Kansas Retailers Sales Tax Form Ksrevenue 2019

What is the Kansas Retailers Sales Tax Form Ksrevenue

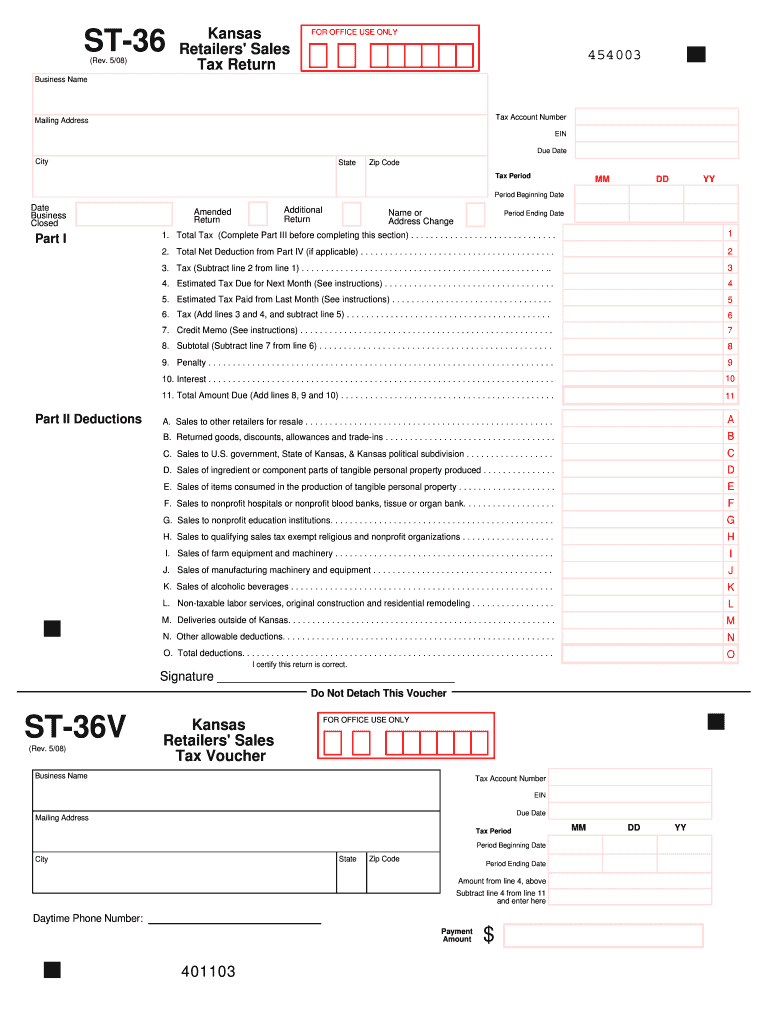

The Kansas Retailers Sales Tax Form, commonly referred to as Ksrevenue, is a crucial document for businesses operating within the state of Kansas. This form is used to report sales tax collected from customers and to remit those taxes to the Kansas Department of Revenue. It is essential for compliance with state tax laws and helps ensure that businesses fulfill their tax obligations accurately and timely. The form includes various sections that require detailed information about sales transactions, tax rates, and exemptions applicable to the business.

How to use the Kansas Retailers Sales Tax Form Ksrevenue

Using the Kansas Retailers Sales Tax Form involves several steps to ensure accurate reporting. First, gather all necessary sales records for the reporting period, including invoices and receipts. Next, complete the form by entering total sales, taxable sales, and any exempt sales. It is important to calculate the total sales tax collected and provide the appropriate payment if there is any tax due. After completing the form, businesses can submit it via mail or electronically, depending on their preference and the options provided by the Kansas Department of Revenue.

Steps to complete the Kansas Retailers Sales Tax Form Ksrevenue

Completing the Kansas Retailers Sales Tax Form requires careful attention to detail. Follow these steps:

- Gather all sales records for the reporting period.

- Fill in your business information, including name, address, and tax identification number.

- Report total sales, taxable sales, and exempt sales in the designated sections of the form.

- Calculate the total sales tax collected based on applicable tax rates.

- Review the form for accuracy before submission.

- Submit the completed form either online or by mail, ensuring it is sent by the due date.

Legal use of the Kansas Retailers Sales Tax Form Ksrevenue

The Kansas Retailers Sales Tax Form is legally binding when completed and submitted in accordance with state regulations. It serves as an official record of sales tax collected and remitted, which is essential for both the business and the state. Proper use of the form helps businesses avoid penalties for non-compliance and ensures that they meet their tax obligations. It is important to maintain accurate records and retain copies of submitted forms for future reference, as they may be required during audits or reviews by tax authorities.

Filing Deadlines / Important Dates

Filing deadlines for the Kansas Retailers Sales Tax Form vary based on the reporting frequency assigned to the business. Generally, businesses may be required to file monthly, quarterly, or annually. It is crucial to be aware of these deadlines to avoid late fees and penalties. The Kansas Department of Revenue provides a calendar of important dates, including the due date for each filing period. Businesses should mark these dates on their calendars to ensure timely submissions.

Form Submission Methods (Online / Mail / In-Person)

Businesses have multiple options for submitting the Kansas Retailers Sales Tax Form. The form can be filed electronically through the Kansas Department of Revenue's online portal, which offers a convenient and efficient way to submit tax information. Alternatively, businesses may choose to mail the completed form to the appropriate address provided by the department. In some cases, in-person submissions may also be accepted, allowing for direct interaction with tax officials. Each method has its own advantages, and businesses should choose the one that best suits their needs.

