to Calculate the Amount Needed, Divide the Amount of the Expected Tax by the Number of Pay Periods in a 2020

Understanding the W-4 Form for Missouri

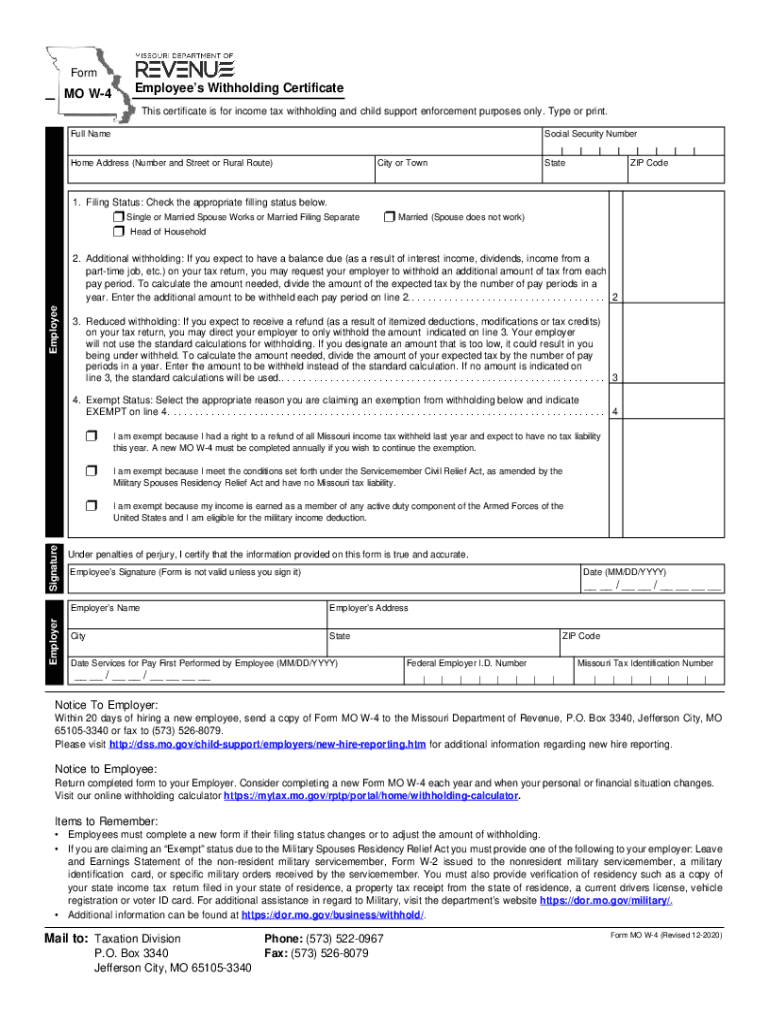

The Missouri W-4 form, officially known as the Employee's Withholding Certificate, is essential for employees to determine the amount of state income tax to withhold from their paychecks. This form is particularly important for new hires or those who wish to adjust their withholding status. The information provided on the form helps employers calculate the correct amount of Missouri state tax to deduct based on various factors such as marital status, number of dependents, and additional withholding amounts.

Steps to Complete the Missouri W-4 Form

Filling out the Missouri W-4 form involves several straightforward steps:

- Personal Information: Begin by entering your name, address, and Social Security number.

- Filing Status: Indicate your filing status by checking the appropriate box (single, married, etc.).

- Allowances: Calculate and enter the number of allowances you are claiming based on your personal circumstances.

- Additional Withholding: If you wish to have extra withholding, specify the amount in the designated section.

- Signature: Sign and date the form to validate your submission.

Key Elements of the Missouri W-4 Form

Several key elements are crucial for accurately completing the Missouri W-4 form:

- Allowances: The number of allowances directly affects your tax withholding. More allowances result in less tax withheld.

- Additional Amounts: You can request additional withholding if you anticipate owing more tax at the end of the year.

- Filing Status: Your marital status influences your tax rate and should be accurately reflected on the form.

IRS Guidelines for the Missouri W-4 Form

The Internal Revenue Service (IRS) provides guidelines that govern the use of the W-4 form. It is essential to follow these guidelines to ensure compliance and avoid penalties. The IRS requires that employees submit a new W-4 form whenever they experience significant life changes, such as marriage, divorce, or the birth of a child, which may affect their tax situation. Additionally, it is advisable to review your withholding annually to ensure it aligns with your current financial circumstances.

Filing Deadlines and Important Dates

Understanding the filing deadlines for the Missouri W-4 form is crucial for timely tax compliance. Generally, employees should submit their W-4 forms to their employer as soon as they start a new job or when they wish to make changes to their withholding. Employers are required to implement the changes within one pay period after receiving the updated form. Staying aware of these timelines helps ensure that your withholding accurately reflects your tax obligations throughout the year.

Digital vs. Paper Version of the Missouri W-4 Form

Both digital and paper versions of the Missouri W-4 form are available, allowing for flexibility in how you submit your information. The digital version can be completed and signed electronically, making it a convenient option for many employees. Electronic submission often streamlines the process and reduces the chances of errors. However, some individuals may prefer the traditional paper form for its tangible nature. Regardless of the method chosen, ensure that the form is filled out accurately to avoid issues with tax withholding.

