Florida Business Tax Application Form Dr 1 Florida Department 2020

What is the Florida Business Tax Application Form Dr 1 Florida Department

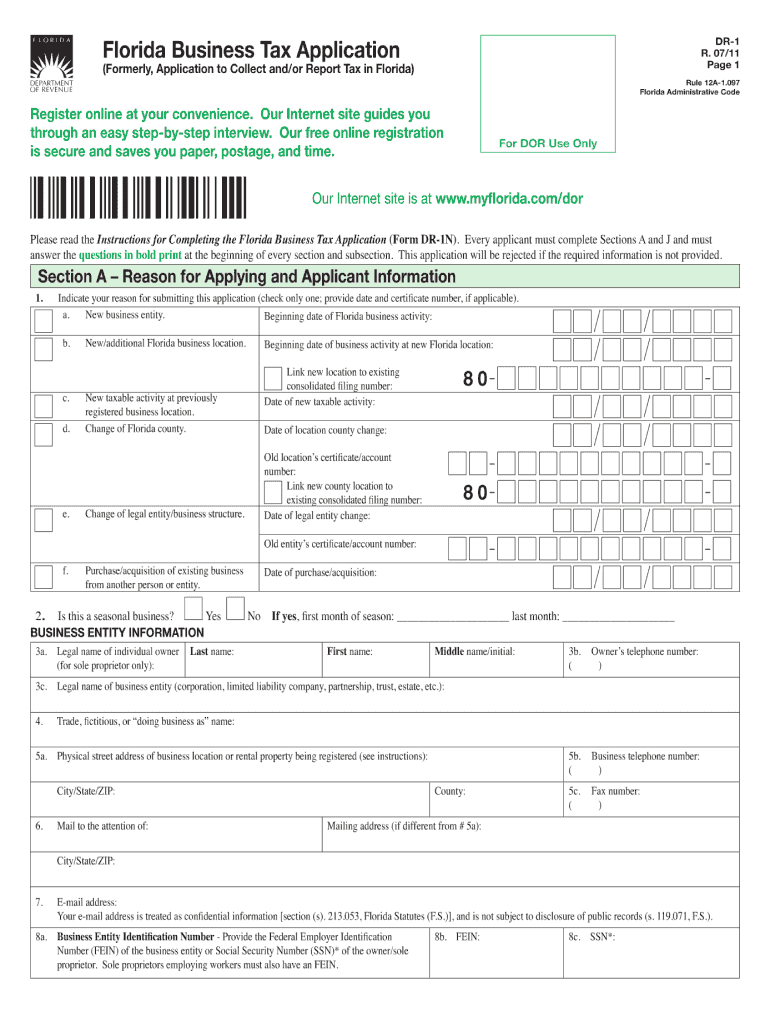

The Florida Business Tax Application Form Dr 1 is a crucial document used by businesses to register for various tax accounts with the Florida Department of Revenue. This form is essential for entities seeking to operate legally within the state, as it facilitates the establishment of tax obligations related to sales tax, corporate income tax, and other business-related taxes. By completing this form, businesses provide necessary information such as their legal name, address, and type of business entity, which helps the state manage tax compliance effectively.

How to use the Florida Business Tax Application Form Dr 1 Florida Department

Utilizing the Florida Business Tax Application Form Dr 1 involves several steps to ensure accurate completion and submission. First, gather all required information, including your business's legal structure and contact details. Next, fill out the form carefully, ensuring that all sections are completed accurately to avoid delays in processing. After completing the form, you can submit it electronically or via mail, depending on your preference. It's important to retain a copy for your records, as this document serves as proof of your business's registration with the state.

Steps to complete the Florida Business Tax Application Form Dr 1 Florida Department

Completing the Florida Business Tax Application Form Dr 1 involves a systematic approach:

- Obtain the latest version of the form from the Florida Department of Revenue's official website.

- Provide your business's legal name and physical address in the designated fields.

- Select the appropriate business entity type, such as LLC, corporation, or partnership.

- Include the Federal Employer Identification Number (FEIN) if applicable.

- Indicate the types of taxes for which you are registering, such as sales tax or corporate income tax.

- Review the completed form for accuracy before submission.

Legal use of the Florida Business Tax Application Form Dr 1 Florida Department

The Florida Business Tax Application Form Dr 1 is legally binding once submitted to the Florida Department of Revenue. This form must be completed in accordance with state regulations, ensuring that all information provided is truthful and accurate. Misrepresentation or failure to comply with the requirements can lead to penalties or legal repercussions. Therefore, it is vital to understand the legal implications of this form, as it establishes your business's tax responsibilities and obligations under Florida law.

Required Documents

When completing the Florida Business Tax Application Form Dr 1, certain documents may be required to support your application. These typically include:

- Federal Employer Identification Number (FEIN) documentation.

- Proof of business registration, such as Articles of Incorporation or Organization.

- Identification documents for the business owner or principal.

Having these documents ready can streamline the application process and ensure compliance with state requirements.

Form Submission Methods (Online / Mail / In-Person)

The Florida Business Tax Application Form Dr 1 can be submitted through various methods, offering flexibility to business owners. You can choose to submit the form electronically via the Florida Department of Revenue's online portal, which is often the fastest method. Alternatively, you may print the completed form and mail it to the appropriate address provided by the department. In some cases, in-person submissions may also be accepted at designated offices. Each method has its own processing times, so it is advisable to choose one that aligns with your business needs.

