Instructions for Schedule R Form 941 Rev September Instructions for Schedule R Form 941, Allocation Schedule for Aggregate Form 2020

What is the Instructions For Schedule R Form 941 Rev September

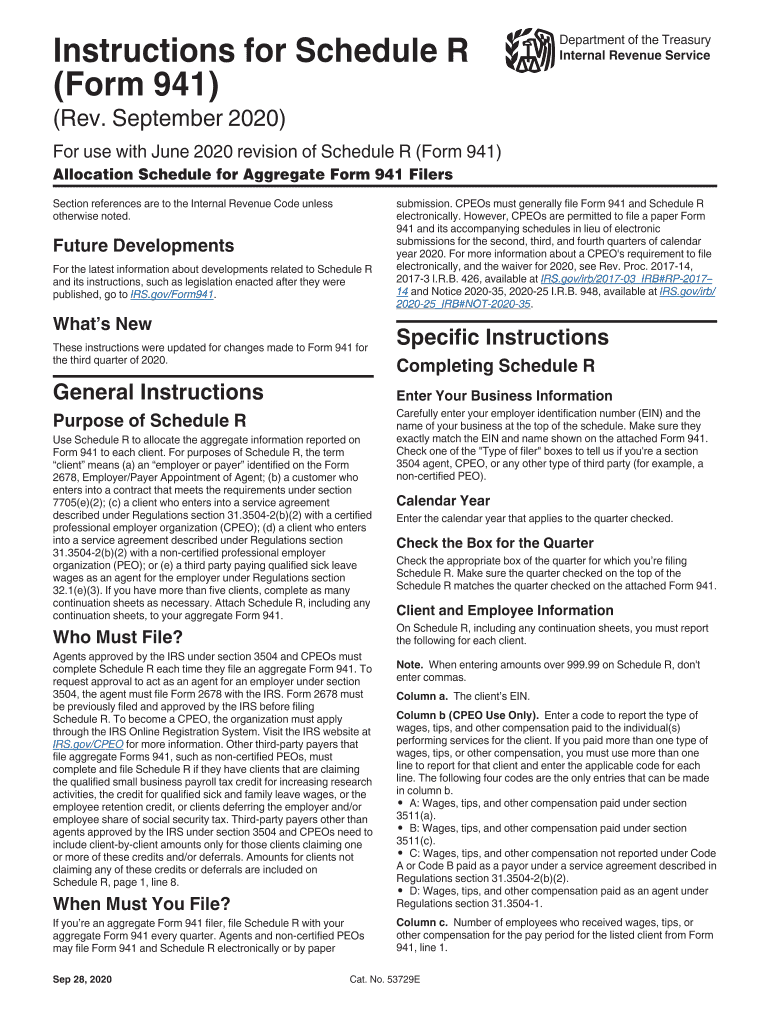

The Instructions For Schedule R Form 941 Rev September provide detailed guidance for employers who need to allocate their tax liabilities when filing Form 941, the Employer's Quarterly Federal Tax Return. This form is particularly relevant for aggregate filers, which are businesses that report taxes for multiple entities under a single return. The instructions clarify how to properly allocate wages, tips, and other compensation among various entities, ensuring compliance with IRS regulations. Understanding these instructions is crucial for accurate reporting and avoiding potential penalties.

Steps to complete the Instructions For Schedule R Form 941 Rev September

Completing the Instructions For Schedule R Form 941 involves several key steps:

- Gather all necessary information about your business entities, including their Employer Identification Numbers (EINs).

- Review the specific allocation methods outlined in the instructions, as they vary based on the type of business structure.

- Fill out the allocation schedule accurately, ensuring that all wages and tax liabilities are reported correctly for each entity.

- Double-check the calculations for accuracy to avoid discrepancies that could lead to penalties.

- Submit the completed Schedule R along with your Form 941 by the designated filing deadline.

Legal use of the Instructions For Schedule R Form 941 Rev September

The legal use of the Instructions For Schedule R Form 941 is governed by IRS regulations, which stipulate that employers must accurately report their payroll taxes. Utilizing these instructions ensures that businesses comply with federal tax laws, thereby minimizing the risk of audits or penalties. It is essential for employers to understand that any misreporting or failure to follow the guidelines can lead to legal repercussions, including fines or additional tax liabilities.

Key elements of the Instructions For Schedule R Form 941 Rev September

Several key elements are essential to effectively utilize the Instructions For Schedule R Form 941:

- Understanding the definitions of terms such as "aggregate filer" and "allocation" is crucial for proper completion.

- Familiarity with the various sections of the form, including how to report wages and taxes for each entity, is necessary.

- Knowledge of the filing deadlines is important to ensure timely submission and avoid late fees.

- Awareness of the penalties for non-compliance can motivate accurate reporting and adherence to the guidelines.

Filing Deadlines / Important Dates

Filing deadlines for the Instructions For Schedule R Form 941 are critical for compliance. Employers must submit their Form 941, including Schedule R, on a quarterly basis. The deadlines typically fall on the last day of the month following the end of each quarter. For example, for the first quarter ending March 31, the due date is April 30. Missing these deadlines can result in penalties and interest on unpaid taxes, making it vital to stay informed about these important dates.

Examples of using the Instructions For Schedule R Form 941 Rev September

Examples of using the Instructions For Schedule R Form 941 can help clarify the allocation process for various business scenarios:

- A corporation with multiple subsidiaries may use Schedule R to allocate payroll taxes among them based on their respective wage distributions.

- A partnership that operates in different states might need to report taxes separately for each entity, requiring careful adherence to the allocation instructions.

- Employers who have acquired new businesses during the quarter must accurately reflect the payroll liabilities of both the original and acquired entities.

