K 120S Kansas Department of Revenue Ksrevenue 2020

What is the K-120S Kansas Department of Revenue Ksrevenue?

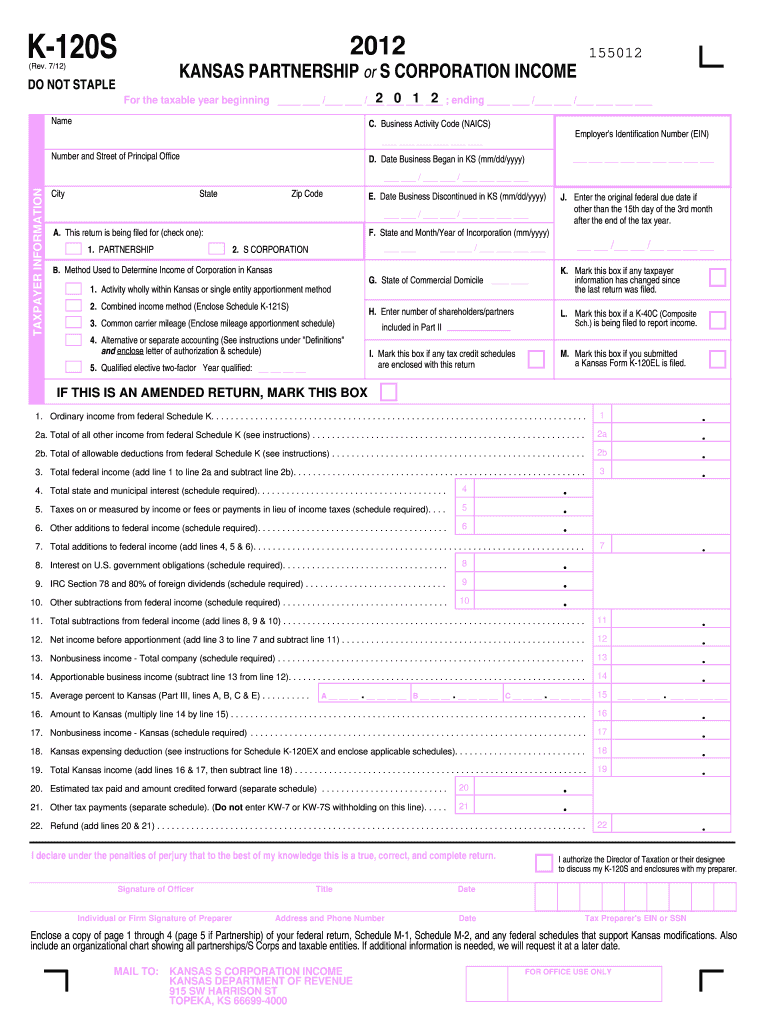

The K-120S form is a specific tax document issued by the Kansas Department of Revenue. It is primarily used for reporting income and calculating tax liabilities for certain types of entities, such as S corporations and partnerships. This form plays a crucial role in ensuring compliance with state tax regulations, allowing businesses to accurately report their income and deductions. Understanding the purpose and requirements of the K-120S is essential for any entity operating within Kansas.

How to use the K-120S Kansas Department of Revenue Ksrevenue

Using the K-120S form involves several steps to ensure accurate completion and submission. First, gather all necessary financial documents, including income statements and expense records. Next, accurately fill out the form, providing detailed information about the entity's income, deductions, and credits. It is important to double-check all entries for accuracy before submission. Once completed, the form can be submitted electronically or via mail, depending on the preferences of the taxpayer and the regulations set by the Kansas Department of Revenue.

Steps to complete the K-120S Kansas Department of Revenue Ksrevenue

Completing the K-120S form requires careful attention to detail. Here are the steps to follow:

- Gather financial records, including income statements and expense reports.

- Download the K-120S form from the Kansas Department of Revenue website.

- Fill in the entity's name, address, and identification number at the top of the form.

- Report total income and allowable deductions in the respective sections.

- Calculate the total tax liability based on the provided information.

- Sign and date the form, certifying that the information is accurate and complete.

- Submit the form electronically or by mail, following the specified submission guidelines.

Legal use of the K-120S Kansas Department of Revenue Ksrevenue

The K-120S form is legally binding when completed and submitted in accordance with Kansas tax laws. It must be filled out truthfully and accurately to avoid penalties. The form serves as an official record of the entity's income and tax obligations, and any discrepancies can lead to audits or legal consequences. Therefore, it is vital to ensure that all information provided is correct and that the form is submitted by the due date to maintain compliance with state regulations.

Filing Deadlines / Important Dates

Filing deadlines for the K-120S form are crucial for compliance. Typically, the form must be submitted by the fifteenth day of the fourth month following the end of the entity's tax year. For entities operating on a calendar year, this means the due date is April 15. It is important to stay informed about any changes to deadlines or extensions that may be announced by the Kansas Department of Revenue to avoid late filing penalties.

Form Submission Methods (Online / Mail / In-Person)

The K-120S form can be submitted through various methods to accommodate the preferences of taxpayers. Options include:

- Online Submission: Many taxpayers prefer to file electronically through the Kansas Department of Revenue's online portal, which offers a streamlined process.

- Mail: The completed form can be printed and mailed to the appropriate address provided by the Kansas Department of Revenue.

- In-Person: Taxpayers may also choose to submit the form in person at designated state offices, although this option may be less common.

