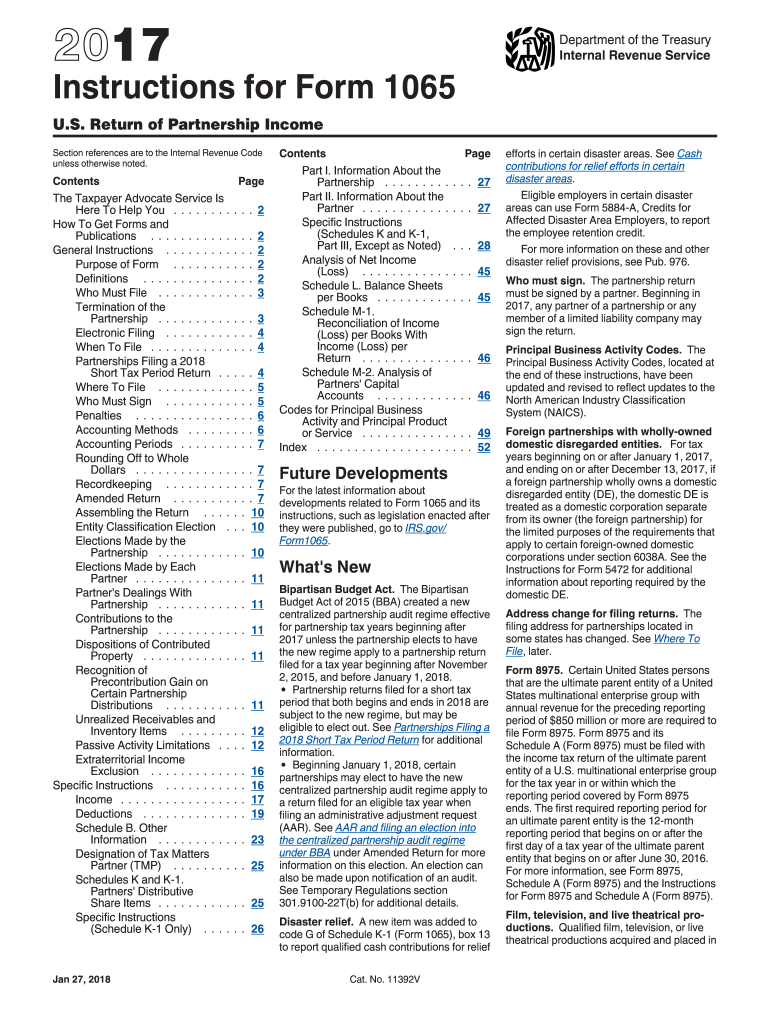

Irs Instruction 1065 Form 2017

What is the Irs Instruction 1065 Form

The Irs Instruction 1065 Form is a tax document used by partnerships in the United States to report income, deductions, gains, and losses from the partnership's operations. This form is essential for partnerships, as it provides the IRS with a comprehensive overview of the partnership's financial activities. Each partner receives a Schedule K-1, which details their share of the income, deductions, and credits, allowing them to report this information on their individual tax returns.

How to use the Irs Instruction 1065 Form

Using the Irs Instruction 1065 Form involves several steps. First, gather all necessary financial information, including income and expenses for the partnership. Next, complete the form by accurately entering the partnership’s financial data. Ensure that all partners’ information is included, as this will affect their individual tax returns. After completing the form, review it for accuracy before submission to avoid penalties or delays.

Steps to complete the Irs Instruction 1065 Form

Completing the Irs Instruction 1065 Form requires careful attention to detail. Follow these steps:

- Collect financial records, including income statements and expense reports.

- Fill out the identification section with the partnership's name, address, and Employer Identification Number (EIN).

- Report total income and deductions in the appropriate sections.

- Calculate the partnership's taxable income.

- Distribute income, deductions, and credits to each partner using Schedule K-1.

- Review the completed form for accuracy.

- Submit the form to the IRS by the deadline.

Legal use of the Irs Instruction 1065 Form

The Irs Instruction 1065 Form is legally required for partnerships to report their income to the IRS. Failure to file this form can result in penalties and interest on unpaid taxes. It is crucial for partnerships to ensure that the information reported is accurate and complete to maintain compliance with federal tax laws. Additionally, partners must report their share of income on their individual tax returns, which relies on the information provided in this form.

Filing Deadlines / Important Dates

Partnerships must file the Irs Instruction 1065 Form by the 15th day of the third month following the end of their tax year. For partnerships operating on a calendar year, this means the filing deadline is March 15. If the deadline falls on a weekend or holiday, it is extended to the next business day. Partnerships can request a six-month extension, but they must still pay any owed taxes by the original deadline to avoid penalties.

