K 40 Form 2020

What is the K-40 Form

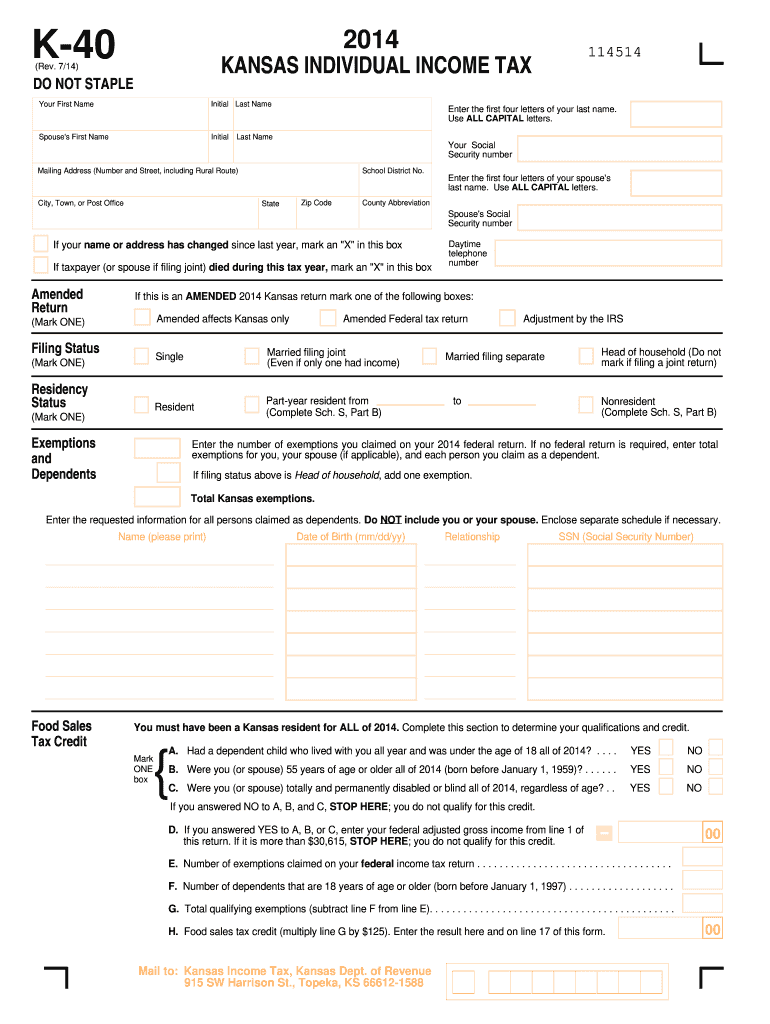

The K-40 Form is a tax document used by residents of Kansas to report their income and calculate their state income tax liability. This form is essential for individuals and couples filing their state taxes, as it captures various sources of income, deductions, and credits. The K-40 Form is designed to ensure compliance with Kansas tax laws, providing a clear framework for taxpayers to accurately report their financial information.

How to use the K-40 Form

Using the K-40 Form involves several steps to ensure accurate completion and submission. Taxpayers should begin by gathering all necessary financial documents, including W-2s, 1099s, and any other income statements. Next, individuals must fill out the form with their personal information, income details, and applicable deductions. It is crucial to review the form for accuracy before submission, as errors can lead to delays or penalties. Finally, submit the completed K-40 Form according to the preferred method, whether online, by mail, or in person.

Steps to complete the K-40 Form

Completing the K-40 Form involves a systematic approach to ensure all required information is accurately reported. Follow these steps:

- Gather all necessary documents, including income statements and previous tax returns.

- Fill in personal information, such as name, address, and Social Security number.

- Report all sources of income, including wages, interest, and dividends.

- Claim any eligible deductions, such as property taxes or charitable contributions.

- Calculate the total tax owed or refund due, based on the provided instructions.

- Review the completed form for accuracy and completeness.

- Submit the form by the designated deadline.

Legal use of the K-40 Form

The K-40 Form is legally binding when completed accurately and submitted in accordance with Kansas tax regulations. To ensure its legal validity, taxpayers must adhere to the guidelines set forth by the Kansas Department of Revenue. This includes providing truthful information, signing the form, and submitting it by the required deadlines. Failure to comply with these regulations can result in penalties, including fines or audits.

Filing Deadlines / Important Dates

Filing deadlines for the K-40 Form are crucial for taxpayers to keep in mind to avoid penalties. Typically, the deadline for submitting the K-40 Form is April 15 of each year, aligning with the federal tax filing deadline. If this date falls on a weekend or holiday, the deadline may be extended. Additionally, taxpayers should be aware of any changes in deadlines due to state regulations or special circumstances, such as disaster relief extensions.

Required Documents

To complete the K-40 Form accurately, taxpayers need to gather several essential documents. These include:

- W-2 forms from employers, detailing annual wages and tax withholdings.

- 1099 forms for any freelance or contract work.

- Documentation of other income sources, such as rental or investment income.

- Receipts or records for eligible deductions, such as medical expenses or educational costs.

- Previous year’s tax return for reference.

