IA 706 Iowa InheritanceEstate Tax Return 2020

What is the IA 706 Iowa Inheritance Estate Tax Return

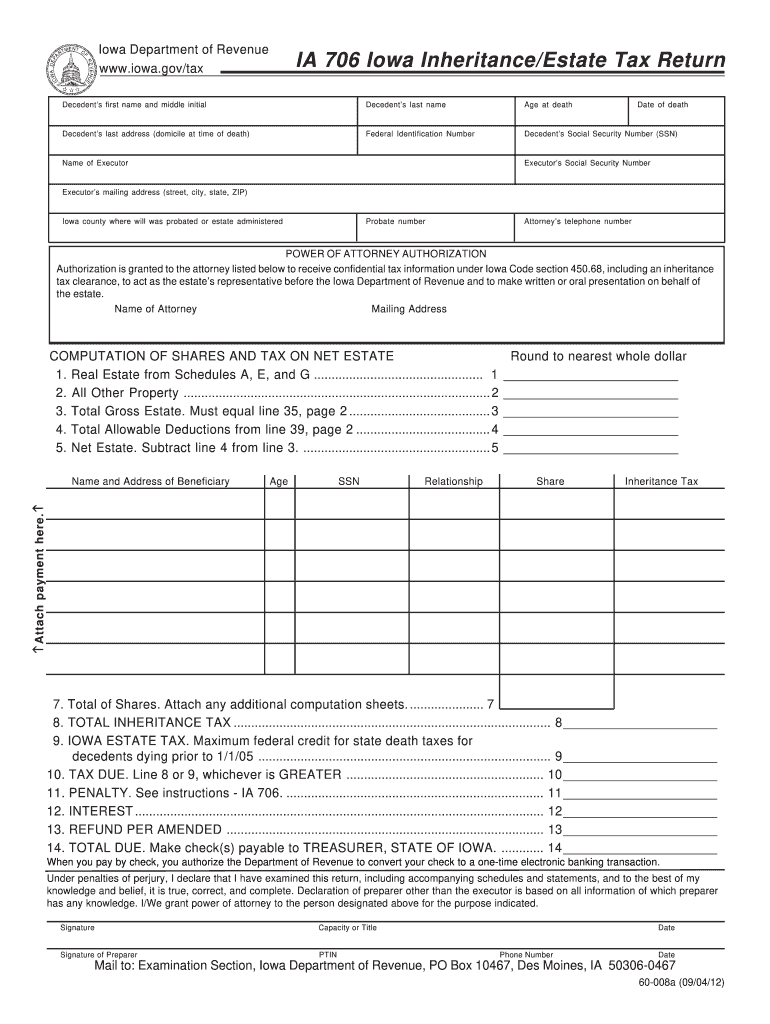

The IA 706 Iowa Inheritance Estate Tax Return is a legal document required by the state of Iowa for reporting the transfer of assets from a deceased individual to their heirs. This form is essential for calculating the inheritance tax owed based on the value of the estate. It is applicable to estates that exceed a certain threshold, which varies depending on the year and specific circumstances surrounding the estate. Completing this form accurately ensures compliance with state tax laws and helps facilitate the proper distribution of assets.

Steps to complete the IA 706 Iowa Inheritance Estate Tax Return

Completing the IA 706 Iowa Inheritance Estate Tax Return involves several key steps:

- Gather necessary documentation, including the deceased's will, asset valuations, and any other relevant financial records.

- Determine the total value of the estate, including real estate, personal property, and financial accounts.

- Complete the IA 706 form, ensuring all sections are filled out accurately, including information about the decedent and the beneficiaries.

- Calculate the inheritance tax due based on the current Iowa tax rates and the value of the estate.

- Review the completed form for accuracy and completeness before submission.

Legal use of the IA 706 Iowa Inheritance Estate Tax Return

The IA 706 form serves a critical legal function in the estate settlement process. It is used to report the inheritance tax liability to the state of Iowa, which is a legal requirement for estates exceeding the specified value threshold. Filing this form ensures that the estate complies with state tax laws, preventing potential legal issues for the heirs or estate administrators. Proper use of the IA 706 helps establish the legitimacy of the estate's financial dealings and protects the interests of all parties involved.

Required Documents

To complete the IA 706 Iowa Inheritance Estate Tax Return, several documents are necessary:

- The deceased's will or trust documents.

- Death certificate of the decedent.

- Asset valuations, including appraisals for real estate and personal property.

- Financial statements for bank accounts, investment accounts, and retirement accounts.

- Any prior tax returns or documents related to the decedent's financial history.

Filing Deadlines / Important Dates

Timely filing of the IA 706 Iowa Inheritance Estate Tax Return is crucial. Generally, the form must be filed within nine months of the decedent's date of death. If the return is not submitted by this deadline, penalties and interest may accrue on the unpaid inheritance tax. It is advisable to check for any specific updates or changes to deadlines that may occur due to state regulations or other factors.

Form Submission Methods

The IA 706 Iowa Inheritance Estate Tax Return can be submitted through various methods:

- Online submission via the Iowa Department of Revenue's website, if available.

- Mailing a hard copy of the completed form to the appropriate state office.

- In-person submission at designated state offices, if preferred.

