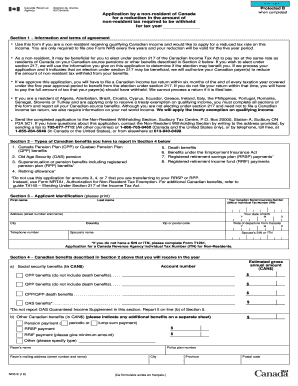

Revenue Quebec Tax Form 2018

What is the Revenue Quebec Tax Form

The Revenue Quebec Tax Form is a document used by individuals and businesses in Quebec to report their income and calculate their tax obligations. This form is essential for compliance with provincial tax laws and is administered by Revenu Québec, the provincial tax authority. It ensures that taxpayers accurately report their earnings and claim any applicable deductions or credits. Understanding this form is crucial for anyone filing taxes in Quebec, as it affects the overall tax liability and potential refunds.

How to use the Revenue Quebec Tax Form

Using the Revenue Quebec Tax Form involves several steps to ensure accurate completion. First, gather all necessary documents, including income statements, receipts for deductions, and any previous tax returns. Next, carefully fill out the form, entering personal information, income details, and applicable deductions. It is important to follow the instructions provided with the form to avoid errors. After completing the form, review it for accuracy before submitting it to Revenu Québec, either online or by mail.

Steps to complete the Revenue Quebec Tax Form

Completing the Revenue Quebec Tax Form requires a systematic approach. Start by collecting all relevant financial documents, such as T4 slips and receipts. Then, follow these steps:

- Fill in your personal information, including your name, address, and social insurance number.

- Report your total income from all sources, ensuring to include any taxable benefits.

- Claim eligible deductions, such as childcare expenses or medical costs, to reduce your taxable income.

- Calculate your total tax owed based on the applicable rates and credits.

- Sign and date the form before submission.

Legal use of the Revenue Quebec Tax Form

The legal use of the Revenue Quebec Tax Form is governed by provincial tax laws. It is essential to ensure that the information provided is accurate and truthful, as submitting false information can lead to penalties. The form serves as a legal declaration of income and tax obligations, and it is crucial for maintaining compliance with tax regulations. Taxpayers should retain copies of their completed forms and supporting documents for future reference and potential audits.

Filing Deadlines / Important Dates

Filing deadlines for the Revenue Quebec Tax Form are critical to avoid penalties and interest. Typically, individual taxpayers must file their returns by April 30 of the following year. If April 30 falls on a weekend or holiday, the deadline is extended to the next business day. Businesses may have different deadlines depending on their fiscal year. It is important to stay informed about these dates to ensure timely filing and avoid complications.

Required Documents

To complete the Revenue Quebec Tax Form, several documents are required. These typically include:

- T4 slips from employers, detailing income earned.

- Receipts for deductible expenses, such as medical or childcare costs.

- Previous tax returns for reference.

- Any relevant documentation for tax credits, such as tuition receipts.

Having these documents ready will streamline the filing process and help ensure accuracy.

Form Submission Methods (Online / Mail / In-Person)

The Revenue Quebec Tax Form can be submitted through various methods, providing flexibility for taxpayers. Options include:

- Online submission via the Revenu Québec website, which allows for quick processing.

- Mailing a paper copy of the completed form to the designated tax center.

- In-person submission at local Revenu Québec offices, if preferred.

Choosing the right method depends on individual preferences and circumstances, but online submission is often the most efficient.

Quick guide on how to complete revenue quebec tax form 2020

Prepare Revenue Quebec Tax Form effortlessly on any gadget

Online document management has gained popularity among businesses and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed documents, as you can easily find the correct template and securely store it online. airSlate SignNow equips you with all the tools required to create, modify, and electronically sign your documents promptly without delays. Handle Revenue Quebec Tax Form on any gadget using airSlate SignNow's Android or iOS applications and simplify any document-related task today.

How to modify and electronically sign Revenue Quebec Tax Form with ease

- Obtain Revenue Quebec Tax Form and click Get Form to begin.

- Utilize the tools we offer to complete your template.

- Highlight pertinent sections of your documents or obscure sensitive details with tools specifically designed for that purpose by airSlate SignNow.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional pen-and-ink signature.

- Review all the details and click the Done button to save your modifications.

