Maine Worksheets a B Residency Information and Income 2020

What is the Maine Worksheets A B Residency Information And Income

The Maine Worksheets A and B are essential documents used for determining residency status and calculating income for tax purposes in the state of Maine. These worksheets help taxpayers identify their residency status as either resident, non-resident, or part-year resident. Understanding your residency classification is crucial as it affects the income subject to Maine state tax. Additionally, these worksheets guide taxpayers in reporting their income accurately, ensuring compliance with state tax laws.

How to use the Maine Worksheets A B Residency Information And Income

To effectively use the Maine Worksheets A and B, begin by gathering all necessary financial documents, including W-2 forms, 1099s, and any other income statements. Next, determine your residency status by completing Worksheet A, which outlines the criteria for residency classification. Once your residency is established, proceed to Worksheet B to report your income. Follow the instructions on each worksheet carefully, ensuring that all figures are accurate and reflect your financial situation for the tax year.

Steps to complete the Maine Worksheets A B Residency Information And Income

Completing the Maine Worksheets A and B involves several key steps:

- Gather all relevant income documentation, such as W-2s and 1099 forms.

- Fill out Worksheet A to determine your residency status based on the provided criteria.

- Once residency is confirmed, complete Worksheet B to report your total income.

- Review all entries for accuracy and ensure compliance with Maine tax regulations.

- Submit the completed worksheets along with your Maine income tax return.

Legal use of the Maine Worksheets A B Residency Information And Income

The Maine Worksheets A and B are legally recognized documents that must be completed accurately to comply with state tax laws. The information provided on these worksheets is used by the Maine Revenue Services to assess tax liability. Failing to complete these worksheets correctly can result in penalties or delays in processing your tax return. It is essential to ensure that all information is truthful and reflects your actual financial situation to maintain compliance with legal requirements.

Filing Deadlines / Important Dates

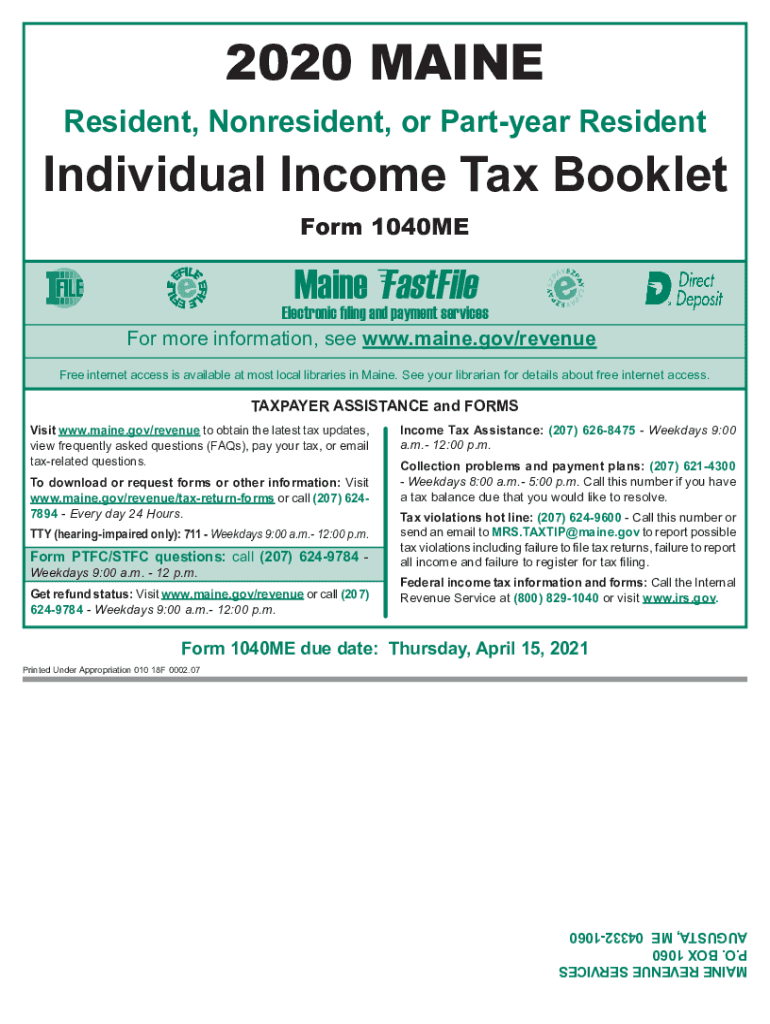

Filing deadlines for the Maine Worksheets A and B align with the general tax filing deadlines set by the state. Typically, individual income tax returns are due on April fifteenth of each year. However, if this date falls on a weekend or holiday, the deadline may be extended. It is crucial to stay informed about any changes to these dates and ensure that your worksheets are submitted on time to avoid penalties and interest on unpaid taxes.

Who Issues the Form

The Maine Worksheets A and B are issued by the Maine Revenue Services, which is responsible for administering the state's tax laws. These worksheets are part of the overall tax filing process for residents and non-residents alike. Taxpayers can obtain these forms directly from the Maine Revenue Services website or through authorized tax preparation services. It is essential to use the most current version of these worksheets to ensure compliance with any updates to tax regulations.

Quick guide on how to complete maine worksheets a b residency information and income

Complete Maine Worksheets A B Residency Information And Income effortlessly on any device

Online document management has gained popularity among companies and individuals. It offers an ideal environmentally friendly alternative to conventional printed and signed documents, since you can locate the correct form and safely store it online. airSlate SignNow provides you with all the tools you need to create, modify, and eSign your documents swiftly without delays. Manage Maine Worksheets A B Residency Information And Income on any platform using airSlate SignNow Android or iOS applications and enhance any document-based workflow today.

