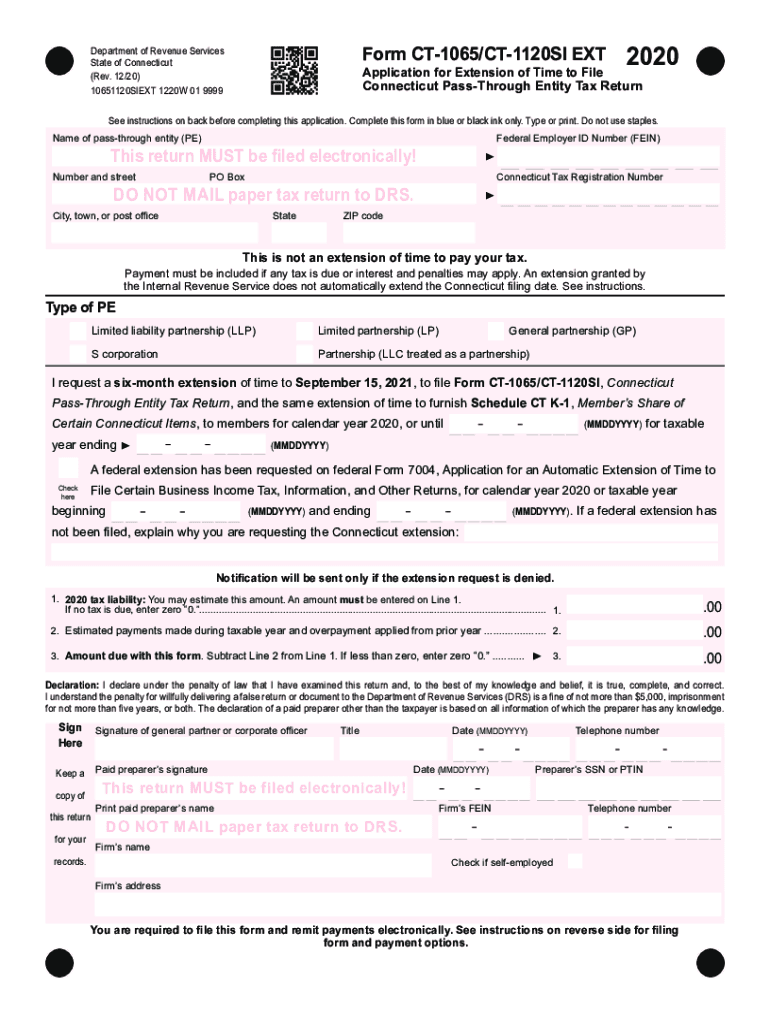

PDF Form CT 1065CT 1120SI EXT This Return MUST Be Filed CT Gov 2020

What is the 2019 CT 1065 Extension?

The 2019 CT 1065 extension is a crucial tax form used by partnerships in Connecticut to request an extension for filing their annual income tax return. This form allows partnerships to extend their filing deadline, providing additional time to prepare and submit their tax documents. Understanding this form is essential for compliance with state tax regulations, ensuring that partnerships avoid penalties associated with late submissions.

Steps to Complete the 2019 CT 1065 Extension

Completing the 2019 CT 1065 extension involves several key steps:

- Gather necessary information, including the partnership's tax ID number and financial details.

- Access the form, which can be downloaded from the Connecticut Department of Revenue Services website.

- Fill in the required fields accurately, ensuring all information is correct to avoid delays.

- Review the completed form for any errors or omissions.

- Submit the form electronically or via mail, adhering to the specified deadlines.

Filing Deadlines for the 2019 CT 1065 Extension

It is important to be aware of the filing deadlines associated with the 2019 CT 1065 extension. The standard deadline for filing the CT 1065 is typically the fifteenth day of the fourth month following the end of the partnership's tax year. By submitting the extension form, partnerships can extend this deadline by six months, allowing for more time to finalize their tax returns.

Required Documents for the 2019 CT 1065 Extension

To complete the 2019 CT 1065 extension, certain documents must be prepared:

- Partnership's federal tax return information.

- Financial statements, including income and expense reports.

- Any prior year tax returns for reference.

Having these documents ready will facilitate a smoother completion process for the extension form.

Penalties for Non-Compliance with the 2019 CT 1065 Extension

Failing to file the 2019 CT 1065 extension on time can result in significant penalties. Partnerships may incur fines for late filing, which can accumulate over time. Additionally, interest may be charged on any unpaid taxes. Therefore, it is essential to adhere to the filing deadlines and ensure that all required forms are submitted accurately and promptly.

Digital vs. Paper Version of the 2019 CT 1065 Extension

The 2019 CT 1065 extension can be completed and submitted in both digital and paper formats. The digital version offers convenience and faster processing times, while the paper version may be preferred by those who are more comfortable with traditional methods. Regardless of the format chosen, it is vital to ensure that the form is filled out correctly and submitted by the deadline to avoid penalties.

Quick guide on how to complete pdf form ct 1065ct 1120si ext this return must be filed ctgov

Complete PDF Form CT 1065CT 1120SI EXT This Return MUST Be Filed CT gov effortlessly on any gadget

Digital document management has gained traction among businesses and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed papers, allowing you to locate the right template and securely store it online. airSlate SignNow equips you with all the features necessary to create, alter, and eSign your documents promptly without interruptions. Handle PDF Form CT 1065CT 1120SI EXT This Return MUST Be Filed CT gov on any gadget with airSlate SignNow Android or iOS applications and simplify any document-related task today.

