Form 1065 Instructions 2015

What is the Form 1065 Instructions

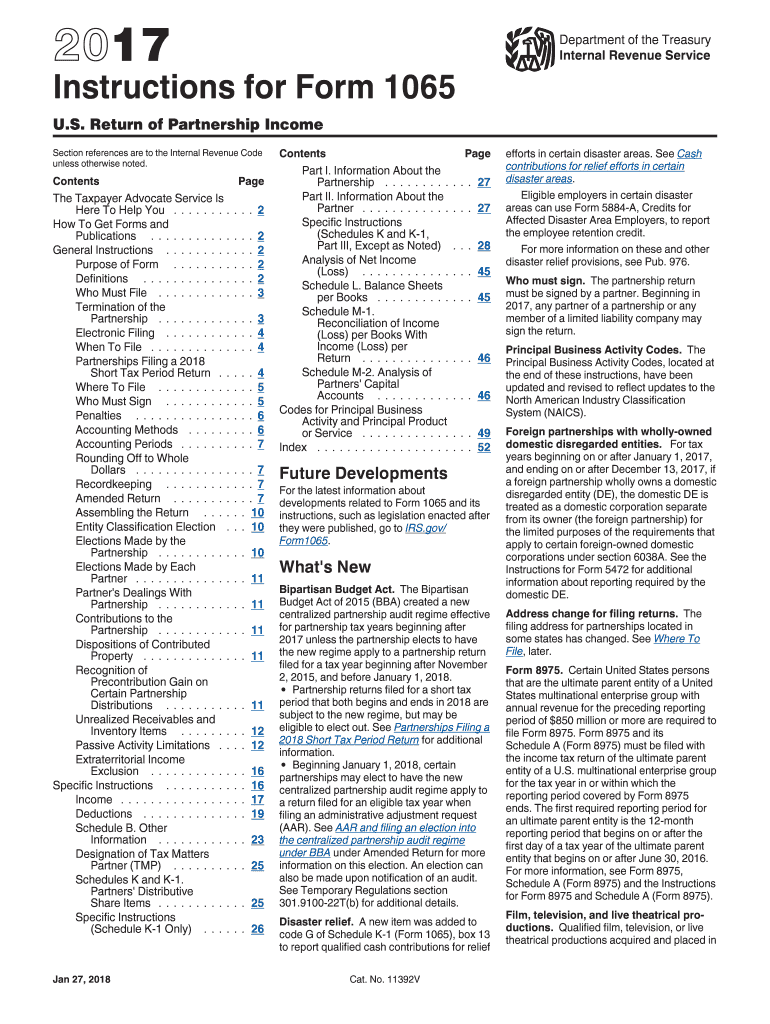

The Form 1065 Instructions provide essential guidance for partnerships filing their annual income tax returns with the Internal Revenue Service (IRS). This form is specifically designed for partnerships, including multi-member limited liability companies (LLCs) treated as partnerships for tax purposes. The instructions detail how to accurately report income, deductions, and credits, ensuring compliance with federal tax laws. Understanding these instructions is crucial for partners to avoid penalties and ensure proper tax treatment of their business activities.

Steps to complete the Form 1065 Instructions

Completing the Form 1065 involves several key steps to ensure accuracy and compliance. First, gather all necessary financial documents, including income statements, expense records, and prior year tax returns. Next, follow the instructions sequentially, starting with identifying the partnership and its principal business activity. Fill out the income and deductions sections, ensuring that all figures are accurately reported. After completing the form, review it for any errors or omissions, and ensure that all partners have signed where required. Finally, submit the form to the IRS by the designated deadline.

Legal use of the Form 1065 Instructions

The legal use of the Form 1065 Instructions is grounded in federal tax regulations. Partnerships must adhere to these guidelines to ensure their tax filings are valid and legally recognized. The instructions outline the necessary information required by the IRS, including how to report partnership income and expenses. Compliance with these instructions helps mitigate the risk of audits and penalties associated with incorrect filings. Utilizing electronic tools for completion can enhance the legal standing of the document, provided that all electronic signature laws are followed.

Filing Deadlines / Important Dates

Filing deadlines for the Form 1065 are crucial for partnerships to avoid penalties. Typically, the form is due on the fifteenth day of the third month following the end of the partnership's tax year. For partnerships operating on a calendar year, this means the deadline is March 15. If additional time is needed, partnerships can file for an extension, which allows for an additional six months. It is important to note that while the extension provides more time to file, any taxes owed must still be paid by the original deadline to avoid interest and penalties.

Key elements of the Form 1065 Instructions

The Form 1065 Instructions encompass several key elements that are vital for accurate completion. These include guidance on reporting partnership income, allowable deductions, and the allocation of income and losses among partners. The instructions also provide information on specific schedules that may need to be attached, such as Schedule K-1, which details each partner's share of the partnership's income, deductions, and credits. Understanding these elements is essential for ensuring that all required information is accurately reported and compliant with IRS regulations.

