Maine Revenue Services Forms Individual Maine Gov 2019

Steps to complete the Maine Revenue Services Forms

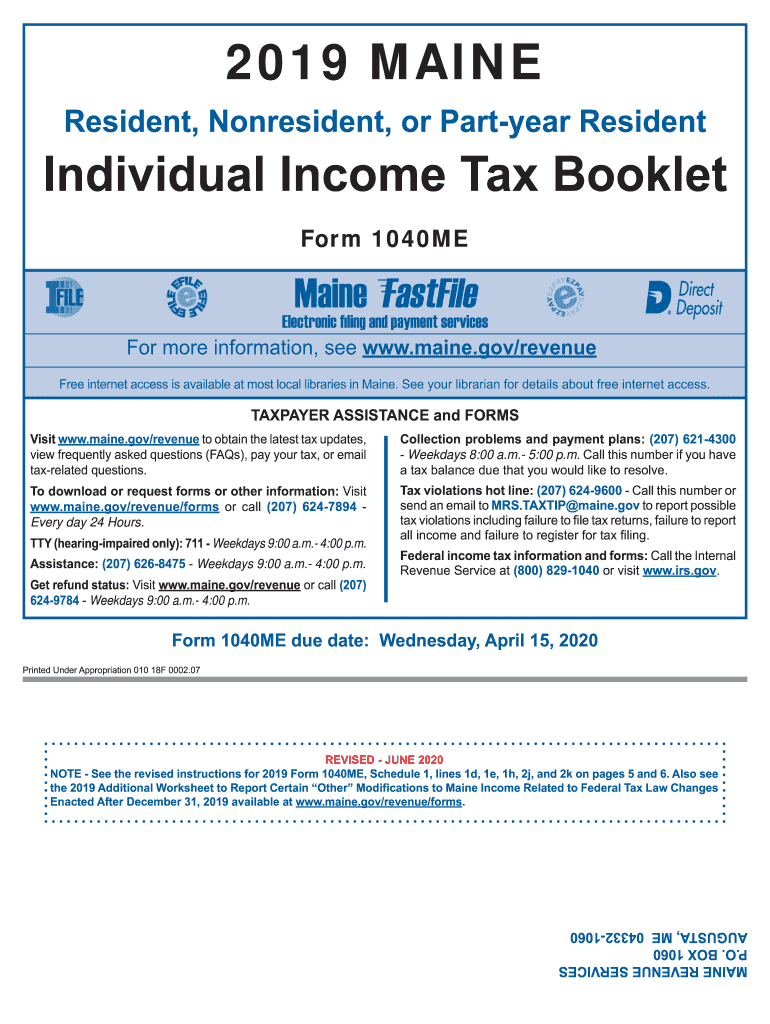

Completing the Maine Revenue Services forms, including the 1040ME, involves several key steps to ensure accuracy and compliance. Begin by gathering all necessary documentation, such as W-2 forms, 1099s, and any other income statements. This information is essential for accurately reporting your income.

Next, download the 1040ME form from the Maine Revenue Services website. Ensure you have the correct version for the tax year you are filing. Carefully read the instructions provided with the form, as they outline how to fill it out correctly. Pay attention to specific sections that require detailed information about your income, deductions, and credits.

Once you have filled out the form, review it thoroughly for any errors or omissions. It's important to double-check your calculations and ensure all required fields are completed. After confirming the accuracy of your form, you can choose to submit it electronically or via mail, depending on your preference.

Legal use of the Maine Revenue Services Forms

The legal use of Maine Revenue Services forms, such as the 1040ME, is governed by state tax laws. To be considered valid, these forms must be completed accurately and submitted by the designated deadlines. E-signatures are accepted under U.S. law, provided they comply with the ESIGN and UETA regulations, ensuring that electronic submissions are legally binding.

It is crucial to maintain a copy of your submitted forms and any supporting documents for your records. This documentation may be necessary for future reference, especially in the event of an audit or inquiry by the Maine Revenue Services.

Required Documents for the Maine Revenue Services Forms

When preparing to fill out the Maine Revenue Services forms, it is essential to gather all required documents to ensure a smooth filing process. Key documents include:

- W-2 Forms: These forms report your annual wages and the taxes withheld by your employer.

- 1099 Forms: If you are self-employed or received other income, these forms will detail your earnings.

- Proof of Deductions: Gather receipts and documentation for any deductions you plan to claim, such as medical expenses or charitable contributions.

- Previous Year’s Tax Return: This can provide a reference for your current filing and help ensure consistency.

Having these documents ready will facilitate the completion of your 1040ME form and help you avoid delays in processing your tax return.

Filing Deadlines / Important Dates

Understanding the filing deadlines for the Maine Revenue Services forms is crucial for timely submission. Typically, the deadline for filing your state income tax return, including the 1040ME, is April fifteenth of the year following the tax year. If this date falls on a weekend or holiday, the deadline may be extended to the next business day.

It is advisable to check for any changes or extensions that may be announced by the Maine Revenue Services, especially in response to unforeseen circumstances. Marking these important dates on your calendar can help ensure that you do not miss your filing deadline.

Form Submission Methods

There are several methods available for submitting the Maine Revenue Services forms, including the 1040ME. You can file your taxes electronically using approved e-filing software, which is often the fastest and most efficient method. This option allows for quicker processing and confirmation of your submission.

Alternatively, you may choose to print your completed form and mail it to the appropriate address provided by the Maine Revenue Services. Ensure that you send your form with sufficient postage and consider using a trackable mailing option for added security. In-person submission is also available at designated state offices, although this option may require an appointment.

