Partnership Replacement Tax Forms 2017

What is the Partnership Replacement Tax Forms

The Partnership Replacement Tax Forms are essential documents used by partnerships to report income, deductions, and credits to the Internal Revenue Service (IRS). Specifically, Form 1065 is the primary form utilized by partnerships to file their annual tax returns. This form provides the IRS with a comprehensive overview of the partnership's financial activities and ensures that each partner's share of income and losses is accurately reported. Additionally, partners receive Schedule K-1, which details their individual share of the partnership's income, deductions, and credits.

Steps to complete the Partnership Replacement Tax Forms

Completing the Partnership Replacement Tax Forms involves several key steps to ensure accuracy and compliance. First, gather all necessary financial documents, including income statements, expense reports, and any prior year tax returns. Next, fill out Form 1065, ensuring that all sections are completed, including the partnership's name, address, and Employer Identification Number (EIN). After completing the main form, prepare Schedule K-1 for each partner, detailing their respective shares of the partnership's income and deductions. Finally, review all forms for accuracy before submitting them to the IRS by the designated deadline.

Filing Deadlines / Important Dates

Understanding the filing deadlines for the Partnership Replacement Tax Forms is crucial for compliance. Typically, Form 1065 must be filed by the fifteenth day of the third month following the end of the partnership's tax year. For partnerships operating on a calendar year, this means the deadline is March 15. If additional time is needed, partnerships can file for an extension, which generally allows for an additional six months to submit the forms. However, it is important to note that any taxes owed must still be paid by the original deadline to avoid penalties.

IRS Guidelines

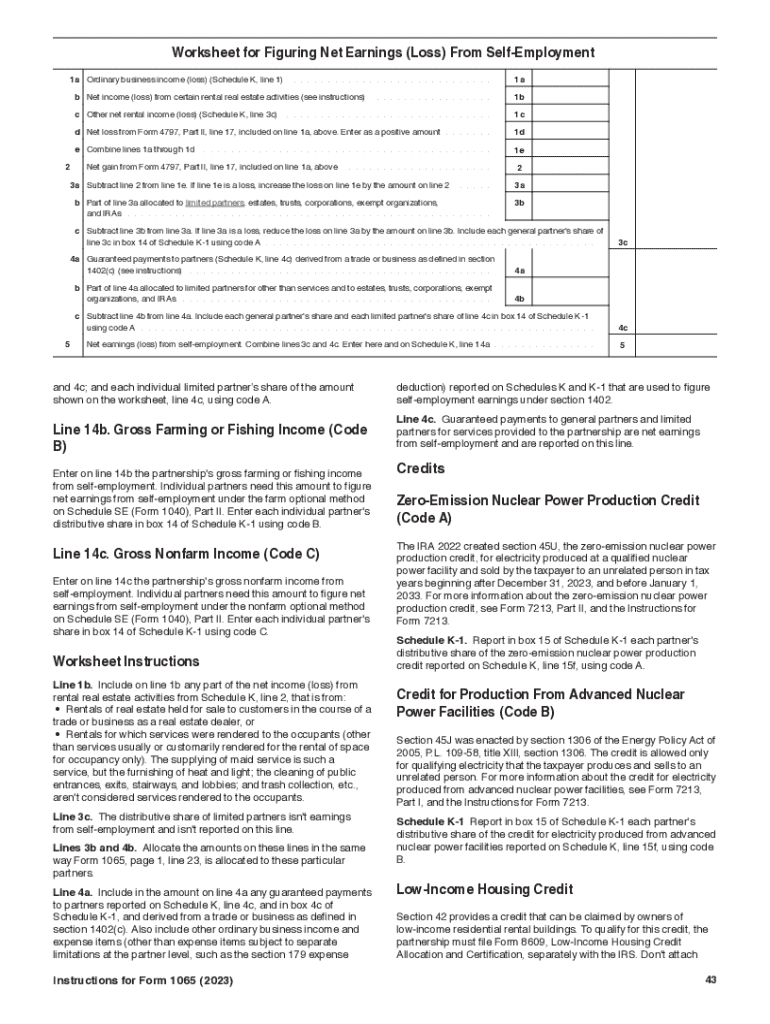

The IRS provides specific guidelines for completing and submitting the Partnership Replacement Tax Forms. These guidelines include instructions on how to properly report income, deductions, and credits, as well as how to handle special situations such as the sale of partnership assets or changes in partnership structure. It is essential for partnerships to familiarize themselves with these guidelines to ensure compliance and avoid potential audit issues. The IRS website offers detailed instructions for Form 1065 and related schedules, which can be invaluable resources during the filing process.

Required Documents

Before completing the Partnership Replacement Tax Forms, it is necessary to gather all required documents. Essential documents include financial statements, bank statements, receipts for expenses, and any prior year tax returns. Additionally, partnerships should prepare documentation related to any changes in ownership or partnership agreements, as these can affect the reporting process. Having all relevant documents organized will facilitate a smoother filing experience and help ensure that all income and deductions are accurately reported.

Key elements of the Partnership Replacement Tax Forms

Form 1065 consists of several key elements that partnerships must complete. These include the partnership's basic information, such as its name, address, and EIN, as well as the income section, where total revenue and cost of goods sold are reported. The deductions section allows partnerships to detail allowable business expenses, while the tax and payments section summarizes any taxes owed. Additionally, partnerships must complete Schedule K-1 for each partner, which outlines their individual share of the partnership's income, deductions, and credits. Understanding these key elements is vital for accurate reporting.

