Ct 13 Form 2017

What is the Ct 13 Form

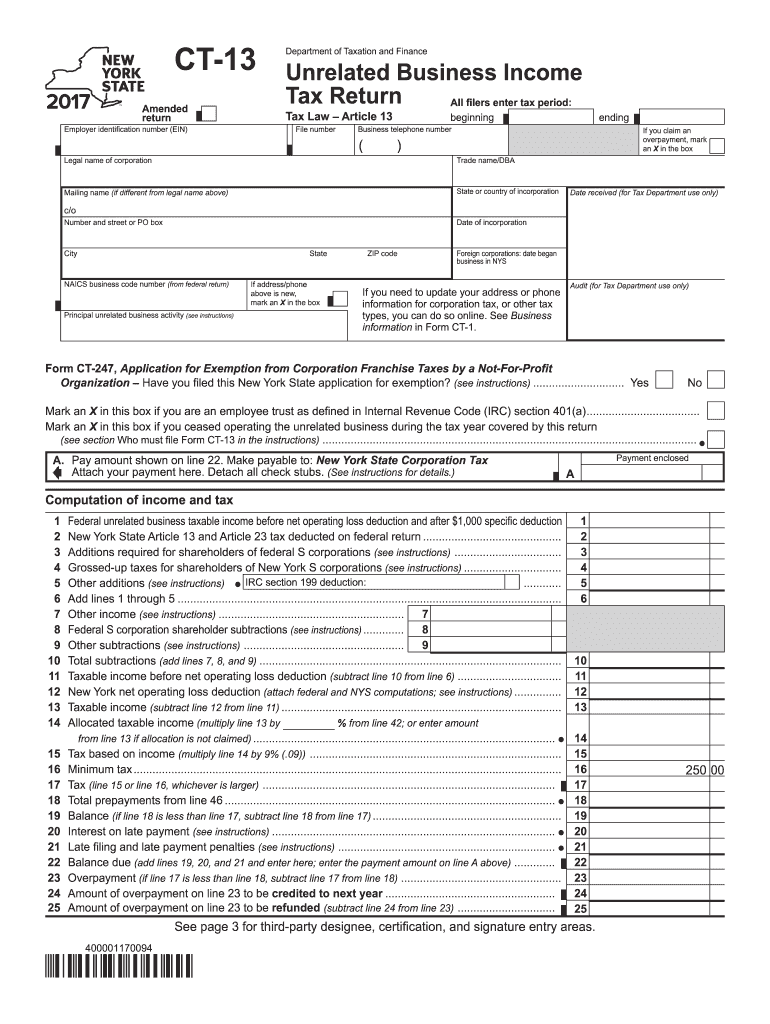

The Ct 13 Form is a tax-related document used in the United States, specifically designed for individuals and businesses to report certain financial information. This form is essential for compliance with state tax regulations and is often utilized to ensure accurate reporting of income and deductions. Understanding the purpose of the Ct 13 Form is crucial for taxpayers to avoid penalties and ensure their filings are complete and accurate.

How to use the Ct 13 Form

Using the Ct 13 Form involves several steps to ensure proper completion and submission. First, gather all necessary financial documents, including income statements and deduction records. Next, carefully fill out the form, ensuring that all information is accurate and corresponds with the supporting documents. Once completed, review the form for any errors or omissions before signing and submitting it. Utilizing digital tools for eSigning can streamline this process, making it more efficient.

Steps to complete the Ct 13 Form

Completing the Ct 13 Form requires attention to detail. Follow these steps for a successful submission:

- Collect all relevant financial documents, including W-2s and 1099s.

- Access the Ct 13 Form through an official source or a trusted eSignature platform.

- Fill in personal information, including name, address, and Social Security number.

- Report income accurately, ensuring all figures match your documentation.

- Detail any deductions or credits you are eligible for, based on IRS guidelines.

- Review the completed form for accuracy and completeness.

- Sign the form electronically or manually, as required.

- Submit the form according to the specified submission methods.

Legal use of the Ct 13 Form

The Ct 13 Form is legally recognized for tax reporting purposes in the United States. It is essential for taxpayers to understand that submitting this form accurately is a legal requirement. Failure to comply with the regulations associated with the Ct 13 Form can result in penalties or audits by tax authorities. Therefore, it is important to ensure that all information provided is truthful and complete.

