4582 Tax 2019

What is the 4582 Tax

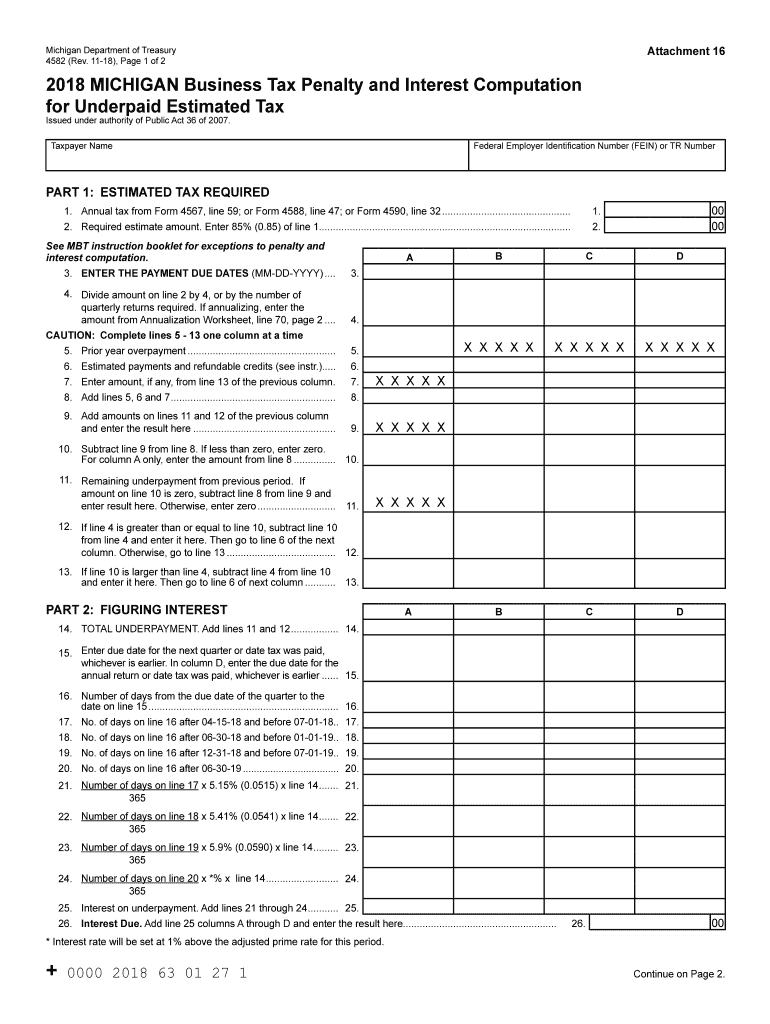

The 4582 tax form is a specific document used in Michigan for tax purposes. It primarily serves to report certain tax information required by the state. Understanding the purpose of this form is essential for compliance with state tax regulations. The 4582 tax form is often associated with the reporting of income, deductions, and credits that may affect an individual's or business's tax obligations.

Steps to Complete the 4582 Tax

Filling out the 4582 tax form involves several key steps to ensure accuracy and compliance. Begin by gathering all necessary financial documents, including income statements, previous tax returns, and any relevant deductions. Next, carefully follow the instructions provided with the form, ensuring that each section is completed accurately. It's important to double-check all entries for errors before submission. Once completed, you can submit the form electronically or via mail, depending on your preference and the requirements set by the state.

Legal Use of the 4582 Tax

The 4582 tax form is legally binding when completed correctly and submitted in accordance with state laws. To ensure its validity, it must be signed by the individual or authorized representative. Compliance with the legal requirements surrounding this form is crucial, as improper filing can lead to penalties or legal issues. Utilizing a reliable eSignature solution can enhance the legitimacy of your submission, providing an electronic certificate that confirms the authenticity of your signature.

Filing Deadlines / Important Dates

Timely filing of the 4582 tax form is essential to avoid penalties. The deadlines for submission typically align with the annual tax filing period, which is usually April 15 for individual taxpayers. However, specific dates may vary based on individual circumstances or changes in state regulations. It is advisable to stay informed about any updates to filing deadlines to ensure compliance and avoid unnecessary complications.

Required Documents

To accurately complete the 4582 tax form, certain documents are required. These may include proof of income, such as W-2 forms or 1099 statements, documentation of any deductions or credits claimed, and previous tax returns for reference. Having these documents readily available can streamline the process and help ensure that all necessary information is included in your submission.

Form Submission Methods

The 4582 tax form can be submitted through various methods, providing flexibility to taxpayers. Options typically include electronic submission via a secure online platform, mailing a physical copy to the appropriate state tax office, or delivering it in person. Each method has its own advantages, and choosing the right one depends on personal preferences and the urgency of the submission.

Penalties for Non-Compliance

Failure to file the 4582 tax form correctly or on time can result in significant penalties. These may include fines, interest on unpaid taxes, and potential legal action. Understanding the consequences of non-compliance emphasizes the importance of accurate and timely filing. Taxpayers should be aware of the regulations governing the 4582 tax form to avoid these repercussions.

