Form T183 2019

What is the Form T183

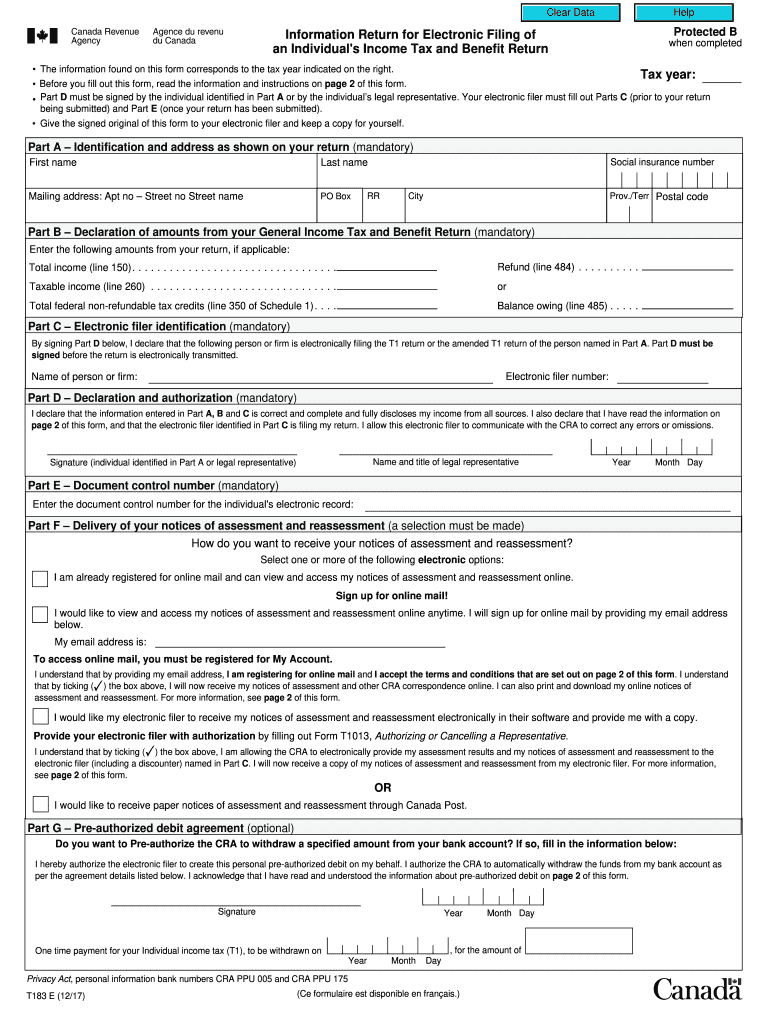

The T183 form, also known as the Revenue Canada Form T183, is a crucial document used in the Canadian tax system. It serves as a declaration of the taxpayer's consent for a tax professional to file their income tax return electronically on their behalf. This form is essential for ensuring that the information submitted to the Canada Revenue Agency (CRA) is accurate and authorized by the taxpayer. It is particularly relevant for individuals who prefer to have their taxes prepared and submitted by a third party, such as an accountant or tax service.

How to Use the Form T183

Using the T183 form involves several straightforward steps. First, the taxpayer must fill out the form with accurate personal information, including their name, address, and Social Insurance Number (SIN). Next, the tax professional must complete their section, which includes their registration number and other relevant details. Once both parties have filled out the necessary sections, the taxpayer must sign the form to provide consent for electronic filing. This signed form can then be submitted to the CRA alongside the electronic tax return.

Steps to Complete the Form T183

Completing the T183 form requires careful attention to detail. Here are the steps to follow:

- Gather all necessary personal and financial information, including your SIN and income details.

- Obtain the T183 form from the CRA website or your tax professional.

- Fill in your personal information accurately in the designated fields.

- Your tax professional should complete their section, including their registration number.

- Review the completed form for accuracy.

- Sign the form to authorize your tax professional to file on your behalf.

- Submit the signed form to your tax professional for electronic filing with the CRA.

Legal Use of the Form T183

The T183 form is legally binding when it is completed and signed correctly. It complies with the Electronic Transactions Act and ensures that the taxpayer's consent is documented for electronic filing. This legal framework protects both the taxpayer and the tax professional, as it establishes a clear agreement regarding the filing of tax returns. Furthermore, the use of an electronic signature on the T183 form is recognized as valid, provided it meets the requirements set forth by the CRA.

Required Documents

To complete the T183 form, certain documents and information are necessary:

- Personal identification, such as a driver's license or passport.

- Your Social Insurance Number (SIN).

- Income statements, including T4 slips and any other relevant tax documents.

- Information about your tax professional, including their registration number.

Form Submission Methods

The T183 form can be submitted in several ways, depending on the preferences of the taxpayer and the tax professional. The most common method is electronic submission, where the signed form is sent directly to the CRA alongside the electronic tax return. Alternatively, the form can be printed and mailed to the CRA if preferred. It is essential to ensure that the form is submitted in a timely manner to avoid any delays in processing the tax return.

