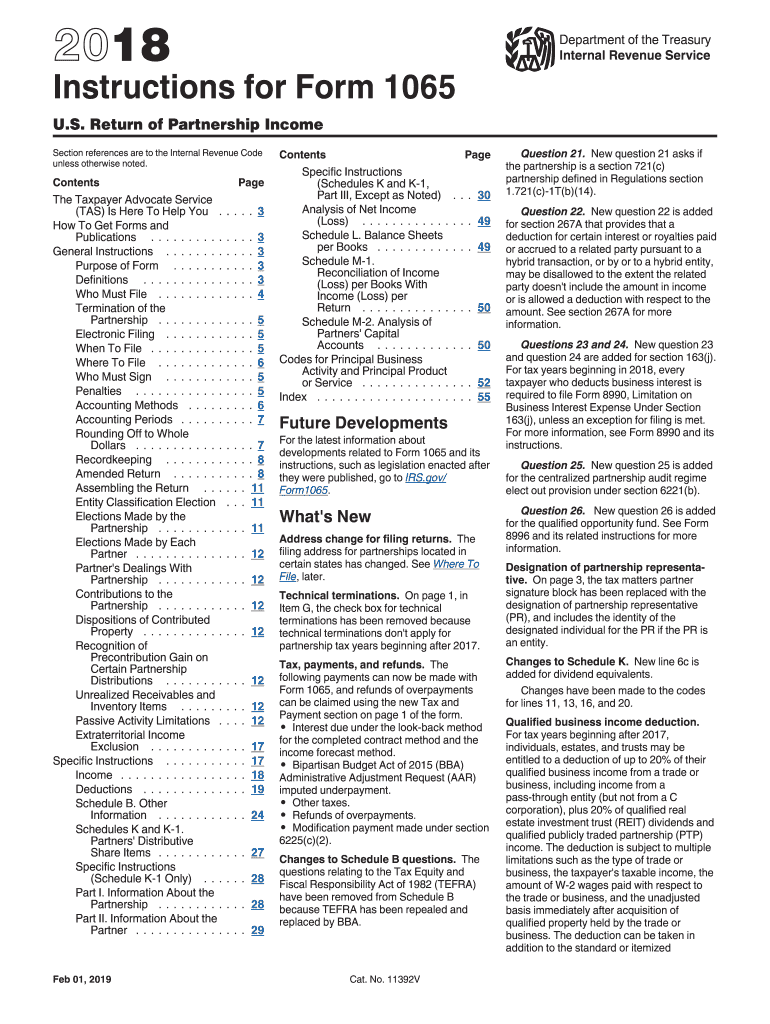

1065 Instructions 2018

What is the 1065 Instructions

The 1065 instructions provide detailed guidance for partnerships on how to complete Form 1065, which is used to report income, deductions, gains, losses, and other information from the operation of a partnership. This form is essential for partnerships to accurately report their financial activities to the IRS. The instructions outline the necessary steps to fill out the form correctly, ensuring compliance with federal tax regulations.

Steps to complete the 1065 Instructions

Completing the 1065 instructions involves several key steps:

- Gather all necessary financial documents, including income statements, expense reports, and previous tax returns.

- Review the instructions thoroughly to understand the requirements for each section of the form.

- Fill out the form accurately, ensuring that all required fields are completed and that calculations are correct.

- Attach any necessary schedules or additional forms as specified in the instructions.

- Double-check the completed form for accuracy before submission.

How to obtain the 1065 Instructions

The 1065 instructions can be obtained directly from the IRS website. They are available for download in PDF format, allowing users to access the most current version. Additionally, tax professionals and accountants often have copies of the instructions available for their clients. It is important to ensure that the version of the instructions corresponds to the tax year for which the form is being completed.

Filing Deadlines / Important Dates

Understanding the filing deadlines is crucial for compliance. For partnerships, Form 1065 is typically due on the 15th day of the third month following the end of the partnership's tax year. For partnerships operating on a calendar year, this means the form is due by March 15. If the deadline falls on a weekend or holiday, the due date is extended to the next business day. Partnerships may also apply for an extension, which can provide an additional six months to file.

