1040me 2017

What is the 1040me

The 1040me is the official income tax form used by residents of Maine to report their income and calculate their state income tax liability. This form is specifically designed for individuals and includes various sections to capture income details, deductions, and credits applicable to Maine taxpayers. Understanding the 1040me is essential for accurate tax filing and compliance with state tax laws.

Steps to complete the 1040me

Completing the 1040me involves several key steps to ensure accuracy and compliance. First, gather all necessary documents, including W-2s, 1099s, and any other income statements. Next, follow these steps:

- Fill out personal information, including name, address, and Social Security number.

- Report all sources of income in the designated sections.

- Claim any eligible deductions and credits to reduce taxable income.

- Calculate total tax owed or refund due based on the provided instructions.

- Review the completed form for accuracy before submission.

Legal use of the 1040me

The 1040me is legally recognized as the official document for reporting income and calculating tax obligations in Maine. To ensure its legal validity, taxpayers must adhere to the state’s tax laws and regulations. This includes providing accurate information and signing the form where required. Utilizing an electronic signature through a compliant platform can enhance the legal standing of the submitted form.

Filing Deadlines / Important Dates

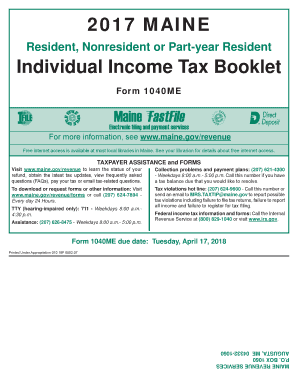

Timely filing of the 1040me is crucial to avoid penalties. The standard deadline for submitting the form is typically April 15 of each year. However, if this date falls on a weekend or holiday, the deadline may be extended. Taxpayers should also be aware of any specific deadlines for extensions or estimated tax payments to ensure compliance with Maine's tax regulations.

Form Submission Methods (Online / Mail / In-Person)

Taxpayers in Maine have several options for submitting the 1040me. The form can be filed electronically through approved e-filing services, which often provide a streamlined process. Alternatively, individuals can print the completed form and mail it to the appropriate state tax office. In-person submissions may be possible at designated tax offices, allowing for direct assistance if needed.

Required Documents

When preparing to file the 1040me, certain documents are essential for accurate reporting. These include:

- W-2 forms from employers detailing wages and tax withholdings.

- 1099 forms for any freelance or contract income.

- Records of other income sources, such as rental income or interest.

- Documentation for deductions, such as mortgage interest statements or receipts for charitable contributions.

Eligibility Criteria

Eligibility to file the 1040me generally requires that the individual is a resident of Maine and has earned income during the tax year. Specific income thresholds may apply, and certain exemptions or credits may be available based on age, disability status, or other factors. Understanding these criteria helps ensure that all eligible taxpayers comply with state tax obligations.

Quick guide on how to complete 1040me form booklet

Effortlessly Prepare 1040me on Any Device

The management of documents online has gained signNow popularity among both organizations and individuals. It serves as an ideal environmentally-friendly substitute for traditional printed and signed documents, allowing you to obtain the correct form and securely store it on the web. airSlate SignNow provides all the necessary tools for you to create, modify, and electronically sign your documents promptly, avoiding unnecessary delays. Handle 1040me on any platform with the airSlate SignNow applications for Android or iOS and simplify any document-related tasks today.

How to Alter and eSign 1040me with Ease

- Find 1040me and select Get Form to begin.

- Make use of the tools available to complete your document.

- Emphasize pertinent sections of the documents or obscure sensitive information using the tools provided by airSlate SignNow for this specific purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and has the same legal validity as a standard wet ink signature.

- Review all the details and click the Done button to save your modifications.

- Choose your preferred method to send your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tedious form navigation, or errors that require reprinting new copies of documents. airSlate SignNow fulfills your document management needs in just a few clicks from any device of your choice. Modify and eSign 1040me to guarantee excellent communication at every stage of your form preparation process using airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 1040me form booklet

Create this form in 5 minutes!

