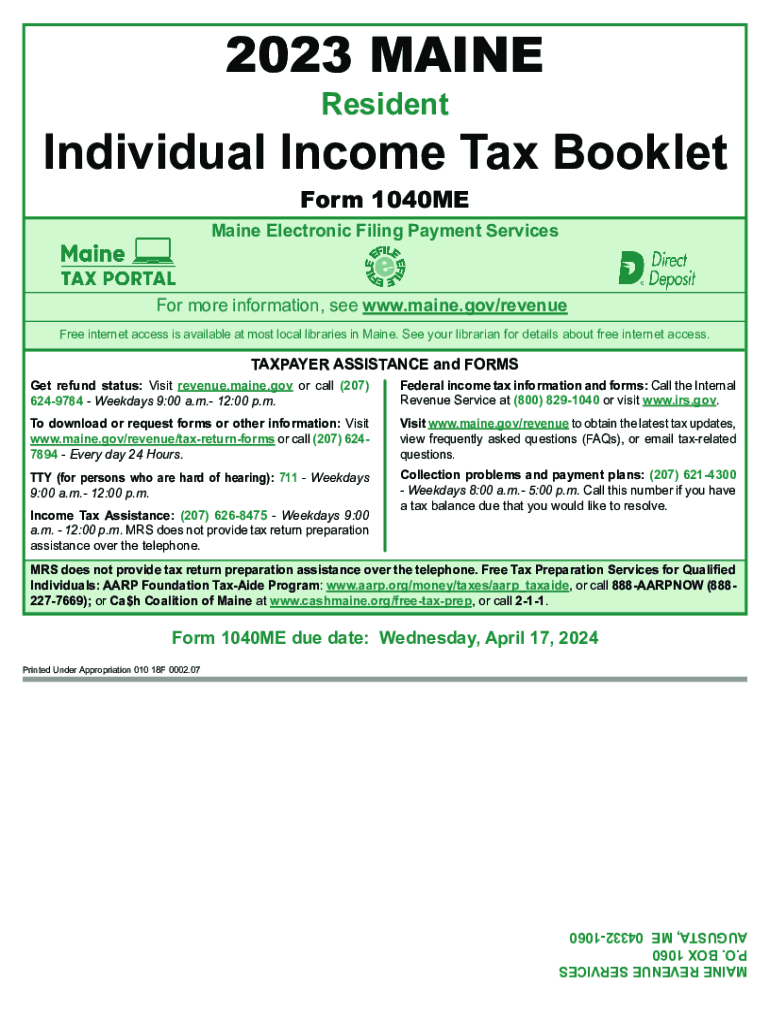

Maine Electronic Filing Payment Services 2023-2026

What is the Maine Electronic Filing Payment Services

The Maine Electronic Filing Payment Services is a streamlined platform designed to facilitate the electronic submission of individual income tax forms. This service allows taxpayers to file their Maine income tax returns online, ensuring a more efficient and secure process. By utilizing this service, individuals can avoid the complexities associated with paper filing, making it easier to meet their tax obligations.

How to use the Maine Electronic Filing Payment Services

To use the Maine Electronic Filing Payment Services, taxpayers need to access the official state tax website. Once there, they can create an account or log in if they already have one. After logging in, users can select the appropriate Maine income tax form, fill it out digitally, and submit it directly through the platform. It is essential to have all necessary documentation ready, such as income statements and deductions, to ensure a smooth filing process.

Steps to complete the Maine Electronic Filing Payment Services

Completing the Maine Electronic Filing Payment Services involves several key steps:

- Visit the Maine state tax website and log in to your account.

- Select the Maine individual income tax booklet relevant to the current tax year.

- Fill out the required fields accurately, ensuring all information is complete.

- Review the form for any errors or omissions.

- Submit the form electronically and keep a confirmation for your records.

Required Documents

When using the Maine Electronic Filing Payment Services, taxpayers should have the following documents ready:

- W-2 forms from employers

- 1099 forms for additional income

- Documentation for deductions and credits

- Previous year’s tax return for reference

Filing Deadlines / Important Dates

It is crucial to be aware of the filing deadlines when using the Maine Electronic Filing Payment Services. Typically, the deadline for submitting individual income tax returns is April fifteenth. However, extensions may be available under certain circumstances. Taxpayers should check the Maine state tax website for any updates or changes to these dates.

Penalties for Non-Compliance

Failure to comply with Maine tax filing requirements can result in penalties. These may include late filing fees, interest on unpaid taxes, and potential legal action for persistent non-compliance. It is important for taxpayers to file their returns on time and pay any taxes owed to avoid these consequences.

Quick guide on how to complete maine electronic filing payment services

Effortlessly prepare Maine Electronic Filing Payment Services on any device

Digital document management has gained traction among companies and individuals. It serves as an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to obtain the correct form and store it securely online. airSlate SignNow equips you with all the necessary tools to generate, modify, and electronically sign your documents quickly and without hassles. Manage Maine Electronic Filing Payment Services on any device using the airSlate SignNow Android or iOS applications and enhance any document-focused process today.

