Instructions for Form CT 13 Unrelated Business Income Tax Return Tax Year 2020

Understanding Form CT 13: Unrelated Business Income Tax Return

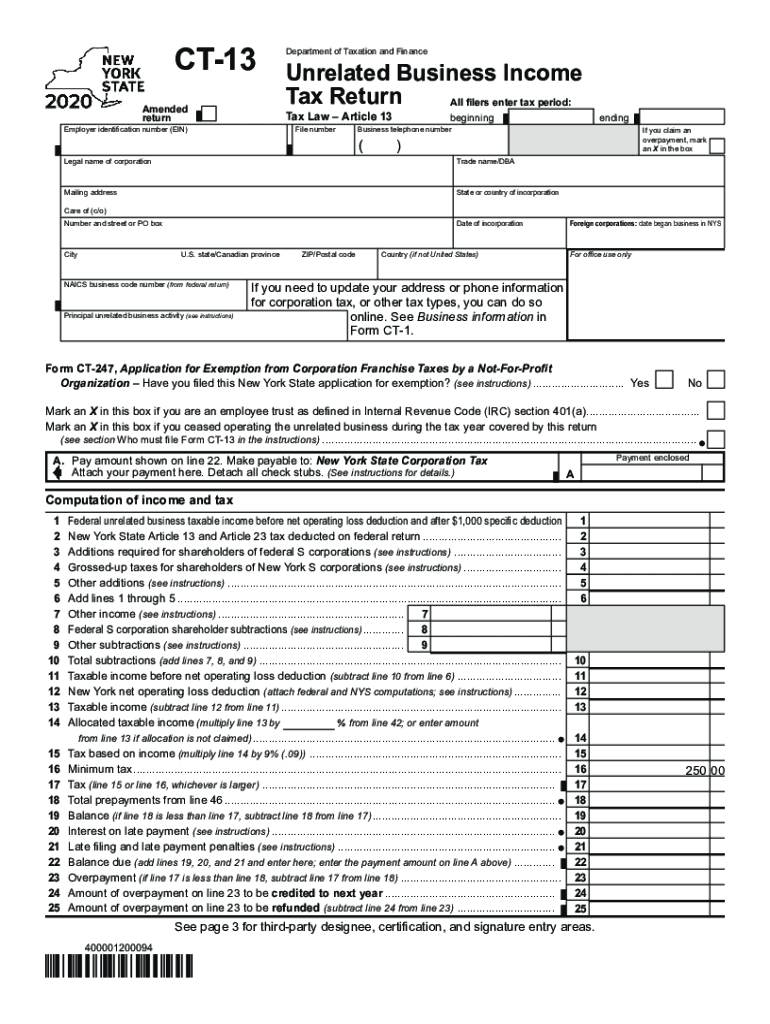

Form CT 13 is used by organizations to report unrelated business income tax (UBIT) to the state of New York. This form is specifically designed for entities that are exempt from federal income tax but generate income from activities not substantially related to their exempt purpose. Understanding the purpose of this form is essential for compliance and accurate tax reporting.

Steps to Complete Form CT 13

Completing Form CT 13 involves several key steps to ensure accuracy and compliance. Begin by gathering all necessary financial records related to unrelated business income. This includes income statements, expense reports, and any relevant documentation that supports your claims. Next, accurately fill out the form, detailing your organization's income and expenses. Be sure to calculate the taxable income correctly, as this will determine your tax liability. Finally, review the completed form for any errors before submission.

Required Documents for Form CT 13

To successfully file Form CT 13, certain documents are necessary. These typically include:

- Financial statements showing unrelated business income.

- Expense documentation related to the generation of that income.

- Previous tax returns, if applicable.

- Any additional forms required by the New York State Department of Taxation and Finance.

Having these documents ready will facilitate a smoother filing process.

Filing Deadlines for Form CT 13

It is crucial to be aware of the filing deadlines associated with Form CT 13. Generally, the form must be filed on or before the 15th day of the fifth month following the close of the organization’s tax year. For most organizations operating on a calendar year, this means the deadline is May 15. Missing this deadline can result in penalties and interest on unpaid taxes.

Legal Use of Form CT 13

Form CT 13 serves a legal purpose in ensuring that organizations comply with state tax laws regarding unrelated business income. Filing this form accurately and on time helps maintain the tax-exempt status of the organization while fulfilling its obligations under New York tax law. Failure to file or inaccuracies can lead to legal repercussions, including fines and loss of tax-exempt status.

Examples of Unrelated Business Income

Unrelated business income can arise from various activities. Common examples include:

- Income from advertising in publications produced by the organization.

- Revenue from rental of property that is not used for exempt purposes.

- Sales of merchandise unrelated to the organization’s mission.

Identifying these income sources is vital for accurate reporting on Form CT 13.

Penalties for Non-Compliance with Form CT 13

Non-compliance with the requirements of Form CT 13 can lead to significant penalties. Organizations may face fines for late filing or failure to file altogether. Additionally, any discrepancies in reported income can result in further audits and potential legal action. It is essential to adhere to all filing requirements to avoid these issues.

