W4 Form for Missouri 2018

What is the W-4 Form for Missouri

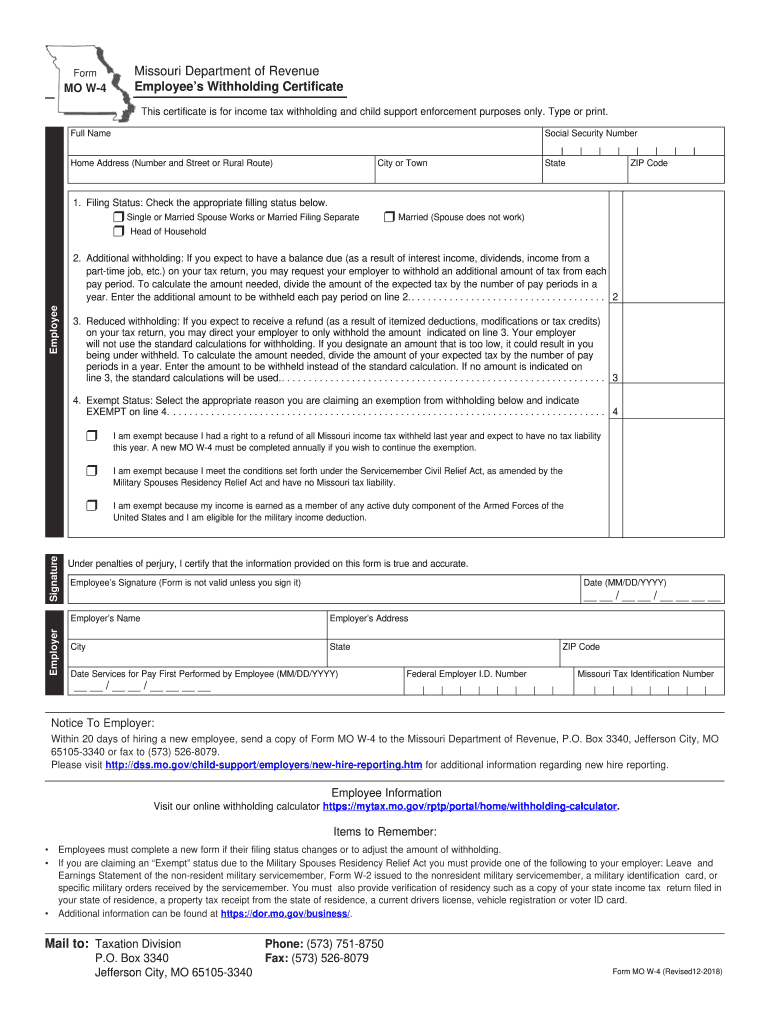

The W-4 form for Missouri, also known as the Missouri Employee's Withholding Certificate, is a crucial document for employees in the state. It allows employees to indicate their tax withholding preferences to their employers. This form helps determine the amount of state income tax that should be withheld from an employee's paycheck. Proper completion of the W-4 ensures that individuals are not over- or under-withheld, which can affect their tax returns.

How to Use the W-4 Form for Missouri

Using the W-4 form for Missouri involves a few straightforward steps. First, employees must download the form from a reliable source or obtain it from their employer. After filling out the required information, including personal details and withholding allowances, the employee submits the form to their employer. It is essential to review the form periodically, especially after significant life changes, such as marriage or the birth of a child, to ensure that withholding amounts remain accurate.

Steps to Complete the W-4 Form for Missouri

Completing the W-4 form for Missouri is a systematic process. Begin by providing your name, address, and Social Security number at the top of the form. Next, indicate your filing status, such as single or married. Then, determine the number of allowances you wish to claim, which will directly impact your withholding amount. Finally, sign and date the form before submitting it to your employer. It is advisable to keep a copy for your records.

Key Elements of the W-4 Form for Missouri

The W-4 form for Missouri includes several key elements that are important for accurate tax withholding. These elements consist of personal information, filing status, and the number of allowances claimed. Additionally, there are sections for additional withholding requests and exemptions, which can further tailor the withholding process to individual circumstances. Understanding these components is essential for effective tax planning.

