Kentucky Department of Revenue Form 725 2016

What is the Kentucky Department Of Revenue Form 725

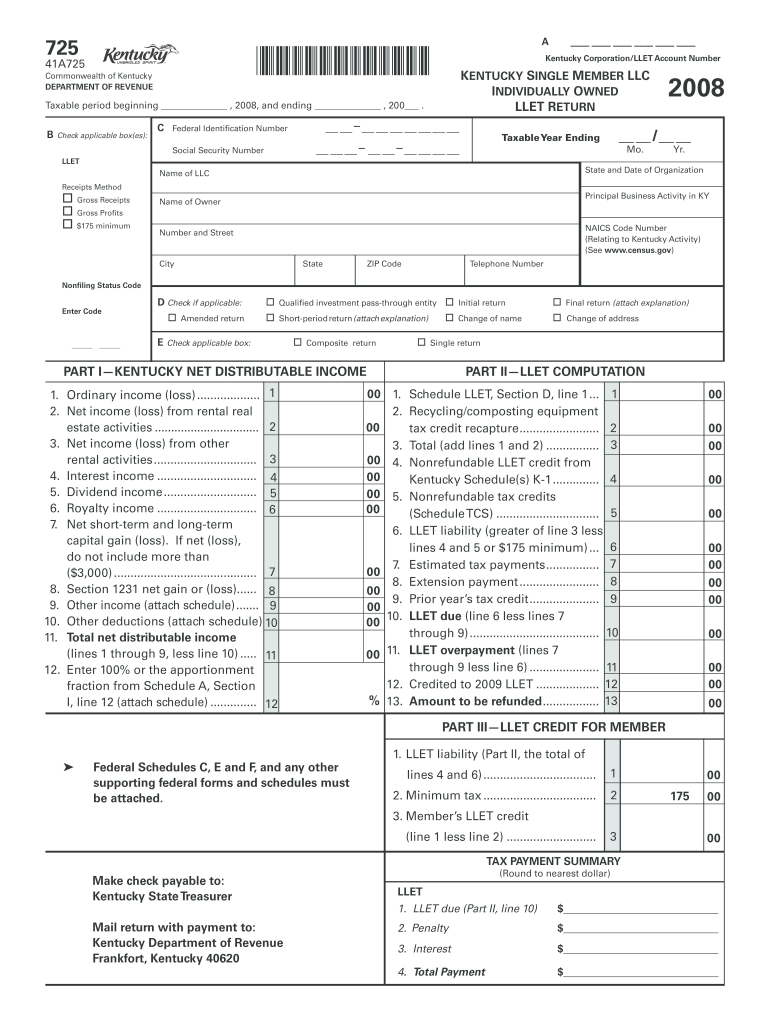

The Kentucky Department Of Revenue Form 725 is a tax form specifically designed for reporting income and calculating tax liabilities for certain business entities in Kentucky. This form is primarily used by corporations and limited liability companies (LLCs) to report their income, deductions, and credits. Understanding the purpose of Form 725 is essential for compliance with state tax regulations and ensuring accurate tax filings.

How to use the Kentucky Department Of Revenue Form 725

Using the Kentucky Department Of Revenue Form 725 involves several steps to ensure proper completion and submission. First, gather all necessary financial documents, including income statements and expense records. Next, accurately fill out each section of the form, ensuring that all figures are correct and reflect your business's financial situation. Once completed, review the form for any errors before submission to avoid potential penalties.

Steps to complete the Kentucky Department Of Revenue Form 725

Completing the Kentucky Department Of Revenue Form 725 requires attention to detail. Follow these steps:

- Begin by entering your business information, including the name, address, and tax identification number.

- Report your total income for the year in the designated section.

- List all allowable deductions, ensuring you have documentation to support each claim.

- Calculate your total tax liability based on the provided tax rates.

- Sign and date the form, verifying that all information is accurate and complete.

Legal use of the Kentucky Department Of Revenue Form 725

The legal use of the Kentucky Department Of Revenue Form 725 is governed by state tax laws. To ensure that your submission is legally binding, it is crucial to adhere to the guidelines set forth by the Kentucky Department of Revenue. This includes providing accurate information, meeting filing deadlines, and maintaining proper documentation to support your claims. Failure to comply with these regulations may result in penalties or legal repercussions.

Form Submission Methods

The Kentucky Department Of Revenue Form 725 can be submitted through various methods. Businesses may choose to file the form online through the Kentucky Department of Revenue's e-filing system, which offers a convenient and efficient way to submit tax documents. Alternatively, the form can be mailed to the appropriate address provided by the department or submitted in person at designated offices. Each method has its own set of guidelines, so it is important to follow the instructions carefully.

Required Documents

When completing the Kentucky Department Of Revenue Form 725, certain documents are required to support your submission. These may include:

- Financial statements, including profit and loss statements.

- Records of all business expenses and deductions.

- Previous tax returns, if applicable.

- Any additional documentation that may be required by the Kentucky Department of Revenue.

