05 169 Texas Franchise Tax E Z Computation Annual Report 2018

What is the 05 169 Texas Franchise Tax E Z Computation Annual Report

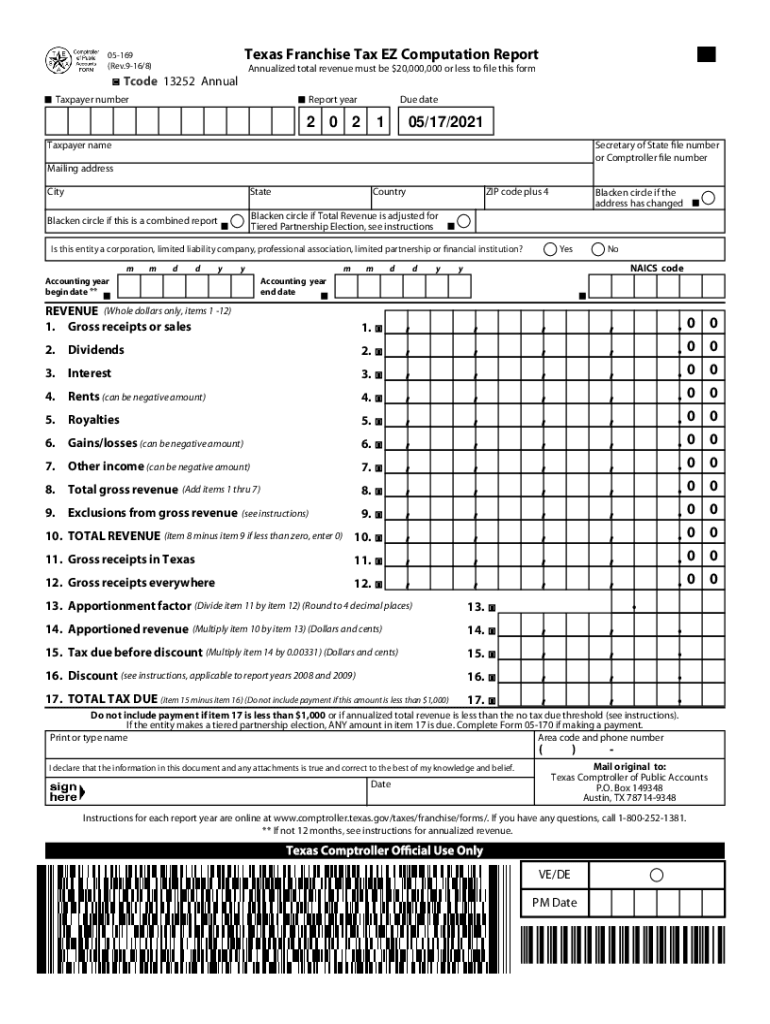

The 05 169 Texas Franchise Tax E Z Computation Annual Report is a simplified tax form designed for certain business entities in Texas. This form allows eligible entities to report their franchise tax liability in a streamlined manner, making it easier for small businesses and those with lower revenue to fulfill their tax obligations. The report is specifically tailored for entities that meet specific criteria, ensuring they can comply with state tax regulations without unnecessary complexity.

Steps to complete the 05 169 Texas Franchise Tax E Z Computation Annual Report

Completing the 05 169 Texas Franchise Tax E Z Computation Annual Report involves several key steps:

- Gather necessary financial information, including revenue and expenses for the reporting period.

- Review the eligibility criteria to ensure your entity qualifies to use this form.

- Access the form through the Texas Comptroller's website or other official sources.

- Fill out the required sections accurately, providing all necessary details.

- Review the completed form for accuracy and completeness.

- Submit the form electronically or via mail, following the submission guidelines provided.

Legal use of the 05 169 Texas Franchise Tax E Z Computation Annual Report

The legal use of the 05 169 Texas Franchise Tax E Z Computation Annual Report hinges on compliance with Texas tax laws. To ensure the report is legally binding, it must be completed accurately and submitted by the designated deadlines. Electronic submissions are accepted and are considered valid under the ESIGN Act, provided that proper eSignature protocols are followed. This includes using a reliable eSignature solution that meets legal standards for digital documents.

Key elements of the 05 169 Texas Franchise Tax E Z Computation Annual Report

Several key elements are essential when filling out the 05 169 Texas Franchise Tax E Z Computation Annual Report:

- Entity information, including name, address, and taxpayer identification number.

- Revenue figures for the reporting period, which determine tax liability.

- Calculation of the franchise tax due, based on the simplified computation method.

- Signature of an authorized representative, affirming the accuracy of the information provided.

Filing Deadlines / Important Dates

Filing deadlines for the 05 169 Texas Franchise Tax E Z Computation Annual Report are crucial for compliance. Typically, the report is due on May 15 of each year. However, if this date falls on a weekend or holiday, the deadline may be extended to the next business day. It is important for businesses to mark their calendars and ensure timely submission to avoid penalties.

Form Submission Methods (Online / Mail / In-Person)

The 05 169 Texas Franchise Tax E Z Computation Annual Report can be submitted through various methods:

- Online: The preferred method, allowing for quick processing and confirmation of receipt.

- Mail: Completed forms can be sent to the Texas Comptroller's office, but this method may result in longer processing times.

- In-Person: Businesses may also deliver their forms directly to a local Comptroller office, ensuring immediate submission.