Quick guide on how to complete k 120s 2012 kansas department of revenue ksrevenue

Complete K 120S Kansas Department Of Revenue Ksrevenue easily on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an excellent eco-friendly substitute for traditional printed and signed documents, allowing you to access the correct form and securely save it online. airSlate SignNow equips you with all the tools necessary to create, edit, and eSign your documents quickly without delays. Manage K 120S Kansas Department Of Revenue Ksrevenue on any device with airSlate SignNow applications for Android or iOS and streamline any document-related process today.

The easiest way to edit and eSign K 120S Kansas Department Of Revenue Ksrevenue effortlessly

- Locate K 120S Kansas Department Of Revenue Ksrevenue and click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Highlight important sections of your documents or redact sensitive information with tools that airSlate SignNow specifically provides for that purpose.

- Create your eSignature using the Sign tool, which takes seconds and holds the same legal validity as a traditional wet ink signature.

- Review all the information and click the Done button to save your modifications.

- Select how you wish to send your form, via email, text message (SMS), invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or mistakes that require reprinting new copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Edit and eSign K 120S Kansas Department Of Revenue Ksrevenue and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct k 120s 2012 kansas department of revenue ksrevenue

Create this form in 5 minutes!

How to create an eSignature for the k 120s 2012 kansas department of revenue ksrevenue

How to make an eSignature for your PDF online

How to make an eSignature for your PDF in Google Chrome

The way to generate an electronic signature for signing PDFs in Gmail

The way to create an electronic signature from your smartphone

The best way to make an electronic signature for a PDF on iOS

The way to create an electronic signature for a PDF file on Android

People also ask

-

What is the K 120S form for the Kansas Department of Revenue?

The K 120S form is specifically designed for S corporations in Kansas to report their income and pay the appropriate taxes. It is a crucial document that ensures compliance with the Kansas Department of Revenue regulations. Using airSlate SignNow to eSign and send your K 120S form can streamline the filing process.

-

How can airSlate SignNow help with the K 120S Kansas Department of Revenue filing?

airSlate SignNow simplifies the process of completing and submitting your K 120S form to the Kansas Department of Revenue. With its user-friendly platform, you can easily gather signatures and ensure that all required documentation is properly submitted. This efficient method ultimately saves you time and reduces the risk of errors.

-

Is there a cost associated with using airSlate SignNow for the K 120S Kansas Department of Revenue forms?

Yes, airSlate SignNow offers cost-effective pricing plans that cater to various business needs. Depending on your requirements, you can choose a plan that allows you to send and eSign multiple K 120S Kansas Department of Revenue documents without breaking your budget. Visit our pricing page to find the right option for you.

-

What features does airSlate SignNow offer for K 120S Kansas Department of Revenue processing?

airSlate SignNow provides several features that make processing your K 120S form easy. These include customizable templates, secure eSigning, and real-time tracking of document status. These tools enhance efficiency and ensure you never miss a deadline when submitting to the Kansas Department of Revenue.

-

Can I integrate airSlate SignNow with other software for managing K 120S forms?

Absolutely! airSlate SignNow offers robust integrations with various software applications, making it easier to manage your K 120S Kansas Department of Revenue forms alongside your existing workflows. Whether you use CRM systems or accounting software, our integrations can enhance productivity and organization.

-

What are the benefits of using airSlate SignNow for K 120S forms?

Using airSlate SignNow for your K 120S Kansas Department of Revenue forms offers numerous benefits, including increased efficiency, reduced paperwork, and enhanced security. The platform's easy-to-use interface allows for quick adjustments and e-signatures, streamlining the entire filing process. This can signNowly reduce stress during tax season.

-

Is airSlate SignNow secure for handling sensitive K 120S Kansas Department of Revenue information?

Yes, airSlate SignNow prioritizes security when it comes to handling your K 120S Kansas Department of Revenue information. Our platform uses advanced encryption and security protocols to protect your sensitive data. You can confidently eSign and send documents knowing your information is safe and secure.

Get more for K 120S Kansas Department Of Revenue Ksrevenue

- Ap physics 1 exam multiple choice pdf form

- Saga cash ct form

- Dishwasher temperature log template form

- Refusal of treatment form pdf

- Nj abc liquor license application form

- New york state vicuna license form

- Cfstes professional certification state fire marshal ca gov form

- Registration fee and payment form btransradialworldbbcomb

Find out other K 120S Kansas Department Of Revenue Ksrevenue

- eSignature Idaho Real Estate Cease And Desist Letter Online

- eSignature Idaho Real Estate Cease And Desist Letter Simple

- eSignature Wyoming Plumbing Quitclaim Deed Myself

- eSignature Colorado Sports Living Will Mobile

- eSignature Iowa Real Estate Moving Checklist Simple

- eSignature Iowa Real Estate Quitclaim Deed Easy

- eSignature Real Estate Form Louisiana Simple

- eSignature Louisiana Real Estate LLC Operating Agreement Myself

- Can I eSignature Louisiana Real Estate Quitclaim Deed

- eSignature Hawaii Sports Living Will Safe

- eSignature Hawaii Sports LLC Operating Agreement Myself

- eSignature Maryland Real Estate Quitclaim Deed Secure

- eSignature Idaho Sports Rental Application Secure

- Help Me With eSignature Massachusetts Real Estate Quitclaim Deed

- eSignature Police Document Florida Easy

- eSignature Police Document Florida Safe

- How Can I eSignature Delaware Police Living Will

- eSignature Michigan Real Estate LLC Operating Agreement Mobile

- eSignature Georgia Police Last Will And Testament Simple

- How To eSignature Hawaii Police RFP