Required Documents

To complete Form 1065, several documents are required:

- Financial statements, including profit and loss statements and balance sheets.

- Records of income, expenses, and deductions incurred during the tax year.

- Partnership agreements that outline the terms of the partnership.

- Any relevant schedules or forms that accompany the 1065, such as Schedule K-1 for each partner.

Legal use of the 1065 Instructions

The 1065 instructions are legally binding documents that must be followed to ensure compliance with IRS regulations. Using outdated or incorrect instructions can lead to inaccuracies in tax reporting, which may result in penalties or audits. It is essential to use the most current version of the instructions to avoid legal issues and ensure that all tax obligations are met accurately.

Quick guide on how to complete 2018 instructions for form 1065 instructions for form 1065 us return of partnership income

Discover the easiest method to complete and sign your 1065 Instructions

Are you still spending time preparing your official documents on paper instead of doing it online? airSlate SignNow provides a superior way to fill out and sign your 1065 Instructions and related forms for public services. Our intelligent eSignature solution equips you with everything necessary to handle paperwork swiftly and in line with official regulations - comprehensive PDF editing, managing, protecting, signing, and sharing tools all at your fingertips within a user-friendly interface.

Only a few steps are needed to fill out and sign your 1065 Instructions:

- Upload the editable template to the editor using the Get Form button.

- Identify what information you need to include in your 1065 Instructions.

- Move between the fields using the Next option to ensure you don’t miss anything.

- Utilize Text, Check, and Cross tools to fill the blanks with your information.

- Edit the content with Text boxes or Images from the top toolbar.

- Emphasize what is essential or Blackout sections that are no longer relevant.

- Click on Sign to create a legally valid eSignature using any method you choose.

- Add the Date beside your signature and finalize your work by pressing the Done button.

Store your finished 1065 Instructions in the Documents folder of your profile, download it, or transfer it to your chosen cloud storage. Our solution also offers versatile form sharing options. There’s no need to print your templates when you need to send them to the appropriate public office - handle it via email, fax, or by requesting a USPS “snail mail” delivery from your account. Try it out today!

Create this form in 5 minutes or less

Find and fill out the correct 2018 instructions for form 1065 instructions for form 1065 us return of partnership income

FAQs

-

What's the best way to get users to read a set of instructions for filling out a form?

Your question confuses me a bit. What's missing is "WHY are the instructions displayed?" What makes them so important? More to the point, what makes them so important to the user?You say it's a simple form, but also say they must read the instructions before filling it out. If it's simple, what are all the instructions for? I haven't seen the form and already I'm confused.People will do things if they understand (and agree with) the purpose for doing them. If they don't understand the need for the instructions (e.g. because the form appears to be simple), you'll have a hard time getting users to read them (they won't see the need).My suggestion would be to take a step back from the design a bit and look at the form's purpose. If the instructions are to minimize data entry errors, look for ways in your design to do that and eliminate an instruction or two. For example, do real-time validation of things like zip codes, phone numbers, usernames, and anything else your web page can do.If the instructions are to educate the user on some specific process, look at the process to see if it can be made simpler or more obvious such that it doesn't need any explanation.Finally, don't forget user testing--ask some potential (or representative) users what they think works for them.

-

How do I understand the 1040 U.S. tax form in terms of an equation instead of a ton of boxes to fill in and instructions to read?

First the 1040 is an exercise in sets:Gross Income - A collection and summation of all your income types.Adjustments - A collection of deductions the tax law allow you to deduct before signNowing AGI. (AGI is used as a threshold for another set of deductions).ExemptionsDeductions - A collection of allowed deductions.Taxes - A Collection of Different collected along with Income TaxesCredits - A collection of allowed reductions in tax owed.Net Tax Owed or Refundable - Hopefully Self Explanatory.Now the formulas:[math]Gross Income - Adjustments = Adjusted Gross Income (AGI)[/math][math]AGI - Exemptions - Deductions = Taxable Income[/math][math]Tax Function (Taxable Income ) = Income Tax[/math][math]Taxes - Credits = Net Tax Owed or Refundable[/math]Please Note each set of lines is meant as a means to make collecting and summing the subsidiary information easier.It would probably be much easier to figure out if everyone wanted to pay more taxes instead of less.