Who Issues the Form

The Partnership Replacement Tax Forms, specifically Form 1065, are issued by the Internal Revenue Service (IRS). This federal agency is responsible for administering tax laws and collecting taxes in the United States. Partnerships must comply with IRS regulations when filing Form 1065 to ensure that they meet their tax obligations. The IRS provides resources and instructions to assist partnerships in accurately completing and submitting their tax forms.

Quick guide on how to complete partnership replacement tax forms

Prepare Partnership Replacement Tax Forms effortlessly on any device

Web-based document management has gained traction among businesses and individuals. It offers an excellent eco-friendly substitute for conventional printed and signed documents, as you can obtain the correct format and securely store it online. airSlate SignNow equips you with all the necessary tools to create, alter, and electronically sign your documents swiftly without delays. Handle Partnership Replacement Tax Forms on any device using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

The easiest method to modify and eSign Partnership Replacement Tax Forms without hassle

- Find Partnership Replacement Tax Forms and then click Get Form to begin.

- Use the tools available to submit your document.

- Highlight signNow parts of your documents or redact sensitive information with the tools that airSlate SignNow specifically provides for that purpose.

- Create your signature using the Sign tool, which takes seconds and holds the same legal validity as a traditional wet ink signature.

- Review the information and then click on the Done button to save your changes.

- Choose how you would prefer to send your form, whether by email, SMS, invite link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you select. Edit and eSign Partnership Replacement Tax Forms and ensure outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct partnership replacement tax forms

Create this form in 5 minutes!

How to create an eSignature for the partnership replacement tax forms

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are the instructions for form 1065 in airSlate SignNow?

The instructions for form 1065 can be easily accessed within the airSlate SignNow platform. Users can navigate to the forms section and find detailed guidelines on completing the form accurately. This feature ensures that all users can confidently manage their filings without confusion.

-

How does airSlate SignNow simplify the completion of form 1065?

AirSlate SignNow streamlines the completion of form 1065 by providing a user-friendly interface and templates for easy document management. The platform allows users to fill out and eSign documents seamlessly, reducing the need for extensive paperwork. With our intuitive tools, users can complete their forms efficiently.

-

Are there any costs associated with using airSlate SignNow for form 1065?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs. The cost-effectiveness of our solution makes it a smart choice for those looking to file form 1065 without breaking the bank. Detailed pricing information can be found on our website, allowing you to select the best option for your requirements.

-

Can I integrate airSlate SignNow with other applications for form 1065 workflow?

Absolutely! AirSlate SignNow offers integrations with numerous applications to enhance your workflow for form 1065. This includes popular accounting software and document management systems, making it easier for users to manage their financial documents seamlessly.

-

What features does airSlate SignNow provide for eSigning form 1065?

AirSlate SignNow includes advanced eSigning features for your form 1065, ensuring that your documents are legally binding and secure. You can set signing orders, add custom fields, and track the signing process in real-time. Our platform prioritizes security while maintaining a straightforward eSignature experience.

-

How can airSlate SignNow help me avoid mistakes on form 1065?

AirSlate SignNow helps minimize mistakes on form 1065 through its guided filling features and validation tools. By providing real-time feedback and error-checking, users can ensure their forms are accurately completed before submission. This reduces the likelihood of costly errors.

-

What are the benefits of using airSlate SignNow for filing form 1065?

Using airSlate SignNow for filing form 1065 offers numerous benefits, including enhanced efficiency, accuracy, and collaboration. Our platform facilitates easy document sharing, tracking, and storage, allowing businesses to handle their forms with ease. Additionally, our cost-effective solution saves time and resources.

Get more for Partnership Replacement Tax Forms

- State compendium of election worker laws and statutes us form

- Nebraska revocable living trust form eforms

- Nebraska state court form dc 693 decree of name change

- In the district court of county nebraska eforms

- Legal notice for name change of a minor child dc 6 form

- Dc 6 11 3doc form

- Dc 611 form

- Petition for name change of a minor child dc 6 form

Find out other Partnership Replacement Tax Forms

- How Can I Sign Ohio Real Estate LLC Operating Agreement

- Sign Ohio Real Estate Quitclaim Deed Later

- How Do I Sign Wisconsin Sports Forbearance Agreement

- How To Sign Oregon Real Estate Resignation Letter

- Can I Sign Oregon Real Estate Forbearance Agreement

- Sign Pennsylvania Real Estate Quitclaim Deed Computer

- How Do I Sign Pennsylvania Real Estate Quitclaim Deed

- How Can I Sign South Dakota Orthodontists Agreement

- Sign Police PPT Alaska Online

- How To Sign Rhode Island Real Estate LLC Operating Agreement

- How Do I Sign Arizona Police Resignation Letter

- Sign Texas Orthodontists Business Plan Template Later

- How Do I Sign Tennessee Real Estate Warranty Deed

- Sign Tennessee Real Estate Last Will And Testament Free

- Sign Colorado Police Memorandum Of Understanding Online

- How To Sign Connecticut Police Arbitration Agreement

- Sign Utah Real Estate Quitclaim Deed Safe

- Sign Utah Real Estate Notice To Quit Now

- Sign Hawaii Police LLC Operating Agreement Online

- How Do I Sign Hawaii Police LLC Operating Agreement