Form CT 1065CT 1120SI EXT "Application for Extension of Time to 2021-2026

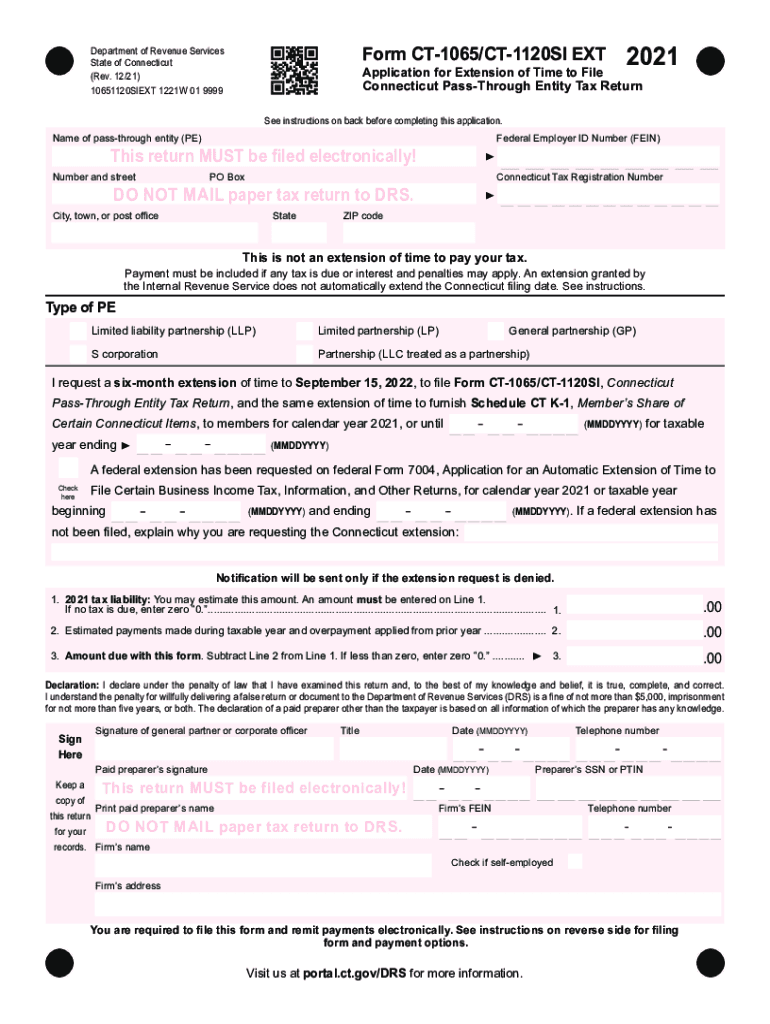

What is the Form CT 1065 Extension?

The Form CT 1065 extension, also known as the Application for Extension of Time to File Connecticut Partnership Income Tax Return, allows partnerships to request additional time to file their tax returns. This form is essential for partnerships in Connecticut seeking to avoid late filing penalties while ensuring compliance with state tax regulations. By submitting this application, partnerships can extend their filing deadline, providing them with the necessary time to prepare accurate and complete tax documents.

Steps to Complete the Form CT 1065 Extension

Completing the Form CT 1065 extension involves several key steps to ensure accuracy and compliance. Follow these steps:

- Gather necessary information, including the partnership's federal employer identification number (EIN) and the names and addresses of all partners.

- Fill out the form accurately, ensuring all required fields are completed. Pay close attention to the partnership's income and deductions.

- Review the form for any errors or omissions before submission to avoid delays.

- Submit the completed form by the original due date of the tax return to avoid penalties.

Filing Deadlines / Important Dates

Understanding the filing deadlines for the Form CT 1065 extension is crucial for compliance. The application must typically be filed by the original due date of the partnership's tax return. For most partnerships, this is the fifteenth day of the third month following the end of the tax year. For partnerships operating on a calendar year, the deadline is March 15. It is important to note that filing the extension does not extend the time to pay any taxes owed, which are still due by the original deadline.

Legal Use of the Form CT 1065 Extension

The legal use of the Form CT 1065 extension is governed by Connecticut tax laws. Submitting this form allows partnerships to obtain an extension of time to file their tax returns without incurring late fees. However, it is important to understand that the extension only applies to the filing of the return, not to the payment of taxes owed. Partnerships must ensure that they pay any taxes due by the original filing deadline to avoid penalties and interest.

Key Elements of the Form CT 1065 Extension

The Form CT 1065 extension includes several key elements that must be filled out correctly:

- Partnership Information: Include the partnership's name, address, and EIN.

- Requested Extension Period: Specify the length of the extension being requested.

- Signature: An authorized partner must sign the form to validate the request.

Who Issues the Form CT 1065 Extension?

The Form CT 1065 extension is issued by the Connecticut Department of Revenue Services (DRS). This state agency is responsible for administering tax laws and ensuring compliance among taxpayers. Partnerships must ensure they are using the most current version of the form, which can be obtained directly from the DRS website or through official state publications.

Quick guide on how to complete form ct 1065ct 1120si ext ampquotapplication for extension of time to

Complete Form CT 1065CT 1120SI EXT "Application For Extension Of Time To effortlessly on any device

Digital document management has gained popularity among businesses and individuals. It offers an excellent eco-friendly alternative to traditional printed and signed documents, as you can easily locate the necessary form and securely store it online. airSlate SignNow equips you with all the tools needed to create, edit, and eSign your documents rapidly without delays. Manage Form CT 1065CT 1120SI EXT "Application For Extension Of Time To on any platform with airSlate SignNow's Android or iOS applications and simplify any document-related process today.