Who Issues the Form

The Form 1065 is issued by the Internal Revenue Service (IRS), the federal agency responsible for tax collection and enforcement in the United States. The IRS provides the form along with comprehensive instructions to assist partnerships in meeting their tax obligations. It is important for partnerships to use the most current version of the form and instructions, as tax laws and requirements can change annually. Accessing the latest version ensures compliance and accuracy in tax reporting.

Quick guide on how to complete 2015 form 1065 instructions

Handle Form 1065 Instructions seamlessly on any device

Online document management has gained traction among businesses and individuals alike. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to find the correct form and securely save it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents quickly without delays. Manage Form 1065 Instructions on any platform with airSlate SignNow's Android or iOS applications and enhance any document-driven process today.

The easiest way to modify and electronically sign Form 1065 Instructions effortlessly

- Find Form 1065 Instructions and click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Highlight important sections of the documents or obscure sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Create your electronic signature using the Sign tool, which takes only seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and click the Done button to save your modifications.

- Choose how you would like to send your form, via email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or errors that require printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Modify and electronically sign Form 1065 Instructions and guarantee excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2015 form 1065 instructions

Create this form in 5 minutes!

How to create an eSignature for the 2015 form 1065 instructions

How to generate an electronic signature for your 2015 Form 1065 Instructions in the online mode

How to create an electronic signature for your 2015 Form 1065 Instructions in Chrome

How to make an electronic signature for putting it on the 2015 Form 1065 Instructions in Gmail

How to make an eSignature for the 2015 Form 1065 Instructions from your mobile device

How to make an eSignature for the 2015 Form 1065 Instructions on iOS devices

How to make an eSignature for the 2015 Form 1065 Instructions on Android devices

People also ask

-

What are Form 1065 Instructions and why are they important?

Form 1065 Instructions provide guidance on how to accurately complete the IRS Form 1065, which is essential for partnerships to report their income, deductions, and credits. Following these instructions ensures compliance with tax regulations and helps avoid costly mistakes during the filing process.

-

How can airSlate SignNow assist with Form 1065 Instructions?

airSlate SignNow streamlines the process of filling out and eSigning Form 1065 by providing templates and easy-to-use document management features. This allows you to collaborate with partners and accountants seamlessly while ensuring that all necessary information aligns with the Form 1065 Instructions.

-

Is there a cost associated with using airSlate SignNow for Form 1065?

Yes, airSlate SignNow offers various pricing plans tailored to different business needs, including options for small businesses and enterprises. Investing in our service provides access to essential features that facilitate compliance with Form 1065 Instructions and enhance document workflow efficiency.

-

What features does airSlate SignNow offer for handling Form 1065?

airSlate SignNow includes features like document templates, secure eSigning, and real-time collaboration, all designed to simplify the completion of Form 1065. These tools ensure that all parties involved can follow the Form 1065 Instructions accurately and efficiently.

-

Can airSlate SignNow integrate with accounting software for Form 1065?

Absolutely! airSlate SignNow offers integrations with popular accounting software, allowing for seamless data transfer and management. This integration helps ensure that your Form 1065 aligns with your financial records, making it easier to follow the Form 1065 Instructions.

-

What are the benefits of using airSlate SignNow for Form 1065?

Using airSlate SignNow for Form 1065 provides numerous benefits, including improved accuracy, faster processing times, and enhanced security. Our platform ensures that you can adhere to the Form 1065 Instructions with ease, making tax season less stressful.

-

How secure is airSlate SignNow when handling Form 1065?

airSlate SignNow prioritizes security for all documents, including Form 1065. Our platform uses encryption and secure cloud storage to protect sensitive information, ensuring that your completed Form 1065 remains confidential while you follow the Form 1065 Instructions.

Get more for Form 1065 Instructions

Find out other Form 1065 Instructions

- eSignature Delaware Time Off Policy Online

- Help Me With Electronic signature Indiana Direct Deposit Enrollment Form

- Electronic signature Iowa Overtime Authorization Form Online

- Electronic signature Illinois Employee Appraisal Form Simple

- Electronic signature West Virginia Business Ethics and Conduct Disclosure Statement Free

- Electronic signature Alabama Disclosure Notice Simple

- Electronic signature Massachusetts Disclosure Notice Free

- Electronic signature Delaware Drug Testing Consent Agreement Easy

- Electronic signature North Dakota Disclosure Notice Simple

- Electronic signature California Car Lease Agreement Template Free

- How Can I Electronic signature Florida Car Lease Agreement Template

- Electronic signature Kentucky Car Lease Agreement Template Myself

- Electronic signature Texas Car Lease Agreement Template Easy

- Electronic signature New Mexico Articles of Incorporation Template Free

- Electronic signature New Mexico Articles of Incorporation Template Easy

- Electronic signature Oregon Articles of Incorporation Template Simple

- eSignature Montana Direct Deposit Enrollment Form Easy

- How To Electronic signature Nevada Acknowledgement Letter

- Electronic signature New Jersey Acknowledgement Letter Free

- Can I eSignature Oregon Direct Deposit Enrollment Form