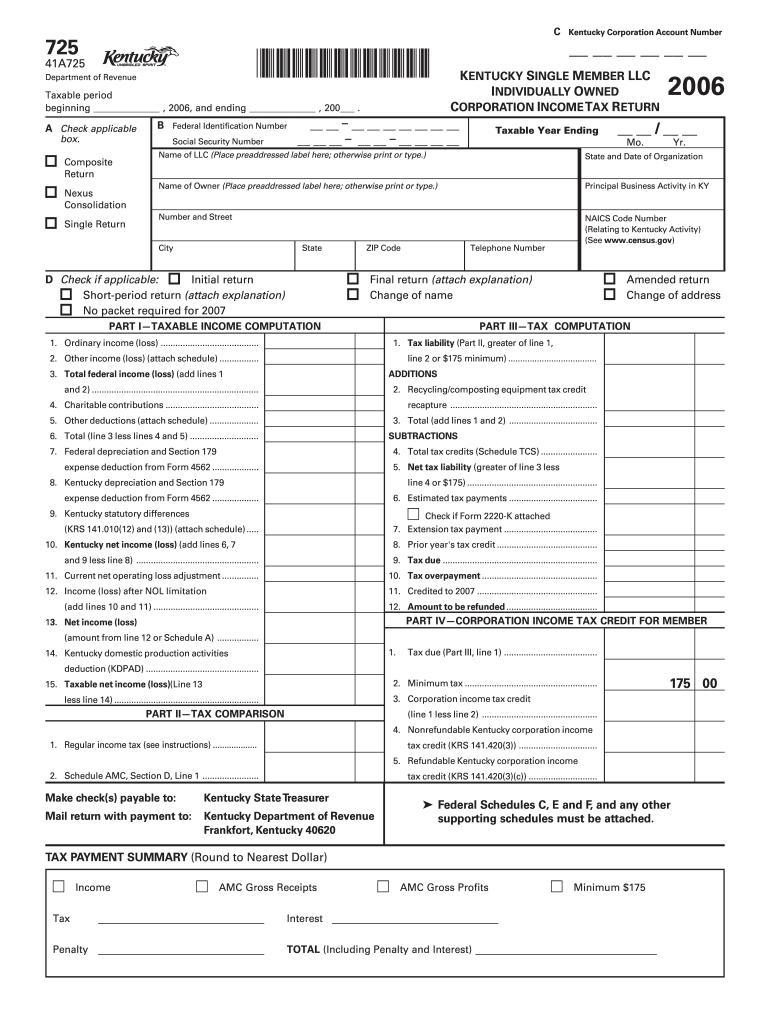

Form 725 Instructions 2016

What is the Form 725 Instructions

The Form 725 Instructions provide detailed guidance on how to complete and submit Form 725, which is typically used for specific tax-related purposes in the United States. This form is essential for individuals and businesses to report certain financial information to the Internal Revenue Service (IRS). The instructions outline the necessary steps and requirements to ensure accurate and compliant submission.

Steps to complete the Form 725 Instructions

Completing the Form 725 requires careful attention to detail. Here are the key steps involved:

- Gather all necessary financial documents and information relevant to the form.

- Review the Form 725 Instructions thoroughly to understand the requirements.

- Fill out the form accurately, ensuring all fields are completed as directed.

- Double-check your entries for any errors or omissions.

- Sign and date the form as required.

- Submit the form according to the specified submission methods.

How to obtain the Form 725 Instructions

The Form 725 Instructions can be obtained directly from the IRS website or through authorized tax preparation services. It is important to ensure that you are using the most current version of the instructions to comply with any recent updates or changes in tax regulations.

Legal use of the Form 725 Instructions

The legal use of the Form 725 Instructions is crucial for ensuring compliance with U.S. tax laws. Properly following these instructions helps to avoid penalties and ensures that your submitted information is valid. It is essential to adhere to the guidelines provided to maintain legal standing and fulfill your tax obligations.

Filing Deadlines / Important Dates

Filing deadlines for Form 725 can vary based on individual circumstances, such as whether you are filing as an individual or a business. It is important to be aware of these deadlines to avoid late fees or penalties. Typically, deadlines align with the annual tax filing schedule, so staying informed about these dates is essential for timely submission.

Form Submission Methods (Online / Mail / In-Person)

Form 725 can be submitted through various methods, including online filing, mailing a paper form, or submitting it in person at designated IRS offices. Each method has its own requirements and processing times, so it is advisable to choose the method that best suits your needs and ensures timely processing of your submission.

Key elements of the Form 725 Instructions

The key elements of the Form 725 Instructions include detailed descriptions of each section of the form, guidance on required documentation, and specific instructions for different filing scenarios. Understanding these elements is vital for accurate completion and compliance with IRS regulations.

Quick guide on how to complete form 725 instructions 2006

Complete Form 725 Instructions effortlessly on any device

Managing documents online has gained popularity among businesses and individuals alike. It offers an ideal environmentally friendly alternative to conventional printed and signed documents, allowing you to find the necessary form and securely store it online. airSlate SignNow equips you with all the features required to create, modify, and eSign your documents swiftly without delays. Manage Form 725 Instructions on any device using airSlate SignNow's Android or iOS applications and enhance any document-driven process today.

