Ct 34sh Form 2020

What is the Ct 34sh Form

The Ct 34sh Form is a specific document used in the state of Connecticut, primarily for the purpose of reporting and calculating the income tax for individuals and businesses. This form is essential for taxpayers who need to provide accurate information regarding their income, deductions, and tax credits to ensure compliance with state tax laws. Understanding the purpose of the Ct 34sh Form is crucial for anyone filing taxes in Connecticut, as it helps determine the amount of tax owed or the refund due.

How to obtain the Ct 34sh Form

To obtain the Ct 34sh Form, individuals can visit the official Connecticut Department of Revenue Services website. The form is available for download in PDF format, which allows for easy printing and completion. Additionally, taxpayers can request a physical copy of the form by contacting the Department of Revenue Services directly. It is advisable to ensure you have the most current version of the form, as tax regulations may change annually.

Steps to complete the Ct 34sh Form

Completing the Ct 34sh Form involves several key steps:

- Gather necessary documentation, including income statements, W-2 forms, and any relevant deductions.

- Fill out personal information, including your name, address, and Social Security number.

- Report all sources of income accurately, ensuring that all figures match your documentation.

- Calculate deductions and credits applicable to your situation, following the guidelines provided with the form.

- Review the completed form for accuracy before signing and dating it.

Taking these steps carefully can help ensure that your tax return is accurate and complete.

Legal use of the Ct 34sh Form

The Ct 34sh Form is legally binding and must be completed in accordance with Connecticut tax laws. It is important to ensure that all information provided is truthful and accurate, as any discrepancies can lead to penalties or audits. The form serves as an official record of your income and tax obligations, making it essential for compliance with state regulations. Taxpayers are encouraged to keep copies of submitted forms for their records.

Form Submission Methods

The Ct 34sh Form can be submitted through various methods to accommodate different preferences:

- Online Submission: Taxpayers can file electronically through the Connecticut Department of Revenue Services website, which offers a streamlined process.

- Mail: Completed forms can be mailed to the designated address provided on the form. Ensure that postage is affixed and that the form is sent well before any deadlines.

- In-Person: Individuals may also submit the form in person at local Department of Revenue Services offices, which can be beneficial for those seeking immediate assistance.

Key elements of the Ct 34sh Form

Understanding the key elements of the Ct 34sh Form is essential for accurate completion. The form typically includes sections for personal identification, income reporting, deductions, and tax credits. Each section is designed to capture specific information required by the state to assess tax liability. Additionally, there are instructions provided for each section, guiding taxpayers on how to fill out the form correctly. Familiarity with these elements can help prevent errors and ensure compliance.

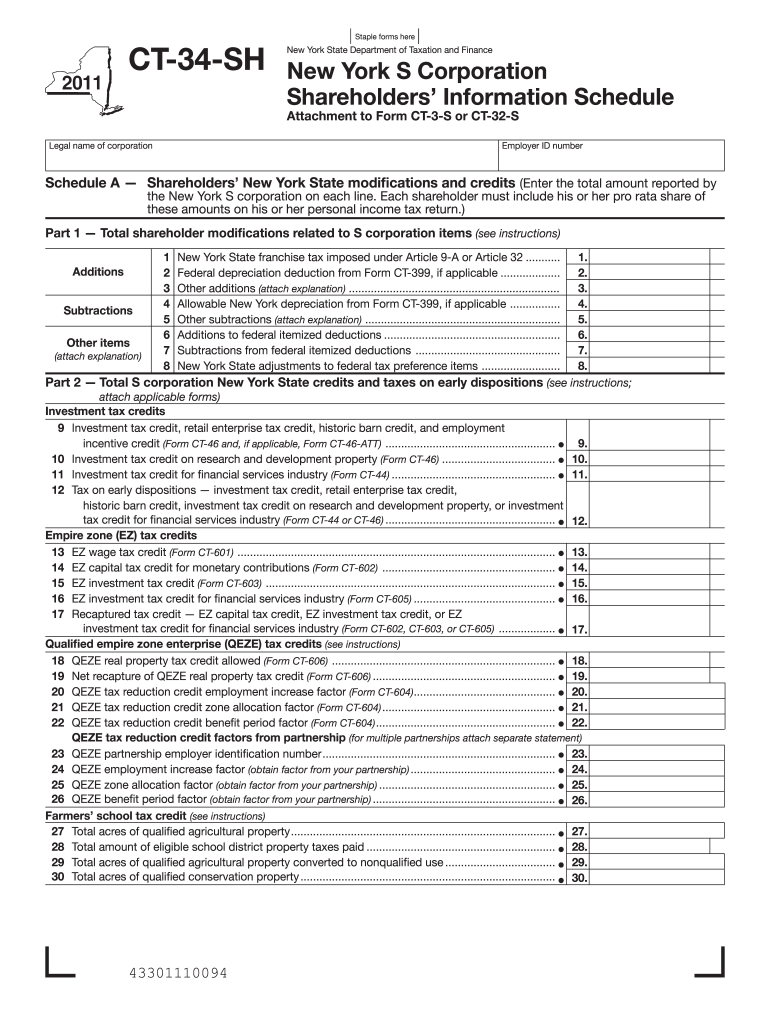

Quick guide on how to complete ct 2011 34sh form

Complete Ct 34sh Form seamlessly on any device

Online document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documentation, as you can access the necessary form and securely store it online. airSlate SignNow equips you with all the tools you need to create, modify, and eSign your documents promptly without delays. Manage Ct 34sh Form on any platform using airSlate SignNow Android or iOS applications and enhance any document-centric process today.