-

My business partner and I have registered a LLC in Wyoming. We are a software startup and have not yet made any income. Neither of us is a resident of the USA and we do not operate the business from there, although in the future all our revenue for our software product will be from US businesses. What are our obligations in regards to filing taxes for the LLC? Is it just form 1065? Do we also need to file a personal tax return as I understand an LLC is a pass through entity? Neither of us has an

A partnership is a pass-through entity, meaning all the profits and/or losses will flow through to you the individual owners. You do have to file a Form 1065 for the LLC if you are choosing to be a partnership. Individual owners do not need an ITIN to file a 1065; however, assuming you and your partner are both actively involved in operating the business, you may still be subject to US tax and be required to file a 1040NR. Filing a 1040NR would require you to obtain an ITIN. The problem is your earnings from the partnership is income that is effectively connected to a US business.Another option is to have the LLC taxed as a C-Corporation, which is not a pass-through type of entity, but taxes all the profits at the business level. The downside to you is that to get funds out of the business, you have to pay yourself either wages, independent contractor fees or dividends. There are pros and cons to all those types of payments, and is probably beyond what I could discuss here as it really depends on your unique situation, but there can be some tax saving opportunities as a non-US resident owner of a business.Even though you do not have any earnings, I would not say it is premature to hire an accountant, as decisions you make now can have long lasting impact on your future earnings and taxes from the business.Unfortunately as a multi-member LLC, there is no way for you to not file a tax return. The only LLC that is not required to file a US federal tax return every year is one that is a single member disregarded entity with less than $400 of profits. Every other tax form of an LLC-partnership, S-corp or C-corp is required to file a tax return.

-

For the amended tax return, the only thing I needed to correct was the filing status. Do I still need to fill out the rest of the form involving income, etc.?

Yes, it depends what kind of income. For social security incomes, there is a different threshold amount for single and Married Filing joint. Different filing status have a certain treatment and that tax rates are different for every filing status. The filing status change goes on the very top of the 1040X. When I was a Tax Auditor for the IRS, the 1040X was one of the hardest thing to calculate. Just a few years ago, the IRS decided to change but with disastrous results- people were more confused than the original. So IRS changed the 1040X to its original. Follow your program’s instruction or go to an Enrolled Agent. I found out throughout my career that a good majority of CPA’s do not know the mechanics of the 1040X. Chances are you may need to send the returns by mail.

-

As one of the cofounders of a multi-member LLC taxed as a partnership, how do I pay myself for work I am doing as a contractor for the company? What forms do I need to fill out?