- Select your preferred method to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate the worry of lost or mislaid documents, tedious form searching, or mistakes that necessitate printing additional copies. airSlate SignNow satisfies your document management needs within a few clicks from any device you choose. Modify and electronically sign Revenue Quebec Tax Form to ensure outstanding communication at every phase of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct revenue quebec tax form 2020

Create this form in 5 minutes!

How to create an eSignature for the revenue quebec tax form 2020

The best way to generate an electronic signature for a PDF file in the online mode

The best way to generate an electronic signature for a PDF file in Chrome

The way to create an electronic signature for putting it on PDFs in Gmail

The way to make an electronic signature right from your smartphone

The way to make an eSignature for a PDF file on iOS devices

The way to make an electronic signature for a PDF on Android

People also ask

-

What is the Canadian Tax Guide 2018?

The Canadian Tax Guide 2018 is a comprehensive resource designed to help individuals and businesses understand their tax obligations for that year. It covers various aspects of the Canadian tax system, including key deductions, credits, and filing requirements to ensure compliance.

-

How can the Canadian Tax Guide 2018 help me with my tax filing?

Utilizing the Canadian Tax Guide 2018 can simplify your tax filing process by providing detailed information on relevant tax laws, forms, and deadlines. It also highlights common pitfalls and tax-saving strategies to help you maximize your returns and avoid costly mistakes.

-

Is the Canadian Tax Guide 2018 suitable for both individuals and businesses?

Yes, the Canadian Tax Guide 2018 is suitable for both individuals and small businesses. It offers insights tailored to different tax situations, ensuring that everyone can benefit from accurate guidance for their specific tax needs.

-

Are there any features included in the Canadian Tax Guide 2018?

The Canadian Tax Guide 2018 includes an easy-to-follow breakdown of tax rates, eligibility for credits, and tips for smooth filing. Additionally, it may provide examples and scenarios to illustrate complex concepts for better understanding.

-

What are the benefits of using the Canadian Tax Guide 2018?

Using the Canadian Tax Guide 2018 offers numerous benefits, including a clearer understanding of tax laws, potential savings through deductions, and peace of mind knowing you have reliable information at your fingertips. It's an essential tool for making informed financial decisions.

-

How does pricing work for the Canadian Tax Guide 2018?

The pricing for the Canadian Tax Guide 2018 varies based on the format you choose, whether it's a physical copy or a digital download. Typically, the cost is reasonable, considering the immense value of understanding tax regulations and maximizing your tax refund.

-

Can I integrate other tools with the Canadian Tax Guide 2018?

While the Canadian Tax Guide 2018 itself may not directly integrate with software, it complements various accounting and tax preparation tools. Using it alongside your existing financial software can enhance your overall efficiency during tax season.

Get more for Revenue Quebec Tax Form

- Renunciation and disclaimer of joint tenant or tenancy interest wisconsin form

- Subcontractor identification notice wisconsin form

- Quitclaim deed by two individuals to husband and wife wisconsin form

- Warranty deed from two individuals to husband and wife wisconsin form

- Transfer death deed 497430540 form

- Wisconsin llc company form

- Wisconsin claim online form

- Quitclaim deed by two individuals to llc wisconsin form

Find out other Revenue Quebec Tax Form

- eSign North Carolina Car Dealer Arbitration Agreement Now

- eSign Ohio Car Dealer Business Plan Template Online

- eSign Ohio Car Dealer Bill Of Lading Free

- How To eSign North Dakota Car Dealer Residential Lease Agreement

- How Do I eSign Ohio Car Dealer Last Will And Testament

- Sign North Dakota Courts Lease Agreement Form Free

- eSign Oregon Car Dealer Job Description Template Online

- Sign Ohio Courts LLC Operating Agreement Secure

- Can I eSign Michigan Business Operations POA

- eSign Car Dealer PDF South Dakota Computer

- eSign Car Dealer PDF South Dakota Later

- eSign Rhode Island Car Dealer Moving Checklist Simple

- eSign Tennessee Car Dealer Lease Agreement Form Now

- Sign Pennsylvania Courts Quitclaim Deed Mobile

- eSign Washington Car Dealer Bill Of Lading Mobile

- eSign Wisconsin Car Dealer Resignation Letter Myself

- eSign Wisconsin Car Dealer Warranty Deed Safe

- eSign Business Operations PPT New Hampshire Safe

- Sign Rhode Island Courts Warranty Deed Online

- Sign Tennessee Courts Residential Lease Agreement Online