Form CT 13 Unrelated Business Income Tax Return Tax Year 2021

What is the Form CT 13 Unrelated Business Income Tax Return?

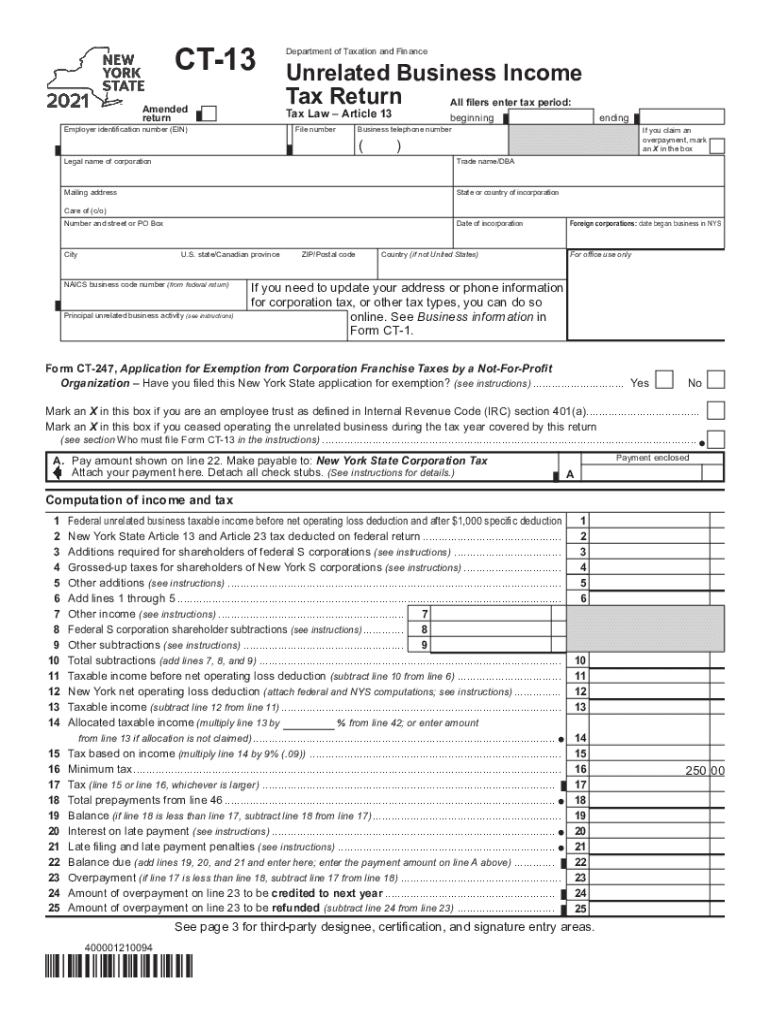

The Form CT 13 is the Unrelated Business Income Tax Return used by organizations in Connecticut that generate income from activities unrelated to their primary exempt purpose. This form is essential for tax compliance, ensuring that tax-exempt organizations report any income that is taxable under state law. The tax year for which the form is filed typically aligns with the organization's fiscal year, and it is crucial for maintaining tax-exempt status while complying with state regulations.

Steps to Complete the Form CT 13 Unrelated Business Income Tax Return

Completing the Form CT 13 involves several key steps:

- Gather Financial Information: Collect all relevant financial data, including income generated from unrelated business activities and any allowable deductions.

- Fill Out the Form: Accurately enter the required information on the form, including details about the organization, income sources, and expenses.

- Review for Accuracy: Ensure all entries are correct and complete, as errors can lead to delays or penalties.

- Sign and Date: The form must be signed by an authorized representative of the organization, affirming the accuracy of the information provided.

- Submit the Form: Choose your submission method, whether online, by mail, or in person, and ensure it is sent before the deadline.

Filing Deadlines / Important Dates

Organizations must be aware of the filing deadlines for the Form CT 13. Typically, the form is due on the fifteenth day of the fifth month following the end of the tax year. For example, if the tax year ends on December 31, the form is due by May 15 of the following year. It is essential to file on time to avoid penalties and interest on any unpaid taxes.

Legal Use of the Form CT 13 Unrelated Business Income Tax Return

The Form CT 13 serves a legal purpose by ensuring that tax-exempt organizations comply with state tax laws regarding unrelated business income. Proper use of the form helps maintain transparency and accountability in financial reporting. Additionally, it protects the organization's tax-exempt status by demonstrating compliance with the rules governing unrelated business activities.

Key Elements of the Form CT 13 Unrelated Business Income Tax Return

Key elements of the Form CT 13 include:

- Organization Information: Name, address, and tax identification number of the organization.

- Income Reporting: Detailed reporting of income from unrelated business activities, including gross receipts and specific sources of income.

- Deductions: Allowable deductions related to the income generated, which can help reduce the overall tax liability.

