Tax Form Et 706 2019

What is the Tax Form ET 706

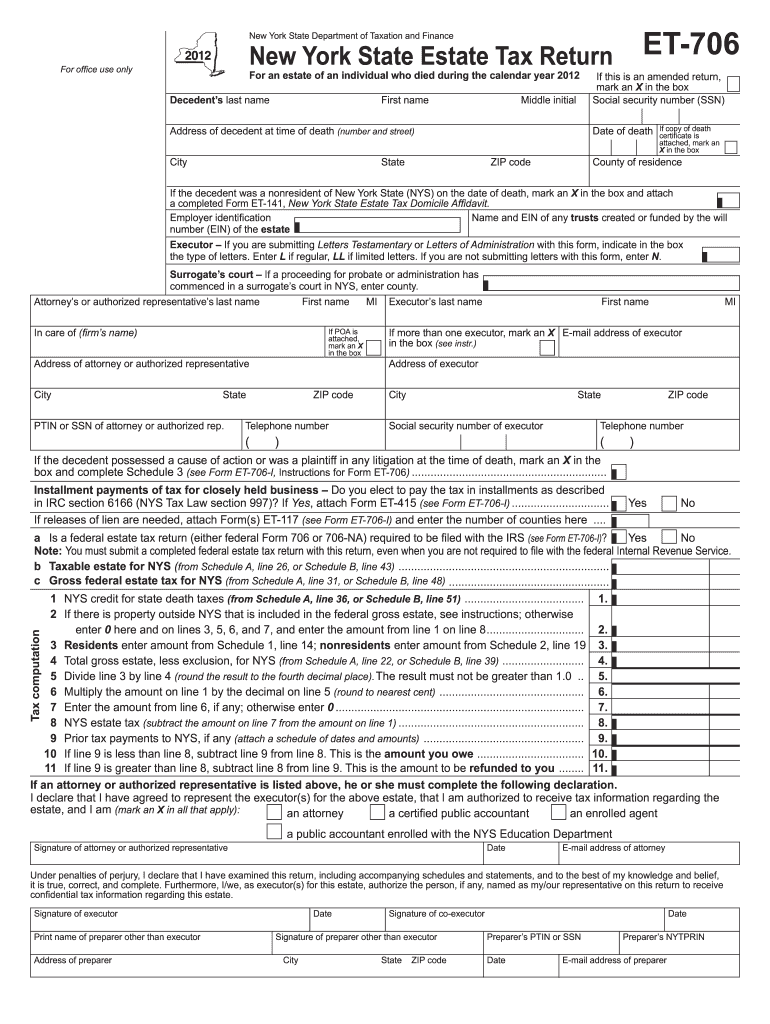

The Tax Form ET 706 is a federal estate tax return used in the United States to report the value of a deceased individual's estate. This form is required when the gross estate exceeds a specific threshold, which is subject to change based on tax laws. The ET 706 provides the Internal Revenue Service (IRS) with detailed information about the assets, liabilities, and deductions associated with the estate, ensuring compliance with federal tax obligations.

How to use the Tax Form ET 706

Using the Tax Form ET 706 involves several key steps. First, gather all necessary documentation related to the deceased's assets, including bank statements, property deeds, and investment records. Next, accurately complete the form by entering the required information about the estate's value and any applicable deductions. It is essential to review the form for accuracy before submission, as errors can lead to delays or penalties. Finally, submit the completed form to the IRS by the designated filing deadline.

Steps to complete the Tax Form ET 706

Completing the Tax Form ET 706 requires careful attention to detail. Follow these steps:

- Gather documentation: Collect all financial records, including real estate, bank accounts, and personal property valuations.

- Determine the gross estate value: Calculate the total value of all assets owned by the deceased at the time of death.

- Identify deductions: List any applicable deductions, such as debts, funeral expenses, and charitable contributions.

- Fill out the form: Enter the information into the ET 706, ensuring all sections are completed accurately.

- Review and sign: Double-check all entries for accuracy and completeness before signing the form.

- Submit the form: File the completed form with the IRS by the deadline, either electronically or by mail.

Legal use of the Tax Form ET 706

The legal use of the Tax Form ET 706 is crucial for ensuring that estates comply with federal tax laws. This form must be filed accurately and on time to avoid penalties. The IRS requires that the form be signed by the executor or administrator of the estate, affirming that the information provided is true and complete. Failure to file the form or inaccuracies in reporting can result in significant legal and financial consequences for the estate.

Filing Deadlines / Important Dates

Filing deadlines for the Tax Form ET 706 are critical for compliance. Generally, the form must be filed within nine months of the date of death. However, an extension may be requested, allowing for an additional six months to file. It is important to note that any tax owed must still be paid by the original deadline to avoid interest and penalties. Keeping track of these dates is essential for the timely handling of estate tax obligations.

Required Documents

To complete the Tax Form ET 706, several documents are necessary. These include:

- Death certificate of the deceased

- Valuations of all estate assets

- Records of debts and liabilities

- Documentation of any deductions claimed

- Previous tax returns, if applicable

Having these documents readily available will facilitate the accurate completion of the form and ensure compliance with IRS requirements.