First, the LLC operates as tax partnership (“TP”) as the default tax status if no election has been made as noted in Treasury Regulation Section 301.7701-3(b)(i). For legal purposes, we have a LLC. For tax purposes we have a tax partnership. Since we are discussing a tax issue here, we will discuss the issue from the perspective of a TP.A partner cannot under any circumstances be an employee of the TP as Revenue Ruling 69-184 dictated such. And, the 2016 preamble to Temporary Treasury Regulation Section 301.7701-2T notes the Treasury still supports this revenue ruling.Though a partner can engage in a transaction with the TP in a non partner capacity (Section 707a(a)).A partner receiving a 707(a) payment from the partnership receives the payment as any stranger receives a payment from the TP for services rendered. This partner gets treated for this transaction as if he/she were not a member of the TP (Treasury Regulation Section 1.707-1(a).As an example, a partner owns and operates a law firm specializing in contract law. The TP requires advice on terms and creation for new contracts the TP uses in its business with clients. This partner provides a bid for this unique job and the TP accepts it. Here, the partner bills the TP as it would any other client, and the partner reports the income from the TP client job as he/she would for any other client. The TP records the job as an expense and pays the partner as it would any other vendor. Here, I am assuming the law contract job represents an expense versus a capital item. Of course, the partner may have a law corporation though the same principle applies.Further, a TP can make fixed payments to a partner for services or capital — called guaranteed payments as noted in subsection (c).A 707(c) guaranteed payment shows up in the membership agreement drawn up by the business attorney. This payment provides a service partner with a guaranteed payment regardless of the TP’s income for the year as noted in Treasury Regulation Section 1.707-1(c).As an example, the TP operates an exclusive restaurant. Several partners contribute capital for the venture. The TP’s key service partner is the chef for the restaurant. And, the whole restaurant concept centers on this chef’s experience and creativity. The TP’s operating agreement provides the chef receives a certain % profit interest but as a minimum receives yearly a fixed $X guaranteed payment regardless of TP’s income level. In the first year of operations the TP has low profits as expected. The chef receives the guaranteed $X payment as provided in the membership agreement.The TP allocates the guaranteed payment to the capital interest partners on their TP k-1s as business expense. And, the TP includes the full $X guaranteed payment as income on the chef’s K-1. Here, the membership agreement demonstrates the chef only shares in profits not losses. So, the TP only allocates the guaranteed expense to those partners responsible for making up losses (the capital partners) as noted in Treasury Regulation Section 707-1(c) Example 3. The chef gets no allocation for the guaranteed expense as he/she does not participate in losses.If we change the situation slightly, we may change the tax results. If the membership agreement says the chef shares in losses, we then allocate a portion of the guaranteed expense back to the chef following the above treasury regulation.As a final note, a TP return requires knowledge of primary tax law if the TP desires filing a completed an accurate partnership tax return.I have completed the above tax analysis based on primary partnership tax law. If the situation changes in any manner, the tax outcome may change considerably. www.rst.tax

-

How can I take my child (16yrs) to the U.S if my immigrant visa is approved? My husband, a US citizen, filled out form I 130 for me and mentioned this child as migrating in future.

Just petition using a I-130 yourself. Read the instructions very carefully. I am not sure but it’s possible that the affidavit of support will need to be filled by your husband since he is the citizen and he filled one for you - again, check the instructions very carefully. It should be a pretty clear, straightforward process.Your child is still well below the age limit and should be fine. If there are any problems, do the same thing you did with your own process - use the numbers you are given to check on the process and if you see it stuck call to make sure they have everything they need early.It is my understanding that the age limit of the child is based on the petition date, so go ahead and do it.You still have plenty of time at 16, just don’t delay.

-

Is the filing of Individual Income tax returns mandatory to claim Relief u/s 89(1) of the income tax act? Suppose I received arrears of 2014-15 in 2017-18, is ITR mandatory for 2014-15? Or is relief allowed by filing form 10E?

Its not mandatory to file ITR for 2014–15. However you need to consider the income of 2014–15, to calculate the relief u.s 89(1), basically the calculation is to consider the fact that had the amount been received in 2014–15, what would be tax liablity, and its not appropriate to pay the tax liablity on arrears received, considering it completely in 2017–18.For any further information you can ping me at sfstaxsolutions17@gmail.com

Create this form in 5 minutes!

How to create an eSignature for the 2018 instructions for form 1065 instructions for form 1065 us return of partnership income

How to generate an eSignature for the 2018 Instructions For Form 1065 Instructions For Form 1065 Us Return Of Partnership Income online

How to make an eSignature for your 2018 Instructions For Form 1065 Instructions For Form 1065 Us Return Of Partnership Income in Chrome

How to make an eSignature for signing the 2018 Instructions For Form 1065 Instructions For Form 1065 Us Return Of Partnership Income in Gmail

How to generate an eSignature for the 2018 Instructions For Form 1065 Instructions For Form 1065 Us Return Of Partnership Income right from your smartphone

How to generate an eSignature for the 2018 Instructions For Form 1065 Instructions For Form 1065 Us Return Of Partnership Income on iOS

How to create an eSignature for the 2018 Instructions For Form 1065 Instructions For Form 1065 Us Return Of Partnership Income on Android

People also ask

-

What is the IRS 2018 instruction book and how can it help me?