Quick guide on how to complete ia 706 iowa inheritanceestate tax return

Complete IA 706 Iowa InheritanceEstate Tax Return effortlessly on any device

Digital document management has gained traction among businesses and individuals. It serves as an ideal eco-friendly alternative to conventional printed and signed documents, enabling you to locate the required form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and eSign your documents promptly without delays. Manage IA 706 Iowa InheritanceEstate Tax Return on any platform using airSlate SignNow's Android or iOS applications and streamline any document-related procedure today.

How to modify and eSign IA 706 Iowa InheritanceEstate Tax Return with ease

- Locate IA 706 Iowa InheritanceEstate Tax Return and click Get Form to initiate the process.

- Employ the tools we provide to complete your document.

- Highlight pertinent sections of your documents or conceal sensitive information with tools expressly designed for that purpose by airSlate SignNow.

- Create your eSignature using the Sign tool, which takes only seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Choose your preferred method of delivering your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you choose. Modify and eSign IA 706 Iowa InheritanceEstate Tax Return and ensure exceptional communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct ia 706 iowa inheritanceestate tax return

Create this form in 5 minutes!

How to create an eSignature for the ia 706 iowa inheritanceestate tax return

How to create an electronic signature for a PDF document online

How to create an electronic signature for a PDF document in Google Chrome

How to generate an eSignature for signing PDFs in Gmail

The best way to create an eSignature from your smart phone

How to create an eSignature for a PDF document on iOS

The best way to create an eSignature for a PDF file on Android OS

People also ask

-

What is the IA 706 Iowa Inheritance Estate Tax Return?

The IA 706 Iowa Inheritance Estate Tax Return is a document required by the state of Iowa to report the value of an estate and determine the inheritance tax owed. It is essential for the executor of the estate to complete this form accurately to ensure compliance with Iowa tax laws.

-

How do I file the IA 706 Iowa Inheritance Estate Tax Return?

To file the IA 706 Iowa Inheritance Estate Tax Return, you need to gather all necessary financial documents related to the estate. This includes valuation documents, death certificates, and any prior tax returns. Once completed, the return can be submitted to the Iowa Department of Revenue for processing.

-

Are there any fees associated with filing the IA 706 Iowa Inheritance Estate Tax Return?

There are no direct fees for filing the IA 706 Iowa Inheritance Estate Tax Return itself, but it's advisable to consult with a tax professional. They can help ensure that your return is filed correctly, which may incur a fee, but this can help avoid costly mistakes that lead to penalties.

-

What features does airSlate SignNow offer for signing the IA 706 Iowa Inheritance Estate Tax Return?

airSlate SignNow offers a variety of features for signing the IA 706 Iowa Inheritance Estate Tax Return, including secure eSignature options and document tracking. These features ensure that the necessary parties can sign the form quickly and that you maintain a record of all transactions related to the return.

-

How can airSlate SignNow help me manage my IA 706 Iowa Inheritance Estate Tax Return documents?

With airSlate SignNow, you can easily upload, organize, and share your IA 706 Iowa Inheritance Estate Tax Return documents. The platform allows for efficient collaboration between executors, attorneys, and heirs, making the estate management process smoother.

-

Is airSlate SignNow affordable for small estates that need to file the IA 706 Iowa Inheritance Estate Tax Return?

Yes, airSlate SignNow is designed to be cost-effective, making it an excellent choice for small estates needing to file the IA 706 Iowa Inheritance Estate Tax Return. The subscription models provide flexibility, allowing you to choose a plan that fits your budget without sacrificing essential features.

-

Can I integrate airSlate SignNow with other software for tax preparation?

Absolutely! airSlate SignNow is compatible with various software applications used for tax preparation. This integration allows for seamless transfer of information needed for the IA 706 Iowa Inheritance Estate Tax Return, streamlining the filing process.

Get more for IA 706 Iowa InheritanceEstate Tax Return

Find out other IA 706 Iowa InheritanceEstate Tax Return

- eSignature Finance & Tax Accounting Presentation Arkansas Secure

- eSignature Arkansas Government Affidavit Of Heirship Online

- eSignature New Jersey Doctors Permission Slip Mobile

- eSignature Colorado Government Residential Lease Agreement Free

- Help Me With eSignature Colorado Government Medical History

- eSignature New Mexico Doctors Lease Termination Letter Fast

- eSignature New Mexico Doctors Business Associate Agreement Later

- eSignature North Carolina Doctors Executive Summary Template Free

- eSignature North Dakota Doctors Bill Of Lading Online

- eSignature Delaware Finance & Tax Accounting Job Description Template Fast

- How To eSignature Kentucky Government Warranty Deed

- eSignature Mississippi Government Limited Power Of Attorney Myself

- Can I eSignature South Dakota Doctors Lease Agreement Form

- eSignature New Hampshire Government Bill Of Lading Fast

- eSignature Illinois Finance & Tax Accounting Purchase Order Template Myself

- eSignature North Dakota Government Quitclaim Deed Free

- eSignature Kansas Finance & Tax Accounting Business Letter Template Free

- eSignature Washington Government Arbitration Agreement Simple

- Can I eSignature Massachusetts Finance & Tax Accounting Business Plan Template

- Help Me With eSignature Massachusetts Finance & Tax Accounting Work Order