Form CT 13 Unrelated Business Income Tax Return Tax Year 2024-2026

What is the Form CT 13 Unrelated Business Income Tax Return?

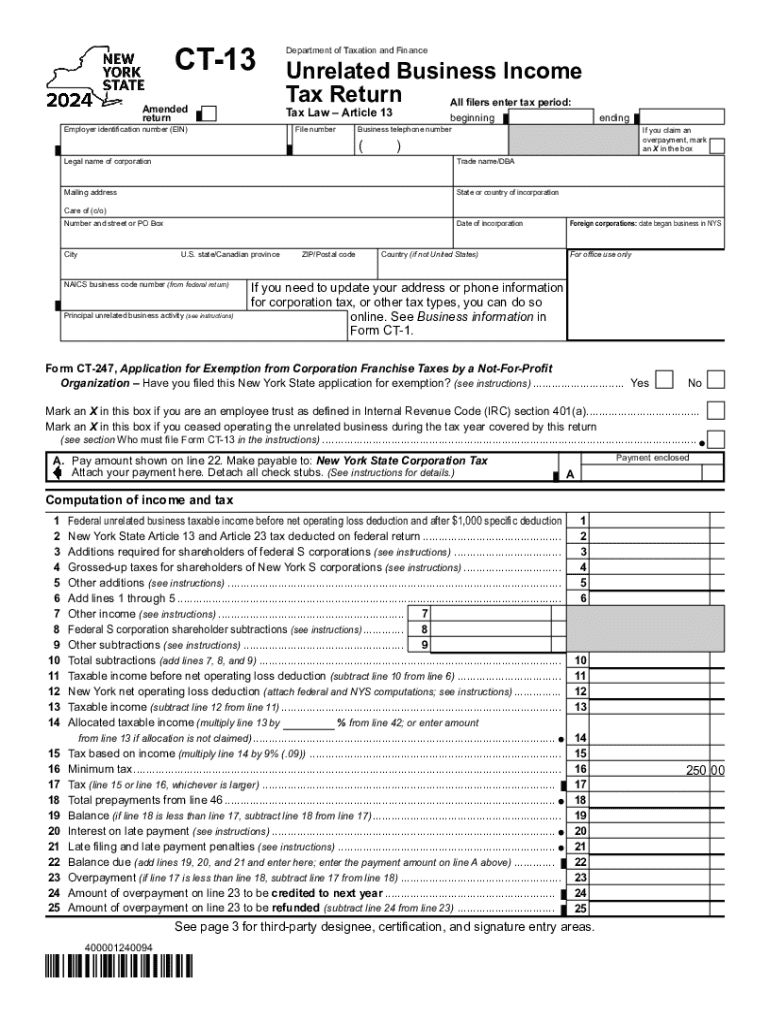

The Form CT 13 is the Unrelated Business Income Tax Return used by organizations in Connecticut to report income generated from activities that are not substantially related to their exempt purposes. This form is primarily relevant for tax-exempt organizations, such as charities and educational institutions, that engage in business activities. The income reported on this form may be subject to taxation under Connecticut law, even if the organization is generally exempt from income tax.

How to Obtain the Form CT 13 Unrelated Business Income Tax Return

The Form CT 13 can be obtained through the Connecticut Department of Revenue Services (DRS) website. It is available as a downloadable PDF, which can be filled out online or printed for manual completion. Additionally, physical copies may be requested directly from the DRS office. It is important for organizations to ensure they have the most current version of the form to comply with state regulations.

Steps to Complete the Form CT 13 Unrelated Business Income Tax Return

Completing the Form CT 13 involves several key steps:

- Gather financial records related to unrelated business income, including revenue and expenses.

- Fill out the form by providing necessary information such as the organization's name, address, and tax identification number.

- Report the total unrelated business income and applicable deductions on the form.

- Calculate the tax due based on the reported income.

- Review the completed form for accuracy before submission.

Filing Deadlines / Important Dates

The filing deadline for the Form CT 13 is typically the fifteenth day of the fifth month following the end of the organization's fiscal year. For organizations operating on a calendar year basis, this means the form is due by May 15. It is crucial for organizations to adhere to this deadline to avoid penalties and ensure compliance with state tax laws.