The IRS 2018 instruction book provides valuable guidelines and instructions for filing taxes that year. Using the information within this book can help ensure you complete your tax returns accurately and on time, reducing the risk of errors. Accessing the IRS 2018 instruction book can also aid in understanding various tax benefits and deductions that may apply to your situation.

-

How does airSlate SignNow simplify the process related to the IRS 2018 instruction book?

airSlate SignNow streamlines the document signing process, making it easier to manage and send forms related to the IRS 2018 instruction book. With an intuitive platform, users can prepare and eSign tax documents efficiently, ensuring they meet IRS requirements. This cost-effective solution reduces the hassle associated with traditional paper processes, allowing for quicker filings.

-

Is there a cost to access the IRS 2018 instruction book through airSlate SignNow?

The IRS 2018 instruction book is usually available for free on the IRS website; however, airSlate SignNow comes with subscription plans that unlock premium features. These features can enhance your document management process when dealing with tax forms, including the IRS 2018 instruction book. It’s best to review airSlate SignNow’s pricing plans to determine the best fit for your needs.

-

Can I integrate airSlate SignNow with other tools for tax preparation?

Yes, airSlate SignNow offers integrations with various tax preparation tools that can enhance your experience while utilizing the IRS 2018 instruction book. Users can easily connect their accounts with popular software applications, streamlining the workflow from document creation to eSignature. This enhances efficiency and ensures compliance with tax requirements.

-

What are the main benefits of using airSlate SignNow for tax-related processes?

Using airSlate SignNow for tax-related processes, especially with the IRS 2018 instruction book, provides a user-friendly interface and fast document turnaround times. The ability to eSign documents securely also increases compliance and reduces the risk of data bsignNowes. Additionally, features like templates and reminders can help keep you organized and on track with your tax submissions.

-

How do I ensure compliance with the IRS 2018 instruction book while using airSlate SignNow?

airSlate SignNow is designed with compliance in mind, providing features that help you adhere to the guidelines in the IRS 2018 instruction book. Users can create secure, legally binding documents and keep comprehensive records of all signed agreements. Regular updates ensure that you are using the most current procedures, aligning with IRS guidelines.

-

Is airSlate SignNow suitable for both personal and business tax needs with the IRS 2018 instruction book?

Absolutely! airSlate SignNow is versatile and caters to both individual and business tax needs when referring to the IRS 2018 instruction book. Whether you are filing personal tax returns or managing business documents, the platform provides the necessary tools to customize and manage your documents effectively. This adaptability makes it an essential asset for various users.

Get more for 1065 Instructions

- Formulir klaim asuransi pengangkutan marine cargo

- Lesson 5 homework practice graph proportional relationships form

- Dhcs 6216 form

- Pats specialist certification form section a pats wacountry health wa gov

- Adult 65d 30 residential level iv asam level iiii dimensions intranet spbh form

- Arizona form 140es 771772654

- Supplemental agreement template form

- Supplementary agreement template form

Find out other 1065 Instructions

- How Do I Sign Maine Profit and Loss Statement

- How To Sign Wisconsin Operational Budget Template

- Sign North Carolina Profit and Loss Statement Computer

- Sign Florida Non-Compete Agreement Fast

- How Can I Sign Hawaii Non-Compete Agreement

- Sign Oklahoma General Partnership Agreement Online

- Sign Tennessee Non-Compete Agreement Computer

- Sign Tennessee Non-Compete Agreement Mobile

- Sign Utah Non-Compete Agreement Secure

- Sign Texas General Partnership Agreement Easy

- Sign Alabama LLC Operating Agreement Online

- Sign Colorado LLC Operating Agreement Myself

- Sign Colorado LLC Operating Agreement Easy

- Can I Sign Colorado LLC Operating Agreement

- Sign Kentucky LLC Operating Agreement Later

- Sign Louisiana LLC Operating Agreement Computer

- How Do I Sign Massachusetts LLC Operating Agreement

- Sign Michigan LLC Operating Agreement Later

- Sign Oklahoma LLC Operating Agreement Safe

- Sign Rhode Island LLC Operating Agreement Mobile