State-Specific Rules for the W-4 Form for Missouri

Missouri has specific rules governing the use of the W-4 form. For instance, the state requires employees to submit a new W-4 form whenever they experience a change in their withholding situation. Furthermore, Missouri allows for additional withholding amounts to be specified on the form, which can be beneficial for those expecting to owe taxes at the end of the year. Familiarity with these state-specific rules can help ensure compliance and optimize tax withholding.

Digital vs. Paper Version of the W-4 Form for Missouri

Both digital and paper versions of the W-4 form for Missouri are available, providing flexibility for employees. The digital version can be filled out and submitted electronically, which is often more convenient and can reduce processing time. Conversely, the paper version may be preferred by those who are more comfortable with traditional methods. Regardless of the format chosen, it is crucial to ensure that the completed form is submitted to the employer promptly to avoid any issues with tax withholding.

Quick guide on how to complete tax return form 1099 2017 missouri department of revenue 2018 2019

Your instructional manual on how to prepare your W4 Form For Missouri

If you wish to learn how to fill out and submit your W4 Form For Missouri, here are some straightforward instructions to make tax filing easier.

To begin, you simply need to create your airSlate SignNow account to revolutionize how you handle documents online. airSlate SignNow provides an intuitive and robust document management solution that enables you to edit, draft, and finalize your tax paperwork effortlessly. With its editor, you can toggle between text, checkboxes, and eSignatures and go back to revise any answers as necessary. Simplify your tax handling with advanced PDF modifications, eSigning, and hassle-free sharing.

Follow the instructions below to complete your W4 Form For Missouri in just a few minutes:

- Establish your account and start editing PDFs within moments.

- Utilize our library to obtain any IRS tax form; browse through variations and schedules.

- Click Get form to access your W4 Form For Missouri in our editor.

- Populate the necessary fillable sections with your details (text, figures, check marks).

- Employ the Sign Tool to add your legally-recognized eSignature (if needed).

- Examine your document and amend any errors.

- Save modifications, print your version, send it to your recipient, and download it to your device.

Utilize this guide to electronically file your taxes with airSlate SignNow. Remember that submitting on paper can lead to increased return mistakes and delays in refunds. Additionally, prior to e-filing your taxes, consult the IRS website for filing regulations in your state.

Create this form in 5 minutes or less

Find and fill out the correct tax return form 1099 2017 missouri department of revenue 2018 2019

FAQs

-

How can I file the income tax returns Form 16 for the year of 2017–2018 and 2018–2019? Is there any chance, with a late fee?

No, you can’t file ITR for AY:2017–18 & 2018–19 as the due date for filing ITR is over i.e 31st March 2019.But you can apply for condonation of delay in filing ITR with reasons to CIT. Once the condonation is accepted you can file but it is a complex process.For specific clarifications / legal advice feel free to write to dsssvtax[at]gmail or call/WhatsApp: 9052535440.

-

If an LLC is formed in January 2018, can foreign members of the LLC apply for their ITIN numbers before 2019? How would they do that when the W-7 form (probably) has to be sent in together with a tax return?

Hi Yes they can apply now. The EIN and LLC agreement listing them as member needs to be included. They would check the reason for an exception to filing a tax return.All ITINs take 7 to 11 weeks to be issued for international applicants.The ID documents need to be included. These can be the original documents which the IRS will return or you can use a CAA like myself to assist.

Create this form in 5 minutes!

How to create an eSignature for the tax return form 1099 2017 missouri department of revenue 2018 2019

How to make an electronic signature for the Tax Return Form 1099 2017 Missouri Department Of Revenue 2018 2019 in the online mode

How to make an eSignature for the Tax Return Form 1099 2017 Missouri Department Of Revenue 2018 2019 in Chrome

How to generate an electronic signature for signing the Tax Return Form 1099 2017 Missouri Department Of Revenue 2018 2019 in Gmail

How to make an eSignature for the Tax Return Form 1099 2017 Missouri Department Of Revenue 2018 2019 right from your smartphone

How to make an electronic signature for the Tax Return Form 1099 2017 Missouri Department Of Revenue 2018 2019 on iOS

How to make an eSignature for the Tax Return Form 1099 2017 Missouri Department Of Revenue 2018 2019 on Android OS

People also ask

-

What is a printable W4 Missouri form?

