Ct 3 S Form 2020

What is the Ct 3 S Form

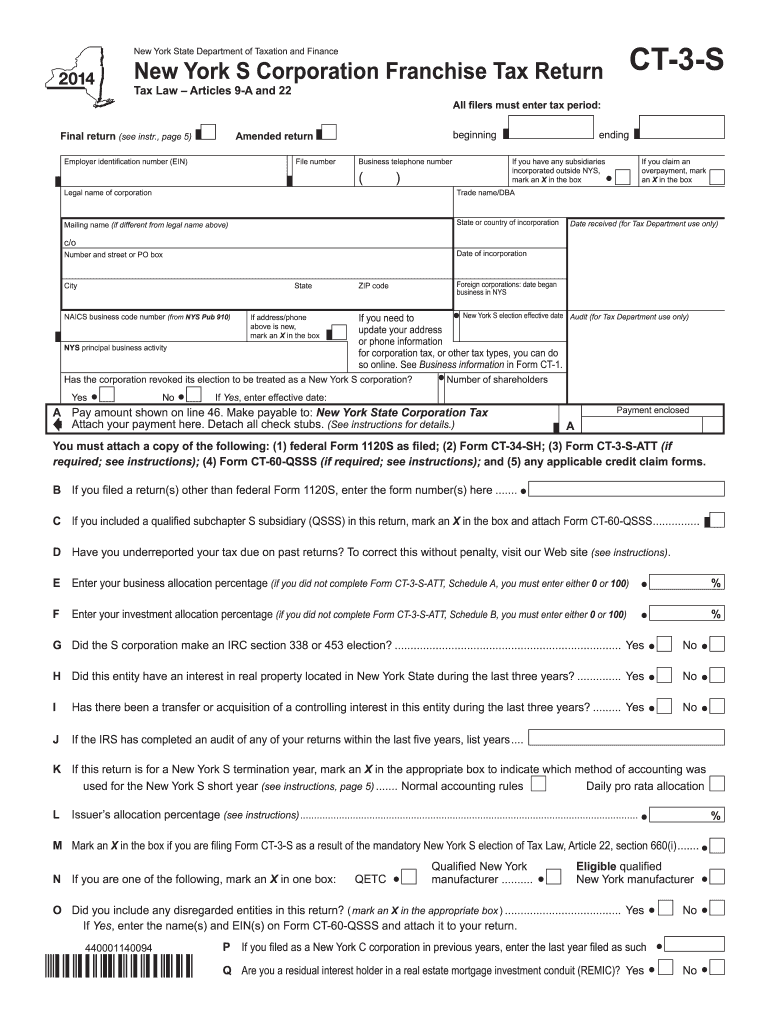

The Ct 3 S Form is a specific tax form used by corporations in the state of New York to report their income, gains, losses, and other tax-related information. This form is essential for corporations that are subject to the New York City General Corporation Tax. The Ct 3 S Form allows businesses to calculate their tax liability accurately, ensuring compliance with local tax laws. It is important for corporations to understand the purpose and requirements of this form to avoid penalties and ensure proper tax reporting.

How to use the Ct 3 S Form

Using the Ct 3 S Form involves several steps to ensure accurate completion and submission. First, gather all necessary financial documents, including income statements and balance sheets. Next, fill out the form with the required information, such as total income, deductions, and credits. Ensure that all calculations are correct to avoid discrepancies. Once completed, the form can be submitted electronically or via mail, depending on the preferences of the corporation. It is advisable to keep a copy of the submitted form for record-keeping purposes.

Steps to complete the Ct 3 S Form

Completing the Ct 3 S Form involves a systematic approach. Begin by entering the corporation's identifying information, including the name and Employer Identification Number (EIN). Then, report total income and allowable deductions, which are crucial for calculating the taxable income. Next, apply any relevant tax credits. After ensuring all sections are filled out accurately, review the form for any errors. Finally, sign and date the form before submission. It is essential to adhere to the specific guidelines provided by the New York City Department of Finance to ensure compliance.

Legal use of the Ct 3 S Form

The Ct 3 S Form has legal significance as it is used to report a corporation's tax obligations to the state of New York. Properly completing and submitting this form ensures that the corporation complies with local tax laws, thus avoiding potential legal issues or penalties. The information provided on the form must be accurate and truthful, as any discrepancies can lead to audits or legal repercussions. Corporations are encouraged to consult tax professionals to ensure that they meet all legal requirements associated with the Ct 3 S Form.

Filing Deadlines / Important Dates

Filing deadlines for the Ct 3 S Form are critical for compliance. Typically, the form must be submitted on or before the fifteenth day of the fourth month following the end of the corporation's fiscal year. For corporations operating on a calendar year, this means the deadline is April 15. It is important to be aware of any changes in deadlines or extensions that may be applicable. Missing the filing deadline can result in penalties, so corporations should mark these dates on their calendars and prepare their forms in advance.

