Ny Ct 3 Instructions Form 2020

What is the Ny Ct 3 Instructions Form

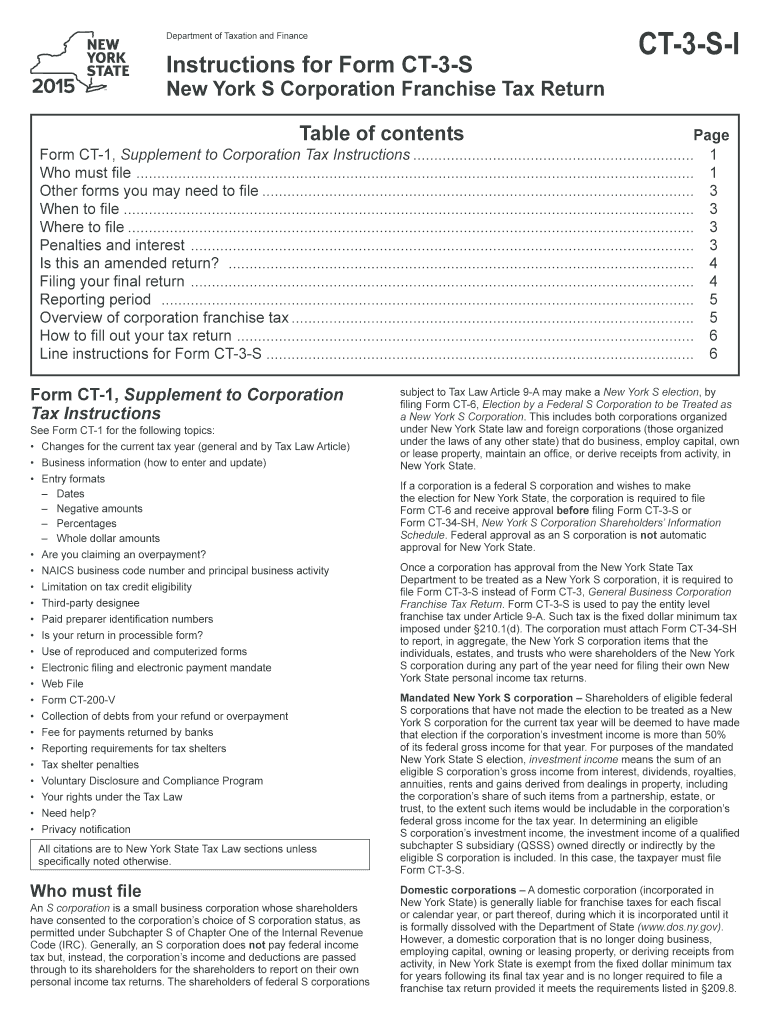

The Ny Ct 3 Instructions Form is a crucial document used for filing corporate taxes in New York State. It provides detailed guidance on how corporations should report their income, deductions, and credits to the New York State Department of Taxation and Finance. This form is essential for ensuring compliance with state tax laws and helps businesses accurately calculate their tax liabilities. Understanding the nuances of this form is vital for corporations operating within New York, as it dictates the necessary information required for proper tax reporting.

How to use the Ny Ct 3 Instructions Form

Using the Ny Ct 3 Instructions Form involves several steps that guide corporations through the tax filing process. First, businesses must gather all relevant financial documents, including income statements and expense records. Next, the form must be completed accurately, ensuring that all required fields are filled in. Corporations should refer to the instructions provided within the form to avoid common mistakes. After completing the form, it can be submitted electronically or via mail, depending on the preferences and capabilities of the business. Ensuring that the form is filled out correctly is crucial for avoiding penalties and ensuring compliance with state tax regulations.

Steps to complete the Ny Ct 3 Instructions Form

Completing the Ny Ct 3 Instructions Form involves a systematic approach:

- Gather necessary financial records, including income and expense statements.

- Review the form's instructions to understand the required information.

- Fill out the form, ensuring accuracy in all entries.

- Double-check for any errors or omissions.

- Submit the completed form electronically or by mail, as preferred.

Following these steps carefully will help ensure that the filing process is smooth and compliant with New York State tax laws.

Legal use of the Ny Ct 3 Instructions Form

The Ny Ct 3 Instructions Form is legally binding when completed and submitted in accordance with New York State tax laws. It is important for corporations to ensure that all information provided is truthful and accurate, as any discrepancies can lead to legal consequences, including audits or penalties. The form must be signed by an authorized representative of the corporation, which further solidifies its legal standing. Understanding the legal implications of this form is essential for maintaining compliance and avoiding potential legal issues.

Filing Deadlines / Important Dates

Corporations must be aware of specific filing deadlines associated with the Ny Ct 3 Instructions Form to avoid penalties. Typically, the form is due on the fifteenth day of the third month following the end of the corporation's fiscal year. For corporations operating on a calendar year, this means the form is generally due by March 15. It is crucial to stay informed about any changes to these deadlines, as they can vary based on specific circumstances or legislative updates.

Required Documents

To successfully complete the Ny Ct 3 Instructions Form, corporations must have several key documents on hand. These include:

- Income statements detailing revenue and other income sources.

- Expense records, including operating expenses and deductions.

- Previous tax returns for reference and consistency.

- Any relevant financial statements that support the information reported on the form.

Having these documents readily available will facilitate a smoother completion process and help ensure accuracy in reporting.

Form Submission Methods (Online / Mail / In-Person)

The Ny Ct 3 Instructions Form can be submitted through various methods, providing flexibility for corporations. Businesses may choose to file online through the New York State Department of Taxation and Finance's electronic filing system, which is often the quickest method. Alternatively, the form can be mailed to the appropriate tax office, ensuring that it is sent well before the deadline to avoid late penalties. In-person submissions may also be possible, depending on the specific requirements of the local tax office. Understanding these submission options can help corporations choose the most convenient and efficient method for their needs.

