Connecticut Pass through Entity Tax Return 2019

What is the Connecticut Pass Through Entity Tax Return

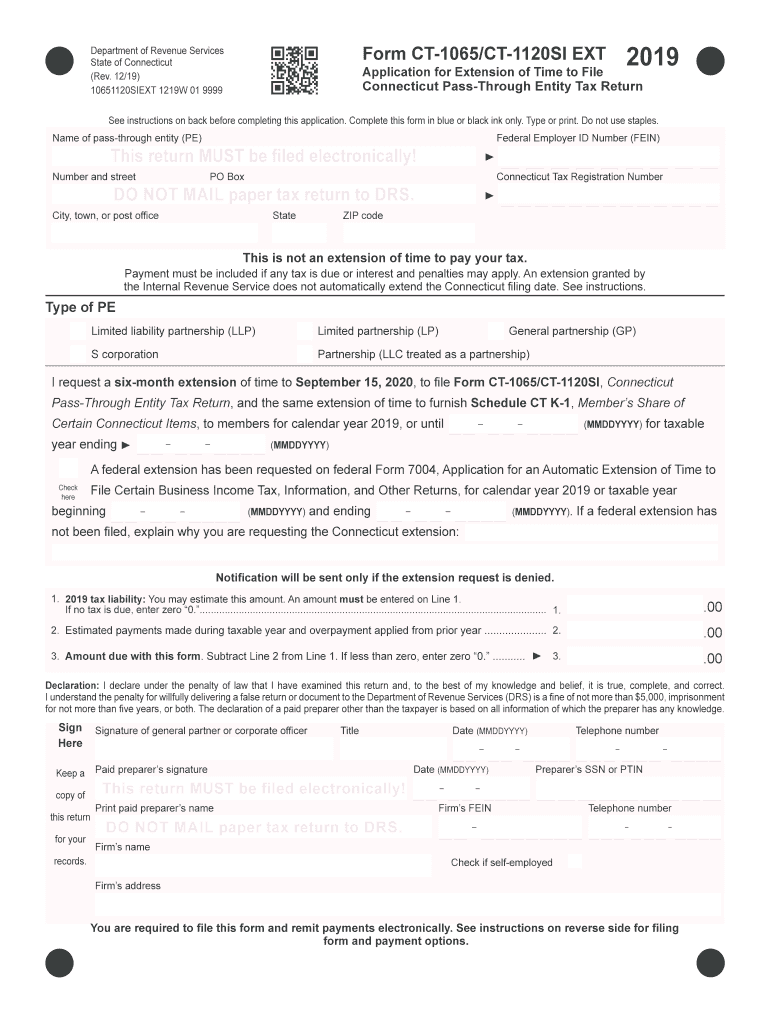

The Connecticut Pass Through Entity Tax Return, commonly referred to as the CT-1065, is a tax form used by partnerships, limited liability companies (LLCs), and S corporations to report income, gains, losses, and other tax-related information to the state of Connecticut. This form is essential for entities that pass their income through to their owners, who then report it on their individual tax returns. Understanding the purpose and requirements of the CT-1065 is crucial for compliance with state tax laws.

How to use the Connecticut Pass Through Entity Tax Return

To use the Connecticut Pass Through Entity Tax Return, entities must complete the form accurately, providing details about their income, deductions, and credits. The CT-1065 requires information such as the entity's name, address, federal employer identification number (EIN), and a breakdown of income and expenses. It is important to follow the specific instructions provided for the form to ensure that all necessary information is included, which will facilitate proper processing by the Connecticut Department of Revenue Services.

Steps to complete the Connecticut Pass Through Entity Tax Return

Completing the Connecticut Pass Through Entity Tax Return involves several key steps:

- Gather all relevant financial documents, including income statements and expense records.

- Fill out the entity's identifying information at the top of the form.

- Report total income and deductions in the appropriate sections of the form.

- Calculate the tax liability based on the income reported.

- Review the form for accuracy and completeness before submission.

Filing Deadlines / Important Dates

The filing deadline for the Connecticut Pass Through Entity Tax Return typically aligns with the federal tax return deadlines. For most entities, this means the CT-1065 is due on the fifteenth day of the fourth month following the end of the tax year. It is crucial for entities to be aware of these deadlines to avoid penalties and interest for late filing.

Required Documents

When preparing the Connecticut Pass Through Entity Tax Return, entities should have the following documents ready:

- Financial statements detailing income, expenses, and distributions.

- Federal tax returns, as the information may need to be cross-referenced.

- Any supporting documentation for deductions and credits claimed.

Penalties for Non-Compliance

Failure to file the Connecticut Pass Through Entity Tax Return on time or inaccuracies in reporting can lead to penalties. These may include fines and interest on unpaid taxes. It is important for entities to ensure compliance with all filing requirements to avoid these potential consequences.