Quick guide on how to complete 2008 kansas retailers sales tax form ksrevenue

Complete Kansas Retailers Sales Tax Form Ksrevenue effortlessly on any device

Digital document management has gained popularity among businesses and individuals alike. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to locate the correct form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, edit, and eSign your documents swiftly without challenges. Manage Kansas Retailers Sales Tax Form Ksrevenue on any platform using airSlate SignNow's Android or iOS applications and streamline any document-related process today.

The easiest way to edit and eSign Kansas Retailers Sales Tax Form Ksrevenue without hassle

- Find Kansas Retailers Sales Tax Form Ksrevenue and click Get Form to begin.

- Utilize the tools at your disposal to complete your form.

- Emphasize important sections of your documents or redact sensitive information using the specialized tools provided by airSlate SignNow.

- Create your eSignature with the Sign feature, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and click the Done button to save your modifications.

- Choose your preferred method to share your form, whether by email, text message (SMS), or invite link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form navigation, or mistakes that necessitate printing new document copies. airSlate SignNow accommodates your document management needs in just a few clicks from any device you prefer. Edit and eSign Kansas Retailers Sales Tax Form Ksrevenue and ensure clear communication at every stage of your form creation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2008 kansas retailers sales tax form ksrevenue

Create this form in 5 minutes!

How to create an eSignature for the 2008 kansas retailers sales tax form ksrevenue

The best way to create an electronic signature for a PDF document in the online mode

The best way to create an electronic signature for a PDF document in Chrome

How to generate an eSignature for putting it on PDFs in Gmail

The way to generate an eSignature from your mobile device

The way to create an eSignature for a PDF document on iOS devices

The way to generate an eSignature for a PDF file on Android devices

People also ask

-

What is the Kansas Retailers Sales Tax Form Ksrevenue?

The Kansas Retailers Sales Tax Form Ksrevenue is a document required by the state of Kansas for businesses to report and pay sales tax collected on taxable sales. It is essential for compliance with local tax laws and helps businesses maintain their good standing with the state.

-

How can airSlate SignNow help with the Kansas Retailers Sales Tax Form Ksrevenue?

airSlate SignNow streamlines the process of preparing and eSigning the Kansas Retailers Sales Tax Form Ksrevenue. With our easy-to-use platform, you can fill out the form quickly, ensuring accuracy and efficiency while saving time.

-

Is there a cost to use airSlate SignNow for filing the Kansas Retailers Sales Tax Form Ksrevenue?

Yes, airSlate SignNow offers flexible pricing plans that cater to various business needs. Our cost-effective solutions ensure that you receive value for your investment while simplifying the filing of the Kansas Retailers Sales Tax Form Ksrevenue.

-

What features does airSlate SignNow provide for the Kansas Retailers Sales Tax Form Ksrevenue?

airSlate SignNow provides several features such as customizable templates, secure eSigning, and automated workflows to enhance your experience with the Kansas Retailers Sales Tax Form Ksrevenue. These features minimize errors and improve the overall efficiency of document handling.

-

Can I integrate airSlate SignNow with other tools for managing the Kansas Retailers Sales Tax Form Ksrevenue?

Yes, airSlate SignNow can integrate seamlessly with various business tools such as CRMs and document management systems. This integration enhances your workflow and ensures that the Kansas Retailers Sales Tax Form Ksrevenue is efficiently managed across different platforms.

-

What are the benefits of using airSlate SignNow for the Kansas Retailers Sales Tax Form Ksrevenue?

Using airSlate SignNow for the Kansas Retailers Sales Tax Form Ksrevenue offers numerous benefits, including increased efficiency, reduced paper usage, and improved compliance. Our platform enables businesses to quickly complete and submit forms, which can lead to timely tax filings.

-

Is it secure to use airSlate SignNow for the Kansas Retailers Sales Tax Form Ksrevenue?

Absolutely! airSlate SignNow prioritizes data security and uses advanced encryption to protect your information when filing the Kansas Retailers Sales Tax Form Ksrevenue. You can trust that your sensitive data is safe while being processed.

Get more for Kansas Retailers Sales Tax Form Ksrevenue

- Petty cash form template

- Conductor licence renewal fees haryana form

- Dole 400 moisture tester manual form

- Form 14446

- Exide life insurance proposal form pdf

- Application for availing of the facility of cheque system form

- Defendants request for driving safety course form

- Wisconsin voluntary paternity acknowledgment form pdf

Find out other Kansas Retailers Sales Tax Form Ksrevenue

- How To eSign New Hampshire Construction Rental Lease Agreement

- eSign Massachusetts Education Rental Lease Agreement Easy

- eSign New York Construction Lease Agreement Online

- Help Me With eSign North Carolina Construction LLC Operating Agreement

- eSign Education Presentation Montana Easy

- How To eSign Missouri Education Permission Slip

- How To eSign New Mexico Education Promissory Note Template

- eSign New Mexico Education Affidavit Of Heirship Online

- eSign California Finance & Tax Accounting IOU Free

- How To eSign North Dakota Education Rental Application

- How To eSign South Dakota Construction Promissory Note Template

- eSign Education Word Oregon Secure

- How Do I eSign Hawaii Finance & Tax Accounting NDA

- eSign Georgia Finance & Tax Accounting POA Fast

- eSign Georgia Finance & Tax Accounting POA Simple

- How To eSign Oregon Education LLC Operating Agreement

- eSign Illinois Finance & Tax Accounting Resignation Letter Now

- eSign Texas Construction POA Mobile

- eSign Kansas Finance & Tax Accounting Stock Certificate Now

- eSign Tennessee Education Warranty Deed Online