Penalties for Non-Compliance

Failure to file the Form CT 13 by the deadline may result in penalties imposed by the Connecticut Department of Revenue Services. These penalties can include late filing fees and interest on any unpaid tax. Organizations are encouraged to file on time and ensure all information is accurate to avoid these consequences.

Key Elements of the Form CT 13 Unrelated Business Income Tax Return

The Form CT 13 includes several essential components that organizations must complete:

- Identification section for the organization, including name and address.

- Income section to report total unrelated business income.

- Deductions section to list allowable expenses related to the business activities.

- Tax calculation section to determine the amount owed based on the reported income.

- Signature section for an authorized representative of the organization.

Create this form in 5 minutes or less

Find and fill out the correct form ct 13 unrelated business income tax return tax year

Create this form in 5 minutes!

How to create an eSignature for the form ct 13 unrelated business income tax return tax year

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the nys form ct 13?

The nys form ct 13 is a tax form used by businesses in New York State to report and pay certain taxes. It is essential for compliance with state tax regulations and helps ensure that your business remains in good standing. Understanding how to properly fill out and submit the nys form ct 13 is crucial for avoiding penalties.

-

How can airSlate SignNow help with the nys form ct 13?

airSlate SignNow simplifies the process of completing and eSigning the nys form ct 13. With our user-friendly platform, you can easily fill out the form, add necessary signatures, and send it securely. This streamlines your workflow and ensures that your documents are processed efficiently.

-

Is there a cost associated with using airSlate SignNow for the nys form ct 13?

Yes, airSlate SignNow offers various pricing plans tailored to meet the needs of different businesses. Our plans are cost-effective and provide access to features that facilitate the completion of the nys form ct 13 and other important documents. You can choose a plan that fits your budget and requirements.

-

What features does airSlate SignNow offer for managing the nys form ct 13?

airSlate SignNow provides features such as customizable templates, secure eSigning, and document tracking specifically for the nys form ct 13. These tools enhance your document management process, making it easier to handle tax forms and ensuring compliance with state regulations.

-

Can I integrate airSlate SignNow with other software for the nys form ct 13?

Absolutely! airSlate SignNow offers integrations with various software applications, allowing you to streamline your workflow when dealing with the nys form ct 13. Whether you use accounting software or CRM systems, our platform can connect seamlessly to enhance your document management.

-

What are the benefits of using airSlate SignNow for the nys form ct 13?

Using airSlate SignNow for the nys form ct 13 provides numerous benefits, including increased efficiency, reduced paperwork, and enhanced security. Our platform ensures that your documents are signed and stored securely, minimizing the risk of errors and ensuring timely submissions.

-

How secure is airSlate SignNow when handling the nys form ct 13?

Security is a top priority at airSlate SignNow. When handling the nys form ct 13, we utilize advanced encryption and secure storage solutions to protect your sensitive information. You can trust that your documents are safe and compliant with industry standards.

Get more for Form CT 13 Unrelated Business Income Tax Return Tax Year

Find out other Form CT 13 Unrelated Business Income Tax Return Tax Year

- How Can I Sign Michigan Personal Leave Policy

- Sign South Carolina Pregnancy Leave Policy Safe

- How To Sign South Carolina Time Off Policy

- How To Sign Iowa Christmas Bonus Letter

- How To Sign Nevada Christmas Bonus Letter

- Sign New Jersey Promotion Announcement Simple

- Sign Louisiana Company Bonus Letter Safe

- How To Sign Delaware Letter of Appreciation to Employee

- How To Sign Florida Letter of Appreciation to Employee

- How Do I Sign New Jersey Letter of Appreciation to Employee

- How Do I Sign Delaware Direct Deposit Enrollment Form

- How To Sign Alabama Employee Emergency Notification Form

- How To Sign Oklahoma Direct Deposit Enrollment Form

- Sign Wyoming Direct Deposit Enrollment Form Online

- Sign Nebraska Employee Suggestion Form Now

- How Can I Sign New Jersey Employee Suggestion Form

- Can I Sign New York Employee Suggestion Form

- Sign Michigan Overtime Authorization Form Mobile

- How To Sign Alabama Payroll Deduction Authorization

- How To Sign California Payroll Deduction Authorization