Form Submission Methods

The Ct 3 S Form can be submitted through various methods to accommodate different preferences. Corporations can choose to file electronically via the New York City Department of Finance's online portal, which offers a streamlined process and immediate confirmation of receipt. Alternatively, the form can be mailed to the appropriate address provided by the department. In-person submissions may also be possible, but it is advisable to check current policies regarding in-person services. Each submission method has its own advantages, and corporations should select the one that best suits their needs.

Quick guide on how to complete ct 3 s 2014 form

Complete Ct 3 S Form effortlessly on any gadget

Online document management has gained traction among businesses and individuals alike. It offers an ideal eco-friendly alternative to traditional printed and signed papers, allowing you to find the required form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents quickly without delays. Manage Ct 3 S Form on any platform using airSlate SignNow's Android or iOS applications and simplify any document-related process today.

How to modify and eSign Ct 3 S Form with ease

- Locate Ct 3 S Form and then click Get Form to begin.

- Utilize the tools provided to finalize your form.

- Emphasize pertinent sections of the documents or obscure sensitive details with tools specifically designed for that purpose by airSlate SignNow.

- Create your eSignature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and then hit the Done button to save your changes.

- Choose how you want to share your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Forget about lost or misplaced documents, laborious form searches, or mistakes that necessitate the printing of new document copies. airSlate SignNow addresses your requirements in document management with just a few clicks from any device of your choice. Edit and eSign Ct 3 S Form to ensure stellar communication at every stage of the form completion process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct ct 3 s 2014 form

Create this form in 5 minutes!

How to create an eSignature for the ct 3 s 2014 form

The way to generate an electronic signature for your PDF in the online mode

The way to generate an electronic signature for your PDF in Chrome

The way to generate an electronic signature for putting it on PDFs in Gmail

The best way to create an electronic signature from your smart phone

The best way to make an electronic signature for a PDF on iOS devices

The best way to create an electronic signature for a PDF file on Android OS

People also ask

-

What is the Ct 3 S Form?

The Ct 3 S Form is a simplified version of the New York City corporate tax return designed for small businesses. It streamlines the filing process and allows for easier reporting of income, deductions, and credits. Using airSlate SignNow can help you electronically sign and send this form quickly.

-

How can airSlate SignNow assist with the Ct 3 S Form?

airSlate SignNow provides a secure platform to electronically sign and manage the Ct 3 S Form. Our user-friendly interface allows businesses to prepare and submit this form efficiently, ensuring compliance with New York City tax regulations. You can save time and reduce errors with our integrated features.

-

Is there a cost associated with using airSlate SignNow for the Ct 3 S Form?

Yes, there is a pricing structure for using airSlate SignNow based on your business needs. We offer various plans that cater to different user requirements, ensuring you find a cost-effective solution for managing your Ct 3 S Form. Visit our pricing page for detailed information.

-

What are the key features of airSlate SignNow relevant to the Ct 3 S Form?

Key features of airSlate SignNow include document templates, electronic signatures, and secure cloud storage, all designed to facilitate the completion of the Ct 3 S Form. Additionally, our platform supports real-time collaboration, making it easier for teams to work together on tax documentation.

-

What benefits can I expect from using airSlate SignNow for the Ct 3 S Form?

Using airSlate SignNow for the Ct 3 S Form streamlines the filing process, enhances accuracy, and ensures compliance with tax regulations. The ability to sign documents electronically speeds up turnaround times while maintaining high data security standards. Overall, it simplifies tax preparation for small businesses.

-

Can I integrate airSlate SignNow with other software for handling the Ct 3 S Form?

Absolutely! airSlate SignNow offers integrations with various accounting and document management software. These integrations help you manage the Ct 3 S Form more efficiently by allowing seamless data transfer and storage, ensuring that all your necessary documentation is in one place.

-

How does airSlate SignNow ensure the security of my Ct 3 S Form?

airSlate SignNow ensures the security of your Ct 3 S Form through advanced encryption and compliance with industry standards. Our platform offers secure document storage and user authentication processes to protect sensitive information. You can sign and manage your forms with confidence.

Get more for Ct 3 S Form

Find out other Ct 3 S Form

- Help Me With Sign Arizona Banking Document

- How Do I Sign Arizona Banking Form

- How Can I Sign Arizona Banking Form

- How Can I Sign Arizona Banking Form

- Can I Sign Colorado Banking PPT

- How Do I Sign Idaho Banking Presentation

- Can I Sign Indiana Banking Document

- How Can I Sign Indiana Banking PPT

- How To Sign Maine Banking PPT

- Help Me With Sign Massachusetts Banking Presentation

- Can I Sign Michigan Banking PDF

- Can I Sign Michigan Banking PDF

- Help Me With Sign Minnesota Banking Word

- How To Sign Missouri Banking Form

- Help Me With Sign New Jersey Banking PDF

- How Can I Sign New Jersey Banking Document

- Help Me With Sign New Mexico Banking Word

- Help Me With Sign New Mexico Banking Document

- How Do I Sign New Mexico Banking Form

- How To Sign New Mexico Banking Presentation