Ct 3 S Fillable Form 2020

What is the Ct 3 S Fillable Form

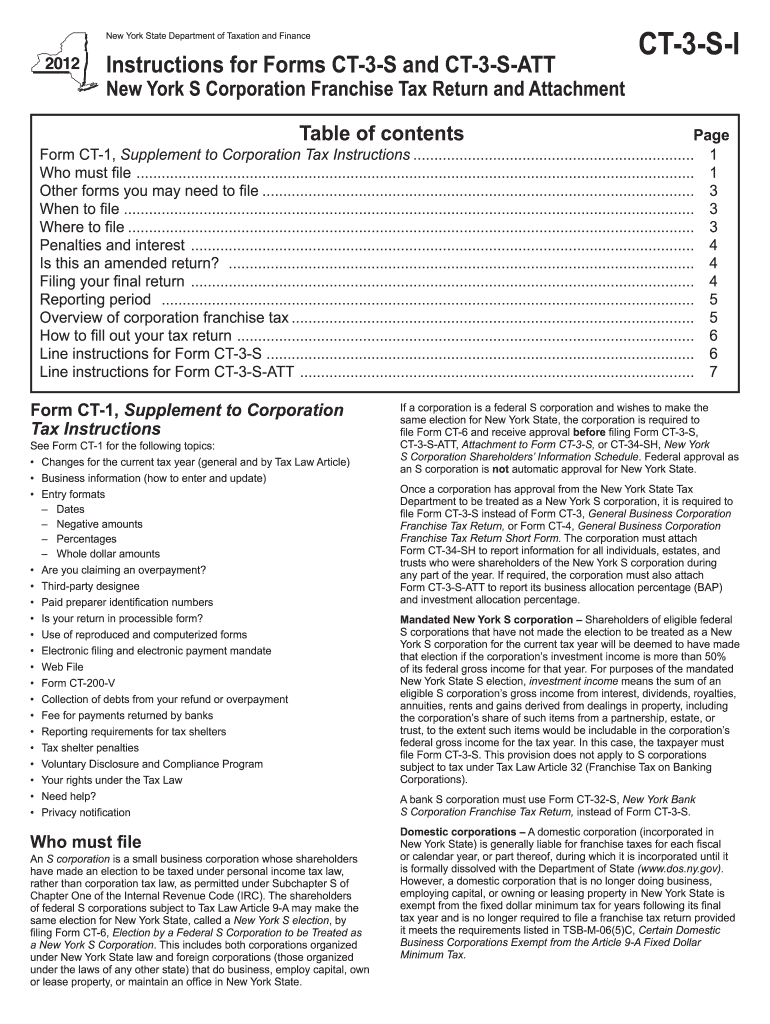

The Ct 3 S Fillable Form is a tax document used by certain business entities in the United States to report income, deductions, and credits to the state tax authority. This form is specifically designed for S corporations and is essential for ensuring compliance with state tax regulations. It allows businesses to detail their financial activities for a given tax year, providing necessary information to calculate tax liabilities accurately. By using a fillable format, users can complete the form electronically, making it easier to manage and submit.

How to use the Ct 3 S Fillable Form

Using the Ct 3 S Fillable Form involves several straightforward steps. First, download the form from a reliable source. Once you have the form, open it in a compatible PDF reader that supports fillable fields. Begin by entering your business information, including the name, address, and taxpayer identification number. Next, fill in the financial details required, such as income, deductions, and credits. Ensure that all entries are accurate and complete, as this will affect your tax calculations. After completing the form, review it for any errors before saving and submitting it according to the instructions provided.

Steps to complete the Ct 3 S Fillable Form

Completing the Ct 3 S Fillable Form can be broken down into a series of clear steps:

- Download the Ct 3 S Fillable Form from an official source.

- Open the form using a PDF reader that allows for filling out forms.

- Enter your business's identifying information in the designated fields.

- Input financial data, including total income, allowable deductions, and any credits applicable.

- Double-check all entries for accuracy and completeness.

- Save the completed form securely on your device.

- Submit the form as instructed, either electronically or via mail.

Legal use of the Ct 3 S Fillable Form

The legal use of the Ct 3 S Fillable Form is crucial for businesses to maintain compliance with state tax laws. When filled out correctly, this form serves as an official document that reports a business's financial activities to the tax authorities. It is important to ensure that the information provided is accurate and truthful, as any discrepancies can lead to penalties or audits. Additionally, the form must be submitted by the established deadlines to avoid late fees or other legal repercussions. Utilizing a reliable electronic signature solution can also enhance the form's legal standing.

Filing Deadlines / Important Dates

Filing deadlines for the Ct 3 S Fillable Form are critical to ensure compliance and avoid penalties. Typically, the form must be submitted by the due date of the business's tax return, which is usually the fifteenth day of the third month following the end of the tax year. For S corporations operating on a calendar year, this means the form is due by March 15. It is advisable to check for any state-specific variations in deadlines, as they may differ. Marking these dates on a calendar can help businesses stay organized and compliant.

Form Submission Methods (Online / Mail / In-Person)

The Ct 3 S Fillable Form can be submitted through various methods, depending on the requirements of the state tax authority. Common submission methods include:

- Online Submission: Many states allow electronic filing of the form through their tax portals, which can expedite processing.

- Mail: Businesses can print the completed form and send it via postal service to the designated tax office.

- In-Person: Some tax offices may accept forms submitted in person, providing an option for those who prefer direct interaction.