How to modify and eSign PDF Form CT 1065CT 1120SI EXT This Return MUST Be Filed CT gov effortlessly

- Obtain PDF Form CT 1065CT 1120SI EXT This Return MUST Be Filed CT gov and then click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Highlight pertinent sections of the documents or redact sensitive information using tools that airSlate SignNow specifically offers for this purpose.

- Create your signature using the Sign tool, which takes moments and carries the same legal validity as a conventional wet ink signature.

- Review all the details and then click on the Done button to save your changes.

- Select your preferred method to send your form: via email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tiring form searches, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any gadget you prefer. Alter and eSign PDF Form CT 1065CT 1120SI EXT This Return MUST Be Filed CT gov and ensure exceptional communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct pdf form ct 1065ct 1120si ext this return must be filed ctgov

Create this form in 5 minutes!

How to create an eSignature for the pdf form ct 1065ct 1120si ext this return must be filed ctgov

How to generate an eSignature for a PDF in the online mode

How to generate an eSignature for a PDF in Chrome

How to create an eSignature for putting it on PDFs in Gmail

The best way to make an eSignature right from your smart phone

The best way to create an eSignature for a PDF on iOS devices

The best way to make an eSignature for a PDF on Android OS

People also ask

-

What is the 2019 ct 1065 extension for businesses?

The 2019 ct 1065 extension allows businesses to receive additional time to file their Connecticut partnership income tax return. By filing this extension, partnerships can ensure they are compliant without incurring late penalties. Utilizing airSlate SignNow simplifies the process of signing and submitting the necessary forms.

-

How can I file for the 2019 ct 1065 extension using airSlate SignNow?

Filing for the 2019 ct 1065 extension with airSlate SignNow is straightforward. Simply upload your extension form, add the required signatures, and send it for electronic signing. Our platform ensures that you can complete this process efficiently and securely.

-

Are there any costs associated with using airSlate SignNow for the 2019 ct 1065 extension?

airSlate SignNow offers cost-effective solutions, with various pricing plans available to suit different business needs. The fees for using our eSignature features may vary based on the plan you choose, but filing your 2019 ct 1065 extension digitally can save you time and reduce the potential for errors.

-

What features does airSlate SignNow offer for managing my 2019 ct 1065 extension?

airSlate SignNow includes several features designed to streamline the management of your 2019 ct 1065 extension. These features include customizable templates, secure storage, and real-time status tracking. This ensures you are always updated on your document's progress.

-

How does airSlate SignNow enhance the filing process for the 2019 ct 1065 extension?

airSlate SignNow enhances the filing process for the 2019 ct 1065 extension by providing an intuitive interface and fast electronic signatures. This minimizes the chances of delays caused by paperwork and ensures timely submission. The platform's automation features further simplify repeat filings in subsequent years.

-

Can airSlate SignNow integrate with other accounting software for the 2019 ct 1065 extension?

Yes, airSlate SignNow seamlessly integrates with popular accounting software to streamline the 2019 ct 1065 extension filing process. This integration allows you to access your documents and tax information directly within your accounting system, improving efficiency and accuracy.

-

What benefits does airSlate SignNow provide for small businesses filing the 2019 ct 1065 extension?

For small businesses, airSlate SignNow offers a cost-effective solution to manage the 2019 ct 1065 extension. Benefits include reduced filing times, lower operational costs, and easy compliance with tax regulations. Additionally, the ability to eSign documents enhances convenience and reliability.

Get more for PDF Form CT 1065CT 1120SI EXT This Return MUST Be Filed CT gov

Find out other PDF Form CT 1065CT 1120SI EXT This Return MUST Be Filed CT gov

- eSignature Oregon Healthcare / Medical Limited Power Of Attorney Computer

- eSignature Pennsylvania Healthcare / Medical Warranty Deed Computer

- eSignature Texas Healthcare / Medical Bill Of Lading Simple

- eSignature Virginia Healthcare / Medical Living Will Computer

- eSignature West Virginia Healthcare / Medical Claim Free

- How To eSignature Kansas High Tech Business Plan Template

- eSignature Kansas High Tech Lease Agreement Template Online

- eSignature Alabama Insurance Forbearance Agreement Safe

- How Can I eSignature Arkansas Insurance LLC Operating Agreement

- Help Me With eSignature Michigan High Tech Emergency Contact Form

- eSignature Louisiana Insurance Rental Application Later

- eSignature Maryland Insurance Contract Safe

- eSignature Massachusetts Insurance Lease Termination Letter Free

- eSignature Nebraska High Tech Rental Application Now

- How Do I eSignature Mississippi Insurance Separation Agreement

- Help Me With eSignature Missouri Insurance Profit And Loss Statement

- eSignature New Hampshire High Tech Lease Agreement Template Mobile

- eSignature Montana Insurance Lease Agreement Template Online

- eSignature New Hampshire High Tech Lease Agreement Template Free

- How To eSignature Montana Insurance Emergency Contact Form