Form Submission Methods (Online / Mail / In-Person)

The Irs Instruction 1065 Form can be submitted in several ways. Partnerships can file electronically using approved e-filing software, which is often the fastest method. Alternatively, the form can be printed and mailed to the IRS. If filing by mail, ensure that the form is sent to the correct address based on the partnership's location. In-person submissions are generally not accepted for this form, as the IRS encourages electronic filing for efficiency.

Quick guide on how to complete irs instruction 1065 form 2017 2019

Discover the simplest method to complete and endorse your Irs Instruction 1065 Form

Are you still spending time assembling your formal documents on paper instead of online? airSlate SignNow offers a superior approach to complete and endorse your Irs Instruction 1065 Form and associated forms for public services. Our advanced electronic signature solution provides everything required to handle documents swiftly and in compliance with official standards - robust PDF editing, managing, safeguarding, signing, and sharing tools all accessible through a user-friendly interface.

Only a few steps are required to complete and endorse your Irs Instruction 1065 Form:

- Insert the fillable template into the editor with the Get Form button.

- Review the information you need to supply in your Irs Instruction 1065 Form.

- Move between the fields using the Next option to ensure nothing is missed.

- Utilize Text, Check, and Cross tools to complete the fields with your details.

- Modify the content using Text boxes or Images from the upper toolbar.

- Emphasize what is signNow or Conceal sections that are no longer relevant.

- Click on Sign to create a legally binding electronic signature using any method you prefer.

- Insert the Date alongside your signature and finish your task with the Done button.

Store your completed Irs Instruction 1065 Form in the Documents folder within your account, download it, or export it to your chosen cloud storage. Our solution also offers versatile form sharing. There's no need to print your templates when you need to submit them to the appropriate public office - do it via email, fax, or by requesting a USPS “snail mail” delivery from your account. Give it a try today!

Create this form in 5 minutes or less

Find and fill out the correct irs instruction 1065 form 2017 2019

FAQs

-

The IRS sent me a form 1065, but I am a sole proprietor. Do I ignore this form and fill out a schedule C?

I would assume that you applied for an employer identification number and checked the partnership box by mistake instead of sole proprietor. If this is the case, this requires you to obtain a new EIN.If you properly filled out the application for an EIN, you can ignore the 1065 notice.Your EIN acknowledgement letter from the IRS will state what type of return they expect you to file under the EIN.

-

How can I fill out an IRS form 8379?

Form 8379, the Injured Spouse declaration, is used to ensure that a spouse’s share of a refund from a joint tax return is not used by the IRS as an offset to pay a tax obligation of the other spouse.Before you file this, make sure that you know the difference between this and the Innocent Spouse declaration, Form 8857. You use Form 8379 when your spouse owes money for a legally enforeceable tax debt (such as a student loan which is in default) for which you are not jointly liable. You use Form 8857 when you want to be released from tax liability for an understatement of tax that resulted from actions taken by your spouse of which you had no knowledge, and had no reason to know.As the other answers have specified, you follow the Instructions for Form 8379 (11/2016) on the IRS Web site to actually fill it out.

-

How do I fill out the CAT Application Form 2017?

CAT 2017 registration opened on August 9, 2017 will close on September 20 at 5PM. CAT online registration form and application form is a single document divided in 5 pages and is to be completed online. The 1st part of CAT online registration form requires your personal details. After completing your online registration, IIMs will send you CAT 2017 registration ID. With this unique ID, you will login to online registration form which will also contain application form and registration form.CAT Registration and application form will require you to fill up your academic details, uploading of photograph, signature and requires category certificates as per the IIMs prescribed format for CAT registration. CAT online application form 2017 consists of programme details on all the 20 IIMs. Candidates have to tick by clicking on the relevant programmes of the IIMs for which they wish to attend the personal Interview Process.

-

How do I fill out a CLAT 2019 application form?

Hi thereFirst of all, let me tell you some important points:CLAT 2019 has gone OFFLINE this yearBut the application forms for CLAT 2019 have to be filled ONLINEThe payment of the application fees also should be made onlineNow, kindly note the important dates:Note the details regarding the application fees:Here, if you want the Previous Year Question papers, Rs.500 would be added to the application fees.Apart from this, there would be bank transaction charges added to the application fees.The application fees is non-refundable.Note one important point here that before you fill the application form, check for your eligibility.To know the complete details of filling the application form along with other information like the eligibility - in terms of age, educational qualification, list of NLUs participating and the seats offered under each category, CLAT Reservation policies, CLAT exam pattern, marking scheme, syllabus, important documents required to be kept ready before filling the form, kindly go to the link below:How to fill CLAT 2019 Application form? Registration OPEN | All you need to knowTo know how to prepare for one of the very important section of CLAT exam, GK and Current Affairs, kindly go to the link below:How to prepare GK & Current Affairs for CLAT 2019To practice, daily MCQs on Current Affairs, kindly go to the link below:#CLAT2019 | #AILET2019 | #DULLB2019 | GK and Current Affairs Series: 5 in 10 Series: Day 12For any other queries, kindly write to us at mailateasyway@gmail.comThanks & Regards!

