Kansas K 120s Form 2020

What is the Kansas K-120s Form

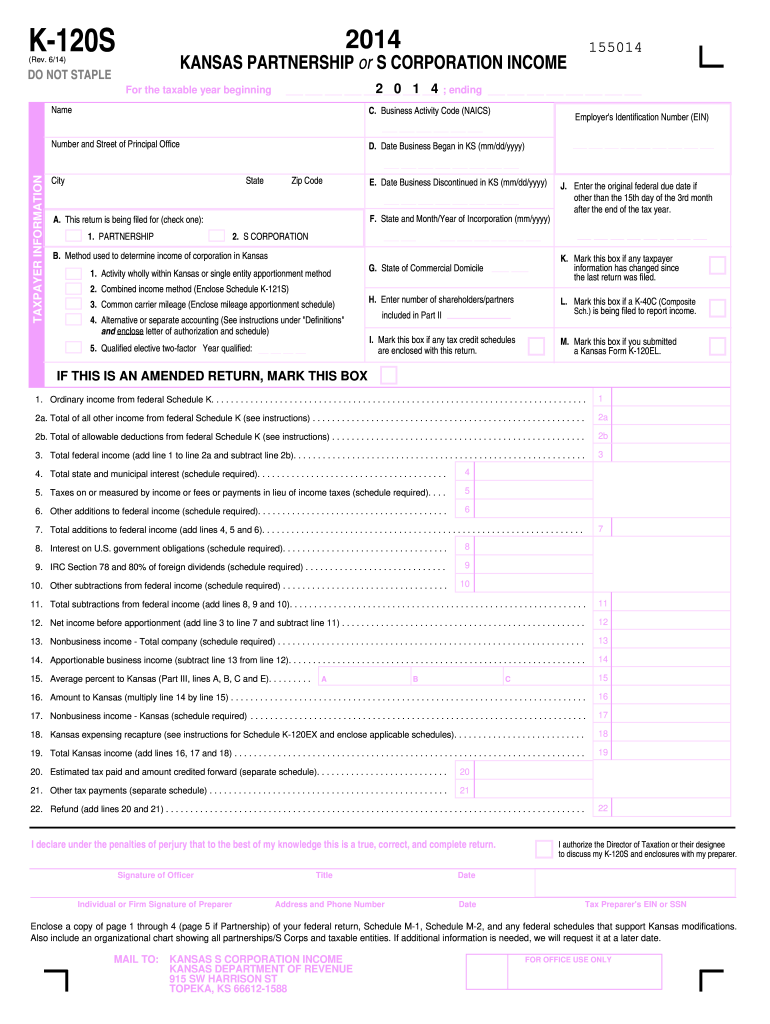

The Kansas K-120s Form is a tax document used by S corporations in the state of Kansas to report income, deductions, and credits. This form is essential for S corporations to comply with state tax regulations and ensure accurate reporting of their financial activities. It is specifically designed for entities that have elected to be taxed as S corporations under federal tax law, allowing them to pass income directly to shareholders without facing corporate income tax at the state level.

How to use the Kansas K-120s Form

To use the Kansas K-120s Form effectively, S corporations must gather all relevant financial information, including income, expenses, and any applicable tax credits. The form requires detailed reporting of the corporation's financial activities, which will be distributed to shareholders. Each shareholder will then report their share of the income on their individual tax returns. It is crucial to ensure that all information is accurate and complete to avoid potential penalties or delays in processing.

Steps to complete the Kansas K-120s Form

Completing the Kansas K-120s Form involves several key steps:

- Gather financial records, including income statements and expense reports.

- Fill out the form with accurate figures for total income, deductions, and credits.

- Distribute the necessary information to shareholders for their personal tax filings.

- Review the form for accuracy and completeness before submission.

- Submit the completed form to the Kansas Department of Revenue by the designated deadline.

Legal use of the Kansas K-120s Form

The Kansas K-120s Form is legally required for S corporations operating in Kansas. Proper completion and timely submission of this form ensure compliance with state tax laws. Failure to file the form or inaccuracies in reporting can result in penalties, interest on unpaid taxes, and other legal repercussions. Therefore, it is essential for corporations to adhere to all guidelines set forth by the Kansas Department of Revenue.

Filing Deadlines / Important Dates

It is important for S corporations to be aware of the filing deadlines associated with the Kansas K-120s Form. Generally, the form must be filed by the 15th day of the third month following the end of the corporation's tax year. For corporations operating on a calendar year basis, this typically means a deadline of March 15. Staying informed about these deadlines helps avoid late fees and ensures compliance with state regulations.

Who Issues the Form

The Kansas K-120s Form is issued by the Kansas Department of Revenue. This state agency is responsible for administering tax laws and ensuring compliance among businesses operating within Kansas. The form can be obtained directly from the department's website or through authorized tax professionals who assist businesses with their tax filings.

Quick guide on how to complete 2014 kansas k 120s form

Complete Kansas K 120s Form effortlessly on any device

Web-based document administration has become increasingly popular among businesses and individuals. It serves as an ideal environmentally friendly substitute for traditional printed and signed documents, allowing you to access the necessary form and securely keep it online. airSlate SignNow provides all the tools required to generate, revise, and electronically sign your documents promptly without hindrances. Manage Kansas K 120s Form on any platform with airSlate SignNow Android or iOS applications and simplify any document-related process today.

