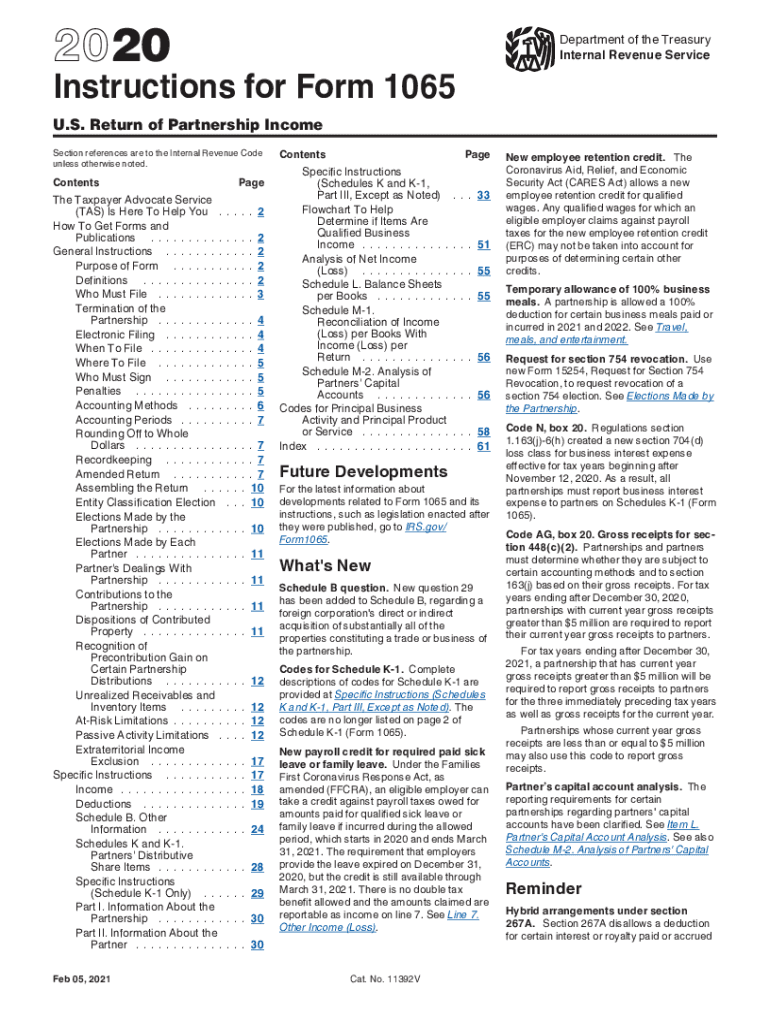

Instructions for Form 1065 Instructions for Form 1065 , U S Return of Partnership Income 2020

Understanding Form 1065: U.S. Return of Partnership Income

The Form 1065 is a crucial document for partnerships in the United States, serving as the U.S. Return of Partnership Income. This form is used to report the income, deductions, gains, and losses from the operation of a partnership. Each partner receives a Schedule K-1, which details their share of the partnership's income, deductions, and credits. Understanding the purpose and requirements of this form is essential for accurate tax reporting and compliance.

Steps to Complete Form 1065 Instructions for 2020

Completing the Form 1065 involves several key steps:

- Gather necessary financial documents, including income statements, expense reports, and prior year tax returns.

- Fill out the basic information section, including the partnership's name, address, and Employer Identification Number (EIN).

- Report the partnership's income and deductions on the appropriate lines of the form.

- Complete the Schedule K-1 for each partner, ensuring accurate allocation of income and deductions.

- Review the completed form for accuracy before submission.

Legal Use of Form 1065 Instructions

The Form 1065 instructions provide the legal framework for completing the form accurately. Compliance with these instructions ensures that the partnership meets its tax obligations and avoids potential penalties. The IRS requires that all information reported is truthful and complete, emphasizing the importance of following the guidelines outlined in the instructions.

Filing Deadlines for Form 1065

Partnerships must file Form 1065 by the 15th day of the third month following the end of their tax year. For partnerships operating on a calendar year basis, this means the deadline is March 15. If additional time is needed, partnerships can file for an extension, but this does not extend the time to pay any taxes owed.

Required Documents for Form 1065

To complete Form 1065, several documents are required:

- Financial statements, including profit and loss statements and balance sheets.

- Records of income and expenses throughout the year.

- Prior year tax returns for reference.

- Information for each partner, including their contributions and distributions.

Form Submission Methods for 1065

Partnerships can submit Form 1065 through various methods:

- Electronically via the IRS e-file system, which is often faster and more secure.

- By mail, sending the completed form to the appropriate IRS address based on the partnership's location.

- In-person at designated IRS offices, though this method is less common.

Quick guide on how to complete 2020 instructions for form 1065 instructions for form 1065 us return of partnership income

Effortlessly Prepare Instructions For Form 1065 Instructions For Form 1065 , U S Return Of Partnership Income on Any Device

Digital document management has gained signNow traction among companies and individuals alike. It serves as an ideal environmentally-friendly alternative to traditional printed and signed papers, as you can easily find the appropriate form and securely store it online. airSlate SignNow provides you with all the tools necessary to swiftly create, edit, and eSign your documents without any delays. Manage Instructions For Form 1065 Instructions For Form 1065 , U S Return Of Partnership Income on any platform using airSlate SignNow's Android or iOS applications and enhance your document-centered processes today.