Create this form in 5 minutes!

How to create an eSignature for the irs instruction 1065 form 2017 2019

How to make an eSignature for the Irs Instruction 1065 Form 2017 2019 in the online mode

How to make an eSignature for your Irs Instruction 1065 Form 2017 2019 in Google Chrome

How to create an eSignature for putting it on the Irs Instruction 1065 Form 2017 2019 in Gmail

How to create an eSignature for the Irs Instruction 1065 Form 2017 2019 straight from your smart phone

How to create an eSignature for the Irs Instruction 1065 Form 2017 2019 on iOS devices

How to make an electronic signature for the Irs Instruction 1065 Form 2017 2019 on Android

People also ask

-

What is the purpose of the IRS Instruction 1065 Form?

The IRS Instruction 1065 Form is used by partnerships to report their income, deductions, and income tax liabilities. It's crucial for ensuring compliance with IRS regulations while properly documenting partnerships' financial activities. Understanding the instructions for this form can help businesses avoid penalties and optimize their tax filings.

-

How can airSlate SignNow help with the IRS Instruction 1065 Form?

airSlate SignNow streamlines the process of completing and signing the IRS Instruction 1065 Form by providing an electronic signature solution. Our platform enables users to securely send the form for eSigning, ensuring all signatures are captured and documented efficiently. This minimizes the hassle of manual paperwork and helps maintain compliance with IRS requirements.

-

What features does airSlate SignNow offer for managing the IRS Instruction 1065 Form?

AirSlate SignNow offers a range of features designed to simplify the management of IRS Instruction 1065 Form. These include customizable templates, automated reminders for signatures, and a robust document tracking system. With these tools, users can enhance their workflow and ensure timely submissions to the IRS.

-

Is there a cost associated with using airSlate SignNow for the IRS Instruction 1065 Form?

Yes, airSlate SignNow operates on a subscription model with different pricing tiers to meet various business needs. The pricing includes features that simplify the handling of IRS Instruction 1065 Form, making it a cost-effective solution. A free trial is also available to help you explore the platform before committing.

-

Can airSlate SignNow integrate with accounting software for the IRS Instruction 1065 Form?

AirSlate SignNow offers integrations with various accounting software applications, allowing for seamless transfer of data related to the IRS Instruction 1065 Form. This integration helps streamline the preparation and filing process, reducing the risk of errors and improving efficiency. Check our integration options to see how we can fit into your existing workflow.

-

What benefits can businesses expect from using airSlate SignNow for IRS Instruction 1065 Form?

Using airSlate SignNow for the IRS Instruction 1065 Form brings numerous benefits, including time savings and increased accuracy. The platform allows for quick, easy document management and ensures that all necessary signatures are collected promptly. Additionally, businesses can enhance their client service by providing a more efficient and user-friendly experience.

-

Is it secure to use airSlate SignNow for the IRS Instruction 1065 Form?

Absolutely. airSlate SignNow prioritizes security, employing advanced encryption methods to protect your documents, including the IRS Instruction 1065 Form. Our platform also complies with industry standards, ensuring that sensitive information remains confidential and secure throughout the signing process.

Get more for Irs Instruction 1065 Form

- Isbe 73 03d form

- Ucla extension number form

- Conditional final waiver form

- Hh application rough huhot mongolian grill form

- South carolina fillable quarterly withholding form wh 1606 for

- Data correction form candidates use only

- Payment arrangementpayment agreement template form

- Payment arrangement car payment agreement template form

Find out other Irs Instruction 1065 Form

- eSignature Texas Healthcare / Medical Bill Of Lading Simple

- eSignature Virginia Healthcare / Medical Living Will Computer

- eSignature West Virginia Healthcare / Medical Claim Free

- How To eSignature Kansas High Tech Business Plan Template

- eSignature Kansas High Tech Lease Agreement Template Online

- eSignature Alabama Insurance Forbearance Agreement Safe

- How Can I eSignature Arkansas Insurance LLC Operating Agreement

- Help Me With eSignature Michigan High Tech Emergency Contact Form

- eSignature Louisiana Insurance Rental Application Later

- eSignature Maryland Insurance Contract Safe

- eSignature Massachusetts Insurance Lease Termination Letter Free

- eSignature Nebraska High Tech Rental Application Now

- How Do I eSignature Mississippi Insurance Separation Agreement

- Help Me With eSignature Missouri Insurance Profit And Loss Statement

- eSignature New Hampshire High Tech Lease Agreement Template Mobile

- eSignature Montana Insurance Lease Agreement Template Online

- eSignature New Hampshire High Tech Lease Agreement Template Free

- How To eSignature Montana Insurance Emergency Contact Form

- eSignature New Jersey High Tech Executive Summary Template Free

- eSignature Oklahoma Insurance Warranty Deed Safe