New York Consolidated Laws, Tax Law TAX 663NY State Senate 2021

What is the New York Consolidated Laws, Tax Law TAX 663NY State Senate

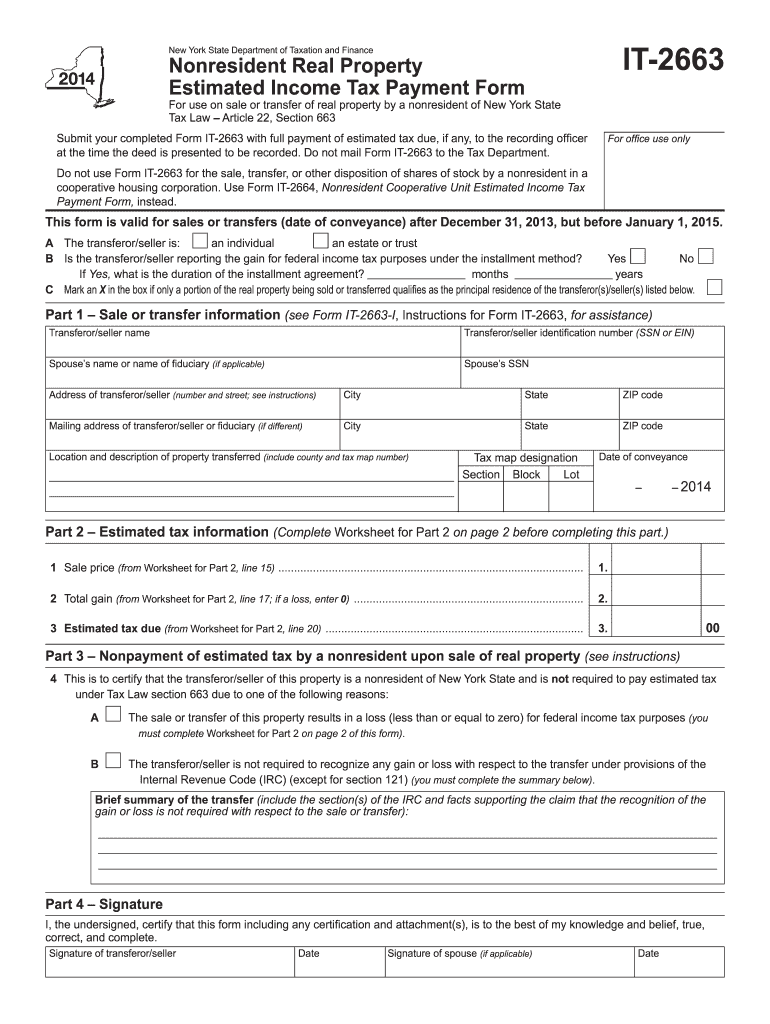

The New York Consolidated Laws, Tax Law TAX 663NY State Senate outlines specific provisions related to taxation in New York State. This law is part of a larger framework that governs how taxes are assessed, collected, and enforced within the state. It includes regulations that affect both individuals and businesses, detailing various tax obligations and rights. Understanding this law is crucial for compliance and effective tax planning.

How to use the New York Consolidated Laws, Tax Law TAX 663NY State Senate

Utilizing the New York Consolidated Laws, Tax Law TAX 663NY State Senate involves familiarizing yourself with its provisions and applying them to your specific tax situation. Taxpayers should review the relevant sections to determine their obligations, including filing requirements and payment deadlines. It is advisable to consult with a tax professional to ensure accurate interpretation and application of the law to your circumstances.

Steps to complete the New York Consolidated Laws, Tax Law TAX 663NY State Senate

Completing the requirements set forth by the New York Consolidated Laws, Tax Law TAX 663NY State Senate involves several key steps:

- Identify the applicable tax categories under the law.

- Gather necessary documentation, such as income statements and deductions.

- Complete the required forms accurately, ensuring all information is current and correct.

- Submit the forms by the designated deadlines, either electronically or via mail.

Key elements of the New York Consolidated Laws, Tax Law TAX 663NY State Senate

Key elements of the New York Consolidated Laws, Tax Law TAX 663NY State Senate include:

- Definitions of taxable income and allowable deductions.

- Tax rates applicable to various income brackets.

- Filing requirements for different taxpayer categories.

- Penalties for non-compliance with tax obligations.

Legal use of the New York Consolidated Laws, Tax Law TAX 663NY State Senate

The legal use of the New York Consolidated Laws, Tax Law TAX 663NY State Senate ensures that taxpayers comply with state tax regulations. This law provides the legal framework for tax assessments, appeals, and enforcement actions. Taxpayers must adhere to the stipulations outlined in the law to avoid penalties and ensure their rights are protected during tax processes.

Filing Deadlines / Important Dates

Filing deadlines for the New York Consolidated Laws, Tax Law TAX 663NY State Senate are critical for compliance. Generally, individual income tax returns must be filed by April fifteenth each year. Businesses may have different deadlines depending on their structure and tax year. It is essential to keep track of these dates to avoid late fees and penalties.

Quick guide on how to complete new york consolidated laws tax law tax 663ny state senate

Effortlessly Prepare New York Consolidated Laws, Tax Law TAX 663NY State Senate on Any Device

The management of online documents has become increasingly popular among businesses and individuals. It offers an excellent environmentally friendly substitute for traditional printed and signed documents, as you can obtain the appropriate form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, edit, and eSign your documents quickly without delays. Handle New York Consolidated Laws, Tax Law TAX 663NY State Senate on any platform with the airSlate SignNow Android or iOS applications and enhance any document-centric process today.