Quick guide on how to complete instructions for schedule r form 941 rev september 2020 instructions for schedule r form 941 allocation schedule for aggregate

Complete Instructions For Schedule R Form 941 Rev September Instructions For Schedule R Form 941, Allocation Schedule For Aggregate Form effortlessly on any device

Managing documents online has become increasingly popular among companies and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed papers, as you can access the correct format and securely store it online. airSlate SignNow provides all the resources you require to create, modify, and eSign your documents quickly without delays. Manage Instructions For Schedule R Form 941 Rev September Instructions For Schedule R Form 941, Allocation Schedule For Aggregate Form on any platform with the airSlate SignNow Android or iOS applications and streamline any document-related operation today.

The easiest way to modify and eSign Instructions For Schedule R Form 941 Rev September Instructions For Schedule R Form 941, Allocation Schedule For Aggregate Form effortlessly

- Find Instructions For Schedule R Form 941 Rev September Instructions For Schedule R Form 941, Allocation Schedule For Aggregate Form and then click Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Emphasize relevant parts of your documents or obscure sensitive information using specific tools provided by airSlate SignNow.

- Create your eSignature with the Sign tool, which only takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and then click on the Done button to save your modifications.

- Select how you wish to send your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate the hassle of lost or misfiled documents, tedious form searching, or mistakes that necessitate printing new copies. airSlate SignNow fulfills all your document management requirements in just a few clicks from any device you prefer. Edit and eSign Instructions For Schedule R Form 941 Rev September Instructions For Schedule R Form 941, Allocation Schedule For Aggregate Form and ensure outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct instructions for schedule r form 941 rev september 2020 instructions for schedule r form 941 allocation schedule for aggregate

Create this form in 5 minutes!

How to create an eSignature for the instructions for schedule r form 941 rev september 2020 instructions for schedule r form 941 allocation schedule for aggregate

The best way to create an electronic signature for a PDF file in the online mode

The best way to create an electronic signature for a PDF file in Chrome

How to create an electronic signature for putting it on PDFs in Gmail

How to generate an eSignature from your smartphone

The way to create an eSignature for a PDF file on iOS devices

How to generate an eSignature for a PDF file on Android

People also ask

-

What are the Instructions For Schedule R Form 941 Rev September?

The Instructions For Schedule R Form 941 Rev September provide detailed guidelines on how to complete the Schedule R for aggregate Form 941 filers. This document helps businesses accurately allocate employment tax credits and determine the correct amounts owed. Understanding these instructions is crucial for compliance and to avoid potential penalties.

-

How can airSlate SignNow assist with completing Schedule R Form 941?

airSlate SignNow offers tools that streamline the process of filling out the Instructions For Schedule R Form 941 Rev September. Our platform allows users to easily input data and eSign documents securely, ensuring compliance while saving time. With user-friendly features, you can focus on your business without worrying about paperwork.

-

Is airSlate SignNow cost-effective for handling tax documents?

Yes, airSlate SignNow is a cost-effective solution for managing tax documents, including the Instructions For Schedule R Form 941 Rev September. Our competitive pricing enables businesses of all sizes to access eSigning and document management tools without high upfront costs. By utilizing our services, you can enhance efficiency while staying within budget.

-

What features does airSlate SignNow offer for tax form management?

airSlate SignNow provides a variety of features designed to simplify tax form management, including templates for the Instructions For Schedule R Form 941 Rev September. Users can create, edit, and store documents securely, while also tracking the signing process. These functionalities contribute to a smoother workflow, especially for aggregate Form 941 filers.

-

Can I integrate airSlate SignNow with other software systems?

Absolutely! airSlate SignNow integrates seamlessly with various software systems to enhance productivity, including those used for handling the Instructions For Schedule R Form 941 Rev September. This allows for efficient data transfer and document handling across platforms, making it easier to collaborate and ensure compliance.

-

What are the benefits of using airSlate SignNow for tax-related documents?

Using airSlate SignNow for tax-related documents, like the Instructions For Schedule R Form 941 Rev September, offers numerous benefits, including improved accuracy, faster processing times, and enhanced document security. Our platform ensures that all tax forms are completed with precision, reducing the risk of errors. Additionally, eSigning capabilities dramatically speed up the approval process.

-

How secure is the information processed through airSlate SignNow?

Security is a top priority at airSlate SignNow. We implement advanced encryption and security protocols to protect all information, including data related to the Instructions For Schedule R Form 941 Rev September. Our compliance with industry standards ensures that your business documents are safe from unauthorized access.

Get more for Instructions For Schedule R Form 941 Rev September Instructions For Schedule R Form 941, Allocation Schedule For Aggregate Form

Find out other Instructions For Schedule R Form 941 Rev September Instructions For Schedule R Form 941, Allocation Schedule For Aggregate Form

- Sign Florida Contract Safe

- Sign Nebraska Contract Safe

- How To Sign North Carolina Contract

- How Can I Sign Alabama Personal loan contract template

- Can I Sign Arizona Personal loan contract template

- How To Sign Arkansas Personal loan contract template

- Sign Colorado Personal loan contract template Mobile

- How Do I Sign Florida Personal loan contract template

- Sign Hawaii Personal loan contract template Safe

- Sign Montana Personal loan contract template Free

- Sign New Mexico Personal loan contract template Myself

- Sign Vermont Real estate contracts Safe

- Can I Sign West Virginia Personal loan contract template

- How Do I Sign Hawaii Real estate sales contract template

- Sign Kentucky New hire forms Myself

- Sign Alabama New hire packet Online

- How Can I Sign California Verification of employment form

- Sign Indiana Home rental application Online

- Sign Idaho Rental application Free

- Sign South Carolina Rental lease application Online