A printable W4 Missouri form is a tax document that allows employees in Missouri to determine the amount of federal income tax withholding from their paychecks. This form is essential for employees to declare their tax exemptions and ensure the correct withholding amount based on their personal situation. Understanding and using a printable W4 Missouri correctly helps avoid tax-related issues at the end of the year.

-

How do I obtain a printable W4 Missouri form?

You can easily obtain a printable W4 Missouri form through the IRS website or directly from the Missouri Department of Revenue. Additionally, airSlate SignNow offers streamlined access to this form, allowing you to print and fill it out at your convenience. Simply search for 'printable W4 Missouri' on our platform to find the latest version without any hassle.

-

Is there a fee for using airSlate SignNow to handle my printable W4 Missouri forms?

AirSlate SignNow offers flexible pricing plans that cater to different business needs, providing you with cost-effective solutions. Creating, sending, and managing your printable W4 Missouri forms can be done at a minimal cost, allowing you to enhance your business processes without breaking the bank. Sign up today for a free trial to explore our full offerings.

-

Can I electronically sign my printable W4 Missouri form using airSlate SignNow?

Yes, airSlate SignNow allows you to electronically sign your printable W4 Missouri form with legally binding signatures. Our platform ensures compliance with e-signature laws, offering a secure method for signing important tax documents. This feature not only allows for quick turnaround times but also enhances your record-keeping.

-

What features does airSlate SignNow offer for managing printable W4 Missouri forms?

AirSlate SignNow provides a range of features for managing your printable W4 Missouri forms, including template creation, automated workflows, and detailed tracking. These tools allow you to simplify the process of collecting employee information and ensure compliance with tax regulations. Our user-friendly interface makes it easy to navigate through all functionalities.

-

Are printable W4 Missouri forms customizable on airSlate SignNow?

Absolutely! AirSlate SignNow enables you to customize your printable W4 Missouri forms to suit your specific business needs. You can add branding, modify fields, and adjust content to match your requirements, ensuring the form aligns with your company’s standards while maintaining essential tax information.

-

How does airSlate SignNow integrate with other tools for handling printable W4 Missouri forms?

AirSlate SignNow integrates seamlessly with various business tools, such as Google Drive, Salesforce, and more. This allows you to manage your printable W4 Missouri forms alongside your other business documents without any friction. The integration capabilities streamline workflows and enhance overall efficiency.

Get more for W4 Form For Missouri

- Veterinary release form owners fill in please

- Arkansas articles of organization for domestic limited liability company llc form

- Census language identification flashcard form

- Cell city worksheet form

- Efks tusi faitau aso results form

- Bd 33 94 form

- 604 564 confidential medical referral and follow up form prekkid

- Castro valley unified school district form

Find out other W4 Form For Missouri

- Help Me With eSignature Michigan High Tech Emergency Contact Form

- eSignature Louisiana Insurance Rental Application Later

- eSignature Maryland Insurance Contract Safe

- eSignature Massachusetts Insurance Lease Termination Letter Free

- eSignature Nebraska High Tech Rental Application Now

- How Do I eSignature Mississippi Insurance Separation Agreement

- Help Me With eSignature Missouri Insurance Profit And Loss Statement

- eSignature New Hampshire High Tech Lease Agreement Template Mobile

- eSignature Montana Insurance Lease Agreement Template Online

- eSignature New Hampshire High Tech Lease Agreement Template Free

- How To eSignature Montana Insurance Emergency Contact Form

- eSignature New Jersey High Tech Executive Summary Template Free

- eSignature Oklahoma Insurance Warranty Deed Safe

- eSignature Pennsylvania High Tech Bill Of Lading Safe

- eSignature Washington Insurance Work Order Fast

- eSignature Utah High Tech Warranty Deed Free

- How Do I eSignature Utah High Tech Warranty Deed

- eSignature Arkansas Legal Affidavit Of Heirship Fast

- Help Me With eSignature Colorado Legal Cease And Desist Letter

- How To eSignature Connecticut Legal LLC Operating Agreement