Quick guide on how to complete kentucky department of revenue form 725 2008

Complete Kentucky Department Of Revenue Form 725 seamlessly on any device

Digital document management has surged in popularity among businesses and individuals alike. It offers an ideal eco-friendly substitute to conventional printed and signed paperwork, as you can access the right form and securely save it online. airSlate SignNow provides you with all the tools necessary to create, modify, and electronically sign your documents swiftly without delays. Handle Kentucky Department Of Revenue Form 725 on any device using airSlate SignNow's Android or iOS applications and streamline any document-centric process today.

The easiest way to alter and eSign Kentucky Department Of Revenue Form 725 effortlessly

- Find Kentucky Department Of Revenue Form 725 and click Get Form to begin.

- Use the tools we offer to fill out your form.

- Emphasize important sections of the documents or redact sensitive information with tools that airSlate SignNow specifically supplies for that purpose.

- Create your eSignature using the Sign tool, which only takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your modifications.

- Decide how you wish to share your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate the worry of lost or overlooked documents, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you prefer. Modify and eSign Kentucky Department Of Revenue Form 725 and guarantee excellent communication at any stage of your form preparation with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct kentucky department of revenue form 725 2008

Create this form in 5 minutes!

How to create an eSignature for the kentucky department of revenue form 725 2008

The best way to make an electronic signature for your PDF online

The best way to make an electronic signature for your PDF in Google Chrome

The best way to generate an electronic signature for signing PDFs in Gmail

How to generate an eSignature right from your smartphone

How to generate an electronic signature for a PDF on iOS

How to generate an eSignature for a PDF on Android

People also ask

-

What is the Kentucky Department Of Revenue Form 725?

The Kentucky Department Of Revenue Form 725 is a vital document used for reporting and paying various taxes in Kentucky. This form is essential for businesses to ensure compliance with state tax laws and streamline the filing process.

-

How can airSlate SignNow help with the Kentucky Department Of Revenue Form 725?

airSlate SignNow simplifies the process of completing and eSigning the Kentucky Department Of Revenue Form 725. With our platform, you can easily fill out the form, gather necessary signatures, and send it securely, saving you time and ensuring accuracy.

-

What are the pricing plans for using airSlate SignNow to manage the Kentucky Department Of Revenue Form 725?

airSlate SignNow offers flexible pricing plans tailored to fit various business needs. By selecting a suitable plan, you can access features that assist in managing the Kentucky Department Of Revenue Form 725 efficiently, making it a cost-effective solution.

-

Can I integrate airSlate SignNow with other tools for managing the Kentucky Department Of Revenue Form 725?

Yes, airSlate SignNow integrates seamlessly with various applications and software commonly used in business. This ensures that submitting the Kentucky Department Of Revenue Form 725 becomes part of a larger workflow, enhancing productivity and collaboration.

-

What are the benefits of using airSlate SignNow for the Kentucky Department Of Revenue Form 725?

Using airSlate SignNow for the Kentucky Department Of Revenue Form 725 provides several benefits, including faster processing times and enhanced security. Automated features reduce the risk of errors, while eSignature capabilities allow for quick approvals from stakeholders.

-

Is airSlate SignNow compliant with state regulations for the Kentucky Department Of Revenue Form 725?

Absolutely! airSlate SignNow is designed to be compliant with all relevant state regulations, ensuring that the process of handling the Kentucky Department Of Revenue Form 725 adheres to legal standards. This gives you peace of mind knowing your documents are secure and valid.

-

How user-friendly is airSlate SignNow for completing the Kentucky Department Of Revenue Form 725?

airSlate SignNow offers an intuitive interface that makes completing the Kentucky Department Of Revenue Form 725 easy for users of all skill levels. Whether you're tech-savvy or a beginner, our platform guides you seamlessly through the process.

Get more for Kentucky Department Of Revenue Form 725

- List of household expenses template form

- Blank autopsy body diagram form

- Cobol coding sheet form

- Form 1417 community support program

- Nyc apparment rental agreement form

- Registration forms lake howell pop warner

- Articles of dissolution connecticut secretary of the state ct gov form

- Dbpr hr 7020 formfill out printable pdf forms online

Find out other Kentucky Department Of Revenue Form 725

- How To eSign West Virginia Courts Confidentiality Agreement

- eSign Wyoming Courts Quitclaim Deed Simple

- eSign Vermont Sports Stock Certificate Secure

- eSign Tennessee Police Cease And Desist Letter Now

- Help Me With eSign Texas Police Promissory Note Template

- eSign Utah Police LLC Operating Agreement Online

- eSign West Virginia Police Lease Agreement Online

- eSign Wyoming Sports Residential Lease Agreement Online

- How Do I eSign West Virginia Police Quitclaim Deed

- eSignature Arizona Banking Moving Checklist Secure

- eSignature California Banking Warranty Deed Later

- eSignature Alabama Business Operations Cease And Desist Letter Now

- How To eSignature Iowa Banking Quitclaim Deed

- How To eSignature Michigan Banking Job Description Template

- eSignature Missouri Banking IOU Simple

- eSignature Banking PDF New Hampshire Secure

- How Do I eSignature Alabama Car Dealer Quitclaim Deed

- eSignature Delaware Business Operations Forbearance Agreement Fast

- How To eSignature Ohio Banking Business Plan Template

- eSignature Georgia Business Operations Limited Power Of Attorney Online