The simplest method to edit and eSign Maine Worksheets A B Residency Information And Income with ease

- Obtain Maine Worksheets A B Residency Information And Income and click on Get Form to begin.

- Utilize the tools we provide to complete your form.

- Highlight relevant sections of your documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature with the Sign tool, which requires mere seconds and carries the same legal validity as a traditional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Select your preferred method to send your form, whether by email, SMS, or invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow addresses all your needs in document management in just a few clicks from a device of your choice. Modify and eSign Maine Worksheets A B Residency Information And Income and ensure excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct maine worksheets a b residency information and income

Create this form in 5 minutes!

How to create an eSignature for the maine worksheets a b residency information and income

How to make an electronic signature for a PDF file online

How to make an electronic signature for a PDF file in Google Chrome

The best way to create an electronic signature for signing PDFs in Gmail

The best way to make an electronic signature from your mobile device

The best way to generate an eSignature for a PDF file on iOS

The best way to make an electronic signature for a PDF file on Android devices

People also ask

-

What is the 18 1040me book no No Download Needed needed pdf no No Download Needed needed?

The 18 1040me book no No Download Needed needed pdf no No Download Needed needed is a comprehensive resource designed to assist individuals in completing their tax forms efficiently. It provides guidance on how to fill out the 1040ME form without the hassle of downloading any additional materials. This PDF resource is perfect for those seeking convenience in their tax preparation.

-

How can I access the 18 1040me book no No Download Needed needed pdf no No Download Needed needed?

You can easily access the 18 1040me book no No Download Needed needed pdf no No Download Needed needed directly from our landing page. Simply click the link provided, and it will open for you to view immediately, eliminating the need for any downloads. This ensures that you have immediate access to all necessary tax information.

-

Is the 18 1040me book no No Download Needed needed pdf no No Download Needed needed free?

Yes, the 18 1040me book no No Download Needed needed pdf no No Download Needed needed is available for free. Our goal is to provide valuable resources to help users navigate their tax obligations without any added costs. You can start using this guide right away without any financial commitment.

-

What are the benefits of using the 18 1040me book no No Download Needed needed pdf no No Download Needed needed?

The benefits of using the 18 1040me book no No Download Needed needed pdf no No Download Needed needed include ease of use and instant accessibility. This resource is designed to simplify the tax filing process by providing clear instructions and essential tips. Additionally, it saves time by allowing you to complete your forms without delays from downloads.

-

What features does the 18 1040me book no No Download Needed needed pdf no No Download Needed needed offer?

The 18 1040me book no No Download Needed needed pdf no No Download Needed needed offers a variety of features, including clear step-by-step instructions, example scenarios, and common pitfalls to avoid. These tools help ensure that your tax filing is accurate and efficient. All these features aim to enhance your overall experience with tax preparation.

-

Can I use the 18 1040me book no No Download Needed needed pdf no No Download Needed needed on any device?

Absolutely! The 18 1040me book no No Download Needed needed pdf no No Download Needed needed is accessible on multiple devices such as smartphones, tablets, and computers. This ensures you can utilize this crucial tax resource whenever and wherever you need it. The versatile format allows for easy viewing on any screen.

-

Is personal information required to access the 18 1040me book no No Download Needed needed pdf no No Download Needed needed?

No, personal information is not required to access the 18 1040me book no No Download Needed needed pdf no No Download Needed needed. We prioritize your privacy, so simply click the link to access the resource with no strings attached. This straightforward access allows you to focus on your tax preparation without any concerns.

Get more for Maine Worksheets A B Residency Information And Income

- Hra 121 form

- 604c pdf form

- British council certificate pdf form

- Mad minute online form

- Modern marvels renewable energy worksheet answers form

- Tattoo apprenticeship checklist form

- Home affordable modification program hardship affidavit form 1021 home affordable modification program hardship affidavit

- Employee starter form 650166683

Find out other Maine Worksheets A B Residency Information And Income

- Sign Wyoming Insurance LLC Operating Agreement Simple

- Sign Kentucky Life Sciences Profit And Loss Statement Now

- How To Sign Arizona Non-Profit Cease And Desist Letter

- Can I Sign Arkansas Non-Profit LLC Operating Agreement

- Sign Arkansas Non-Profit LLC Operating Agreement Free

- Sign California Non-Profit Living Will Easy

- Sign California Non-Profit IOU Myself

- Sign California Non-Profit Lease Agreement Template Free

- Sign Maryland Life Sciences Residential Lease Agreement Later

- Sign Delaware Non-Profit Warranty Deed Fast

- Sign Florida Non-Profit LLC Operating Agreement Free

- Sign Florida Non-Profit Cease And Desist Letter Simple

- Sign Florida Non-Profit Affidavit Of Heirship Online

- Sign Hawaii Non-Profit Limited Power Of Attorney Myself

- Sign Hawaii Non-Profit Limited Power Of Attorney Free

- Sign Idaho Non-Profit Lease Agreement Template Safe

- Help Me With Sign Illinois Non-Profit Business Plan Template

- Sign Maryland Non-Profit Business Plan Template Fast

- How To Sign Nevada Life Sciences LLC Operating Agreement

- Sign Montana Non-Profit Warranty Deed Mobile