Quick guide on how to complete maine revenue services forms individual mainegov

Effortlessly Prepare Maine Revenue Services Forms Individual Maine gov on Any Gadget

Digital document management has gained traction among organizations and individuals alike. It serves as an excellent eco-friendly alternative to conventional printed and signed documents, as you can easily find the correct form and securely save it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents quickly without any hold-ups. Manage Maine Revenue Services Forms Individual Maine gov across any platform using the airSlate SignNow apps for Android or iOS and enhance any document-related procedure today.

How to Modify and Electronically Sign Maine Revenue Services Forms Individual Maine gov with Ease

- Find Maine Revenue Services Forms Individual Maine gov and then click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize important sections of the documents or redact sensitive information with tools specifically provided by airSlate SignNow.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and then click on the Done button to finalize your edits.

- Choose how you wish to send your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form navigation, or errors that require reprinting new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Modify and electronically sign Maine Revenue Services Forms Individual Maine gov while ensuring outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct maine revenue services forms individual mainegov

Create this form in 5 minutes!

How to create an eSignature for the maine revenue services forms individual mainegov

The best way to generate an eSignature for your PDF document in the online mode

The best way to generate an eSignature for your PDF document in Chrome

How to make an electronic signature for putting it on PDFs in Gmail

How to create an electronic signature right from your mobile device

How to create an electronic signature for a PDF document on iOS devices

How to create an electronic signature for a PDF on Android devices

People also ask

-

What is the 18 1040me book no No Download Needed needed pdf no No Download Needed needed?

The 18 1040me book no No Download Needed needed pdf no No Download Needed needed is an essential resource for understanding tax preparation. It provides guidance and forms necessary to complete your tax filings efficiently. This easy-to-access PDF is designed for users who prefer not to download additional software.

-

Is the 18 1040me book no No Download Needed needed pdf no No Download Needed needed free?

Yes, the 18 1040me book no No Download Needed needed pdf no No Download Needed needed is available for free. Users can access it directly online without any hidden fees. This makes it a cost-effective option for those needing tax assistance.

-

How does the 18 1040me book no No Download Needed needed pdf no No Download Needed needed help with tax filing?

The 18 1040me book no No Download Needed needed pdf no No Download Needed needed simplifies the tax filing process by providing clear instructions and forms. It walks users through the necessary steps to accurately complete their returns. By using this resource, individuals can feel more confident in their tax submissions.

-

Can I access the 18 1040me book no No Download Needed needed pdf no No Download Needed needed on mobile devices?

Absolutely! The 18 1040me book no No Download Needed needed pdf no No Download Needed needed is designed to be mobile-friendly. Users can easily view and navigate the PDF from their smartphones or tablets, ensuring convenience for on-the-go tax preparation.

-

What features are included with the 18 1040me book no No Download Needed needed pdf no No Download Needed needed?

The 18 1040me book no No Download Needed needed pdf no No Download Needed needed includes detailed tax preparation instructions, sample forms, and tips for maximizing deductions. It's an all-in-one resource aimed at making tax filing easier for everyone. This ensures that users have all the information they need at their fingertips.

-

Are there any integrations available for the 18 1040me book no No Download Needed needed pdf no No Download Needed needed?

While the 18 1040me book no No Download Needed needed pdf no No Download Needed needed is a standalone resource, it can complement various online tax software solutions. Users can utilize it alongside popular tax software for enhanced performance. This integration potential ensures users can maximize efficiency in their tax preparation.

-

How can I provide feedback on the 18 1040me book no No Download Needed needed pdf no No Download Needed needed?

We welcome user feedback on the 18 1040me book no No Download Needed needed pdf no No Download Needed needed. Users can easily signNow out through our website or customer service channels to share their thoughts. Your insights greatly help us improve the resource for future users.

Get more for Maine Revenue Services Forms Individual Maine gov

- Hearing injunction wisconsin form

- Injunction risk form

- Marital domestic separation and property settlement agreement for persons with no children no joint property or debts where 497430857 form

- Marital domestic separation and property settlement agreement minor children no joint property or debts where divorce action 497430858 form

- Marital domestic separation and property settlement agreement minor children no joint property or debts effective immediately 497430859 form

- Marital domestic separation and property settlement agreement minor children parties may have joint property or debts where 497430860 form

- Marital domestic separation and property settlement agreement minor children parties may have joint property or debts effective 497430861 form

- Marital domestic separation and property settlement agreement for persons with no children no joint property or debts effective 497430862 form

Find out other Maine Revenue Services Forms Individual Maine gov

- How Do I eSignature North Carolina Construction LLC Operating Agreement

- eSignature Arkansas Doctors LLC Operating Agreement Later

- eSignature Tennessee Construction Contract Safe

- eSignature West Virginia Construction Lease Agreement Myself

- How To eSignature Alabama Education POA

- How To eSignature California Education Separation Agreement

- eSignature Arizona Education POA Simple

- eSignature Idaho Education Lease Termination Letter Secure

- eSignature Colorado Doctors Business Letter Template Now

- eSignature Iowa Education Last Will And Testament Computer

- How To eSignature Iowa Doctors Business Letter Template

- Help Me With eSignature Indiana Doctors Notice To Quit

- eSignature Ohio Education Purchase Order Template Easy

- eSignature South Dakota Education Confidentiality Agreement Later

- eSignature South Carolina Education Executive Summary Template Easy

- eSignature Michigan Doctors Living Will Simple

- How Do I eSignature Michigan Doctors LLC Operating Agreement

- How To eSignature Vermont Education Residential Lease Agreement

- eSignature Alabama Finance & Tax Accounting Quitclaim Deed Easy

- eSignature West Virginia Education Quitclaim Deed Fast