Instructions for Tax Return of Certain 2020-2026

Understanding the Instructions for Tax Return of Certain Organizations

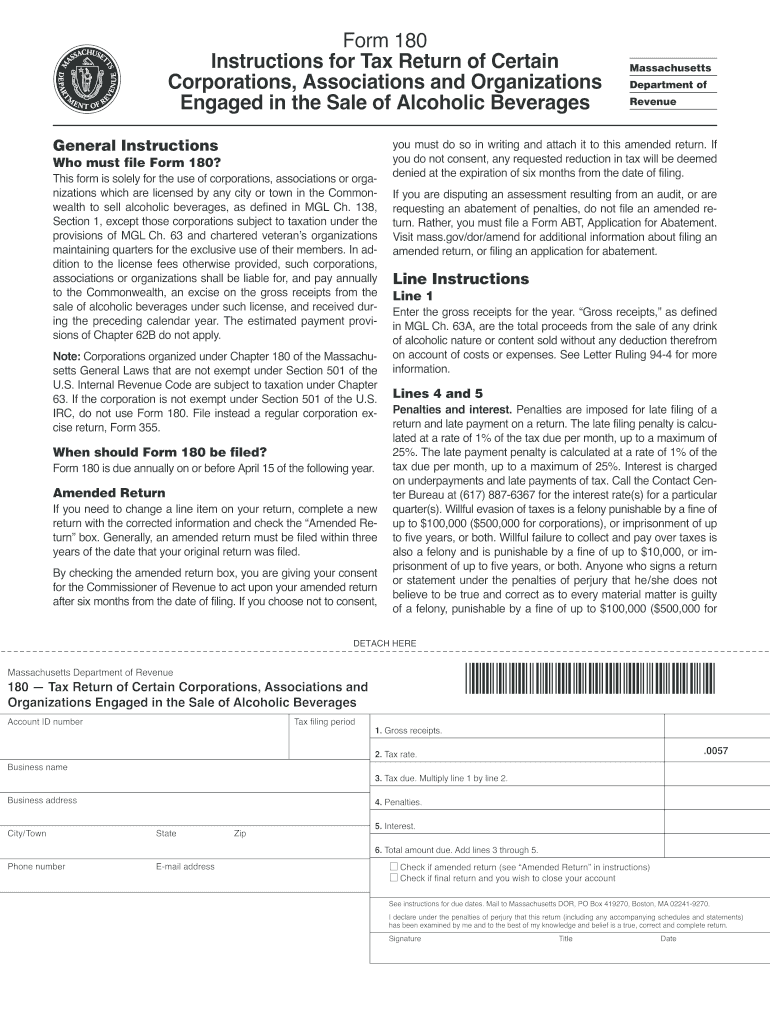

The Instructions for Tax Return of Certain organizations, often referred to as Form 180, provide essential guidance for organizations that need to report their revenue and expenses accurately. This form is crucial for ensuring compliance with federal and state tax regulations. Organizations must understand the specific requirements outlined in these instructions to avoid penalties and ensure their tax filings are processed smoothly.

Steps to Complete the Instructions for Tax Return of Certain Organizations

Completing the Instructions for Tax Return of Certain organizations involves several key steps:

- Gather necessary financial documents, including income statements and expense reports.

- Review the specific requirements outlined in the Instructions for Form 180 to ensure all information is accurate.

- Fill out the form carefully, ensuring that all sections are completed as per the guidelines.

- Double-check calculations and ensure that all figures are accurate.

- Submit the completed form through the designated method, whether online, by mail, or in person.

Required Documents for Filing Form 180

To successfully file the Instructions for Tax Return of Certain organizations, several documents are typically required:

- Financial statements, including balance sheets and income statements.

- Previous tax returns for reference.

- Any supporting documentation for deductions and credits claimed.

- Records of contributions and grants received during the tax year.

Legal Use of the Instructions for Tax Return of Certain Organizations

The Instructions for Tax Return of Certain organizations are legally binding and must be followed to ensure compliance with tax laws. Organizations that fail to adhere to these instructions may face penalties, including fines and increased scrutiny from tax authorities. It is vital to understand the legal implications of submitting inaccurate or incomplete information.

Filing Deadlines and Important Dates for Form 180

Organizations must be aware of the filing deadlines associated with the Instructions for Tax Return of Certain organizations. Typically, the deadline for submitting Form 180 is the fifteenth day of the fifth month after the end of the organization’s fiscal year. Missing this deadline can result in penalties, so it is essential to plan ahead and ensure timely submission.

State-Specific Rules for the Instructions for Tax Return of Certain Organizations

In addition to federal guidelines, organizations must also comply with state-specific rules regarding the Instructions for Tax Return of Certain organizations. Each state may have its own requirements for filing, including additional forms or documentation. It is important for organizations to research and understand these state-specific regulations to ensure full compliance.

