and click Get Form to initiate.

- Utilize the tools we offer to complete your form.

- Emphasize relevant segments of your documents or obscure sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Create your signature using the Sign tool, which takes only a few seconds and carries the same legal validity as a traditional wet ink signature.

- Review all the information and click the Done button to save your changes.

- Choose how you wish to deliver your form: via email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form navigation, or mistakes that necessitate reprinting new document copies. airSlate SignNow addresses your document management needs with just a few clicks from any device of your choice. Modify and electronically sign Irs Form 4626 For and ensure exceptional communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct irs form 4626 for 2011

Create this form in 5 minutes!

How to create an eSignature for the irs form 4626 for 2011

How to generate an electronic signature for your PDF file online

How to generate an electronic signature for your PDF file in Google Chrome

The way to make an eSignature for signing PDFs in Gmail

The best way to generate an electronic signature from your mobile device

How to make an electronic signature for a PDF file on iOS

The best way to generate an electronic signature for a PDF file on Android devices

People also ask

-

What is IRS Form 4626 for?

IRS Form 4626 is used to calculate the alternative minimum tax (AMT) for corporations. It ensures that corporations pay at least a minimum level of tax regardless of the deductions and credits they may claim. Understanding IRS Form 4626 is essential for compliance with tax regulations.

-

How can airSlate SignNow help with IRS Form 4626?

AirSlate SignNow allows businesses to efficiently send and eSign IRS Form 4626. With our platform, you can streamline the document signing process, ensuring timely compliance with tax regulations. This enhanced efficiency makes managing IRS Form 4626 easier for corporations.

-

What are the pricing options for airSlate SignNow?

AirSlate SignNow offers flexible pricing plans designed to fit various business needs, starting from a cost-effective solution for startups to more comprehensive packages for larger enterprises. By using airSlate SignNow, you can simplify processes, including handling IRS Form 4626, without breaking the bank.

-

Is airSlate SignNow secure for handling sensitive documents like IRS Form 4626?

Absolutely! Security is a top priority at airSlate SignNow. We provide bank-level encryption and secure storage, ensuring your sensitive documents, including IRS Form 4626, remain protected from unauthorized access and data bsignNowes.

-

Can I integrate airSlate SignNow with other software for IRS Form 4626 processing?

Yes, airSlate SignNow supports integrations with various software solutions, enhancing your workflow efficiency. By integrating with your existing systems, you can easily manage IRS Form 4626 alongside other financial and administrative documents seamlessly.

-

What features does airSlate SignNow offer for managing IRS Form 4626?

AirSlate SignNow includes features that streamline document management, such as customizable templates, automatic reminders, and eSignature functionality. These tools make it easier for businesses to fill out and submit IRS Form 4626 while ensuring compliance and accuracy.

-

How does airSlate SignNow improve document workflows for IRS Form 4626?

With airSlate SignNow, document workflows for IRS Form 4626 can be automated and optimized. Our platform allows for real-time collaboration, easy tracking of document status, and quick eSigning, which signNowly reduces the time required to complete tax forms.

Get more for Irs Form 4626 For

- Aging parent package delaware form

- Sale of a business package delaware form

- Legal documents for the guardian of a minor package delaware form

- New state resident package delaware form

- Delaware health care directive form

- Commercial property sales package delaware form

- Delaware advance directive form

- General partnership package delaware form

Find out other Irs Form 4626 For

- eSignature Oregon Amendment to an LLC Operating Agreement Free

- Can I eSign Hawaii Managed services contract template

- How Do I eSign Iowa Managed services contract template

- Can I eSignature Wyoming Amendment to an LLC Operating Agreement

- eSign Massachusetts Personal loan contract template Simple

- How Do I eSign Massachusetts Personal loan contract template

- How To eSign Mississippi Personal loan contract template

- How Do I eSign Oklahoma Personal loan contract template

- eSign Oklahoma Managed services contract template Easy

- Can I eSign South Carolina Real estate contracts

- eSign Texas Renter's contract Mobile

- How Do I eSign Texas Renter's contract

- eSign Hawaii Sales contract template Myself

- How Can I eSign Washington Real estate sales contract template

- How To eSignature California Stock Certificate

- How Can I eSignature Texas Stock Certificate

- Help Me With eSign Florida New employee checklist

- How To eSign Illinois Rental application

- How To eSignature Maryland Affidavit of Identity

- eSignature New York Affidavit of Service Easy