Quick guide on how to complete 05 169 texas franchise tax 2021 e z computation annual report

Manage 05 169 Texas Franchise Tax E Z Computation Annual Report seamlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It offers a perfect eco-friendly substitute for conventional printed and signed paperwork, allowing you to access the appropriate form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and electronically sign your documents quickly and efficiently. Handle 05 169 Texas Franchise Tax E Z Computation Annual Report on any platform through airSlate SignNow's Android or iOS applications and simplify any document-related task today.

The easiest way to modify and eSign 05 169 Texas Franchise Tax E Z Computation Annual Report effortlessly

- Obtain 05 169 Texas Franchise Tax E Z Computation Annual Report and click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize relevant sections of the documents or redact sensitive information with tools provided by airSlate SignNow specifically for that purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional handwritten signature.

- Review all the details and click on the Done button to save your modifications.

- Select your preferred method of sending your form, whether by email, SMS, or invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow meets all your document management requirements in just a few clicks from any device you choose. Modify and eSign 05 169 Texas Franchise Tax E Z Computation Annual Report and ensure outstanding communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 05 169 texas franchise tax 2021 e z computation annual report

Create this form in 5 minutes!

How to create an eSignature for the 05 169 texas franchise tax 2021 e z computation annual report

The way to create an electronic signature for a PDF in the online mode

The way to create an electronic signature for a PDF in Chrome

How to create an eSignature for putting it on PDFs in Gmail

How to make an eSignature right from your smart phone

The best way to create an eSignature for a PDF on iOS devices

How to make an eSignature for a PDF on Android OS

People also ask

-

What is the tx franchise tax for 05 169?

The tx franchise tax for 05 169 refers to the franchise tax code specific to Texas businesses operating under section 05.169. This tax is designed to generate revenue from business operations within the state, and understanding how it applies to your company is crucial for compliance. airSlate SignNow can help streamline the document processes related to filing this tax.

-

How does airSlate SignNow help with tx franchise tax for 05 169 documentation?

airSlate SignNow simplifies the document management process required for tx franchise tax for 05 169 filings. Our platform allows you to easily send, eSign, and store necessary documents securely. This efficiency helps ensure that your submissions are timely and accurately completed, reducing the stress of tax season.

-

What features assist in managing the tx franchise tax for 05 169?

Key features of airSlate SignNow that assist in managing tx franchise tax for 05 169 include secure electronic signatures, document templates, and real-time collaboration. These tools improve accuracy and efficiency when preparing and submitting tax documents. As a result, businesses can focus on growth rather than administrative tasks.

-

Is airSlate SignNow cost-effective for managing tx franchise tax for 05 169?

Yes, airSlate SignNow is a cost-effective solution for businesses dealing with tx franchise tax for 05 169. We offer competitive pricing plans that cater to various business sizes, ensuring that you receive excellent value for your investment. This affordability frees up resources to focus on other critical areas of your business.

-

Can airSlate SignNow integrate with accounting software for tx franchise tax for 05 169?

Absolutely! airSlate SignNow integrates seamlessly with popular accounting software, which is beneficial for managing tx franchise tax for 05 169. This integration allows for efficient data sharing and ensures your financial records are aligned with your tax obligations. Keeping everything in sync simplifies compliance and reduces errors.

-

What are the benefits of using airSlate SignNow for tx franchise tax for 05 169?

Using airSlate SignNow for tx franchise tax for 05 169 offers numerous benefits, including enhanced efficiency and accuracy in document handling. Our platform ensures that your tax documents are easily accessible and securely stored. This can lead to faster filing times and a reduced risk of penalties due to missed deadlines.

-

How do electronic signatures work for tx franchise tax for 05 169 forms?

Electronic signatures for tx franchise tax for 05 169 forms through airSlate SignNow are legally binding and secure. Users can sign documents digitally from anywhere, which speeds up the signing process. This convenience caters to the needs of modern businesses and ensures that tax paperwork is completed without unnecessary delays.

Get more for 05 169 Texas Franchise Tax E Z Computation Annual Report

Find out other 05 169 Texas Franchise Tax E Z Computation Annual Report

- Sign Nevada Non-Profit LLC Operating Agreement Free

- Sign Non-Profit Document New Mexico Mobile

- Sign Alaska Orthodontists Business Plan Template Free

- Sign North Carolina Life Sciences Purchase Order Template Computer

- Sign Ohio Non-Profit LLC Operating Agreement Secure

- Can I Sign Ohio Non-Profit LLC Operating Agreement

- Sign South Dakota Non-Profit Business Plan Template Myself

- Sign Rhode Island Non-Profit Residential Lease Agreement Computer

- Sign South Carolina Non-Profit Promissory Note Template Mobile

- Sign South Carolina Non-Profit Lease Agreement Template Online

- Sign Oregon Life Sciences LLC Operating Agreement Online

- Sign Texas Non-Profit LLC Operating Agreement Online

- Can I Sign Colorado Orthodontists Month To Month Lease

- How Do I Sign Utah Non-Profit Warranty Deed

- Help Me With Sign Colorado Orthodontists Purchase Order Template

- Sign Virginia Non-Profit Living Will Fast

- How To Sign Virginia Non-Profit Lease Agreement Template

- How To Sign Wyoming Non-Profit Business Plan Template

- How To Sign Wyoming Non-Profit Credit Memo

- Sign Wisconsin Non-Profit Rental Lease Agreement Simple