Quick guide on how to complete florida business tax application form dr 1 florida department 2011

Complete Florida Business Tax Application Form Dr 1 Florida Department effortlessly on any device

Online document management has become well-liked among businesses and individuals. It serves as an ideal environmentally friendly alternative to conventional printed and signed documents, as you can access the appropriate form and securely save it online. airSlate SignNow equips you with all the tools required to create, modify, and electronically sign your documents swiftly without interruptions. Manage Florida Business Tax Application Form Dr 1 Florida Department on any device using airSlate SignNow's Android or iOS applications and streamline any document-related task today.

The easiest way to modify and electronically sign Florida Business Tax Application Form Dr 1 Florida Department without effort

- Obtain Florida Business Tax Application Form Dr 1 Florida Department and click on Get Form to begin.

- Make use of the tools we offer to complete your form.

- Select pertinent sections of your documents or obscure sensitive information with tools that airSlate SignNow specifically provides for such purposes.

- Create your signature using the Sign tool, which takes seconds and holds the same legal validity as a traditional handwritten signature.

- Review the information and then click the Done button to save your updates.

- Decide how you wish to send your form, whether by email, text message (SMS), invite link, or download it to your computer.

Eliminate the hassle of lost or misplaced documents, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Edit and electronically sign Florida Business Tax Application Form Dr 1 Florida Department to ensure outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct florida business tax application form dr 1 florida department 2011

Create this form in 5 minutes!

How to create an eSignature for the florida business tax application form dr 1 florida department 2011

The best way to generate an eSignature for your PDF file online

The best way to generate an eSignature for your PDF file in Google Chrome

How to make an eSignature for signing PDFs in Gmail

The way to create an eSignature straight from your mobile device

How to create an electronic signature for a PDF file on iOS

The way to create an eSignature for a PDF document on Android devices

People also ask

-

What is the Florida Business Tax Application Form Dr 1 Florida Department?

The Florida Business Tax Application Form Dr 1 Florida Department is a required document for businesses to register for a tax account in Florida. This form is essential for obtaining various state tax identification numbers necessary for conducting business. It allows the Florida Department of Revenue to collect the appropriate taxes owed by businesses operating in the state.

-

How can airSlate SignNow help with the Florida Business Tax Application Form Dr 1 Florida Department?

airSlate SignNow streamlines the process of completing and submitting the Florida Business Tax Application Form Dr 1 Florida Department electronically. With our user-friendly interface, you can easily fill out, sign, and send the form securely. This saves you time and ensures that your application is submitted accurately to the Florida Department.

-

Is there a fee to file the Florida Business Tax Application Form Dr 1 Florida Department?

While there is no fee to file the Florida Business Tax Application Form Dr 1 Florida Department, businesses may incur other tax-related costs once registered. It is advisable to check the Florida Department of Revenue's website for any potential fees associated with specific tax accounts. Using airSlate SignNow helps eliminate additional costs related to paperwork and mailing.

-

What features does airSlate SignNow offer for handling documents like the Florida Business Tax Application Form Dr 1 Florida Department?

airSlate SignNow offers a range of features designed to enhance the document signing process, including electronic signatures, document templates, and secure cloud storage. These features make it easy to manage the Florida Business Tax Application Form Dr 1 Florida Department digitally. Additionally, automated notifications keep you updated about the status of your document.

-

Can I integrate airSlate SignNow with other software for my business needs?

Yes, airSlate SignNow easily integrates with various business applications to enhance your workflow. You can connect with platforms like Google Drive, Dropbox, and CRM systems to manage the Florida Business Tax Application Form Dr 1 Florida Department efficiently. This flexibility makes it an ideal choice for businesses looking to streamline their document management processes.

-

What are the benefits of using airSlate SignNow for the Florida Business Tax Application Form Dr 1 Florida Department?

Using airSlate SignNow to manage the Florida Business Tax Application Form Dr 1 Florida Department provides numerous benefits, such as faster turnaround times and improved accuracy. The electronic signing process eliminates the hassle of printing and mailing documents. With built-in security features, you can be confident that your sensitive information is protected.

-

How does airSlate SignNow ensure the security of my Florida Business Tax Application Form Dr 1 Florida Department?

airSlate SignNow prioritizes the security of your documents, employing encryption and secure cloud storage. Confidential information related to the Florida Business Tax Application Form Dr 1 Florida Department is protected throughout the signing process. You can trust that your data is safeguarded while you efficiently manage your business tax needs.

Get more for Florida Business Tax Application Form Dr 1 Florida Department

Find out other Florida Business Tax Application Form Dr 1 Florida Department

- eSignature Louisiana Insurance Rental Application Later

- eSignature Maryland Insurance Contract Safe

- eSignature Massachusetts Insurance Lease Termination Letter Free

- eSignature Nebraska High Tech Rental Application Now

- How Do I eSignature Mississippi Insurance Separation Agreement

- Help Me With eSignature Missouri Insurance Profit And Loss Statement

- eSignature New Hampshire High Tech Lease Agreement Template Mobile

- eSignature Montana Insurance Lease Agreement Template Online

- eSignature New Hampshire High Tech Lease Agreement Template Free

- How To eSignature Montana Insurance Emergency Contact Form

- eSignature New Jersey High Tech Executive Summary Template Free

- eSignature Oklahoma Insurance Warranty Deed Safe

- eSignature Pennsylvania High Tech Bill Of Lading Safe

- eSignature Washington Insurance Work Order Fast

- eSignature Utah High Tech Warranty Deed Free

- How Do I eSignature Utah High Tech Warranty Deed

- eSignature Arkansas Legal Affidavit Of Heirship Fast

- Help Me With eSignature Colorado Legal Cease And Desist Letter

- How To eSignature Connecticut Legal LLC Operating Agreement

- eSignature Connecticut Legal Residential Lease Agreement Mobile