How to modify and eSign Form 725 Instructions with ease

- Find Form 725 Instructions and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Mark important sections of the documents or obscure sensitive information with the tools provided by airSlate SignNow specifically for this purpose.

- Create your signature using the Sign tool, which takes moments and carries the same legal validity as a conventional wet ink signature.

- Review all the information and click on the Done button to save your changes.

- Choose your preferred method for submitting your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate concerns over lost or misplaced documents, tedious form searches, or errors that require printing new copies. airSlate SignNow satisfies all your document management needs in just a few clicks from any device you choose. Modify and eSign Form 725 Instructions to ensure exceptional communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 725 instructions 2006

Create this form in 5 minutes!

How to create an eSignature for the form 725 instructions 2006

The best way to make an electronic signature for a PDF file online

The best way to make an electronic signature for a PDF file in Google Chrome

The best way to create an electronic signature for signing PDFs in Gmail

How to create an electronic signature from your mobile device

How to generate an eSignature for a PDF file on iOS

How to create an electronic signature for a PDF file on Android devices

People also ask

-

What are the Form 725 Instructions?

The Form 725 Instructions provide detailed guidance on how to complete and submit the form correctly. Understanding these instructions is essential as they outline the requirements, necessary documentation, and steps to ensure your submission is accepted without delays. With airSlate SignNow, you can easily eSign and submit important documents like Form 725.

-

How can airSlate SignNow assist with completing Form 725 Instructions?

airSlate SignNow simplifies the process of adhering to Form 725 Instructions by offering an intuitive interface for document preparation and eSigning. You can create, edit, and send documents directly through our platform, ensuring all details align with the Form 725 requirements. Our tool helps eliminate errors, making compliance easier for businesses.

-

Is there a cost associated with using airSlate SignNow for Form 725 Instructions?

Yes, there are subscription plans available for airSlate SignNow that cater to various business needs, offering a cost-effective solution for document management. Each plan provides access to features that assist with completing processes like the Form 725 Instructions. You can easily choose a plan that fits your budget while ensuring you meet all form requirements.

-

What features does airSlate SignNow offer for effectively managing Form 725 Instructions?

airSlate SignNow includes features such as document creation, customizable templates, and an easy-to-use eSigning functionality that streamline the management of Form 725 Instructions. These tools enable users to fill, sign, and distribute documents efficiently. Additionally, our integration capabilities allow seamless connectivity with other applications you may use.

-

Can airSlate SignNow integrate with other software I use for handling Form 725 Instructions?

Absolutely! airSlate SignNow offers robust integrations with various software platforms, enhancing your workflow while managing Form 725 Instructions. This allows you to combine our eSigning capabilities with tools you already utilize, making processes more efficient and straightforward for your team.

-

What are the main benefits of using airSlate SignNow for Form 725 Instructions?

Using airSlate SignNow for Form 725 Instructions ensures a faster, error-free submission process. Our platform enhances collaboration by allowing multiple users to eSign and review documents in real time. By automating administrative tasks, businesses can focus on their core activities while maintaining compliance with the Form 725 requirements.

-

How secure is my information when using airSlate SignNow for Form 725 Instructions?

airSlate SignNow prioritizes the security of your information when managing documents related to Form 725 Instructions. Our solution employs advanced security protocols, including data encryption and secure hosting, to protect your sensitive data. You can trust that your documents and information are handled with the utmost care and confidentiality.

Get more for Form 725 Instructions

- Area and perimeter in the coordinate plane problems worksheet answers pdf form

- Blue cross blue shield centennial form

- Kiwa logbook form

- Soonerride mileage reimbursement form 419471496

- Tupperware form

- Hoa approval letter template 485813598 form

- Do the mlo license endorsement requirements apply to form

- California real estate broker license endorsement mortgage nationwidelicensingsystem form

Find out other Form 725 Instructions

- eSignature Pennsylvania Plumbing Business Plan Template Safe

- eSignature Florida Real Estate Quitclaim Deed Online

- eSignature Arizona Sports Moving Checklist Now

- eSignature South Dakota Plumbing Emergency Contact Form Mobile

- eSignature South Dakota Plumbing Emergency Contact Form Safe

- Can I eSignature South Dakota Plumbing Emergency Contact Form

- eSignature Georgia Real Estate Affidavit Of Heirship Later

- eSignature Hawaii Real Estate Operating Agreement Online

- eSignature Idaho Real Estate Cease And Desist Letter Online

- eSignature Idaho Real Estate Cease And Desist Letter Simple

- eSignature Wyoming Plumbing Quitclaim Deed Myself

- eSignature Colorado Sports Living Will Mobile

- eSignature Iowa Real Estate Moving Checklist Simple

- eSignature Iowa Real Estate Quitclaim Deed Easy

- eSignature Real Estate Form Louisiana Simple

- eSignature Louisiana Real Estate LLC Operating Agreement Myself

- Can I eSignature Louisiana Real Estate Quitclaim Deed

- eSignature Hawaii Sports Living Will Safe

- eSignature Hawaii Sports LLC Operating Agreement Myself

- eSignature Maryland Real Estate Quitclaim Deed Secure