The easiest way to edit and eSign Form CT 1065CT 1120SI EXT "Application For Extension Of Time To effortlessly

- Locate Form CT 1065CT 1120SI EXT "Application For Extension Of Time To and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Highlight important sections of your documents or redact confidential information with tools specifically designed for that purpose by airSlate SignNow.

- Create your eSignature using the Sign tool, which takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and then click on the Done button to save your modifications.

- Choose how you wish to send your form, via email, text message (SMS), invitation link, or download it to your computer.

Forget about lost or misplaced files, tedious form searches, or errors requiring new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Edit and eSign Form CT 1065CT 1120SI EXT "Application For Extension Of Time To to ensure excellent communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form ct 1065ct 1120si ext ampquotapplication for extension of time to

Create this form in 5 minutes!

How to create an eSignature for the form ct 1065ct 1120si ext ampquotapplication for extension of time to

The way to generate an electronic signature for your PDF file online

The way to generate an electronic signature for your PDF file in Google Chrome

The way to make an e-signature for signing PDFs in Gmail

The way to create an electronic signature from your mobile device

The best way to make an electronic signature for a PDF file on iOS

The way to create an electronic signature for a PDF file on Android devices

People also ask

-

What are the key features of airSlate SignNow for handling ct 1065 instructions 2023?

airSlate SignNow offers a user-friendly platform for managing ct 1065 instructions 2023, allowing businesses to prepare, sign, and send documents seamlessly. The platform includes features like customizable templates, collaboration tools, and secure storage, making it ideal for handling complex tax forms. With its mobile accessibility, users can complete their tasks on the go.

-

How does airSlate SignNow simplify the process of eSigning ct 1065 instructions 2023?

The eSigning process for ct 1065 instructions 2023 on airSlate SignNow is straightforward and efficient. Users can quickly upload their documents, add fields for signatures, and send them to multiple recipients without any hassle. This streamlined process helps businesses save time and reduce errors.

-

What are the pricing plans for airSlate SignNow focused on ct 1065 instructions 2023?

airSlate SignNow provides flexible pricing plans to cater to different business needs, especially for those dealing with ct 1065 instructions 2023. Plans typically offer a variety of features such as unlimited document signing and advanced integrations, starting at a competitive monthly rate. It's advisable to visit our website for the most accurate and up-to-date pricing details.

-

Can airSlate SignNow integrate with other software for managing ct 1065 instructions 2023?

Yes, airSlate SignNow can seamlessly integrate with numerous third-party applications, enhancing the management of ct 1065 instructions 2023. Compatible integrations include popular accounting and tax software, which allow users to import and export documents effortlessly. This feature creates a more cohesive workflow, making tax preparation more efficient.

-

What benefits does airSlate SignNow offer for businesses managing ct 1065 instructions 2023?

Using airSlate SignNow for ct 1065 instructions 2023 provides businesses with signNow benefits, including improved efficiency and reduced paperwork. The platform enables quick document turnaround times and helps maintain compliance with legal requirements. Furthermore, the electronic signature capabilities ensure documents are securely signed and stored.

-

Is airSlate SignNow secure for handling sensitive ct 1065 instructions 2023 data?

Absolutely, airSlate SignNow prioritizes the security of its users' data, making it a safe choice for handling ct 1065 instructions 2023. The platform employs advanced encryption protocols and offers features like multi-factor authentication to protect sensitive information. This commitment to security ensures peace of mind for businesses.

-

How user-friendly is airSlate SignNow for newcomers dealing with ct 1065 instructions 2023?

airSlate SignNow is designed to be user-friendly, making it accessible for newcomers who need to manage ct 1065 instructions 2023. The intuitive interface and comprehensive tutorials allow users to quickly learn how to navigate and utilize the platform effectively. Support is also available for any questions that may arise.

Get more for Form CT 1065CT 1120SI EXT "Application For Extension Of Time To

- Tenants maintenance repair request form louisiana

- Guaranty attachment to lease for guarantor or cosigner louisiana form

- Amendment to lease or rental agreement louisiana form

- Warning notice due to complaint from neighbors louisiana form

- Lease subordination agreement louisiana form

- Apartment rules and regulations louisiana form

- Agreed cancellation of lease louisiana form

- Amendment of residential lease louisiana form

Find out other Form CT 1065CT 1120SI EXT "Application For Extension Of Time To

- Sign Wyoming Car Dealer Purchase Order Template Mobile

- Sign Arizona Charity Business Plan Template Easy

- Can I Sign Georgia Charity Warranty Deed

- How To Sign Iowa Charity LLC Operating Agreement

- Sign Kentucky Charity Quitclaim Deed Myself

- Sign Michigan Charity Rental Application Later

- How To Sign Minnesota Charity Purchase Order Template

- Sign Mississippi Charity Affidavit Of Heirship Now

- Can I Sign Nevada Charity Bill Of Lading

- How Do I Sign Nebraska Charity Limited Power Of Attorney

- Sign New Hampshire Charity Residential Lease Agreement Online

- Sign New Jersey Charity Promissory Note Template Secure

- How Do I Sign North Carolina Charity Lease Agreement Form

- How To Sign Oregon Charity Living Will

- Sign South Dakota Charity Residential Lease Agreement Simple

- Sign Vermont Charity Business Plan Template Later

- Sign Arkansas Construction Executive Summary Template Secure

- How To Sign Arkansas Construction Work Order

- Sign Colorado Construction Rental Lease Agreement Mobile

- Sign Maine Construction Business Letter Template Secure