Cr Q1 Form 2020

What is the Cr Q1 Form

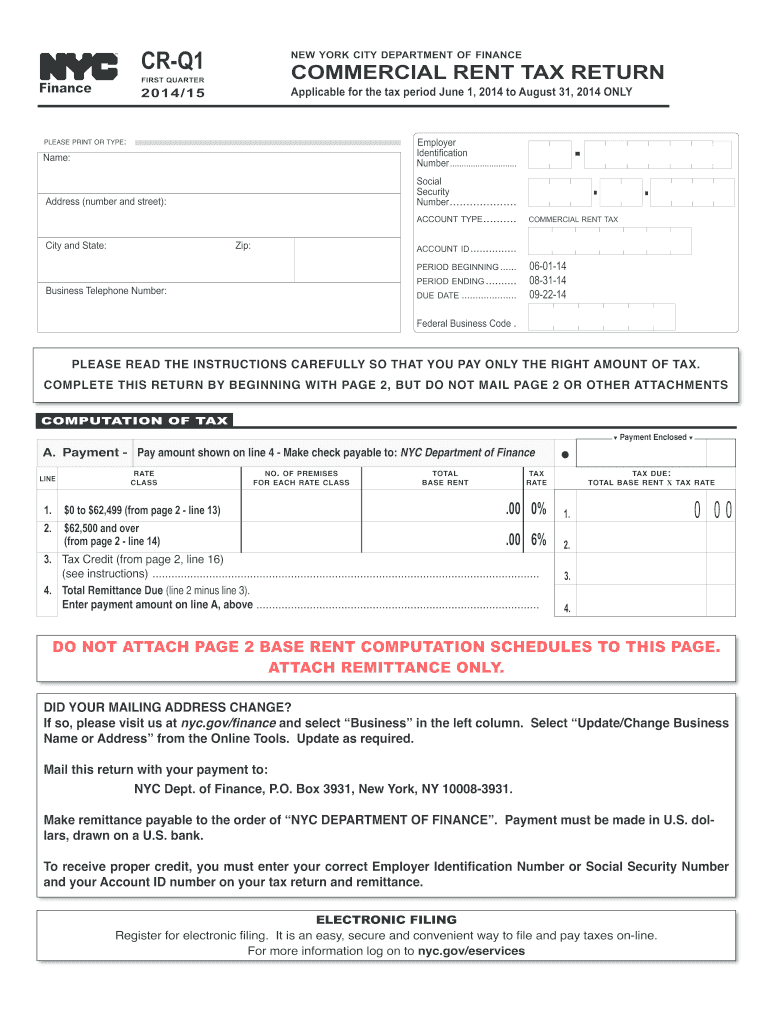

The Cr Q1 Form is a specific document used primarily for tax purposes in the United States. It is designed to report certain financial information to the Internal Revenue Service (IRS). This form is typically utilized by businesses and individuals who need to disclose income, deductions, and credits for a particular quarter. Understanding the purpose and requirements of the Cr Q1 Form is essential for compliance with federal tax regulations.

How to use the Cr Q1 Form

Using the Cr Q1 Form involves several steps to ensure accurate completion and submission. First, gather all necessary financial documents, including income statements and expense records for the reporting period. Next, fill out the form with the required information, ensuring that all figures are accurate and reflect your financial activities. After completing the form, review it for any errors before submitting it to the IRS by the designated deadline. Utilizing digital tools can simplify this process, allowing for easy editing and eSigning.

Steps to complete the Cr Q1 Form

Completing the Cr Q1 Form can be straightforward if you follow these steps:

- Gather documentation: Collect all relevant financial records, including income and expenses.

- Fill out the form: Enter your financial data accurately in the designated fields.

- Review for accuracy: Double-check all entries to ensure there are no mistakes.

- Sign the form: Use a reliable eSignature solution to sign the document digitally.

- Submit the form: Send the completed form to the IRS by the specified deadline, either electronically or by mail.

Legal use of the Cr Q1 Form

The legal use of the Cr Q1 Form is governed by IRS regulations, which stipulate the requirements for tax reporting. To ensure that the form is legally binding, it must be completed accurately and submitted on time. Additionally, using electronic signatures through a compliant platform can enhance the form's legal validity. Compliance with the Electronic Signatures in Global and National Commerce (ESIGN) Act and other relevant laws is crucial for the acceptance of electronically signed documents.

Filing Deadlines / Important Dates

Filing deadlines for the Cr Q1 Form are critical to avoid penalties. Typically, the form must be submitted within a specific timeframe following the end of each quarter. For example, the deadline for the first quarter is usually set for April 15. It is essential to check the IRS website or consult with a tax professional for the most current deadlines, as they may vary based on specific circumstances or changes in tax law.

Form Submission Methods (Online / Mail / In-Person)

The Cr Q1 Form can be submitted through various methods, providing flexibility for taxpayers. The most common submission methods include:

- Online: Many taxpayers prefer to file electronically using IRS-approved software, which can streamline the process and reduce errors.