Quick guide on how to complete ny ct 3 instructions 2015 form

Complete Ny Ct 3 Instructions Form effortlessly on any device

Online document management has gained popularity among businesses and individuals. It offers an excellent eco-friendly substitute for traditional printed and signed documents, allowing you to obtain the correct form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents swiftly without any delays. Manage Ny Ct 3 Instructions Form on any device using airSlate SignNow’s Android or iOS applications and enhance any document-related process today.

How to modify and eSign Ny Ct 3 Instructions Form easily

- Find Ny Ct 3 Instructions Form and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Highlight pertinent sections of the documents or redact sensitive information with the tools that airSlate SignNow supplies specifically for that purpose.

- Create your signature using the Sign tool, which only takes seconds and holds the same legal validity as a traditional handwritten signature.

- Review the information and click on the Done button to save your changes.

- Select how you wish to share your form, whether by email, SMS, invitation link, or download it to your computer.

Say goodbye to lost or mislaid files, tedious form searching, or errors that require printing new document copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device you prefer. Modify and eSign Ny Ct 3 Instructions Form to ensure outstanding communication throughout the entire form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct ny ct 3 instructions 2015 form

Create this form in 5 minutes!

How to create an eSignature for the ny ct 3 instructions 2015 form

The way to generate an electronic signature for your PDF document in the online mode

The way to generate an electronic signature for your PDF document in Chrome

The way to make an electronic signature for putting it on PDFs in Gmail

The best way to create an electronic signature straight from your mobile device

The best way to make an electronic signature for a PDF document on iOS devices

The best way to create an electronic signature for a PDF document on Android devices

People also ask

-

What is the Ny Ct 3 Instructions Form?

The Ny Ct 3 Instructions Form is a document that provides guidance on the completion of the New York State CT-3 tax return for corporations. It helps businesses understand the requirements and procedures needed to successfully file their taxes. Following the Ny Ct 3 Instructions Form can ensure compliance and avoid potential penalties.

-

How does airSlate SignNow assist with the Ny Ct 3 Instructions Form?

airSlate SignNow allows businesses to electronically sign and send the Ny Ct 3 Instructions Form quickly and securely. Our platform simplifies the document management process, making it easier to complete and submit important forms like the Ny Ct 3. This not only saves time but also enhances efficiency in managing corporate paperwork.

-

Is there a cost associated with using airSlate SignNow for the Ny Ct 3 Instructions Form?

Yes, airSlate SignNow offers a range of pricing plans designed to fit different business needs. Each plan includes features that can help streamline the process for completing and eSigning the Ny Ct 3 Instructions Form. You can choose a plan that best suits your requirements and budget.

-

What features are available for the Ny Ct 3 Instructions Form on airSlate SignNow?

airSlate SignNow provides several features for managing the Ny Ct 3 Instructions Form, including comprehensive eSigning, document templates, and cloud storage. These features help users collaborate more effectively and ensure that all necessary signatures are collected efficiently. Additionally, tracking and notifications keep users updated on document status.

-

Are there any benefits to using airSlate SignNow for the Ny Ct 3 Instructions Form?

Utilizing airSlate SignNow for the Ny Ct 3 Instructions Form offers signNow benefits such as enhanced security, faster turnaround times, and improved accuracy. With our platform, you can minimize errors and ensure that your forms are completed correctly. This ultimately helps in streamlining compliance with state tax regulations.

-

Can I integrate airSlate SignNow with other software for the Ny Ct 3 Instructions Form?

Absolutely! airSlate SignNow supports integrations with various software applications to facilitate easier management of documents like the Ny Ct 3 Instructions Form. By connecting with your existing tools, you can automate workflows and enhance productivity while handling your tax documents.

-

Is airSlate SignNow easy to use for submitting the Ny Ct 3 Instructions Form?

Yes, airSlate SignNow is designed with user-friendliness in mind, making it simple to submit the Ny Ct 3 Instructions Form. Our intuitive interface allows even those without technical expertise to navigate the platform easily. The straightforward process ensures that you can complete and submit your forms with minimal hassle.

Get more for Ny Ct 3 Instructions Form

- Linear function word problems independent practice worksheet answers form

- Brevard county sewer credit form

- Motion for reconsideration sample form

- Mga agos sa disyerto graphic organizer form

- Foreigner physical examination form pdf

- Rebut individual justificatiu del pagament de salaris form

- Lump sum promissory note form

- Tc 94 192 form

Find out other Ny Ct 3 Instructions Form

- How Can I Sign Alabama Personal loan contract template

- Can I Sign Arizona Personal loan contract template

- How To Sign Arkansas Personal loan contract template

- Sign Colorado Personal loan contract template Mobile

- How Do I Sign Florida Personal loan contract template

- Sign Hawaii Personal loan contract template Safe

- Sign Montana Personal loan contract template Free

- Sign New Mexico Personal loan contract template Myself

- Sign Vermont Real estate contracts Safe

- Can I Sign West Virginia Personal loan contract template

- How Do I Sign Hawaii Real estate sales contract template

- Sign Kentucky New hire forms Myself

- Sign Alabama New hire packet Online

- How Can I Sign California Verification of employment form

- Sign Indiana Home rental application Online

- Sign Idaho Rental application Free

- Sign South Carolina Rental lease application Online

- Sign Arizona Standard rental application Now

- Sign Indiana Real estate document Free

- How To Sign Wisconsin Real estate document