Mass Dor Form M8379 2020

What is the Mass Dor Form M8379

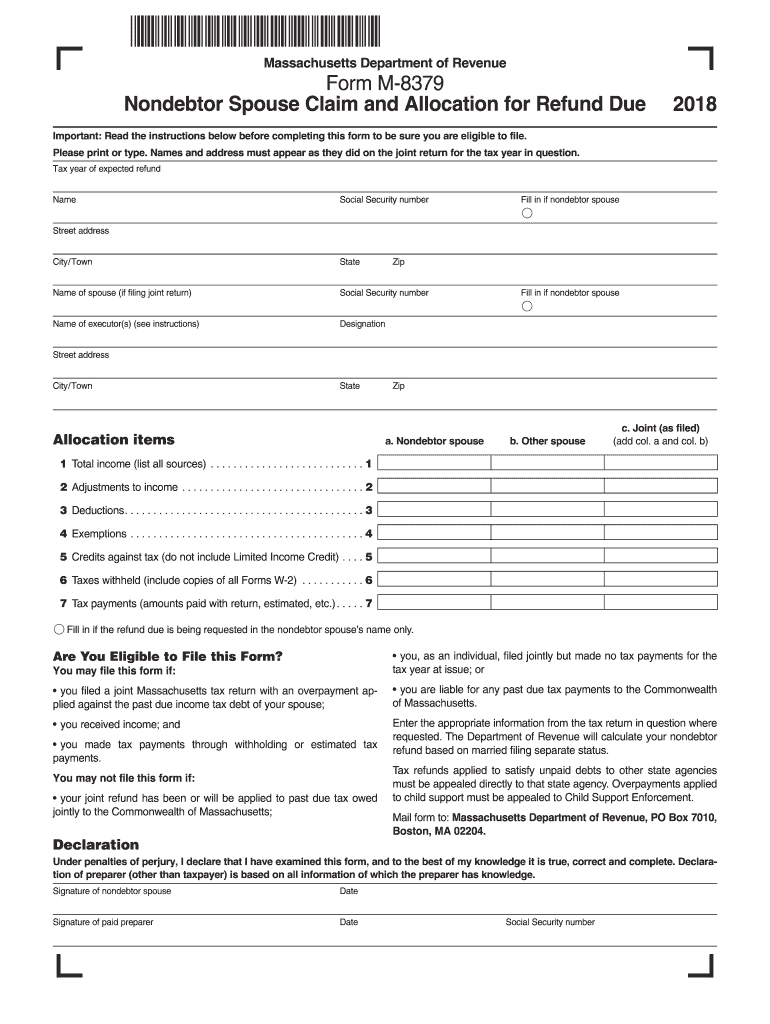

The Mass Dor Form M8379, commonly referred to as the m8379 form, is a tax document used in Massachusetts. This form is specifically designed for individuals who are filing for a tax refund due to the allocation of certain credits or deductions. It allows taxpayers to claim a portion of their tax refund that may be due to their spouse's income, which is particularly relevant in cases of separation or divorce. Understanding the purpose of this form is crucial for ensuring accurate tax filings and maximizing potential refunds.

How to use the Mass Dor Form M8379

Using the Mass Dor Form M8379 involves several straightforward steps. First, ensure you have all necessary information, including your personal details, income, and any relevant tax documents. Next, accurately fill out the form, providing details about your income and your spouse's income if applicable. After completing the form, review it for accuracy before submission. This form can be submitted electronically or via mail, depending on your preference and the requirements set by the Massachusetts Department of Revenue.

Steps to complete the Mass Dor Form M8379

Completing the Mass Dor Form M8379 requires careful attention to detail. Begin by gathering all necessary documents, such as W-2 forms and previous tax returns. Follow these steps:

- Enter your personal information, including your name, address, and Social Security number.

- Provide your filing status and any applicable information regarding your spouse's income.

- Complete the sections related to deductions and credits you are claiming.

- Double-check all entries for accuracy.

- Submit the form electronically or print and mail it to the appropriate address.

Legal use of the Mass Dor Form M8379

The legal use of the Mass Dor Form M8379 is governed by state tax laws. To ensure compliance, it is essential to fill out the form accurately and submit it within the designated timelines. The form must be signed by both spouses if applicable, affirming that the information provided is truthful and complete. Misrepresentation or errors on the form can result in penalties or delays in processing your tax refund.

Required Documents

When completing the Mass Dor Form M8379, certain documents are required to support your claims. These typically include:

- W-2 forms from all employers for both you and your spouse.

- Previous tax returns for reference.

- Any documentation related to deductions or credits you are claiming.

- Proof of identity, such as a driver's license or Social Security card.

Filing Deadlines / Important Dates

Filing deadlines for the Mass Dor Form M8379 align with the general tax filing deadlines set by the Massachusetts Department of Revenue. Typically, the deadline for filing state tax returns is April 15. However, if this date falls on a weekend or holiday, the deadline may be extended. It is crucial to stay informed about any changes to filing dates to avoid late penalties.