How to modify and eSign Ct 34sh Form effortlessly

- Obtain Ct 34sh Form and click Get Form to begin.

- Use the tools we provide to fill out your document.

- Emphasize relevant sections of your documents or obscure sensitive data with tools specifically offered by airSlate SignNow for that purpose.

- Generate your eSignature using the Sign tool, which takes seconds and holds the same legal validity as a traditional ink signature.

- Review the information and click on the Done button to save your changes.

- Choose how you wish to send your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Forget about lost or misplaced files, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow addresses all your document administration needs in just a few clicks from any device you prefer. Modify and eSign Ct 34sh Form and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct ct 2011 34sh form

Create this form in 5 minutes!

How to create an eSignature for the ct 2011 34sh form

The way to generate an eSignature for your PDF in the online mode

The way to generate an eSignature for your PDF in Chrome

How to generate an electronic signature for putting it on PDFs in Gmail

The best way to generate an eSignature straight from your smart phone

The way to create an electronic signature for a PDF on iOS devices

The best way to generate an eSignature for a PDF document on Android OS

People also ask

-

What is the Ct 34sh Form and how is it used?

The Ct 34sh Form is a tax document used in Connecticut for businesses to report their income and expenses. It is crucial for accurate tax reporting and helps ensure compliance with state tax regulations. By understanding how to fill out the Ct 34sh Form, businesses can avoid potential penalties.

-

How can airSlate SignNow help with signing the Ct 34sh Form?

airSlate SignNow provides an efficient platform for electronically signing the Ct 34sh Form, enabling businesses to streamline their document workflows. With its user-friendly interface, you can easily invite others to sign, ensuring that all necessary signatures are collected promptly. This saves time and enhances document security.

-

What are the pricing options for using airSlate SignNow for the Ct 34sh Form?

airSlate SignNow offers various pricing plans to accommodate different business needs, making it affordable for all sizes. The plans include features specifically tailored for managing and signing documents like the Ct 34sh Form. You can choose a plan that fits your budget while ensuring you have all the necessary tools.

-

What features does airSlate SignNow offer for managing the Ct 34sh Form?

airSlate SignNow includes several features that facilitate the effective management of the Ct 34sh Form, such as customizable templates, automated reminders, and a secure cloud storage option. These features help you to organize, track, and authenticate your documents efficiently. You'll find that managing the Ct 34sh Form is straightforward and hassle-free.

-

Is it safe to sign the Ct 34sh Form using airSlate SignNow?

Absolutely! airSlate SignNow employs advanced security measures, such as encryption and secure storage, to protect your sensitive data when signing the Ct 34sh Form. This ensures that your documents remain confidential and tamper-proof. You're in safe hands with airSlate SignNow for all your signing needs.

-

Can I integrate airSlate SignNow with other software for handling the Ct 34sh Form?

Yes, airSlate SignNow offers seamless integrations with various software applications, allowing you to link directly to tools you already use for managing the Ct 34sh Form. Whether it's accounting software or project management tools, these integrations enhance your workflow. You can easily streamline your document processes without any interruptions.

-

What are the benefits of using airSlate SignNow for the Ct 34sh Form over traditional methods?

Using airSlate SignNow for the Ct 34sh Form has several advantages, including reduced turnaround time, improved accuracy, and enhanced accessibility. Unlike traditional signing methods, electronic signatures are quick and can be completed from anywhere, making the process far more efficient. This allows you to focus on your business rather than paperwork.

Get more for Ct 34sh Form

- St peter chanel college gpa form

- New bookkeeping client intake form pdf 33996500

- Cardiovascular system worksheet pdf form

- Home health aide care plan pdf form

- Msf 4201 form

- Indiana driving skills test checklist form

- Chase voice authorization denial code 606 form

- Applying for benefits new york state comptroller form

Find out other Ct 34sh Form

- How To eSignature Iowa Doctors Business Letter Template

- Help Me With eSignature Indiana Doctors Notice To Quit

- eSignature Ohio Education Purchase Order Template Easy

- eSignature South Dakota Education Confidentiality Agreement Later

- eSignature South Carolina Education Executive Summary Template Easy

- eSignature Michigan Doctors Living Will Simple

- How Do I eSignature Michigan Doctors LLC Operating Agreement

- How To eSignature Vermont Education Residential Lease Agreement

- eSignature Alabama Finance & Tax Accounting Quitclaim Deed Easy

- eSignature West Virginia Education Quitclaim Deed Fast

- eSignature Washington Education Lease Agreement Form Later

- eSignature Missouri Doctors Residential Lease Agreement Fast

- eSignature Wyoming Education Quitclaim Deed Easy

- eSignature Alaska Government Agreement Fast

- How Can I eSignature Arizona Government POA

- How Do I eSignature Nevada Doctors Lease Agreement Template

- Help Me With eSignature Nevada Doctors Lease Agreement Template

- How Can I eSignature Nevada Doctors Lease Agreement Template

- eSignature Finance & Tax Accounting Presentation Arkansas Secure

- eSignature Arkansas Government Affidavit Of Heirship Online