Form CT 13 Unrelated Business Income Tax Return Tax Year 2022

What is the Form CT 13 Unrelated Business Income Tax Return Tax Year

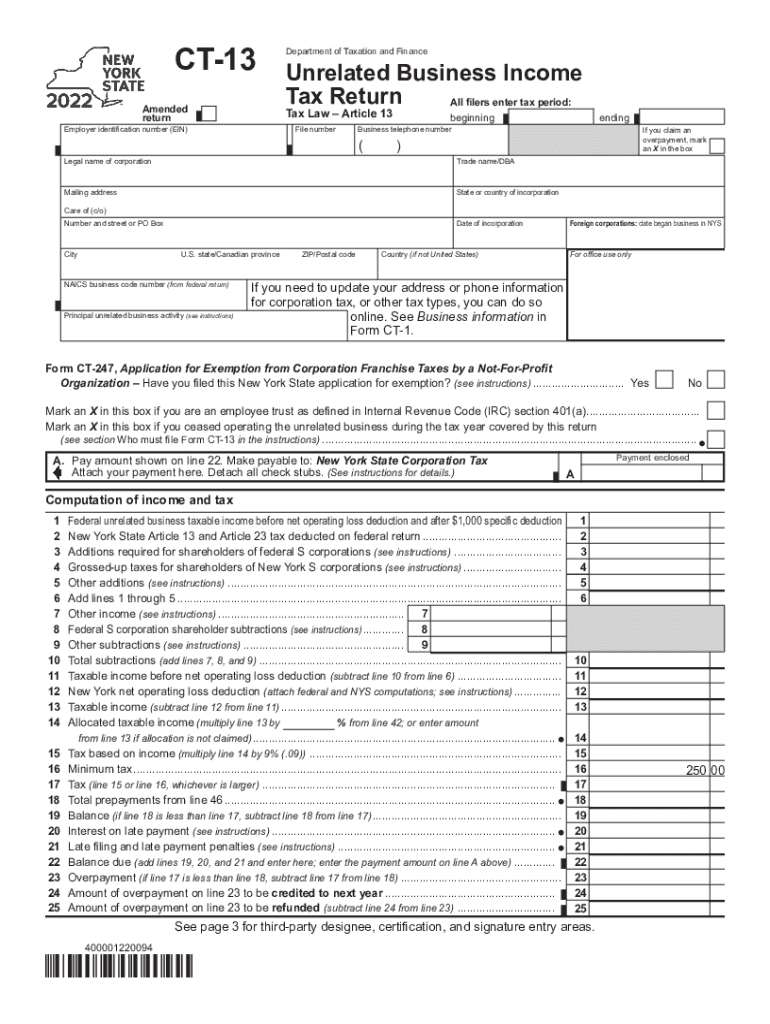

The Form CT 13 is used by organizations to report unrelated business income to the state of Connecticut. This form is specifically designed for tax-exempt entities, such as charities and non-profits, that engage in activities not directly related to their exempt purpose. The income generated from these activities is subject to taxation, and the CT 13 allows organizations to report this income accurately. Each tax year, organizations must determine their unrelated business taxable income (UBTI) and file the CT 13 accordingly to remain compliant with state tax regulations.

Steps to complete the Form CT 13 Unrelated Business Income Tax Return Tax Year

Completing the Form CT 13 involves several key steps to ensure accuracy and compliance. First, gather all necessary financial information regarding unrelated business activities, including revenue and expenses. Next, fill out the form by providing the organization's name, address, and federal employer identification number (EIN). Calculate the unrelated business taxable income by subtracting allowable expenses from gross income. After completing the calculations, review the form for accuracy before submitting it to the Connecticut Department of Revenue Services.

Legal use of the Form CT 13 Unrelated Business Income Tax Return Tax Year

The legal use of the Form CT 13 is essential for tax-exempt organizations engaging in unrelated business activities. Filing this form ensures compliance with Connecticut tax laws, which require that unrelated business income be reported and taxed appropriately. Organizations must adhere to the guidelines set forth by the state to avoid penalties or legal issues. Properly completing and submitting the CT 13 helps maintain the organization's tax-exempt status while fulfilling its tax obligations.

Filing Deadlines / Important Dates

Organizations must be aware of the filing deadlines associated with the Form CT 13 to avoid late penalties. Typically, the form is due on the fifteenth day of the fourth month following the close of the organization's tax year. For example, if the tax year ends on December 31, the CT 13 would be due by April 15 of the following year. It is crucial for organizations to keep track of these dates and ensure timely submission to maintain compliance with state regulations.

Required Documents

To complete the Form CT 13, organizations need to gather several key documents. These include financial statements that detail unrelated business income and expenses, such as profit and loss statements. Additionally, organizations should have their federal tax return on hand, as it may provide relevant information for completing the CT 13. Accurate documentation is vital for ensuring that all reported figures are correct and substantiated, which can help prevent issues during audits.

Penalties for Non-Compliance

Failure to file the Form CT 13 or inaccuracies in the submitted information can lead to significant penalties for organizations. The state of Connecticut imposes fines for late filings, which can accumulate over time. Additionally, organizations may face interest charges on any unpaid taxes resulting from unrelated business income. Non-compliance can also jeopardize an organization’s tax-exempt status, making it crucial to adhere to filing requirements and deadlines.