Quick guide on how to complete connecticut pass through entity tax return

Complete Connecticut Pass Through Entity Tax Return effortlessly on any device

Digital document management has gained popularity among businesses and individuals alike. It offers an ideal environmentally friendly alternative to conventional printed and signed documents, allowing you to find the necessary form and securely store it online. airSlate SignNow provides you with all the tools required to create, edit, and eSign your documents promptly without delays. Manage Connecticut Pass Through Entity Tax Return on any device using the airSlate SignNow Android or iOS applications and enhance any document-related process today.

The easiest way to edit and eSign Connecticut Pass Through Entity Tax Return with ease

- Find Connecticut Pass Through Entity Tax Return and click on Get Form to begin.

- Employ the tools we offer to complete your document.

- Highlight pertinent sections of the documents or redact sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a traditional handwritten signature.

- Review all the details and then click the Done button to save your changes.

- Choose how you would like to deliver your form, via email, SMS, or invitation link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Edit and eSign Connecticut Pass Through Entity Tax Return and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct connecticut pass through entity tax return

Create this form in 5 minutes!

How to create an eSignature for the connecticut pass through entity tax return

How to create an eSignature for the Connecticut Pass Through Entity Tax Return online

How to create an electronic signature for your Connecticut Pass Through Entity Tax Return in Chrome

How to generate an electronic signature for putting it on the Connecticut Pass Through Entity Tax Return in Gmail

How to generate an electronic signature for the Connecticut Pass Through Entity Tax Return right from your smartphone

How to generate an electronic signature for the Connecticut Pass Through Entity Tax Return on iOS devices

How to generate an electronic signature for the Connecticut Pass Through Entity Tax Return on Android

People also ask

-

What is the 2019 CT 1065 extension, and why do I need it?

The 2019 CT 1065 extension is a form that allows partnerships in Connecticut to extend the due date for filing their tax returns. If you're unable to complete your tax filings on time, submitting this extension can avoid penalties while giving you more time to gather necessary documents.

-

How do I file for a 2019 CT 1065 extension?

Filing for a 2019 CT 1065 extension involves submitting Form CT-1065 EXT to the Connecticut Department of Revenue Services. This form can be submitted electronically through our platform, ensuring a seamless and efficient filing process directly from your computer.

-

Are there any fees associated with the 2019 CT 1065 extension?

Generally, there are no additional fees specifically for filing the 2019 CT 1065 extension. However, you must ensure that any tax due payments are made on time to avoid penalties, which can be easily managed through our affordable solutions.

-

What features does airSlate SignNow offer for managing 2019 CT 1065 extensions?

airSlate SignNow provides features like easy document upload, advanced eSignature options, and customizable templates specifically for 2019 CT 1065 extensions. Our platform simplifies the entire process, making it easy for you to manage your tax documents efficiently.

-

How can I ensure the security of my 2019 CT 1065 extension documents?

Our platform is designed with top-notch security measures, including encryption and secure cloud storage, to protect your 2019 CT 1065 extension documents. You can confidently send and eSign documents, knowing that your sensitive information is safe.

-

Can I integrate airSlate SignNow with other accounting software for my 2019 CT 1065 extension?

Yes, airSlate SignNow offers seamless integrations with various accounting and tax software. This allows you to easily manage your financial documents and ensures your 2019 CT 1065 extension fits smoothly into your existing workflow.

-

What are the benefits of using airSlate SignNow for my 2019 CT 1065 extension?

Using airSlate SignNow for your 2019 CT 1065 extension ensures a streamlined and efficient filing process. With user-friendly features and real-time tracking, you can save time and reduce stress, all while retaining full control over your documents.

Get more for Connecticut Pass Through Entity Tax Return

- Alaska native cultural charter school anchorage school district asdk12 form

- Science fair proposal form

- Baltimore city homeschool notification form

- Boston mutual loan form

- Life application access brokerage services form

- 125 fsa claim form gccisd

- Metlife soh website form

- Unit 5 lesson 10 business structures flashcards form

Find out other Connecticut Pass Through Entity Tax Return

- eSign Business Operations PPT New Hampshire Safe

- Sign Rhode Island Courts Warranty Deed Online

- Sign Tennessee Courts Residential Lease Agreement Online

- How Do I eSign Arkansas Charity LLC Operating Agreement

- eSign Colorado Charity LLC Operating Agreement Fast

- eSign Connecticut Charity Living Will Later

- How Can I Sign West Virginia Courts Quitclaim Deed

- Sign Courts Form Wisconsin Easy

- Sign Wyoming Courts LLC Operating Agreement Online

- How To Sign Wyoming Courts Quitclaim Deed

- eSign Vermont Business Operations Executive Summary Template Mobile

- eSign Vermont Business Operations Executive Summary Template Now

- eSign Virginia Business Operations Affidavit Of Heirship Mobile

- eSign Nebraska Charity LLC Operating Agreement Secure

- How Do I eSign Nevada Charity Lease Termination Letter

- eSign New Jersey Charity Resignation Letter Now

- eSign Alaska Construction Business Plan Template Mobile

- eSign Charity PPT North Carolina Now

- eSign New Mexico Charity Lease Agreement Form Secure

- eSign Charity PPT North Carolina Free