Sa103s 2019

What is the SA103S?

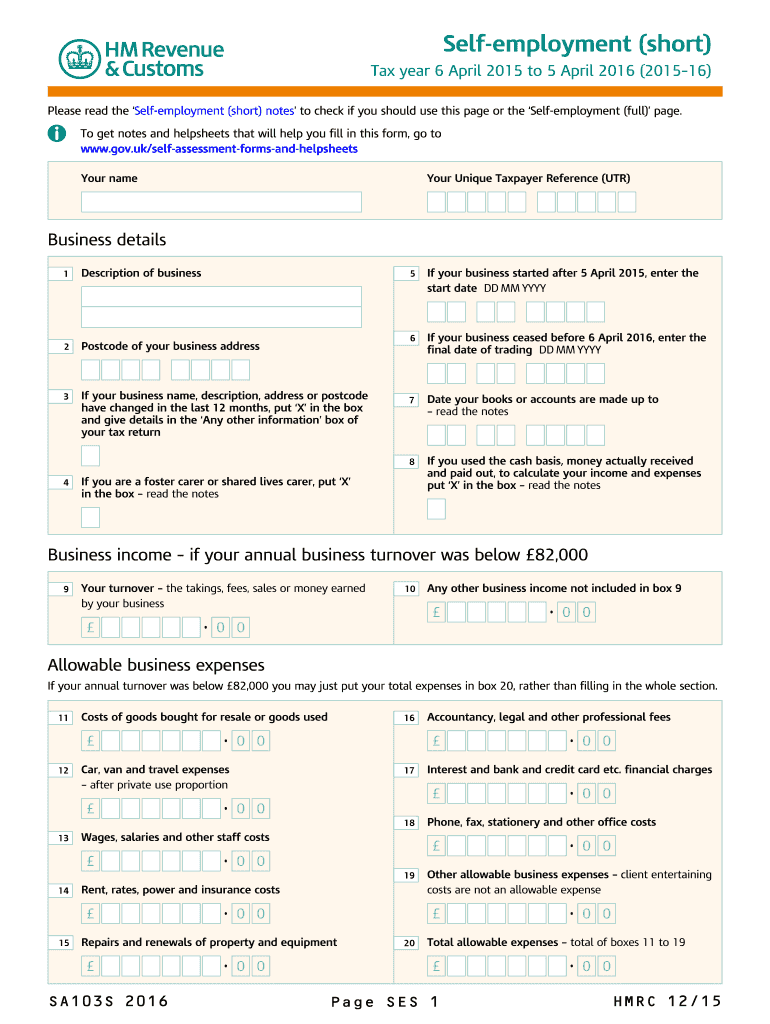

The SA103S is a self-assessment tax return form specifically designed for self-employed individuals in the United States. It allows taxpayers to report their income and expenses related to self-employment. This form is crucial for individuals who earn income outside of traditional employment, ensuring they fulfill their tax obligations. The SA103S is part of the broader self-assessment tax system, which requires individuals to calculate their own tax liability based on their earnings.

How to Obtain the SA103S

To obtain the SA103S form, individuals can visit the official IRS website or contact the IRS directly. The form is available for download in PDF format, making it easy to print and fill out. Additionally, taxpayers can request a physical copy to be mailed to them. It is important to ensure that you are using the most current version of the form, as tax regulations can change annually.

Steps to Complete the SA103S

Completing the SA103S involves several key steps:

- Gather all necessary financial documents, including income statements and expense receipts.

- Fill out the form with accurate information regarding your income and allowable expenses.

- Calculate your total taxable income by subtracting your total expenses from your total income.

- Review the completed form for accuracy and ensure all required fields are filled out.

- Sign and date the form before submission.

Legal Use of the SA103S

The SA103S is legally binding when completed and submitted according to IRS guidelines. It is essential to provide accurate information, as any discrepancies may lead to penalties or audits. The form must be signed, and digital signatures are acceptable if using an eSignature solution that complies with legal standards. Ensuring compliance with laws such as the ESIGN Act and UETA is vital for the legal validity of electronically signed documents.

Filing Deadlines / Important Dates

Filing deadlines for the SA103S typically align with the annual tax return deadlines. For most taxpayers, the deadline is April 15 of each year. However, if this date falls on a weekend or holiday, the deadline may be extended to the next business day. It is advisable to check for any updates or changes to the filing schedule each tax year.

Form Submission Methods

Taxpayers can submit the SA103S form through various methods:

- Online: Using tax software that supports e-filing, individuals can submit their SA103S electronically.

- Mail: The completed form can be printed and mailed to the appropriate IRS address.

- In-Person: Some individuals may choose to file their forms in person at designated IRS offices.