Filing Deadlines / Important Dates

Filing deadlines for the Ct 13 Form can vary based on individual circumstances, such as whether you are filing as an individual or a business. Generally, the form must be submitted by the tax filing deadline, which is typically April fifteenth for individuals. Businesses may have different deadlines based on their fiscal year. It is crucial to stay informed about these dates to avoid late fees and penalties.

Form Submission Methods (Online / Mail / In-Person)

The Ct 13 Form can be submitted through various methods, providing flexibility for taxpayers. Options include:

- Online submission via a secure eSignature platform, which allows for quick processing.

- Mailing a physical copy of the completed form to the appropriate tax authority address.

- In-person submission at designated tax offices, which may be necessary for certain situations.

Each method has its own advantages, such as immediate confirmation of receipt for online submissions.

Quick guide on how to complete ct 13 2017 form

Your assistance manual on how to prepare your Ct 13 Form

If you’re curious about how to generate and submit your Ct 13 Form, here are some brief guidelines on making tax submission more straightforward.

First, you need to set up your airSlate SignNow account to transform how you manage documents online. airSlate SignNow is an exceptionally user-friendly and powerful document platform that enables you to edit, create, and finalize your income tax documents with ease. With its editor, you can alternate between text, checkboxes, and eSignatures, as well as revisit and modify responses as necessary. Streamline your tax processes with advanced PDF editing, eSigning, and user-friendly sharing.

Follow the steps below to finalize your Ct 13 Form in just a few minutes:

- Establish your account and commence working on PDFs in no time.

- Utilize our directory to locate any IRS tax document; browse through different versions and schedules.

- Click Obtain form to access your Ct 13 Form in our editor.

- Complete the necessary fillable fields with your details (text, numbers, checkmarks).

- Employ the Signature Tool to include your legally-binding eSignature (if needed).

- Examine your entry and amend any mistakes.

- Save modifications, print your copy, send it to your recipient, and download it to your device.

Make use of this manual to file your taxes electronically with airSlate SignNow. Be aware that submitting on paper can lead to return errors and postpone refunds. Additionally, before e-filing your taxes, verify the IRS website for reporting guidelines specific to your state.

Create this form in 5 minutes or less

Find and fill out the correct ct 13 2017 form

FAQs

-

How do I fill out the CAT Application Form 2017?

CAT 2017 registration opened on August 9, 2017 will close on September 20 at 5PM. CAT online registration form and application form is a single document divided in 5 pages and is to be completed online. The 1st part of CAT online registration form requires your personal details. After completing your online registration, IIMs will send you CAT 2017 registration ID. With this unique ID, you will login to online registration form which will also contain application form and registration form.CAT Registration and application form will require you to fill up your academic details, uploading of photograph, signature and requires category certificates as per the IIMs prescribed format for CAT registration. CAT online application form 2017 consists of programme details on all the 20 IIMs. Candidates have to tick by clicking on the relevant programmes of the IIMs for which they wish to attend the personal Interview Process.

-

How do I fill out the Delhi Polytechnic 2017 form?

Delhi Polytechnic (CET DELHI) entrance examination form has been published. You can visit Welcome to CET Delhi and fill the online form. For more details you can call @ 7042426818

-

How do I fill out the SSC CHSL 2017-18 form?

Its very easy task, you have to just put this link in your browser SSC, this page will appearOn this page click on Apply buttonthere a dialog box appears, in that dialog box click on CHSL a link will come “ Click here to apply” and you will signNow to registration page.I hope you all have understood the procedure. All the best for your exam

-

When will I can fill the form of CT 1 as a non member in ifoa for 2017?

Registration starts on 30th January for April 2017 Exam. The process is simple.A link will show up on website (actuaries.org.uk) on 30th jan using which you will have to sign up filling in very basic details like name and DOB etc. Do not Forget to tick the option to apply for reduced rate fees if you are earning less than GBP 7140. If you forget to tick the option of reduced rate fees than you will have to pay almost twice after you sign up.Once you sign up, you will get ARN no on your registered email id within 48 hours. You will have to wait till then, It may drop in 5 mins as well sometimes.using this ARN no. you have to log in, select exam centre in India and make the payment.Fees is GBP 130 (if you are eligible for reduced fees i.e. Your annual income is less than GBP 7140, if you are earning more than your fees will be almost twice). You need to have international debit/credit card to make the payment. You can always call the institute for any help. They are very receptive.

-

How do I fill out the UPSEAT 2017 application forms?

