Business Tax Forms and Publications for Tax Filing 2024-2026

Understanding Business Tax Forms and Publications for Tax Filing

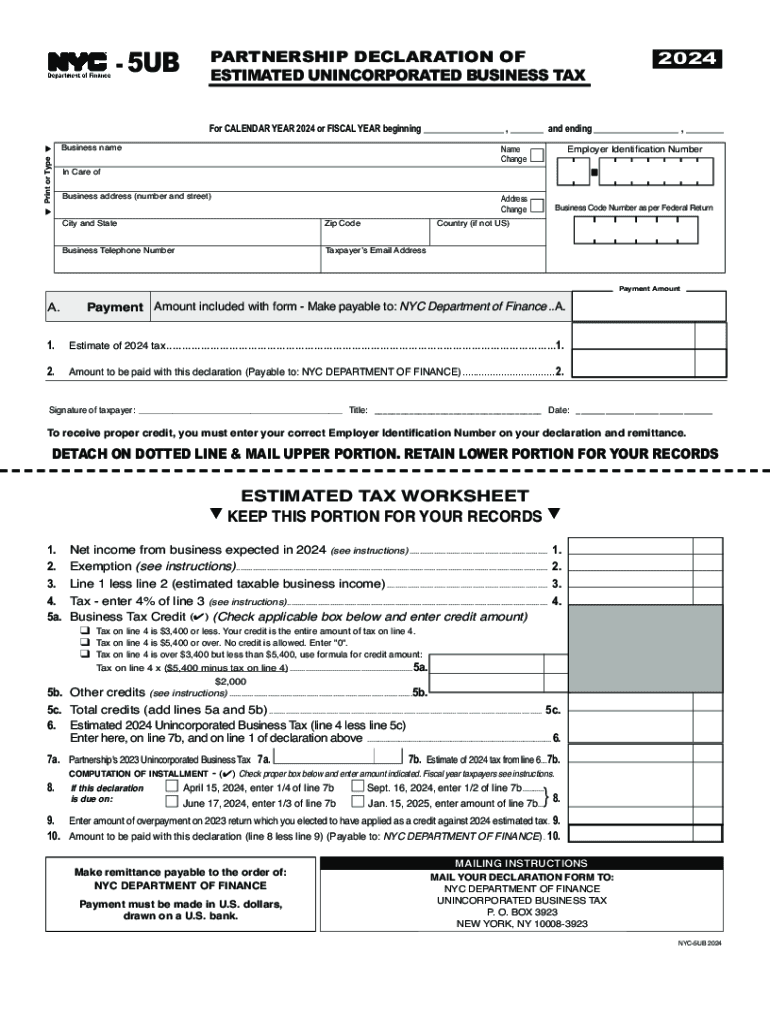

Business tax forms and publications are essential tools for businesses in the United States when it comes to filing taxes accurately and on time. These documents provide the necessary information required by the Internal Revenue Service (IRS) and state tax agencies. They encompass various forms, such as the 1065 for partnerships, the 1120 for corporations, and the 1040 Schedule C for sole proprietors. Each form serves a specific purpose, detailing income, deductions, and credits pertinent to the business entity type.

How to Use Business Tax Forms and Publications

To effectively use business tax forms, start by identifying the correct form based on your business structure. Gather all necessary financial documents, including income statements, expense reports, and any relevant receipts. Carefully read the instructions provided with each form, as they outline how to fill it out correctly. Ensure that all figures are accurate and that you have included all required schedules and attachments. Once completed, review the form for any errors before submission.

Steps to Complete Business Tax Forms

Completing business tax forms involves several key steps:

- Determine your business entity type to select the appropriate form.

- Collect all financial records, including income, expenses, and previous tax returns.

- Fill out the form carefully, following the instructions provided.

- Double-check all entries for accuracy and completeness.

- Submit the form by the designated deadline, either electronically or via mail.

Filing Deadlines and Important Dates

Filing deadlines for business tax forms vary based on the type of business entity. Generally, partnerships must file Form 1065 by March 15, while corporations using Form 1120 have a deadline of April 15. It is crucial to mark these dates on your calendar to avoid penalties. Additionally, extensions may be available, but they must be requested before the original deadline.

IRS Guidelines for Business Tax Forms

The IRS provides comprehensive guidelines on how to complete and submit business tax forms. These guidelines include details on eligibility, required documentation, and specific instructions for various business structures. It is important to consult the IRS website or the instructions accompanying each form to ensure compliance with federal tax laws and regulations.