Quick guide on how to complete sa103s

Effortlessly prepare Sa103s on any device

Digital document management has gained popularity among businesses and individuals alike. It offers an ideal environmentally friendly alternative to traditional printed and signed documents, enabling you to easily locate the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, modify, and electronically sign your documents promptly without delays. Manage Sa103s on any device using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

The simplest way to change and eSign Sa103s with ease

- Locate Sa103s and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize important sections of your documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional ink signature.

- Verify the details and click on the Done button to save your changes.

- Choose how you want to send your form, whether by email, SMS, or invite link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs with just a few clicks from any device you prefer. Edit and eSign Sa103s to ensure excellent communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct sa103s

Create this form in 5 minutes!

How to create an eSignature for the sa103s

The way to generate an eSignature for your PDF document online

The way to generate an eSignature for your PDF document in Google Chrome

How to make an electronic signature for signing PDFs in Gmail

How to generate an electronic signature right from your smart phone

The way to create an electronic signature for a PDF document on iOS

How to generate an electronic signature for a PDF on Android OS

People also ask

-

What is the self assessment sa103s form?

The self assessment sa103s form is used by UK taxpayers who are self-employed to report their income and expenses to HM Revenue and Customs. It is a key part of the self-assessment tax return process. Completing the self assessment sa103s accurately is essential for ensuring compliance and avoiding penalties.

-

How can airSlate SignNow help with the self assessment sa103s?

airSlate SignNow simplifies the process of signing and sending the self assessment sa103s form electronically. Our platform streamlines document workflows, allowing you to collect eSignatures quickly and securely. This makes filing your self assessment sa103s much more efficient and less time-consuming.

-

Are there any costs associated with using airSlate SignNow for self assessment sa103s?

Yes, airSlate SignNow offers various pricing plans to cater to different business needs. The cost-effective solutions help ensure that managing your self assessment sa103s remains budget-friendly. Explore our pricing options to find a plan that works for you.

-

What features does airSlate SignNow offer for handling the self assessment sa103s?

airSlate SignNow provides features like customizable templates, in-person signing, and document tracking for the self assessment sa103s. These features enhance usability and control, ensuring you can manage your documents easily. Our platform also ensures security and compliance throughout the process.

-

Can I integrate airSlate SignNow with other software for my self assessment sa103s?

Absolutely! airSlate SignNow offers seamless integrations with popular business applications like Google Workspace, Salesforce, and others. This allows you to efficiently manage your self assessment sa103s alongside your existing tools, streamlining your overall workflow.

-

What are the benefits of using airSlate SignNow for self assessment sa103s?

Using airSlate SignNow for your self assessment sa103s can save you time and reduce stress by simplifying document management. Enhanced compliance features ensure accuracy, while the eSignature capabilities speed up the signing process. Overall, our solution allows businesses to focus more on growth and less on paperwork.

-

Is airSlate SignNow secure for submitting self assessment sa103s?

Yes, airSlate SignNow prioritizes security, utilizing advanced encryption protocols to protect your documents, including the self assessment sa103s. Our platform is designed to comply with industry standards, ensuring that your sensitive information is safe throughout the process. You can confidently manage your self assessment sa103s with peace of mind.

Get more for Sa103s

- Records request form form 101 f pdf free download

- Annuity beneficiary claim form nationwide life insurance

- Mission ampampamp outreachswedish medical center seattle and form

- Fillable online fillable online reset form print form

- Abstracthospital acquired infectionintensive care unit form

- A comparison of transfer and native university student form

- Wwwtri cedu workforce public safetytri c police academy application process cleveland ohio form

- Month to month residential lease agreement form

Find out other Sa103s

- eSign Police Document Michigan Secure

- eSign Iowa Courts Emergency Contact Form Online

- eSign Kentucky Courts Quitclaim Deed Easy

- How To eSign Maryland Courts Medical History

- eSign Michigan Courts Lease Agreement Template Online

- eSign Minnesota Courts Cease And Desist Letter Free

- Can I eSign Montana Courts NDA

- eSign Montana Courts LLC Operating Agreement Mobile

- eSign Oklahoma Sports Rental Application Simple

- eSign Oklahoma Sports Rental Application Easy

- eSign Missouri Courts Lease Agreement Template Mobile

- Help Me With eSign Nevada Police Living Will

- eSign New York Courts Business Plan Template Later

- Can I eSign North Carolina Courts Limited Power Of Attorney

- eSign North Dakota Courts Quitclaim Deed Safe

- How To eSign Rhode Island Sports Quitclaim Deed

- Help Me With eSign Oregon Courts LLC Operating Agreement

- eSign North Dakota Police Rental Lease Agreement Now

- eSign Tennessee Courts Living Will Simple

- eSign Utah Courts Last Will And Testament Free