Partnership Declaration of Estimated Unincorporated NYC Gov 2021

What is the Partnership Declaration Of Estimated Unincorporated NYC gov

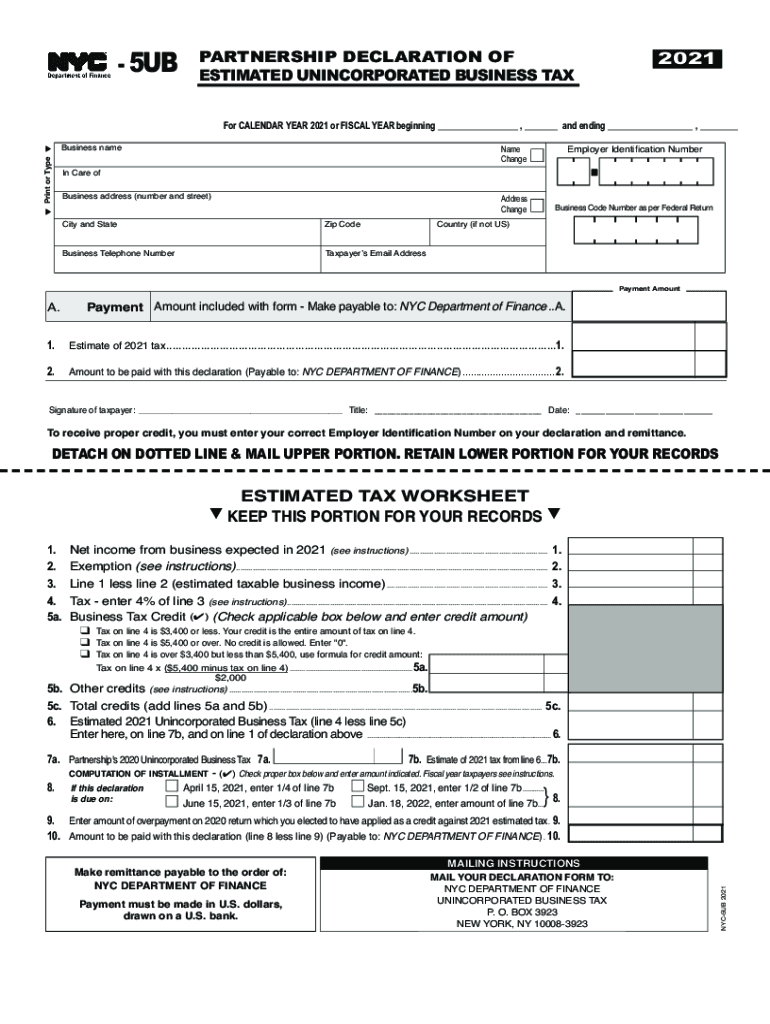

The Partnership Declaration of Estimated Unincorporated Business Tax (UBT) is a form required by the City of New York for partnerships operating within the city. This form is essential for reporting estimated tax payments on income generated by unincorporated businesses. It serves as a declaration to the New York City Department of Finance, allowing the city to assess the tax obligations of partnerships. Understanding this form is crucial for compliance with local tax laws and ensuring that partnerships meet their financial responsibilities.

How to use the Partnership Declaration Of Estimated Unincorporated NYC gov

Using the Partnership Declaration of Estimated Unincorporated Business Tax involves several straightforward steps. First, ensure that your partnership qualifies as an unincorporated business under NYC regulations. Next, gather all necessary financial information, including income estimates for the tax year. The form requires details such as the partnership's name, address, and the names of partners. Once completed, the form can be submitted electronically or via mail, depending on your preference. It is important to keep a copy for your records and ensure timely submission to avoid penalties.

Steps to complete the Partnership Declaration Of Estimated Unincorporated NYC gov

Completing the Partnership Declaration of Estimated Unincorporated Business Tax involves the following steps:

- Gather necessary documentation, including income estimates and partner information.

- Fill out the form accurately, ensuring all required fields are completed.

- Review the form for any errors or omissions before submission.

- Submit the form electronically through the NYC Department of Finance website or mail it to the appropriate address.

- Retain a copy of the submitted form and any confirmation of submission for your records.

Filing Deadlines / Important Dates

Filing deadlines for the Partnership Declaration of Estimated Unincorporated Business Tax are critical to avoid penalties. Typically, the form must be filed quarterly, with estimated payments due on specific dates throughout the year. It is essential to consult the NYC Department of Finance's official calendar for the exact due dates, as they can vary each year. Mark these dates on your calendar to ensure timely compliance and avoid any potential late fees.

Required Documents

To complete the Partnership Declaration of Estimated Unincorporated Business Tax, several documents are required. These include:

- Financial statements reflecting estimated income for the tax year.

- Partnership agreement outlining the roles and responsibilities of each partner.

- Identification information for all partners, such as Social Security numbers or Employer Identification Numbers (EIN).

Having these documents ready will streamline the completion process and ensure accuracy in your tax reporting.

Penalties for Non-Compliance

Failing to file the Partnership Declaration of Estimated Unincorporated Business Tax on time can result in significant penalties. The NYC Department of Finance imposes late fees and interest on unpaid taxes, which can accumulate quickly. Additionally, non-compliance may lead to audits or further scrutiny by tax authorities. It is crucial for partnerships to adhere to filing deadlines and maintain accurate records to avoid these consequences.