Quick guide on how to complete instructions for tax return of certain

Prepare Instructions For Tax Return Of Certain effortlessly on any device

Web-based document management has become increasingly favored by businesses and individuals alike. It serves as an ideal environmentally-friendly alternative to traditional printed and signed papers, as you can obtain the appropriate form and securely store it online. airSlate SignNow provides you with all the resources necessary to create, modify, and eSign your documents swiftly without delays. Manage Instructions For Tax Return Of Certain on any platform using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

How to modify and eSign Instructions For Tax Return Of Certain with ease

- Obtain Instructions For Tax Return Of Certain and then click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Highlight pertinent sections of the documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign feature, which takes mere seconds and carries the same legal validity as a traditional wet ink signature.

- Review all details, then click on the Done button to save your changes.

- Select your preferred method to send your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate the hassle of lost or misplaced documents, tedious form searches, and errors that necessitate printing new document copies. airSlate SignNow fulfills your document management requirements in just a few clicks from any device you choose. Edit and eSign Instructions For Tax Return Of Certain while ensuring outstanding communication throughout your document preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct instructions for tax return of certain

Create this form in 5 minutes!

How to create an eSignature for the instructions for tax return of certain

The way to create an eSignature for your PDF document in the online mode

The way to create an eSignature for your PDF document in Chrome

The best way to make an electronic signature for putting it on PDFs in Gmail

The best way to create an eSignature from your mobile device

The best way to generate an electronic signature for a PDF document on iOS devices

The best way to create an eSignature for a PDF file on Android devices

People also ask

-

What features does airSlate SignNow offer for organizations mass beverages?

airSlate SignNow provides a range of features specifically designed for organizations mass beverages, including customizable templates, bulk sending options, and secure eSignature capabilities. These tools streamline the document workflow, ensuring that your team's contracts and agreements are processed quickly and efficiently.

-

How can airSlate SignNow benefit organizations mass beverages?

For organizations mass beverages, airSlate SignNow offers enhanced efficiency by simplifying document signing processes. By reducing the time spent on paperwork and eliminating manual errors, your team can focus more on core business activities, ultimately driving productivity and growth.

-

Is airSlate SignNow cost-effective for organizations mass beverages?

Absolutely! airSlate SignNow provides competitive pricing models tailored for organizations mass beverages, ensuring that you get maximum value without breaking the bank. By leveraging our solution, organizations can lower operational costs associated with traditional document handling.

-

Can airSlate SignNow integrate with other software used by organizations mass beverages?

Yes, airSlate SignNow seamlessly integrates with a variety of software applications commonly used by organizations mass beverages. This includes CRM systems, project management tools, and various cloud storage options, ensuring that your document workflows remain connected and efficient.

-

How secure is airSlate SignNow for organizations mass beverages?

Security is a top priority for airSlate SignNow, especially for organizations mass beverages handling sensitive documents. Our platform utilizes encryption, secure access controls, and compliance with industry standards to ensure that your documents and data are always protected.

-

What types of documents can organizations mass beverages sign using airSlate SignNow?

Organizations mass beverages can use airSlate SignNow to sign a wide variety of documents, including contracts, purchase agreements, and internal approvals. The platform supports multiple document formats, making it easy to work with whatever documents your organization relies on.

-

Is there a mobile app available for organizations mass beverages to use airSlate SignNow?

Yes, airSlate SignNow offers a mobile app that allows organizations mass beverages to eSign documents from anywhere at any time. This mobility ensures that your team can stay productive even while on the go, accessing and managing documents effortlessly.

Get more for Instructions For Tax Return Of Certain

Find out other Instructions For Tax Return Of Certain

- Can I Sign Arizona Real Estate Confidentiality Agreement

- How Do I Sign Arizona Real Estate Memorandum Of Understanding

- Sign South Dakota Plumbing Job Offer Later

- Sign Tennessee Plumbing Business Letter Template Secure

- Sign South Dakota Plumbing Emergency Contact Form Later

- Sign South Dakota Plumbing Emergency Contact Form Myself

- Help Me With Sign South Dakota Plumbing Emergency Contact Form

- How To Sign Arkansas Real Estate Confidentiality Agreement

- Sign Arkansas Real Estate Promissory Note Template Free

- How Can I Sign Arkansas Real Estate Operating Agreement

- Sign Arkansas Real Estate Stock Certificate Myself

- Sign California Real Estate IOU Safe

- Sign Connecticut Real Estate Business Plan Template Simple

- How To Sign Wisconsin Plumbing Cease And Desist Letter

- Sign Colorado Real Estate LLC Operating Agreement Simple

- How Do I Sign Connecticut Real Estate Operating Agreement

- Sign Delaware Real Estate Quitclaim Deed Secure

- Sign Georgia Real Estate Business Plan Template Computer

- Sign Georgia Real Estate Last Will And Testament Computer

- How To Sign Georgia Real Estate LLC Operating Agreement