The Easiest Way to Edit and eSign Instructions For Form 1065 Instructions For Form 1065 , U S Return Of Partnership Income with Ease

- Find Instructions For Form 1065 Instructions For Form 1065 , U S Return Of Partnership Income and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize relevant sections of your documents or redact sensitive information using tools specifically offered by airSlate SignNow for that purpose.

- Create your signature with the Sign tool, which takes mere seconds and holds the same legal validity as a conventional ink signature.

- Review the details and select the Done button to save your changes.

- Decide how you wish to send your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns over lost or misplaced files, tedious form searches, or errors that necessitate reprinting new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Modify and eSign Instructions For Form 1065 Instructions For Form 1065 , U S Return Of Partnership Income and ensure effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2020 instructions for form 1065 instructions for form 1065 us return of partnership income

Create this form in 5 minutes!

How to create an eSignature for the 2020 instructions for form 1065 instructions for form 1065 us return of partnership income

How to create an electronic signature for a PDF document online

How to create an electronic signature for a PDF document in Google Chrome

How to generate an eSignature for signing PDFs in Gmail

How to create an eSignature from your smart phone

How to create an eSignature for a PDF document on iOS

How to create an eSignature for a PDF file on Android OS

People also ask

-

What are the form 1065 k 1 instructions 2020 for business partners?

The form 1065 k 1 instructions 2020 provide detailed guidelines for business partners on how to report their share of income, deductions, and credits from a partnership. These instructions are crucial for ensuring accurate tax filings and compliance with IRS requirements. Partners should closely follow these guidelines to avoid any potential pitfalls in their tax reporting.

-

How can airSlate SignNow assist with completing form 1065 k 1 instructions 2020?

airSlate SignNow can help by providing an intuitive platform for filling out and signing form 1065 k 1 instructions 2020 electronically. Our solution streamlines the process, allowing users to collaborate in real time and ensure that all necessary fields are completed accurately. With our eSignature functionality, you can securely sign your documents, making tax preparation more efficient.

-

Is there a cost associated with using airSlate SignNow for form 1065 k 1 instructions 2020?

Yes, airSlate SignNow offers various pricing plans to fit different business needs, including features to assist with form 1065 k 1 instructions 2020. Pricing is competitive and designed to provide value through an easy-to-use solution that enhances document management and eSigning. You can choose a plan that suits your volume and specific requirements.

-

What features does airSlate SignNow offer for handling form 1065 k 1 instructions 2020?

airSlate SignNow offers a range of features for managing form 1065 k 1 instructions 2020, including customizable templates, secure storage, and integration options with popular accounting software. Our drag-and-drop interface simplifies document creation, and our built-in reminders help keep your tax filings timely and organized. This makes it easier to follow the instructions accurately.

-

Are the form 1065 k 1 instructions 2020 compatible with electronic signatures?

Yes, the form 1065 k 1 instructions 2020 are compatible with electronic signatures provided by airSlate SignNow. Electronic signatures are legally recognized in the U.S., making it simple to sign and share your documents securely. By using our platform, you can ensure compliance while benefiting from the convenience of eSigning.

-

What are the benefits of using airSlate SignNow for form 1065 k 1 instructions 2020?

Using airSlate SignNow for form 1065 k 1 instructions 2020 offers several benefits, such as improved compliance and efficiency in document handling. Our platform reduces the time spent on paperwork by allowing for digital collaboration and secure storage. Additionally, our user-friendly interface ensures that your team can easily navigate the requirements of the instructions.

-

Can I integrate airSlate SignNow with my existing accounting software for form 1065 k 1 instructions 2020?

Absolutely! airSlate SignNow offers robust integration capabilities with many accounting software solutions. This allows you to seamlessly share information needed for form 1065 k 1 instructions 2020 directly from your accounting tools, facilitating a smoother workflow and ensuring your data is accurately reflected in your tax filings.

Get more for Instructions For Form 1065 Instructions For Form 1065 , U S Return Of Partnership Income

Find out other Instructions For Form 1065 Instructions For Form 1065 , U S Return Of Partnership Income

- Electronic signature West Virginia Orthodontists Living Will Online

- Electronic signature Legal PDF Vermont Online

- How Can I Electronic signature Utah Legal Separation Agreement

- Electronic signature Arizona Plumbing Rental Lease Agreement Myself

- Electronic signature Alabama Real Estate Quitclaim Deed Free

- Electronic signature Alabama Real Estate Quitclaim Deed Safe

- Electronic signature Colorado Plumbing Business Plan Template Secure

- Electronic signature Alaska Real Estate Lease Agreement Template Now

- Electronic signature Colorado Plumbing LLC Operating Agreement Simple

- Electronic signature Arizona Real Estate Business Plan Template Free

- Electronic signature Washington Legal Contract Safe

- How To Electronic signature Arkansas Real Estate Contract

- Electronic signature Idaho Plumbing Claim Myself

- Electronic signature Kansas Plumbing Business Plan Template Secure

- Electronic signature Louisiana Plumbing Purchase Order Template Simple

- Can I Electronic signature Wyoming Legal Limited Power Of Attorney

- How Do I Electronic signature Wyoming Legal POA

- How To Electronic signature Florida Real Estate Contract

- Electronic signature Florida Real Estate NDA Secure

- Can I Electronic signature Florida Real Estate Cease And Desist Letter