- Tax Calculation: Calculation of the tax owed based on the net unrelated business income.

Form Submission Methods

The Form CT 13 can be submitted through various methods to accommodate different preferences:

- Online Submission: Organizations can file electronically through the Connecticut Department of Revenue Services website, which may expedite processing.

- Mail Submission: The completed form can be printed and mailed to the appropriate state tax office.

- In-Person Submission: Organizations may also choose to deliver the form in person to their local tax office, ensuring it is received on time.

Quick guide on how to complete form ct 13 unrelated business income tax return tax year 2021

Complete Form CT 13 Unrelated Business Income Tax Return Tax Year effortlessly on any device

Online document management has gained popularity among organizations and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, as you can locate the necessary form and securely save it online. airSlate SignNow provides all the tools you need to create, modify, and electronically sign your documents quickly and without glitches. Handle Form CT 13 Unrelated Business Income Tax Return Tax Year on any device with airSlate SignNow Android or iOS applications and enhance any document-related task today.

How to modify and electronically sign Form CT 13 Unrelated Business Income Tax Return Tax Year with ease

- Locate Form CT 13 Unrelated Business Income Tax Return Tax Year and click on Get Form to begin.

- Use the tools available to complete your form.

- Emphasize relevant sections of the documents or conceal sensitive information using the tools that airSlate SignNow provides specifically for this purpose.

- Create your signature using the Sign feature, which takes just seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Choose how you would like to send your form: via email, text message (SMS), invite link, or download it to your computer.

Eliminate the stress of lost or misplaced files, tedious document searches, or mistakes that demand printing new copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Revise and electronically sign Form CT 13 Unrelated Business Income Tax Return Tax Year and ensure effective communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form ct 13 unrelated business income tax return tax year 2021

Create this form in 5 minutes!

How to create an eSignature for the form ct 13 unrelated business income tax return tax year 2021

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is 'nys ct 13' in relation to airSlate SignNow?

'Nys ct 13' refers to a specific tax document relevant for New York State taxpayers. With airSlate SignNow, you can easily prepare, send, and eSign your nys ct 13 forms, ensuring compliance and accuracy in your submissions.

-

How does airSlate SignNow help with nys ct 13 document management?

AirSlate SignNow provides features that simplify the management of nys ct 13 documents. You can create templates, automate workflows, and securely store your documents, leading to signNow time savings and reduced errors.

-

What are the pricing options for airSlate SignNow when handling nys ct 13?

AirSlate SignNow offers various pricing tiers to accommodate different business needs, including plans that optimize the handling of nys ct 13 documents. Our pricing is competitive and reflects the value brought by streamlining document processes.

-

Is it easy to integrate airSlate SignNow with other tools for nys ct 13?

Absolutely! AirSlate SignNow allows seamless integrations with popular software solutions used for financial and tax management, ensuring that your nys ct 13 documents sync effortlessly with your existing workflows.

-

What are the key benefits of using airSlate SignNow for nys ct 13?

Using airSlate SignNow for nys ct 13 provides efficiency and accuracy in your tax submissions. Our platform enhances secure electronic signing, minimization of paper usage, and faster processing times, making your workflow smoother.

-

Can I track the status of my nys ct 13 documents with airSlate SignNow?

Yes, airSlate SignNow offers robust tracking features for your nys ct 13 documents. You can monitor when documents are sent, viewed, and signed, ensuring you stay informed throughout the entire process.

-

How secure is the information related to nys ct 13 when using airSlate SignNow?

Security is a priority at airSlate SignNow. We use advanced encryption and comply with industry standards to protect your sensitive information related to nys ct 13, ensuring your documents are safe and secure.

Get more for Form CT 13 Unrelated Business Income Tax Return Tax Year

Find out other Form CT 13 Unrelated Business Income Tax Return Tax Year

- How Can I Electronic signature Oklahoma Doctors Document

- How Can I Electronic signature Alabama Finance & Tax Accounting Document

- How To Electronic signature Delaware Government Document

- Help Me With Electronic signature Indiana Education PDF

- How To Electronic signature Connecticut Government Document

- How To Electronic signature Georgia Government PDF

- Can I Electronic signature Iowa Education Form

- How To Electronic signature Idaho Government Presentation

- Help Me With Electronic signature Hawaii Finance & Tax Accounting Document

- How Can I Electronic signature Indiana Government PDF

- How Can I Electronic signature Illinois Finance & Tax Accounting PPT

- How To Electronic signature Maine Government Document

- How To Electronic signature Louisiana Education Presentation

- How Can I Electronic signature Massachusetts Government PDF

- How Do I Electronic signature Montana Government Document

- Help Me With Electronic signature Louisiana Finance & Tax Accounting Word

- How To Electronic signature Pennsylvania Government Document

- Can I Electronic signature Texas Government PPT

- How To Electronic signature Utah Government Document

- How To Electronic signature Washington Government PDF