Quick guide on how to complete to calculate the amount needed divide the amount of the expected tax by the number of pay periods in a

Complete To Calculate The Amount Needed, Divide The Amount Of The Expected Tax By The Number Of Pay Periods In A effortlessly on any gadget

Digital document management has gained traction among businesses and individuals alike. It offers an ideal eco-friendly substitute for conventional printed and signed documents, as you can obtain the necessary form and securely maintain it online. airSlate SignNow equips you with all the resources you need to create, edit, and electronically sign your documents promptly without hindrances. Manage To Calculate The Amount Needed, Divide The Amount Of The Expected Tax By The Number Of Pay Periods In A on any gadget with airSlate SignNow's Android or iOS applications and simplify any document-related procedure today.

How to edit and electronically sign To Calculate The Amount Needed, Divide The Amount Of The Expected Tax By The Number Of Pay Periods In A with ease

- Find To Calculate The Amount Needed, Divide The Amount Of The Expected Tax By The Number Of Pay Periods In A and then click Get Form to begin.

- Make use of the tools we provide to complete your form.

- Emphasize pertinent sections of the documents or obscure sensitive details using tools that airSlate SignNow offers specifically for that purpose.

- Generate your eSignature with the Sign tool, which takes mere seconds and holds the same legal validity as a traditional wet ink signature.

- Review the details and then click on the Done button to record your changes.

- Select your preferred method for sending your form, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or misfiled documents, time-consuming form searching, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills all your document management requirements in just a few clicks from any device you choose. Revise and electronically sign To Calculate The Amount Needed, Divide The Amount Of The Expected Tax By The Number Of Pay Periods In A and guarantee outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct to calculate the amount needed divide the amount of the expected tax by the number of pay periods in a

Create this form in 5 minutes!

How to create an eSignature for the to calculate the amount needed divide the amount of the expected tax by the number of pay periods in a

How to make an electronic signature for a PDF file online

How to make an electronic signature for a PDF file in Google Chrome

The best way to create an electronic signature for signing PDFs in Gmail

How to make an electronic signature from your mobile device

The best way to generate an eSignature for a PDF file on iOS

How to make an electronic signature for a PDF file on Android devices

People also ask

-

What is a printable W4 Missouri form?

The printable W4 Missouri form is a tax form used by employees to indicate their tax withholding preferences. It provides essential information to employers, ensuring accurate tax deductions from payroll. You can easily obtain a printable W4 Missouri form online to fill out and submit.

-

Where can I find a reliable printable W4 Missouri template?

You can find a reliable printable W4 Missouri template on our airSlate SignNow platform. We offer user-friendly access to all necessary tax forms, including the printable W4 Missouri, which you can fill out and eSign securely. Avoid confusion with our clear templates designed for easy use.

-

How does airSlate SignNow simplify the process of filling out the printable W4 Missouri?

airSlate SignNow simplifies filling out the printable W4 Missouri by providing an online platform that allows you to complete and eSign documents effortlessly. Our intuitive interface guides you through each step, ensuring that your information is accurately captured. This saves you time and reduces the hassle associated with traditional paper forms.

-

Is there a cost for using the printable W4 Missouri on airSlate SignNow?

Using the printable W4 Missouri on airSlate SignNow is part of our cost-effective solutions for businesses. While there may be subscription options available, the benefits of seamless document management and eSigning are well worth the investment. Check our pricing plans to find the best fit for your needs.

-

Can the printable W4 Missouri form be integrated with other software?

Yes, the printable W4 Missouri form can easily be integrated with various HR and payroll software. This integration ensures that all tax information is up-to-date and accurately processed within your existing systems. airSlate SignNow supports these integrations, making your workflows more efficient.

-

What are the benefits of using a printable W4 Missouri with airSlate SignNow?

Using a printable W4 Missouri with airSlate SignNow streamlines your document management and enhances compliance with tax regulations. You'll benefit from secure, digital storage and easy access to your forms anytime. Plus, eSigning eliminates the need for printing and physical signatures, saving you time and resources.

-

Can I edit the printable W4 Missouri form once it’s downloaded?

Yes, once you've downloaded the printable W4 Missouri form, you can edit it using our airSlate SignNow tools. Our platform offers capabilities to customize the form before eSigning and submitting it. This feature helps you ensure that all entries are correct before finalizing your tax withholding preferences.

Get more for To Calculate The Amount Needed, Divide The Amount Of The Expected Tax By The Number Of Pay Periods In A

Find out other To Calculate The Amount Needed, Divide The Amount Of The Expected Tax By The Number Of Pay Periods In A

- Electronic signature Pennsylvania Business Operations Promissory Note Template Later

- Help Me With Electronic signature North Dakota Charity Resignation Letter

- Electronic signature Indiana Construction Business Plan Template Simple

- Electronic signature Wisconsin Charity Lease Agreement Mobile

- Can I Electronic signature Wisconsin Charity Lease Agreement

- Electronic signature Utah Business Operations LLC Operating Agreement Later

- How To Electronic signature Michigan Construction Cease And Desist Letter

- Electronic signature Wisconsin Business Operations LLC Operating Agreement Myself

- Electronic signature Colorado Doctors Emergency Contact Form Secure

- How Do I Electronic signature Georgia Doctors Purchase Order Template

- Electronic signature Doctors PDF Louisiana Now

- How To Electronic signature Massachusetts Doctors Quitclaim Deed

- Electronic signature Minnesota Doctors Last Will And Testament Later

- How To Electronic signature Michigan Doctors LLC Operating Agreement

- How Do I Electronic signature Oregon Construction Business Plan Template

- How Do I Electronic signature Oregon Construction Living Will

- How Can I Electronic signature Oregon Construction LLC Operating Agreement

- How To Electronic signature Oregon Construction Limited Power Of Attorney

- Electronic signature Montana Doctors Last Will And Testament Safe

- Electronic signature New York Doctors Permission Slip Free