The easiest way to edit and eSign Maine Electronic Filing Payment Services with ease

- Obtain Maine Electronic Filing Payment Services and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize important sections of your documents or redact sensitive information with the tools that airSlate SignNow offers specifically for that purpose.

- Generate your signature using the Sign feature, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and then click on the Done button to save your modifications.

- Select how you wish to share your form, via email, SMS, or invite link, or download it to your computer.

Eliminate concerns about lost or mislaid files, tedious form searching, or mistakes that necessitate printing additional document copies. airSlate SignNow caters to your document management requirements in just a few clicks from your preferred device. Edit and eSign Maine Electronic Filing Payment Services and ensure outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct maine electronic filing payment services

Create this form in 5 minutes!

How to create an eSignature for the maine electronic filing payment services

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the airSlate SignNow solution for managing 2017 Maine tax documents?

The airSlate SignNow platform offers a streamlined approach to manage your 2017 Maine tax documents with ease. You can send, receive, and eSign essential tax documents securely and efficiently. This tool simplifies the entire process, allowing you to focus on your financial obligations without unnecessary delays.

-

How does airSlate SignNow help in preparing for the 2017 Maine tax filing?

With airSlate SignNow, you can ensure all your 2017 Maine tax forms are signed and submitted on time. Our platform allows you to collaborate with your tax preparer seamlessly, reducing the chances of errors. Plus, eSigning documents directly speeds up the filing process, helping you meet all deadlines efficiently.

-

What pricing plans are available for airSlate SignNow users focusing on the 2017 Maine tax?

airSlate SignNow offers flexible pricing plans to cater to your needs, starting from basic to advanced options. Each plan provides access to features that can enhance your experience in handling your 2017 Maine tax documents. A free trial is available to help you assess our solution before committing.

-

Can I use airSlate SignNow to integrate with my accounting software for 2017 Maine tax submissions?

Yes, airSlate SignNow can seamlessly integrate with various accounting software to streamline your 2017 Maine tax submissions. This functionality ensures that all your financial data is synchronized, making it easier to track your tax documents. Our integrations enhance efficiency, allowing you to focus on other important tasks.

-

What features does airSlate SignNow provide for managing 2017 Maine tax documents?

airSlate SignNow provides various features designed specifically for managing 2017 Maine tax documents. These include customizable templates, automated workflows, and secure document storage. With electronic signatures and audit trails, you can maintain compliance while keeping everything organized and easy to access.

-

How secure is airSlate SignNow for handling sensitive 2017 Maine tax information?

Security is a top priority at airSlate SignNow, especially when handling 2017 Maine tax information. Our platform employs advanced encryption technologies and follows industry best practices to safeguard your data. This ensures that your sensitive tax documents remain confidential and protected from unauthorized access.

-

What benefits does airSlate SignNow offer for businesses dealing with 2017 Maine tax?

By using airSlate SignNow, businesses can experience signNow benefits when handling their 2017 Maine tax. Our easy-to-use interface increases productivity by minimizing the time spent on document management. Additionally, the cost-effective solution ensures that you save money, allowing you to allocate resources to other areas of your business.

Get more for Maine Electronic Filing Payment Services

- Online wealth declaration form for public servants

- Occupancy certificate format

- Office management book pdf download form

- Funza lushaka application form 2022 pdf

- New american streamline workbook answers form

- Sr nancy nursing book pdf download form

- Wealth declaration tsc form

- Chemistry form 2 questions and answers pdf

Find out other Maine Electronic Filing Payment Services

- How Can I eSignature Oregon Government PDF

- How Can I eSignature Oklahoma Government Document

- How To eSignature Texas Government Document

- Can I eSignature Vermont Government Form

- How Do I eSignature West Virginia Government PPT

- How Do I eSignature Maryland Healthcare / Medical PDF

- Help Me With eSignature New Mexico Healthcare / Medical Form

- How Do I eSignature New York Healthcare / Medical Presentation

- How To eSignature Oklahoma Finance & Tax Accounting PPT

- Help Me With eSignature Connecticut High Tech Presentation

- How To eSignature Georgia High Tech Document

- How Can I eSignature Rhode Island Finance & Tax Accounting Word

- How Can I eSignature Colorado Insurance Presentation

- Help Me With eSignature Georgia Insurance Form

- How Do I eSignature Kansas Insurance Word

- How Do I eSignature Washington Insurance Form

- How Do I eSignature Alaska Life Sciences Presentation

- Help Me With eSignature Iowa Life Sciences Presentation

- How Can I eSignature Michigan Life Sciences Word

- Can I eSignature New Jersey Life Sciences Presentation