How to Edit and eSign New York Consolidated Laws, Tax Law TAX 663NY State Senate with Ease

- Obtain New York Consolidated Laws, Tax Law TAX 663NY State Senate and click Get Form to begin.

- Make use of the tools provided to fill out your document.

- Highlight important sections of the documents or obscure sensitive data with tools that airSlate SignNow specifically offers for this purpose.

- Create your signature using the Sign feature, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click the Done button to save your changes.

- Select your preferred method of sending your form, whether by email, SMS, invitation link, or download it to your computer.

Put an end to lost or misplaced documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow meets all your document management needs with just a few clicks from any device you choose. Edit and eSign New York Consolidated Laws, Tax Law TAX 663NY State Senate to ensure excellent communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct new york consolidated laws tax law tax 663ny state senate

Create this form in 5 minutes!

How to create an eSignature for the new york consolidated laws tax law tax 663ny state senate

The way to make an eSignature for your PDF in the online mode

The way to make an eSignature for your PDF in Chrome

The way to generate an electronic signature for putting it on PDFs in Gmail

The best way to make an electronic signature from your smart phone

The way to make an electronic signature for a PDF on iOS devices

The best way to make an electronic signature for a PDF file on Android OS

People also ask

-

What is the significance of the New York Consolidated Laws, Tax Law TAX 663NY State Senate?

The New York Consolidated Laws, Tax Law TAX 663NY State Senate is crucial as it outlines the legal framework for tax obligations in New York. This law assists businesses in understanding their tax responsibilities, ensuring compliance, and avoiding penalties. By utilizing this law, businesses can effectively navigate the complexities of taxation in the state.

-

How can airSlate SignNow assist with compliance related to the New York Consolidated Laws, Tax Law TAX 663NY State Senate?

airSlate SignNow simplifies document management, helping businesses ensure compliance with the New York Consolidated Laws, Tax Law TAX 663NY State Senate. By allowing users to eSign documents securely and efficiently, it ensures that tax documents are processed and filed on time. This reduces the risk of non-compliance and potential legal issues.

-

What are the pricing options for airSlate SignNow, especially for businesses needing to comply with the New York Consolidated Laws, Tax Law TAX 663NY State Senate?

airSlate SignNow offers competitive pricing tailored for businesses of all sizes. Plans include essential features needed to comply with regulations like the New York Consolidated Laws, Tax Law TAX 663NY State Senate, ensuring affordability. Detailed pricing information can be found on our website, with options for monthly and annual subscriptions.

-

What features does airSlate SignNow offer that are beneficial for New York tax compliance?

airSlate SignNow provides features such as customizable templates, secure eSigning, and automated workflows, all crucial for complying with the New York Consolidated Laws, Tax Law TAX 663NY State Senate. These tools streamline the document process, ensuring taxes are filed correctly and promptly. User-friendly interfaces make it easy for businesses to manage their documentation effectively.

-

Can airSlate SignNow integrate with other software to help with tax document management?

Yes, airSlate SignNow offers integrations with various popular software applications, which can enhance tax document management in accordance with the New York Consolidated Laws, Tax Law TAX 663NY State Senate. This interoperability allows businesses to streamline their workflows and reduce the time spent on document preparation and filing. Check our integration options to see what fits your needs.

-

How does using airSlate SignNow improve the efficiency of tax document processing for New York businesses?

Using airSlate SignNow signNowly enhances the efficiency of tax document processing for New York businesses by providing a platform for quick eSigning and seamless document sharing. This efficiency is essential for compliance with regulations like the New York Consolidated Laws, Tax Law TAX 663NY State Senate. Businesses can save time and reduce the administrative burden associated with tax filings.

-

Is airSlate SignNow secure for handling sensitive tax documents related to the New York Consolidated Laws, Tax Law TAX 663NY State Senate?

Absolutely, airSlate SignNow prioritizes security for all document transactions, including sensitive tax documents linked to the New York Consolidated Laws, Tax Law TAX 663NY State Senate. With encryption and secure access controls, your documents are protected at all times. This focus on security ensures that businesses can confidently manage their tax-related paperwork.

Get more for New York Consolidated Laws, Tax Law TAX 663NY State Senate

Find out other New York Consolidated Laws, Tax Law TAX 663NY State Senate

- How To Sign Oregon High Tech Document

- How Do I Sign California Insurance PDF

- Help Me With Sign Wyoming High Tech Presentation

- How Do I Sign Florida Insurance PPT

- How To Sign Indiana Insurance Document

- Can I Sign Illinois Lawers Form

- How To Sign Indiana Lawers Document

- How To Sign Michigan Lawers Document

- How To Sign New Jersey Lawers PPT

- How Do I Sign Arkansas Legal Document

- How Can I Sign Connecticut Legal Document

- How Can I Sign Indiana Legal Form

- Can I Sign Iowa Legal Document

- How Can I Sign Nebraska Legal Document

- How To Sign Nevada Legal Document

- Can I Sign Nevada Legal Form

- How Do I Sign New Jersey Legal Word

- Help Me With Sign New York Legal Document

- How Do I Sign Texas Insurance Document

- How Do I Sign Oregon Legal PDF