Instructions for Form 1065 2022-2026

What is the Instructions For Form 1065

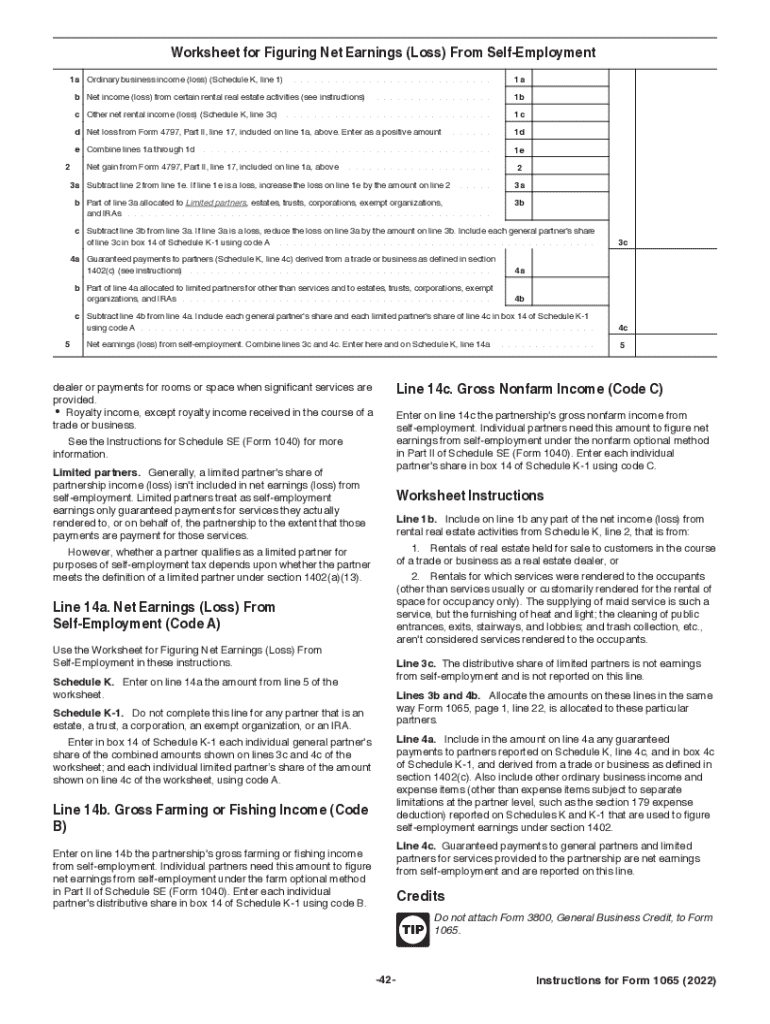

The Instructions for Form 1065 provide detailed guidance on how to complete the IRS Form 1065, which is used by partnerships to report income, deductions, gains, and losses from the operation of a partnership. This form is essential for partnerships, ensuring compliance with federal tax regulations. The instructions outline the necessary information that must be included, such as partnership details, income sources, and deductions, as well as how to report each item accurately.

Steps to complete the Instructions For Form 1065

Completing the Instructions for Form 1065 involves several key steps:

- Gather all necessary financial documents, including income statements and expense records.

- Review the partnership's structure and determine the applicable tax treatment.

- Follow the line-by-line instructions provided in the form to accurately fill out each section.

- Ensure all partners' information is included, particularly their share of income and deductions.

- Double-check for any errors or omissions before submission.

Legal use of the Instructions For Form 1065

The legal use of the Instructions for Form 1065 is crucial for ensuring that partnerships comply with IRS regulations. By following these instructions, partnerships can accurately report their financial activities and avoid potential legal issues. The form must be filed correctly to avoid penalties, and the instructions provide the necessary framework to ensure compliance with federal tax laws.

Filing Deadlines / Important Dates

Filing deadlines for Form 1065 are critical for partnerships to avoid penalties. Typically, the form must be filed by the 15th day of the third month after the end of the partnership's tax year. For partnerships operating on a calendar year, this means the deadline is March 15. If additional time is needed, partnerships may file for an extension, but this must be done before the original deadline.

Required Documents

To complete Form 1065 accurately, several documents are required:

- Partnership agreement.

- Financial statements, including income and expense reports.

- Records of each partner's capital contributions and distributions.

- Supporting documentation for deductions and credits claimed.

Form Submission Methods (Online / Mail / In-Person)

Partnerships can submit Form 1065 through various methods. The form can be filed electronically using IRS-approved software, which is often the most efficient option. Alternatively, partnerships may choose to mail a paper version of the form to the appropriate IRS address. In-person submissions are generally not accepted for Form 1065, making electronic or mail submissions the primary methods.

IRS Guidelines

IRS guidelines for completing Form 1065 are outlined in the instructions provided with the form. These guidelines include specific requirements for reporting income, deductions, and the allocation of profits and losses among partners. Adhering to these guidelines is essential for ensuring that the form is completed accurately and filed on time, thereby avoiding potential penalties for non-compliance.