How to create an eSignature for the 1040me form booklet

How to create an eSignature for the 1040me Form Booklet in the online mode

How to generate an electronic signature for your 1040me Form Booklet in Chrome

How to make an electronic signature for signing the 1040me Form Booklet in Gmail

How to generate an electronic signature for the 1040me Form Booklet straight from your smart phone

How to make an eSignature for the 1040me Form Booklet on iOS devices

How to create an electronic signature for the 1040me Form Booklet on Android

People also ask

-

What is the state of Maine income tax rate for businesses?

The state of Maine income tax rate varies based on your business's earnings. It starts at 3.5% for income up to $25,000 and can go up to 8.93% for income over $500,000. Understanding the state of Maine income tax is crucial for accurate financial planning.

-

How does the state of Maine income tax affect eSigning contracts?

When you eSign contracts, it's essential to consider the implications of the state of Maine income tax. Properly documenting income and expenses can affect your taxable income, potentially saving you money when filing. Utilizing airSlate SignNow for eSigning can streamline your documentation process.

-

What features of airSlate SignNow help with state of Maine income tax documentation?

AirSlate SignNow includes features such as templates, automatic reminders, and secure storage, which can help you maintain accurate documentation for state of Maine income tax. These features reduce the risk of errors and ensure you have all necessary information available for tax filing.

-

Can airSlate SignNow integrate with accounting software to manage state of Maine income tax?

Yes, airSlate SignNow integrates seamlessly with leading accounting software. This integration helps you manage your finances effectively, simplifying the tracking of expenses and revenues that are subject to the state of Maine income tax.

-

Is airSlate SignNow a cost-effective solution for managing state of Maine income tax documents?

Absolutely! AirSlate SignNow provides a cost-effective solution for managing all your document signing needs, including those related to the state of Maine income tax. The savings from reduced paperwork and enhanced efficiency make it a smart choice for businesses.

-

How secure is the eSigning process with airSlate SignNow regarding state of Maine income tax?

AirSlate SignNow ensures high-level security for all eSigning processes, critical for state of Maine income tax documentation. With features like two-factor authentication and secure cloud storage, your sensitive financial information remains protected.

-

Can I access my documents pertaining to state of Maine income tax on mobile with airSlate SignNow?

Yes, airSlate SignNow offers a mobile app that allows you to access and eSign documents on the go. This convenience is particularly beneficial for managing state of Maine income tax documentation, enabling you to stay organized wherever you are.

Get more for 1040me

- 2407 army form

- Dd form 175 may 86 military flight plan hood army

- Da form 2408 4 pdf

- Da form 1119

- Report of foreign travel pom form 154 monterey army

- Separation agreement worksheet form

- Us army aeromedical research laboratory fort rucker alabama form

- Usar form 135 r stayarmyreservecom stayarmyreserve army

Find out other 1040me

- Can I Sign Michigan Home Loan Application

- Sign Arkansas Mortgage Quote Request Online

- Sign Nebraska Mortgage Quote Request Simple

- Can I Sign Indiana Temporary Employment Contract Template

- How Can I Sign Maryland Temporary Employment Contract Template

- How Can I Sign Montana Temporary Employment Contract Template

- How Can I Sign Ohio Temporary Employment Contract Template

- Sign Mississippi Freelance Contract Online

- Sign Missouri Freelance Contract Safe

- How Do I Sign Delaware Email Cover Letter Template

- Can I Sign Wisconsin Freelance Contract

- Sign Hawaii Employee Performance Review Template Simple

- Sign Indiana Termination Letter Template Simple

- Sign Michigan Termination Letter Template Free

- Sign Colorado Independent Contractor Agreement Template Simple

- How Can I Sign Florida Independent Contractor Agreement Template

- Sign Georgia Independent Contractor Agreement Template Fast

- Help Me With Sign Nevada Termination Letter Template

- How Can I Sign Michigan Independent Contractor Agreement Template

- Sign Montana Independent Contractor Agreement Template Simple