Quick guide on how to complete form t183

Effortlessly Prepare Form T183 on Any Device

The management of online documents has surged in popularity among businesses and individuals alike. It offers an excellent eco-friendly substitute for conventional printed and signed documents, allowing you to access the correct format and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and eSign your documents quickly and efficiently. Manage Form T183 on any device using airSlate SignNow's Android or iOS applications and enhance any document-driven process today.

The Easiest Way to Edit and eSign Form T183 Without Stress

- Locate Form T183 and click Get Form to begin.

- Utilize the tools we provide to finish your form.

- Emphasize important sections of your documents or conceal sensitive information with tools specifically designed by airSlate SignNow for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a traditional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Choose how you wish to send your form, whether by email, SMS, invite link, or download it to your computer.

Eliminate concerns over lost or misplaced documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow fulfills all your document management requirements with just a few clicks from any device you prefer. Edit and eSign Form T183 to ensure outstanding communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form t183

Create this form in 5 minutes!

How to create an eSignature for the form t183

The way to create an electronic signature for a PDF online

The way to create an electronic signature for a PDF in Google Chrome

How to create an eSignature for signing PDFs in Gmail

How to make an eSignature right from your smartphone

The best way to create an eSignature for a PDF on iOS

How to make an eSignature for a PDF on Android

People also ask

-

What is the t183 form cra and why is it important?

The t183 form cra is a key document used in the Canadian tax system, particularly for electronic submissions. It authorizes the Canada Revenue Agency (CRA) to file tax returns on behalf of clients. Understanding this form is crucial for tax professionals to ensure compliance and streamline their filing processes.

-

How does airSlate SignNow simplify the signing process for the t183 form cra?

airSlate SignNow offers an intuitive platform that allows users to easily send and eSign the t183 form cra digitally. This eliminates the need for physical paperwork and speeds up the submission process. With secure electronic signatures, you can ensure both compliance and convenience.

-

What features does airSlate SignNow offer for managing the t183 form cra?

airSlate SignNow provides features like customizable templates, automated workflows, and real-time tracking for the t183 form cra. These tools help users manage their documents efficiently and keep a detailed audit trail. This ensures that all submissions are organized and easily accessible.

-

Is airSlate SignNow cost-effective for businesses handling the t183 form cra?

Yes, airSlate SignNow offers competitive pricing plans that make it a cost-effective solution for businesses dealing with the t183 form cra. By reducing the costs associated with paper processing and storage, businesses can save money while improving productivity. Explore our pricing plans to find the best fit for your needs.

-

How can airSlate SignNow integrate with existing systems for the t183 form cra?

airSlate SignNow provides robust integrations with popular CRM and accounting software. This allows for seamless data transfer when working with the t183 form cra, enhancing workflow efficiency. With easy API access, businesses can tailor integrations that meet their specific operational needs.

-

What are the benefits of using airSlate SignNow for the t183 form cra?

Using airSlate SignNow for the t183 form cra offers numerous benefits, including improved speed in document processing, enhanced security with encryption, and better compliance with CRA guidelines. These advantages lead to reduced errors and a smoother overall experience. It empowers businesses to stay focused on their core activities.

-

Can airSlate SignNow be used for bulk submissions of the t183 form cra?

Absolutely! airSlate SignNow supports bulk sending, making it easy to handle multiple t183 form cra submissions at once. This feature is particularly useful for tax professionals managing a large client base and helps streamline workflows signNowly. Save time and eliminate repetitive tasks with bulk functionality.

Get more for Form T183

- Utah child form

- Utah joint custody form

- Residential or rental lease extension agreement utah form

- Commercial rental lease application questionnaire utah form

- Apartment lease rental application questionnaire utah form

- Utah child support form

- Residential rental lease application utah form

- Utah findings form

Find out other Form T183

- Help Me With Electronic signature Alabama Car Dealer Presentation

- How Can I Electronic signature California Car Dealer PDF

- How Can I Electronic signature California Car Dealer Document

- How Can I Electronic signature Colorado Car Dealer Form

- How To Electronic signature Florida Car Dealer Word

- How Do I Electronic signature Florida Car Dealer Document

- Help Me With Electronic signature Florida Car Dealer Presentation

- Can I Electronic signature Georgia Car Dealer PDF

- How Do I Electronic signature Georgia Car Dealer Document

- Can I Electronic signature Georgia Car Dealer Form

- Can I Electronic signature Idaho Car Dealer Document

- How Can I Electronic signature Illinois Car Dealer Document

- How Can I Electronic signature North Carolina Banking PPT

- Can I Electronic signature Kentucky Car Dealer Document

- Can I Electronic signature Louisiana Car Dealer Form

- How Do I Electronic signature Oklahoma Banking Document

- How To Electronic signature Oklahoma Banking Word

- How Can I Electronic signature Massachusetts Car Dealer PDF

- How Can I Electronic signature Michigan Car Dealer Document

- How Do I Electronic signature Minnesota Car Dealer Form