Quick guide on how to complete mass dor form m8379

Access Mass Dor Form M8379 effortlessly on any device

Digital document management has gained traction among companies and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed documents, allowing you to acquire the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, modify, and electronically sign your documents swiftly without any hold-ups. Manage Mass Dor Form M8379 on any platform with airSlate SignNow applications for Android or iOS and simplify any document-related procedure today.

How to modify and electronically sign Mass Dor Form M8379 with ease

- Find Mass Dor Form M8379 and click on Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize pertinent sections of your documents or redact sensitive information with the tools that airSlate SignNow specifically provides for that purpose.

- Create your electronic signature using the Sign tool, which takes just seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and then click the Done button to save your changes.

- Choose how you want to submit your form: via email, text message (SMS), or an invite link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Modify and electronically sign Mass Dor Form M8379 and ensure outstanding communication at every stage of the form creation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct mass dor form m8379

Create this form in 5 minutes!

How to create an eSignature for the mass dor form m8379

How to generate an electronic signature for a PDF file online

How to generate an electronic signature for a PDF file in Google Chrome

The way to create an electronic signature for signing PDFs in Gmail

The best way to generate an eSignature straight from your mobile device

How to make an eSignature for a PDF file on iOS

The best way to generate an eSignature for a PDF document on Android devices

People also ask

-

What is m8379 and how does it relate to airSlate SignNow?

The m8379 refers to a specific feature set within the airSlate SignNow platform that enhances document signing processes. It allows users to efficiently manage eSignatures, ensuring compliance and security. Utilizing m8379 can signNowly streamline your document workflow.

-

How much does airSlate SignNow's m8379 feature cost?

The pricing for m8379 as part of the airSlate SignNow platform depends on the chosen subscription plan. Various tiers are available, each designed to accommodate different business needs. Visit our pricing page to find the best option that incorporates m8379 for your organization.

-

What are the primary benefits of using m8379 in airSlate SignNow?

The m8379 feature offers numerous benefits, including enhanced document security and streamlined eSigning processes. It also improves team collaboration and accelerates contract turnaround times. By using m8379, businesses can achieve greater efficiency in managing their documents.

-

Can airSlate SignNow with m8379 integrate with other software applications?

Yes, airSlate SignNow with m8379 offers robust integration capabilities with various third-party applications. Popular tools like CRM systems, cloud storage solutions, and productivity software can be linked seamlessly. This ensures a holistic workflow that incorporates m8379 functionalities effectively.

-

Is the m8379 feature suitable for small businesses?

Absolutely! The m8379 feature within airSlate SignNow is designed to cater to businesses of all sizes, including small enterprises. Its cost-effective solution enables small businesses to access advanced eSigning and document management tools without breaking the bank.

-

How can m8379 enhance document security?

m8379 enhances document security by providing advanced encryption and authentication features within airSlate SignNow. It ensures that documents are protected from unauthorized access while maintaining compliance with legal standards. With m8379, businesses can trust that their sensitive information is secure.

-

What types of documents can be signed using m8379?

With m8379 in airSlate SignNow, you can sign a wide range of documents, including contracts, agreements, and forms. This flexibility makes it an ideal tool for various industries needing quick and secure eSignatures. The ability to manage these documents efficiently is a key advantage of m8379.

Get more for Mass Dor Form M8379

- Good cause waiver missouri form

- How to file a nevada homestead declarationlaw office of form

- Idnyc complaints status and questionsnyc311idnycaccess nycstart your idnyc application new york cityidnyc complaints status and form

- Bar exam application bar application form

- Work status form f242 052 000 work status form f242 052 000

- List of approved vehicle product protection michigangov form

- Request and authority for leave da form 31 sep 2022

- Architectural compliance certificate form

Find out other Mass Dor Form M8379

- Sign West Virginia High Tech Quitclaim Deed Myself

- Sign Delaware Insurance Claim Online

- Sign Delaware Insurance Contract Later

- Sign Hawaii Insurance NDA Safe

- Sign Georgia Insurance POA Later

- How Can I Sign Alabama Lawers Lease Agreement

- How Can I Sign California Lawers Lease Agreement

- Sign Colorado Lawers Operating Agreement Later

- Sign Connecticut Lawers Limited Power Of Attorney Online

- Sign Hawaii Lawers Cease And Desist Letter Easy

- Sign Kansas Insurance Rental Lease Agreement Mobile

- Sign Kansas Insurance Rental Lease Agreement Free

- Sign Kansas Insurance Rental Lease Agreement Fast

- Sign Kansas Insurance Rental Lease Agreement Safe

- How To Sign Kansas Insurance Rental Lease Agreement

- How Can I Sign Kansas Lawers Promissory Note Template

- Sign Kentucky Lawers Living Will Free

- Sign Kentucky Lawers LLC Operating Agreement Mobile

- Sign Louisiana Lawers Quitclaim Deed Now

- Sign Massachusetts Lawers Quitclaim Deed Later