Quick guide on how to complete instructions for form ct 13 unrelated business income tax return tax year 2020

Complete Instructions For Form CT 13 Unrelated Business Income Tax Return Tax Year seamlessly on any device

Digital document management has gained signNow traction among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed paperwork, as you can obtain the accurate form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents swiftly without delays. Manage Instructions For Form CT 13 Unrelated Business Income Tax Return Tax Year on any device with airSlate SignNow's Android or iOS applications and simplify any document-related process today.

The easiest way to modify and eSign Instructions For Form CT 13 Unrelated Business Income Tax Return Tax Year effortlessly

- Obtain Instructions For Form CT 13 Unrelated Business Income Tax Return Tax Year and click on Get Form to initiate.

- Utilize the tools we offer to complete your document.

- Emphasize important sections of your documents or obscure sensitive information with tools provided specifically for that purpose by airSlate SignNow.

- Create your eSignature using the Sign feature, which takes just seconds and holds the same legal validity as a conventional handwritten signature.

- Review all the details and then hit the Done button to store your modifications.

- Select your preferred method for sharing your form, whether by email, SMS, or invite link, or download it directly to your PC.

Eliminate worries about lost or misfiled documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow caters to your document management needs with just a few clicks from any device of your selection. Alter and eSign Instructions For Form CT 13 Unrelated Business Income Tax Return Tax Year and ensure effective communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct instructions for form ct 13 unrelated business income tax return tax year 2020

Create this form in 5 minutes!

How to create an eSignature for the instructions for form ct 13 unrelated business income tax return tax year 2020

The best way to generate an electronic signature for a PDF online

The best way to generate an electronic signature for a PDF in Google Chrome

The way to create an eSignature for signing PDFs in Gmail

The way to make an eSignature straight from your smartphone

The way to make an eSignature for a PDF on iOS

The way to make an eSignature for a PDF document on Android

People also ask

-

What is the ny form ct 13 and why do I need it?

The ny form ct 13 is a form required to report various types of income in New York. It's essential for ensuring compliance with state tax regulations. Filling out this form accurately can help avoid penalties and tax-related issues.

-

How does airSlate SignNow facilitate the completion of the ny form ct 13?

airSlate SignNow simplifies the process of filling out the ny form ct 13 by providing an easy-to-use electronic signature platform. Users can prepare, send, and eSign their forms in a matter of minutes, ensuring accuracy and efficiency in document handling.

-

What are the pricing plans for airSlate SignNow for using the ny form ct 13?

airSlate SignNow offers competitive pricing plans that accommodate businesses of all sizes. Users can choose from various subscription options, enabling them to select the most cost-effective solution for handling the ny form ct 13 efficiently.

-

Can I integrate airSlate SignNow with other software for filing the ny form ct 13?

Yes, airSlate SignNow supports integrations with various third-party applications to streamline your workflow. This includes accounting and tax software that helps in managing and filing the ny form ct 13 seamlessly.

-

What security measures are in place when using airSlate SignNow for the ny form ct 13?

Security is a top priority at airSlate SignNow, particularly when handling sensitive documents like the ny form ct 13. The platform employs advanced encryption and secure storage practices to protect your personal and financial data from unauthorized access.

-

Are there any features specific to the ny form ct 13 provided by airSlate SignNow?

airSlate SignNow includes features specifically tailored for the ny form ct 13, such as customizable templates and automated reminders. These tools help ensure that all necessary information is included and deadlines are met for timely submissions.

-

How can I access support if I have questions about the ny form ct 13?

If you have any questions regarding the ny form ct 13 while using airSlate SignNow, you can access our dedicated customer support team. We offer multiple channels for assistance, including live chat, email, and phone support, to ensure your concerns are addressed promptly.

Get more for Instructions For Form CT 13 Unrelated Business Income Tax Return Tax Year

Find out other Instructions For Form CT 13 Unrelated Business Income Tax Return Tax Year

- Can I Sign Virginia Business Letter Template

- Can I Sign Ohio Startup Costs Budget Worksheet

- How Do I Sign Maryland 12 Month Sales Forecast

- How Do I Sign Maine Profit and Loss Statement

- How To Sign Wisconsin Operational Budget Template

- Sign North Carolina Profit and Loss Statement Computer

- Sign Florida Non-Compete Agreement Fast

- How Can I Sign Hawaii Non-Compete Agreement

- Sign Oklahoma General Partnership Agreement Online

- Sign Tennessee Non-Compete Agreement Computer

- Sign Tennessee Non-Compete Agreement Mobile

- Sign Utah Non-Compete Agreement Secure

- Sign Texas General Partnership Agreement Easy

- Sign Alabama LLC Operating Agreement Online

- Sign Colorado LLC Operating Agreement Myself

- Sign Colorado LLC Operating Agreement Easy

- Can I Sign Colorado LLC Operating Agreement

- Sign Kentucky LLC Operating Agreement Later

- Sign Louisiana LLC Operating Agreement Computer

- How Do I Sign Massachusetts LLC Operating Agreement