UPESEAT is a placement test directed by the University of Petroleum and Energy Studies. This inclination examination is called as the University of Petroleum and Energy Studies Engineering Entrance Test (UPESEAT). It is essentially an essential sort examination which permits the possibility to apply for the different designing projects on the web. visit - HOW TO FILL THE UPSEAT 2017 APPLICATION FORMS

Create this form in 5 minutes!

How to create an eSignature for the ct 13 2017 form

How to create an electronic signature for your Ct 13 2017 Form in the online mode

How to make an electronic signature for the Ct 13 2017 Form in Chrome

How to make an eSignature for putting it on the Ct 13 2017 Form in Gmail

How to generate an electronic signature for the Ct 13 2017 Form straight from your smart phone

How to create an electronic signature for the Ct 13 2017 Form on iOS

How to create an electronic signature for the Ct 13 2017 Form on Android OS

People also ask

-

What is the Ct 13 Form and how can airSlate SignNow help?

The Ct 13 Form is a specific document used for various business purposes, often related to tax filings or legal agreements. airSlate SignNow empowers businesses to manage and eSign the Ct 13 Form effortlessly, ensuring compliance and speeding up the signing process with its user-friendly platform.

-

Is airSlate SignNow suitable for completing the Ct 13 Form?

Yes, airSlate SignNow is highly suitable for completing the Ct 13 Form. Our platform allows users to fill out, sign, and securely share the Ct 13 Form online, streamlining the entire process while maintaining legal compliance.

-

What features does airSlate SignNow offer for the Ct 13 Form?

airSlate SignNow offers a variety of features for the Ct 13 Form, including customizable templates, easy document sharing, and secure cloud storage. Additionally, users can track the signing process in real-time, ensuring all parties are informed and engaged.

-

How much does it cost to use airSlate SignNow for the Ct 13 Form?

Pricing for airSlate SignNow varies based on the features and plan you choose. However, our platform remains cost-effective for businesses needing to manage the Ct 13 Form and other documents, with plans designed to fit different budgets and requirements.

-

Can I integrate airSlate SignNow with other software for the Ct 13 Form?

Absolutely! airSlate SignNow offers integrations with popular software like Google Drive, Salesforce, and more. This allows for seamless management of the Ct 13 Form alongside your existing tools, enhancing efficiency and workflow.

-

What are the benefits of using airSlate SignNow for the Ct 13 Form?

Using airSlate SignNow for the Ct 13 Form provides numerous benefits, including increased efficiency, reduced paperwork, and enhanced security. Our electronic signature solution also speeds up the signing process, allowing businesses to finalize their documents quicker.

-

Is airSlate SignNow legally compliant for the Ct 13 Form?

Yes, airSlate SignNow is fully compliant with electronic signature laws, ensuring that the Ct 13 Form signed on our platform is legally binding. We adhere to regulations such as ESIGN and UETA, providing peace of mind for our users.

Get more for Ct 13 Form

- Hmi college of hypnotherapy reviews form

- Social work supervision contract template form

- Software engineering kk aggarwal and yogesh singh pdf 448405501 form

- Consignment security declaration form

- Swisscom lsv formular download

- Sharkery job form

- Process specification for the application of electromagnetic interference emi control coatings form

- Process specification form

Find out other Ct 13 Form

- eSignature Virginia Healthcare / Medical Living Will Computer

- eSignature West Virginia Healthcare / Medical Claim Free

- How To eSignature Kansas High Tech Business Plan Template

- eSignature Kansas High Tech Lease Agreement Template Online

- eSignature Alabama Insurance Forbearance Agreement Safe

- How Can I eSignature Arkansas Insurance LLC Operating Agreement

- Help Me With eSignature Michigan High Tech Emergency Contact Form

- eSignature Louisiana Insurance Rental Application Later

- eSignature Maryland Insurance Contract Safe

- eSignature Massachusetts Insurance Lease Termination Letter Free

- eSignature Nebraska High Tech Rental Application Now

- How Do I eSignature Mississippi Insurance Separation Agreement

- Help Me With eSignature Missouri Insurance Profit And Loss Statement

- eSignature New Hampshire High Tech Lease Agreement Template Mobile

- eSignature Montana Insurance Lease Agreement Template Online

- eSignature New Hampshire High Tech Lease Agreement Template Free

- How To eSignature Montana Insurance Emergency Contact Form

- eSignature New Jersey High Tech Executive Summary Template Free

- eSignature Oklahoma Insurance Warranty Deed Safe

- eSignature Pennsylvania High Tech Bill Of Lading Safe