Quick guide on how to complete 4582 tax

Effortlessly prepare 4582 Tax on any device

Digital document management has become increasingly popular among businesses and individuals. It offers a perfect eco-friendly substitute for conventional printed and signed paperwork, as you can obtain the correct form and securely store it online. airSlate SignNow provides all the necessary tools to create, modify, and electronically sign your documents swiftly without delays. Manage 4582 Tax on any device using the airSlate SignNow apps for Android or iOS and streamline any document-related process today.

How to edit and electronically sign 4582 Tax with ease

- Find 4582 Tax and click Get Form to begin.

- Utilize the tools available to complete your document.

- Highlight important sections of your documents or redact sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Create your signature using the Sign tool, which only takes a few seconds and carries the same legal validity as a traditional handwritten signature.

- Review all the details and click the Done button to save your modifications.

- Select your preferred method to send your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tedious form searching, or mistakes that require printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you choose. Edit and electronically sign 4582 Tax and ensure exceptional communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 4582 tax

Create this form in 5 minutes!

How to create an eSignature for the 4582 tax

The way to create an electronic signature for a PDF file online

The way to create an electronic signature for a PDF file in Google Chrome

How to create an electronic signature for signing PDFs in Gmail

How to make an eSignature right from your mobile device

The best way to create an eSignature for a PDF file on iOS

How to make an eSignature for a PDF on Android devices

People also ask

-

What is the 4582 form used for?

The 4582 form is a crucial document used for specific administrative purposes, typically required in various business transactions. Understanding its requirements is essential to ensure compliance and efficiency in processing. airSlate SignNow facilitates the signing and handling of the 4582 form, making it easy to manage.

-

How does airSlate SignNow simplify the completion of the 4582 form?

airSlate SignNow offers an intuitive platform that allows users to quickly fill out and eSign the 4582 form digitally. Our user-friendly interface helps reduce the time spent on paperwork, ensuring your team can focus on more important tasks. Plus, the saving and sharing features streamline the process even further.

-

Is there a cost associated with using the 4582 form on airSlate SignNow?

Yes, there is a pricing plan for airSlate SignNow that offers different tiers depending on your business needs. However, the investment is often offset by the time and resources saved by efficiently managing the 4582 form digitally. Our plans are designed to be cost-effective for businesses of all sizes.

-

Can I integrate airSlate SignNow with other applications for handling the 4582 form?

Absolutely! airSlate SignNow offers robust integrations with many third-party applications, enhancing your workflow. Whether you use CRM systems or document management tools, integrating them with our service makes managing the 4582 form more streamlined and efficient.

-

What are the benefits of using airSlate SignNow for the 4582 form?

Using airSlate SignNow for the 4582 form provides numerous benefits, including faster processing times and enhanced security. Digital signatures ensure that your documents are legally binding, while our platform's tracking features allow you to monitor the status of your form seamlessly. Overall, it enhances productivity and compliance.

-

Is airSlate SignNow secure for signing the 4582 form?

Yes, airSlate SignNow prioritizes security, offering trust and peace of mind when signing the 4582 form. Our platform utilizes encryption and secure storage to protect your sensitive data, ensuring that your electronic signatures are safe and compliant with industry standards.

-

Can I access the 4582 form on mobile devices using airSlate SignNow?

Absolutely! airSlate SignNow is mobile-friendly, allowing you to access and manage the 4582 form from anywhere at any time. This flexibility enables you to sign documents on the go, making it easy to carry out business without being tied to your desk.

Get more for 4582 Tax

- Physical placement form

- Physical placement 497430935 form

- Notice of hearing wisconsin form

- Wisconsin exhibit list form

- Wisconsin exhibit list 497430938 form

- Order to garnishee release of garnishee wisconsin form

- Notification to the state historical society disposition of obsolete records wisconsin form

- Wisconsin property form

Find out other 4582 Tax

- Sign Courts Form Wisconsin Easy

- Sign Wyoming Courts LLC Operating Agreement Online

- How To Sign Wyoming Courts Quitclaim Deed

- eSign Vermont Business Operations Executive Summary Template Mobile

- eSign Vermont Business Operations Executive Summary Template Now

- eSign Virginia Business Operations Affidavit Of Heirship Mobile

- eSign Nebraska Charity LLC Operating Agreement Secure

- How Do I eSign Nevada Charity Lease Termination Letter

- eSign New Jersey Charity Resignation Letter Now

- eSign Alaska Construction Business Plan Template Mobile

- eSign Charity PPT North Carolina Now

- eSign New Mexico Charity Lease Agreement Form Secure

- eSign Charity PPT North Carolina Free

- eSign North Dakota Charity Rental Lease Agreement Now

- eSign Arkansas Construction Permission Slip Easy

- eSign Rhode Island Charity Rental Lease Agreement Secure

- eSign California Construction Promissory Note Template Easy

- eSign Colorado Construction LLC Operating Agreement Simple

- Can I eSign Washington Charity LLC Operating Agreement

- eSign Wyoming Charity Living Will Simple