Quick guide on how to complete 2022 instructions for form 1065

Effortlessly Prepare Instructions For Form 1065 on Any Device

Managing documents online has become increasingly favored by businesses and individuals alike. It offers an ideal eco-friendly alternative to conventional printed and signed documents, enabling you to find the desired form and securely store it online. airSlate SignNow equips you with all the resources necessary to create, modify, and eSign your documents quickly and without delays. Handle Instructions For Form 1065 on any device using the airSlate SignNow Android or iOS applications, and simplify any document-related task today.

The Easiest Way to Modify and eSign Instructions For Form 1065 with Ease

- Find Instructions For Form 1065 and then click Get Form to begin.

- Make use of the tools provided to fill out your form.

- Emphasize relevant parts of the documents or conceal sensitive data with tools specifically offered by airSlate SignNow for that purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and then click the Done button to save your changes.

- Select how you wish to submit your form, by email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or errors that require printing new document copies. airSlate SignNow fulfills your document management needs with just a few clicks from your selected device. Modify and eSign Instructions For Form 1065 and ensure exceptional communication at any point during your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2022 instructions for form 1065

Create this form in 5 minutes!

How to create an eSignature for the 2022 instructions for form 1065

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are the form 1065 instructions?

The form 1065 instructions provide detailed guidance on how to prepare and file Form 1065, which is used for partnerships to report their income, deductions, and profits. Understanding these instructions is crucial for ensuring compliance with IRS requirements and accurate reporting. You can access the official IRS website for comprehensive form 1065 instructions.

-

How can airSlate SignNow help with my form 1065 instructions?

AirSlate SignNow streamlines the process of completing and signing your documents, including those related to form 1065 instructions. With features like eSignature and document templates, you can efficiently gather the necessary information required for Form 1065. This simplifies compliance and reduces the likelihood of errors in your filings.

-

Are there any costs associated with using airSlate SignNow for form 1065 instructions?

AirSlate SignNow offers flexible pricing plans, catering to businesses of all sizes, which can signNowly ease the task of handling form 1065 instructions. Plans typically include various features aimed at enhancing document management and eSigning processes. It’s beneficial to choose a plan that suits your business needs for optimal use of airSlate SignNow.

-

What features does airSlate SignNow offer for handling form 1065 instructions?

AirSlate SignNow provides multiple features specifically designed to assist with form 1065 instructions, such as document collaboration, task assignment, and secure eSigning. You can easily share documents with stakeholders, ensuring everyone involved can contribute. These tools help simplify the preparation of Form 1065 and ensure accurate completion.

-

Can airSlate SignNow integrate with accounting software for form 1065 instructions?

Yes, airSlate SignNow integrates seamlessly with various accounting software, enabling you to directly access form 1065 instructions and relevant financial data. This integration helps streamline the process of gathering and preparing required information for your filings. By utilizing these integrations, you can effectively manage your documentation workload.

-

What benefits does airSlate SignNow offer for business owners dealing with form 1065 instructions?

Using airSlate SignNow for form 1065 instructions allows business owners to save time and reduce the stress of managing documentation. The platform's user-friendly interface and automation features make the signing process quick and efficient. Additionally, secure storage of documents ensures all your important files are safe and accessible.

-

Is technical support available for questions regarding form 1065 instructions and airSlate SignNow?

Yes, airSlate SignNow offers dedicated technical support to assist with any questions related to form 1065 instructions and using the platform. Our support team is available to help you troubleshoot issues and ensure you can effectively leverage the software for your documentation needs. signNow out via chat or email for immediate assistance.

Get more for Instructions For Form 1065

Find out other Instructions For Form 1065

- How Do I Sign Maine Profit and Loss Statement

- How To Sign Wisconsin Operational Budget Template

- Sign North Carolina Profit and Loss Statement Computer

- Sign Florida Non-Compete Agreement Fast

- How Can I Sign Hawaii Non-Compete Agreement

- Sign Oklahoma General Partnership Agreement Online

- Sign Tennessee Non-Compete Agreement Computer

- Sign Tennessee Non-Compete Agreement Mobile

- Sign Utah Non-Compete Agreement Secure

- Sign Texas General Partnership Agreement Easy

- Sign Alabama LLC Operating Agreement Online

- Sign Colorado LLC Operating Agreement Myself

- Sign Colorado LLC Operating Agreement Easy

- Can I Sign Colorado LLC Operating Agreement

- Sign Kentucky LLC Operating Agreement Later

- Sign Louisiana LLC Operating Agreement Computer

- How Do I Sign Massachusetts LLC Operating Agreement

- Sign Michigan LLC Operating Agreement Later

- Sign Oklahoma LLC Operating Agreement Safe

- Sign Rhode Island LLC Operating Agreement Mobile