Quick guide on how to complete tax form et 706 2011

Prepare Tax Form Et 706 effortlessly on any device

Internet-based document management has gained signNow traction among businesses and individuals. It serves as an ideal eco-friendly alternative to conventional printed and signed papers, allowing you to locate the correct form and securely save it online. airSlate SignNow provides all the necessary tools to create, modify, and eSign your documents quickly and without delays. Manage Tax Form Et 706 on any platform using airSlate SignNow's Android or iOS applications and enhance any document-centered task today.

The simplest way to modify and eSign Tax Form Et 706 with ease

- Locate Tax Form Et 706 and then click Get Form to initiate the process.

- Utilize the tools we offer to fill out your document.

- Emphasize necessary parts of your files or obscure sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your eSignature with the Sign tool, which takes just seconds and holds the same legal weight as a traditional wet ink signature.

- Review the information and click the Done button to save your modifications.

- Choose your preferred method for sending your form: via email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misfiled documents, tedious form searches, or mistakes that require new document prints. airSlate SignNow meets your document management needs with just a few clicks from any device you choose. Modify and eSign Tax Form Et 706 and ensure outstanding communication at every step of the form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct tax form et 706 2011

Create this form in 5 minutes!

How to create an eSignature for the tax form et 706 2011

How to generate an eSignature for your PDF file in the online mode

How to generate an eSignature for your PDF file in Chrome

How to make an eSignature for putting it on PDFs in Gmail

The way to make an electronic signature right from your smartphone

The best way to create an electronic signature for a PDF file on iOS devices

The way to make an electronic signature for a PDF on Android

People also ask

-

What is Tax Form Et 706?

Tax Form Et 706 is the United States estate tax return used to report the estate's value and calculate any taxes owed. It is essential for executors to complete this form when the gross estate exceeds the federal exemption limit. Understanding Tax Form Et 706 helps ensure compliance with tax regulations.

-

How can airSlate SignNow help in preparing Tax Form Et 706?

airSlate SignNow provides a seamless platform for preparing and eSigning Tax Form Et 706. Users can easily upload their documents, fill out necessary fields, and send the forms for electronic signatures. This streamlines the process signNowly, ensuring that you can submit your Tax Form Et 706 efficiently.

-

What features does airSlate SignNow offer for Tax Form Et 706?

airSlate SignNow offers features like custom templates, secure document storage, and audit trails that are ideal for managing Tax Form Et 706. Additionally, users can track the status of their documents in real time, ensuring that all steps are captured accurately for your tax submission.

-

Is airSlate SignNow cost-effective for managing Tax Form Et 706?

Yes, airSlate SignNow is a cost-effective solution for managing Tax Form Et 706. With various pricing plans tailored to the needs of different users, businesses can choose a plan that fits their budget while benefiting from the efficiency and reliability of the platform.

-

Can I integrate airSlate SignNow with other tools when working with Tax Form Et 706?

Absolutely! airSlate SignNow offers integrations with numerous tools and applications, allowing for a streamlined workflow when dealing with Tax Form Et 706. Whether it's connecting with accounting software or CRM systems, integrations help simplify the entire process.

-

What are the benefits of using airSlate SignNow for Tax Form Et 706 submissions?

Using airSlate SignNow for Tax Form Et 706 submissions enhances efficiency, reduces paperwork, and ensures compliance with tax regulations. The easy-to-use interface and robust features like eSignatures provide peace of mind while managing sensitive tax documents.

-

Is training available for using airSlate SignNow with Tax Form Et 706?

Yes, airSlate SignNow provides comprehensive resources and training materials to help users understand how to effectively manage Tax Form Et 706. These resources are designed to empower users and ensure they can make the most out of the platform for their tax filings.

Get more for Tax Form Et 706

Find out other Tax Form Et 706

- Sign Maine Construction Business Letter Template Secure

- Can I Sign Louisiana Construction Letter Of Intent

- How Can I Sign Maryland Construction Business Plan Template

- Can I Sign Maryland Construction Quitclaim Deed

- Sign Minnesota Construction Business Plan Template Mobile

- Sign Construction PPT Mississippi Myself

- Sign North Carolina Construction Affidavit Of Heirship Later

- Sign Oregon Construction Emergency Contact Form Easy

- Sign Rhode Island Construction Business Plan Template Myself

- Sign Vermont Construction Rental Lease Agreement Safe

- Sign Utah Construction Cease And Desist Letter Computer

- Help Me With Sign Utah Construction Cease And Desist Letter

- Sign Wisconsin Construction Purchase Order Template Simple

- Sign Arkansas Doctors LLC Operating Agreement Free

- Sign California Doctors Lease Termination Letter Online

- Sign Iowa Doctors LLC Operating Agreement Online

- Sign Illinois Doctors Affidavit Of Heirship Secure

- Sign Maryland Doctors Quitclaim Deed Later

- How Can I Sign Maryland Doctors Quitclaim Deed

- Can I Sign Missouri Doctors Last Will And Testament