Quick guide on how to complete ct 3 s fillable 2012 form

Complete Ct 3 S Fillable Form effortlessly on any device

Digital document management has become increasingly popular among companies and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed paperwork, allowing you to locate the appropriate form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents swiftly without any delays. Manage Ct 3 S Fillable Form on any device with airSlate SignNow's Android or iOS applications and streamline any document-related process today.

How to modify and electronically sign Ct 3 S Fillable Form with ease

- Locate Ct 3 S Fillable Form and click Get Form to initiate the process.

- Utilize the tools we offer to fill out your document.

- Emphasize pertinent sections of the documents or obscure sensitive information with tools that airSlate SignNow specifically provides for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a traditional handwritten signature.

- Review the information and click on the Done button to save your modifications.

- Select your preferred method for delivering your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate the hassle of lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device you choose. Modify and eSign Ct 3 S Fillable Form and guarantee excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct ct 3 s fillable 2012 form

Create this form in 5 minutes!

How to create an eSignature for the ct 3 s fillable 2012 form

How to generate an eSignature for a PDF document in the online mode

How to generate an eSignature for a PDF document in Chrome

How to generate an eSignature for putting it on PDFs in Gmail

The way to make an eSignature from your mobile device

The best way to create an eSignature for a PDF document on iOS devices

The way to make an eSignature for a PDF file on Android devices

People also ask

-

What is the Ct 3 S Fillable Form?

The Ct 3 S Fillable Form is a digital document designed for New York City businesses to report their business income and apportion their income for tax purposes. It simplifies the filing process by allowing users to fill in their information electronically, ensuring accuracy and efficiency. With airSlate SignNow, you can easily create and manage this form to meet your tax obligations.

-

How can airSlate SignNow help with the Ct 3 S Fillable Form?

airSlate SignNow streamlines the completion of the Ct 3 S Fillable Form by providing user-friendly templates and electronic signature capabilities. You can fill out, send, and eSign the form quickly, avoiding manual errors and saving time. This means you can focus on your business while ensuring compliance with tax regulations.

-

Is there a cost associated with using the Ct 3 S Fillable Form through airSlate SignNow?

While airSlate SignNow offers various pricing plans, the cost for using the Ct 3 S Fillable Form depends on the specific features and level of service you choose. The platform provides cost-effective solutions tailored for businesses of all sizes. You can select a plan that best meets your needs and budget while benefiting from comprehensive document management features.

-

Can I integrate other tools with airSlate SignNow while using the Ct 3 S Fillable Form?

Yes, airSlate SignNow offers seamless integrations with various tools and applications to enhance your workflow when using the Ct 3 S Fillable Form. This includes integration with popular CRMs, cloud storage services, and other productivity applications. This versatility allows you to automate processes and improve efficiency in document management.

-

What are the benefits of using the Ct 3 S Fillable Form with airSlate SignNow?

Using the Ct 3 S Fillable Form with airSlate SignNow provides numerous benefits, including time savings, reduced paperwork, and improved accuracy. The digital format minimizes the chances of errors while enabling easy sharing and collaboration. Additionally, electronic signatures streamline the approval process, making tax filing straightforward and efficient.

-

Is it secure to use the Ct 3 S Fillable Form on airSlate SignNow?

Absolutely! airSlate SignNow prioritizes security, employing advanced encryption measures to protect your data while using the Ct 3 S Fillable Form. Your documents are stored safely, and all signatures are legally binding, ensuring your information remains confidential and secure throughout the process.

-

How can I access the Ct 3 S Fillable Form on airSlate SignNow?

You can easily access the Ct 3 S Fillable Form on airSlate SignNow by signing up for an account and navigating to the forms section. From there, you can choose the template, fill it out, and eSign it directly within the platform. The user-friendly interface makes it simple to get started, even for those new to digital forms.

Get more for Ct 3 S Fillable Form

- Daily reading comprehension grade 1 pdf form

- Va 4 form pdf fillable

- Diagnostic test 2 parts of speech answer key form

- Dcjs 2214 a form

- Criminal form 2 8 ori no at a term of the court county of order no at the courthouse at address state of new york nysid no cjtn

- Providing the students ssn to the school board of orange county florida for these purposes means that you consent to the use form

- Audit document request list template form

- Shawnee peak ski area programschool name multi we form

Find out other Ct 3 S Fillable Form

- eSign Oregon Government Business Plan Template Easy

- How Do I eSign Oklahoma Government Separation Agreement

- How Do I eSign Tennessee Healthcare / Medical Living Will

- eSign West Virginia Healthcare / Medical Forbearance Agreement Online

- eSign Alabama Insurance LLC Operating Agreement Easy

- How Can I eSign Alabama Insurance LLC Operating Agreement

- eSign Virginia Government POA Simple

- eSign Hawaii Lawers Rental Application Fast

- eSign Hawaii Lawers Cease And Desist Letter Later

- How To eSign Hawaii Lawers Cease And Desist Letter

- How Can I eSign Hawaii Lawers Cease And Desist Letter

- eSign Hawaii Lawers Cease And Desist Letter Free

- eSign Maine Lawers Resignation Letter Easy

- eSign Louisiana Lawers Last Will And Testament Mobile

- eSign Louisiana Lawers Limited Power Of Attorney Online

- eSign Delaware Insurance Work Order Later

- eSign Delaware Insurance Credit Memo Mobile

- eSign Insurance PPT Georgia Computer

- How Do I eSign Hawaii Insurance Operating Agreement

- eSign Hawaii Insurance Stock Certificate Free