Quick guide on how to complete 2014 k 40 form

Prepare K 40 Form easily on any device

Digital document management has gained traction among businesses and individuals alike. It offers an excellent eco-friendly alternative to traditional printed and signed papers, as you can obtain the correct form and securely save it online. airSlate SignNow provides you with all the resources necessary to create, modify, and electronically sign your documents quickly and efficiently. Handle K 40 Form on any platform using the airSlate SignNow Android or iOS applications and simplify any document-related procedure today.

How to modify and electronically sign K 40 Form effortlessly

- Locate K 40 Form and click Get Form to begin.

- Utilize the features we provide to complete your form.

- Emphasize important sections of the documents or obscure sensitive information with tools that airSlate SignNow provides specifically for this function.

- Create your electronic signature with the Sign feature, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Select how you wish to send your form, whether by email, SMS, invite link, or download it to your computer.

Eliminate concerns about lost or misfiled documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow meets your document management needs with just a few clicks from any device you prefer. Modify and electronically sign K 40 Form and ensure seamless communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2014 k 40 form

Create this form in 5 minutes!

How to create an eSignature for the 2014 k 40 form

The best way to create an electronic signature for your PDF document online

The best way to create an electronic signature for your PDF document in Google Chrome

How to make an electronic signature for signing PDFs in Gmail

The way to generate an electronic signature right from your smart phone

The way to create an electronic signature for a PDF document on iOS

The way to generate an electronic signature for a PDF on Android OS

People also ask

-

What is the K 40 Form and why is it important?

The K 40 Form is essential for individual income tax filing in Kansas. It is used to report income earned in the state, allowing accurate tax calculations and ensuring you meet state compliance. Understanding this form is crucial for maximizing tax deductions and ensuring a smooth filing process.

-

How can airSlate SignNow help with the K 40 Form?

airSlate SignNow streamlines the process of signing and sending your K 40 Form. With its user-friendly interface, you can easily fill out and e-sign the form online, ensuring that you meet deadlines without the hassle of paper documents. This efficiency supports faster processing and helps avoid any potential penalties.

-

Is there a cost associated with using airSlate SignNow for the K 40 Form?

Yes, airSlate SignNow offers various pricing plans to cater to different business needs. The cost depends on the features you choose, but it is designed to be cost-effective, especially for handling documents like the K 40 Form efficiently. You can also take advantage of a free trial to explore its capabilities.

-

What features does airSlate SignNow offer for handling forms like the K 40 Form?

airSlate SignNow provides several features tailored for handling documents, including customizable templates, secure cloud storage, and e-signature capabilities. For the K 40 Form, these features allow you to streamline the preparation and signing process, ensuring an efficient user experience. These tools help keep your documents organized and accessible.

-

Can I integrate airSlate SignNow with other applications to manage the K 40 Form?

Absolutely! airSlate SignNow offers integrations with multiple applications, including cloud storage and CRM solutions, which can help you manage the K 40 Form more efficiently. This capability allows seamless data transfer and eliminates repetitive tasks, enhancing your overall workflow. You can connect with your existing tools easily.

-

What benefits does eSigning the K 40 Form provide?

eSigning the K 40 Form through airSlate SignNow signNowly reduces turnaround time and enhances security. You can sign the document from anywhere, eliminating the need for physical presence or postage, which can delay the filing process. Additionally, eSignatures are secure and legally recognized, protecting your information.

-

Is airSlate SignNow secure for submitting sensitive forms like the K 40 Form?

Yes, airSlate SignNow prioritizes security, implementing advanced encryption and compliance measures to protect your data. When submitting sensitive forms like the K 40 Form, you can trust that your information is safely stored and transmitted. This commitment to security ensures your peace of mind throughout the process.

Get more for K 40 Form

- Form 1 see rule 5 2

- Ielts application form filled sample 22286336

- Elms college transcript request form

- Pet insurance form

- Oxford english for careers medicine 1 answer key form

- Printable fishing trip checklist form

- City of philadelphia fire alarm systems inspector license renewal form

- Fire alarm systems inspector form

Find out other K 40 Form

- How To Electronic signature Ohio High Tech Presentation

- How Can I Electronic signature Alabama Legal PDF

- How To Electronic signature Alaska Legal Document

- Help Me With Electronic signature Arkansas Legal PDF

- How Can I Electronic signature Arkansas Legal Document

- How Can I Electronic signature California Legal PDF

- Can I Electronic signature Utah High Tech PDF

- How Do I Electronic signature Connecticut Legal Document

- How To Electronic signature Delaware Legal Document

- How Can I Electronic signature Georgia Legal Word

- How Do I Electronic signature Alaska Life Sciences Word

- How Can I Electronic signature Alabama Life Sciences Document

- How Do I Electronic signature Idaho Legal Form

- Help Me With Electronic signature Arizona Life Sciences PDF

- Can I Electronic signature Colorado Non-Profit Form

- How To Electronic signature Indiana Legal Form

- How To Electronic signature Illinois Non-Profit Document

- Can I Electronic signature Kentucky Legal Document

- Help Me With Electronic signature New Jersey Non-Profit PDF

- Can I Electronic signature New Jersey Non-Profit Document