Quick guide on how to complete form ct 13 unrelated business income tax return tax year

Complete Form CT 13 Unrelated Business Income Tax Return Tax Year effortlessly on any device

Digital document management has become increasingly favored by businesses and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed paperwork, as you can easily locate the appropriate form and securely store it online. airSlate SignNow provides all the tools necessary to create, edit, and eSign your documents swiftly without delays. Handle Form CT 13 Unrelated Business Income Tax Return Tax Year on any platform using airSlate SignNow's Android or iOS applications and enhance any document-driven process today.

The simplest method to edit and eSign Form CT 13 Unrelated Business Income Tax Return Tax Year without hassle

- Find Form CT 13 Unrelated Business Income Tax Return Tax Year and click Get Form to begin.

- Use the tools we offer to complete your form.

- Highlight pertinent sections of the documents or obscure sensitive details with tools that airSlate SignNow specifically provides for that purpose.

- Create your eSignature with the Sign feature, which takes mere seconds and carries the same legal validity as a conventional ink signature.

- Review the information and click on the Done button to save your changes.

- Select your preferred method to send your form, whether via email, text message (SMS), or invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searches, and errors that necessitate reprinting document copies. airSlate SignNow addresses all your document management needs with just a few clicks from any device of your preference. Edit and eSign Form CT 13 Unrelated Business Income Tax Return Tax Year and ensure excellent communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form ct 13 unrelated business income tax return tax year

Create this form in 5 minutes!

How to create an eSignature for the form ct 13 unrelated business income tax return tax year

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is NYS CT 13 and how can airSlate SignNow help me with it?

NYS CT 13 is a form required for certain tax filings in New York State. airSlate SignNow streamlines the process of completing and signing this document electronically, ensuring your submissions are timely and secure. With our intuitive platform, you can easily fill out and eSign the NYS CT 13, saving both time and effort.

-

What features does airSlate SignNow offer for managing NYS CT 13 documents?

airSlate SignNow provides a range of features for managing your NYS CT 13 documents, including customizable templates, team collaboration tools, and mobile access. You can also track document statuses and set reminders for important deadlines related to your NYS CT 13 submissions. This enhances efficiency and minimizes the risk of errors.

-

Is airSlate SignNow a cost-effective solution for filing NYS CT 13?

Yes, airSlate SignNow is designed to be a cost-effective solution for businesses that need to file the NYS CT 13. By using our platform, you can reduce printing, mailing, and storage costs associated with paper documents. Our pricing plans are transparent and cater to businesses of all sizes.

-

How does airSlate SignNow ensure the security of my NYS CT 13 documents?

Security is a top priority at airSlate SignNow, especially for sensitive documents like the NYS CT 13. We employ advanced encryption standards to protect your data both in transit and at rest. Additionally, our platform complies with industry regulations to ensure your documents are securely handled.

-

What integrations does airSlate SignNow offer for my NYS CT 13 process?

airSlate SignNow integrates seamlessly with various applications such as Google Drive, Salesforce, and Microsoft Office. These integrations facilitate a smooth workflow when handling your NYS CT 13 documentation, allowing you to access and send your files from the tools you already use. This saves you time and improves productivity.

-

Can I track the status of my NYS CT 13 submissions on airSlate SignNow?

Absolutely! airSlate SignNow allows you to track the status of your NYS CT 13 submissions in real-time. You will receive notifications when your document is viewed, signed, or completed, ensuring you are always updated on the progress of your submissions.

-

Is it easy to set up and start using airSlate SignNow for NYS CT 13?

Yes, getting started with airSlate SignNow is a breeze! The platform is user-friendly and offers guided tutorials, making it easy to set up and process your NYS CT 13 documents quickly. You can start sending and eSigning documents within minutes, enhancing your business's efficiency.

Get more for Form CT 13 Unrelated Business Income Tax Return Tax Year

- Fencing contractor package rhode island form

- Hvac contractor package rhode island form

- Landscaping contractor package rhode island form

- Commercial contractor package rhode island form

- Excavation contractor package rhode island form

- Renovation contractor package rhode island form

- Concrete mason contractor package rhode island form

- Demolition contractor package rhode island form

Find out other Form CT 13 Unrelated Business Income Tax Return Tax Year

- Can I eSign Mississippi Car Dealer Resignation Letter

- eSign Missouri Car Dealer Lease Termination Letter Fast

- Help Me With eSign Kentucky Business Operations Quitclaim Deed

- eSign Nevada Car Dealer Warranty Deed Myself

- How To eSign New Hampshire Car Dealer Purchase Order Template

- eSign New Jersey Car Dealer Arbitration Agreement Myself

- eSign North Carolina Car Dealer Arbitration Agreement Now

- eSign Ohio Car Dealer Business Plan Template Online

- eSign Ohio Car Dealer Bill Of Lading Free

- How To eSign North Dakota Car Dealer Residential Lease Agreement

- How Do I eSign Ohio Car Dealer Last Will And Testament

- Sign North Dakota Courts Lease Agreement Form Free

- eSign Oregon Car Dealer Job Description Template Online

- Sign Ohio Courts LLC Operating Agreement Secure

- Can I eSign Michigan Business Operations POA

- eSign Car Dealer PDF South Dakota Computer

- eSign Car Dealer PDF South Dakota Later

- eSign Rhode Island Car Dealer Moving Checklist Simple

- eSign Tennessee Car Dealer Lease Agreement Form Now

- Sign Pennsylvania Courts Quitclaim Deed Mobile