The easiest way to edit and electronically sign Kansas K 120s Form with ease

- Find Kansas K 120s Form and then click Get Form to begin.

- Use the tools we offer to complete your document.

- Highlight important sections of your documents or conceal sensitive information using tools that airSlate SignNow provides specifically for that purpose.

- Create your signature with the Sign feature, which takes moments and holds the same legal standing as a conventional wet ink signature.

- Review all the details and then click on the Done button to save your modifications.

- Choose how you wish to share your form, via email, text message (SMS), or invitation link, or download it to your computer.

Forget about lost or misplaced files, tedious form searches, or errors that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Edit and electronically sign Kansas K 120s Form and ensure excellent communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2014 kansas k 120s form

Create this form in 5 minutes!

How to create an eSignature for the 2014 kansas k 120s form

The best way to create an electronic signature for your PDF document in the online mode

The best way to create an electronic signature for your PDF document in Chrome

How to make an electronic signature for putting it on PDFs in Gmail

The way to generate an electronic signature right from your mobile device

The way to create an electronic signature for a PDF document on iOS devices

The way to generate an electronic signature for a PDF on Android devices

People also ask

-

What is the Kansas K 120s Form and why is it important?

The Kansas K 120s Form is a crucial tax document that businesses in Kansas must complete to report income and pay taxes accurately. It helps ensure compliance with state tax regulations. Understanding how to correctly fill out this form can save your business time and avoid penalties.

-

How can airSlate SignNow assist with the Kansas K 120s Form?

airSlate SignNow provides a seamless platform for electronically signing and sending your Kansas K 120s Form, making the process faster and more efficient. With our solution, you can fill out, eSign, and submit your forms from anywhere. This reduces paperwork and enhances how you manage important tax documents.

-

Is airSlate SignNow cost-effective for handling the Kansas K 120s Form?

Yes, airSlate SignNow offers a cost-effective solution for managing the Kansas K 120s Form. With our competitive pricing plans, you can access features that streamline document handling without breaking the bank. This allows you to focus on your core business operations while we take care of your documentation needs.

-

What features does airSlate SignNow offer for the Kansas K 120s Form?

airSlate SignNow provides a range of features specifically designed for handling the Kansas K 120s Form, including customizable templates, reusable signature fields, and comprehensive tracking options. These features ensure that you can complete and manage your forms efficiently. Our user-friendly interface simplifies the eSigning process.

-

Can I integrate airSlate SignNow with other tools for the Kansas K 120s Form?

Absolutely! airSlate SignNow easily integrates with various business applications, enhancing your ability to manage the Kansas K 120s Form within your existing workflows. This allows you to connect with accounting software and CRM systems to streamline data transfer. Such integrations help you maintain accuracy and efficiency.

-

What are the benefits of using airSlate SignNow for the Kansas K 120s Form?

Using airSlate SignNow for the Kansas K 120s Form offers numerous benefits, such as increased efficiency, reduced paper usage, and improved accuracy. The platform also provides the ability to store documents securely and access them anytime. Plus, eSigning boosts the speed of processing forms, allowing for timely tax submissions.

-

Is the Kansas K 120s Form submission through airSlate SignNow legally valid?

Yes, submissions of the Kansas K 120s Form through airSlate SignNow are legally valid. Our eSignature solution complies with the Electronic Signatures in Global and National Commerce (ESIGN) Act, ensuring that your electronically signed forms meet all legal requirements. This means your documents are both secure and recognized by regulatory authorities.

Get more for Kansas K 120s Form

- Family of origin worksheet pdf form

- Work and power worksheet form

- Combining like terms matching activity pdf form

- Ibgard samples form

- Ice form i 220a 8 15 en espaol

- Florida automobile insurance identification card form

- Searchoffice of the new york state comptroller ny gov form

- Modelo de interposicin de form

Find out other Kansas K 120s Form

- eSignature North Carolina Legal Cease And Desist Letter Safe

- How Can I eSignature Ohio Legal Stock Certificate

- How To eSignature Pennsylvania Legal Cease And Desist Letter

- eSignature Oregon Legal Lease Agreement Template Later

- Can I eSignature Oregon Legal Limited Power Of Attorney

- eSignature South Dakota Legal Limited Power Of Attorney Now

- eSignature Texas Legal Affidavit Of Heirship Easy

- eSignature Utah Legal Promissory Note Template Free

- eSignature Louisiana Lawers Living Will Free

- eSignature Louisiana Lawers Last Will And Testament Now

- How To eSignature West Virginia Legal Quitclaim Deed

- eSignature West Virginia Legal Lease Agreement Template Online

- eSignature West Virginia Legal Medical History Online

- eSignature Maine Lawers Last Will And Testament Free

- eSignature Alabama Non-Profit Living Will Free

- eSignature Wyoming Legal Executive Summary Template Myself

- eSignature Alabama Non-Profit Lease Agreement Template Computer

- eSignature Arkansas Life Sciences LLC Operating Agreement Mobile

- eSignature California Life Sciences Contract Safe

- eSignature California Non-Profit LLC Operating Agreement Fast