Digital vs. Paper Versions of Business Tax Forms

Businesses have the option to file tax forms digitally or via paper submission. Digital filing is often faster and more efficient, allowing for immediate confirmation of receipt. Many tax software programs integrate with IRS systems, streamlining the process. However, some businesses may prefer paper forms for record-keeping or due to specific requirements. Understanding the pros and cons of each method can help businesses choose the best option for their needs.

Create this form in 5 minutes or less

Find and fill out the correct business tax forms and publications for tax filing 732241867

Create this form in 5 minutes!

How to create an eSignature for the business tax forms and publications for tax filing 732241867

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are Business Tax Forms And Publications For Tax Filing?

Business Tax Forms And Publications For Tax Filing are essential documents that businesses need to complete their tax obligations. These forms include various schedules, reports, and instructions provided by the IRS and other tax authorities. Understanding these forms is crucial for accurate tax filing and compliance.

-

How can airSlate SignNow help with Business Tax Forms And Publications For Tax Filing?

airSlate SignNow streamlines the process of managing Business Tax Forms And Publications For Tax Filing by allowing users to easily send, sign, and store documents electronically. This reduces the time spent on paperwork and ensures that all forms are completed accurately and securely. Our platform simplifies the entire tax filing process for businesses.

-

What features does airSlate SignNow offer for Business Tax Forms And Publications For Tax Filing?

airSlate SignNow offers features such as customizable templates for Business Tax Forms And Publications For Tax Filing, secure eSigning, and document tracking. These features enhance efficiency and ensure that all necessary forms are completed and submitted on time. Additionally, our platform provides a user-friendly interface that simplifies document management.

-

Is airSlate SignNow cost-effective for handling Business Tax Forms And Publications For Tax Filing?

Yes, airSlate SignNow is a cost-effective solution for managing Business Tax Forms And Publications For Tax Filing. Our pricing plans are designed to accommodate businesses of all sizes, ensuring that you get the best value for your investment. By reducing the time and resources spent on paperwork, our platform ultimately saves you money.

-

Can airSlate SignNow integrate with other software for Business Tax Forms And Publications For Tax Filing?

Absolutely! airSlate SignNow integrates seamlessly with various accounting and tax software, making it easier to manage Business Tax Forms And Publications For Tax Filing. This integration allows for automatic data transfer and ensures that all your documents are in one place, enhancing your overall workflow and efficiency.

-

What are the benefits of using airSlate SignNow for Business Tax Forms And Publications For Tax Filing?

Using airSlate SignNow for Business Tax Forms And Publications For Tax Filing offers numerous benefits, including increased efficiency, enhanced security, and improved compliance. Our platform allows for quick and easy document management, reducing the risk of errors and ensuring that your tax filings are accurate and timely. This ultimately leads to a smoother tax filing experience.

-

How secure is airSlate SignNow for handling Business Tax Forms And Publications For Tax Filing?

Security is a top priority at airSlate SignNow. We utilize advanced encryption and security protocols to protect your Business Tax Forms And Publications For Tax Filing. Our platform ensures that all documents are stored securely and that your sensitive information remains confidential throughout the signing and filing process.

Get more for Business Tax Forms And Publications For Tax Filing

Find out other Business Tax Forms And Publications For Tax Filing

- Electronic signature Construction Form California Fast

- Help Me With Electronic signature Colorado Construction Rental Application

- Electronic signature Connecticut Construction Business Plan Template Fast

- Electronic signature Delaware Construction Business Letter Template Safe

- Electronic signature Oklahoma Business Operations Stock Certificate Mobile

- Electronic signature Pennsylvania Business Operations Promissory Note Template Later

- Help Me With Electronic signature North Dakota Charity Resignation Letter

- Electronic signature Indiana Construction Business Plan Template Simple

- Electronic signature Wisconsin Charity Lease Agreement Mobile

- Can I Electronic signature Wisconsin Charity Lease Agreement

- Electronic signature Utah Business Operations LLC Operating Agreement Later

- How To Electronic signature Michigan Construction Cease And Desist Letter

- Electronic signature Wisconsin Business Operations LLC Operating Agreement Myself

- Electronic signature Colorado Doctors Emergency Contact Form Secure

- How Do I Electronic signature Georgia Doctors Purchase Order Template

- Electronic signature Doctors PDF Louisiana Now

- How To Electronic signature Massachusetts Doctors Quitclaim Deed

- Electronic signature Minnesota Doctors Last Will And Testament Later

- How To Electronic signature Michigan Doctors LLC Operating Agreement

- How Do I Electronic signature Oregon Construction Business Plan Template