Quick guide on how to complete partnership declaration of estimated unincorporated nycgov

Effortlessly Create Partnership Declaration Of Estimated Unincorporated NYC gov on Any Device

Web-based document management has become increasingly favored by businesses and individuals alike. It offers an ideal environmentally friendly option to traditional printed and signed documents, as you can access the appropriate form and safely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and electronically sign your documents swiftly without interruptions. Handle Partnership Declaration Of Estimated Unincorporated NYC gov on any device with airSlate SignNow's Android or iOS applications and simplify any document-related task today.

How to Alter and Electronically Sign Partnership Declaration Of Estimated Unincorporated NYC gov with Ease

- Find Partnership Declaration Of Estimated Unincorporated NYC gov and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize important sections of your documents or obscure sensitive details with tools provided by airSlate SignNow specifically for this purpose.

- Generate your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional ink signature.

- Review the information and click the Done button to save your changes.

- Choose how you want to send your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misfiled documents, tedious form searching, or mistakes that necessitate printing new copies. airSlate SignNow caters to all your document management requirements in just a few clicks from any device you prefer. Modify and eSign Partnership Declaration Of Estimated Unincorporated NYC gov and guarantee seamless communication at every step of the form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct partnership declaration of estimated unincorporated nycgov

Create this form in 5 minutes!

How to create an eSignature for the partnership declaration of estimated unincorporated nycgov

The best way to generate an eSignature for a PDF document in the online mode

The best way to generate an eSignature for a PDF document in Chrome

How to generate an eSignature for putting it on PDFs in Gmail

How to create an eSignature from your mobile device

How to create an eSignature for a PDF document on iOS devices

How to create an eSignature for a PDF file on Android devices

People also ask

-

What features does airSlate SignNow offer for businesses in the nyc 5ub city?

airSlate SignNow provides a robust set of features designed for businesses in the nyc 5ub city, including electronic signatures, document templates, and real-time collaboration tools. These features streamline your document workflow and ensure compliance with legal standards. With airSlate SignNow, you can enhance efficiency and save valuable time.

-

How does airSlate SignNow support document security for users in nyc 5ub city?

Security is a priority for airSlate SignNow, especially for businesses in the nyc 5ub city. Our platform employs advanced encryption and secure access protocols to protect your documents. You can confidently send and receive sensitive information, knowing that it is secure and compliant with industry standards.

-

What is the pricing structure for airSlate SignNow in the nyc 5ub city?

The pricing structure for airSlate SignNow is designed to be cost-effective for businesses in the nyc 5ub city. We offer various plans that cater to different business sizes and needs, allowing you to choose a solution that fits your budget. You can enjoy unlimited documents and signatures at competitive rates.

-

Can I integrate airSlate SignNow with other applications while working in the nyc 5ub city?

Yes, airSlate SignNow offers seamless integrations with numerous applications that businesses in the nyc 5ub city commonly use. This includes platforms like Google Drive, Salesforce, and Microsoft Office. These integrations enhance your productivity by allowing you to manage documents conveniently from your preferred applications.

-

What are the benefits of choosing airSlate SignNow for businesses in the nyc 5ub city?

Choosing airSlate SignNow provides numerous benefits to businesses in the nyc 5ub city, including enhanced efficiency and reduced turnaround times for document processing. Our user-friendly interface allows teams to collaborate easily, and our mobile-friendly platform ensures you can manage documents on the go. This helps you stay productive and responsive.

-

Is there a mobile app available for airSlate SignNow users in the nyc 5ub city?

Yes, airSlate SignNow offers a mobile app suitable for users in the nyc 5ub city, allowing you to manage your document signing processes on the go. The app delivers the same features as the web platform, ensuring you can sign and send documents anytime and anywhere. This flexibility is crucial for busy professionals.

-

How does airSlate SignNow improve workflow efficiency for businesses in nyc 5ub city?

airSlate SignNow signNowly improves workflow efficiency for businesses in the nyc 5ub city by automating document-related tasks. Its features like bulk sending, reminders, and document tracking help to minimize delays and enhance productivity. Teams can focus more on core tasks, knowing that document management is streamlined.

Get more for Partnership Declaration Of Estimated Unincorporated NYC gov

- Fund administration member benefit claim form

- Noc for electricity connection pdf form

- Ficha para cadastro de clientes word form

- Junior bake off application 2022 form

- Uptown eye specialists referral form

- Motsepe foundation funding for npo 2022 form

- Certificat de rsidence en algrie pdf form

- Indiana first steps annual credential form

Find out other Partnership Declaration Of Estimated Unincorporated NYC gov

- How Do I Electronic signature Iowa Construction Document

- How Can I Electronic signature South Carolina Charity PDF

- How Can I Electronic signature Oklahoma Doctors Document

- How Can I Electronic signature Alabama Finance & Tax Accounting Document

- How To Electronic signature Delaware Government Document

- Help Me With Electronic signature Indiana Education PDF

- How To Electronic signature Connecticut Government Document

- How To Electronic signature Georgia Government PDF

- Can I Electronic signature Iowa Education Form

- How To Electronic signature Idaho Government Presentation

- Help Me With Electronic signature Hawaii Finance & Tax Accounting Document

- How Can I Electronic signature Indiana Government PDF

- How Can I Electronic signature Illinois Finance & Tax Accounting PPT

- How To Electronic signature Maine Government Document

- How To Electronic signature Louisiana Education Presentation

- How Can I Electronic signature Massachusetts Government PDF

- How Do I Electronic signature Montana Government Document

- Help Me With Electronic signature Louisiana Finance & Tax Accounting Word

- How To Electronic signature Pennsylvania Government Document

- Can I Electronic signature Texas Government PPT