- Mail: The form can also be printed and sent via postal service to the appropriate IRS address.

- In-Person: Some individuals may choose to deliver the form in person at local IRS offices, although this method is less common.

Quick guide on how to complete cr q1 form 2014

Effortlessly Complete Cr Q1 Form on Any Device

Digital document management has gained signNow momentum among businesses and individuals. It serves as an ideal environmentally friendly alternative to conventional printed and signed documents, allowing you to obtain the necessary form and securely archive it online. airSlate SignNow equips you with all the tools required to create, edit, and electronically sign your documents rapidly without unnecessary delays. Manage Cr Q1 Form on any device using the airSlate SignNow apps for Android or iOS and enhance any document-driven process today.

How to Edit and Electronically Sign Cr Q1 Form with Ease

- Find Cr Q1 Form and then click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize pertinent sections of the documents or redact sensitive information using the tools that airSlate SignNow specifically provides for that purpose.

- Create your electronic signature with the Sign tool, which takes seconds and holds the same legal validity as a traditional wet ink signature.

- Review the information and then click the Done button to save your modifications.

- Choose how you'd like to send your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow addresses all of your document management needs with just a few clicks from your preferred device. Modify and electronically sign Cr Q1 Form to ensure excellent communication throughout the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct cr q1 form 2014

Create this form in 5 minutes!

How to create an eSignature for the cr q1 form 2014

How to make an eSignature for a PDF document in the online mode

How to make an eSignature for a PDF document in Chrome

The way to generate an eSignature for putting it on PDFs in Gmail

How to create an electronic signature right from your mobile device

The best way to make an eSignature for a PDF document on iOS devices

How to create an electronic signature for a PDF on Android devices

People also ask

-

What is the Cr Q1 Form used for?

The Cr Q1 Form is a key document often required for tax purposes, allowing businesses to report their quarterly earnings and manage their tax obligations effectively. Utilizing airSlate SignNow, users can easily fill out and eSign the Cr Q1 Form, simplifying the submission process.

-

How does airSlate SignNow help with the Cr Q1 Form?

airSlate SignNow provides an intuitive platform for completing and electronically signing the Cr Q1 Form. With features designed for efficiency, users can streamline their document workflow, ensuring that their forms are completed accurately and submitted in a timely manner.

-

Is there a cost associated with using airSlate SignNow for the Cr Q1 Form?

Yes, there are cost-effective pricing plans available for businesses using airSlate SignNow to manage documents like the Cr Q1 Form. These plans are designed to offer flexibility and scalability to meet the needs of various users, whether small businesses or large enterprises.

-

Can I integrate airSlate SignNow with other software for the Cr Q1 Form?

Absolutely! airSlate SignNow offers seamless integrations with various third-party applications that streamline the management of the Cr Q1 Form. This allows users to connect their existing workflows and enhance productivity by eliminating manual data entry and errors.

-

What are the benefits of using airSlate SignNow for the Cr Q1 Form?

Using airSlate SignNow for the Cr Q1 Form provides numerous benefits, including faster processing times, improved accuracy, and enhanced compliance with tax regulations. Additionally, electronic signatures ensure that documents are secure and legally binding, offering peace of mind during submissions.

-

Is the Cr Q1 Form secure when using airSlate SignNow?

Yes, security is a top priority for airSlate SignNow. The platform uses advanced encryption and security protocols to ensure that your Cr Q1 Form and other sensitive documents are protected from unauthorized access, ensuring confidentiality and integrity.

-

How can I get started with airSlate SignNow for the Cr Q1 Form?

To get started with airSlate SignNow for the Cr Q1 Form, visit our website and sign up for a free trial. This allows you to explore our features, including document management and eSigning capabilities, and see how we can simplify your form handling.

Get more for Cr Q1 Form

- Move out document form

- Certificate of disposition form

- Application forms for funza lushaka

- Hipaa training acknowledgement form

- Jubilee health insurance inpatient claim reimbursement form

- Ita 5150 wayne state university form

- Locked bag seven hills nsw 2147 or kennards hire form

- Chain of custody form xlsx

Find out other Cr Q1 Form

- Sign Idaho Banking Rental Lease Agreement Online

- How Do I Sign Idaho Banking Limited Power Of Attorney

- Sign Iowa Banking Quitclaim Deed Safe

- How Do I Sign Iowa Banking Rental Lease Agreement

- Sign Iowa Banking Residential Lease Agreement Myself

- Sign Kansas Banking Living Will Now

- Sign Kansas Banking Last Will And Testament Mobile

- Sign Kentucky Banking Quitclaim Deed Online

- Sign Kentucky Banking Quitclaim Deed Later

- How Do I Sign Maine Banking Resignation Letter

- Sign Maine Banking Resignation Letter Free

- Sign Louisiana Banking Separation Agreement Now

- Sign Maryland Banking Quitclaim Deed Mobile

- Sign Massachusetts Banking Purchase Order Template Myself

- Sign Maine Banking Operating Agreement Computer

- Sign Banking PPT Minnesota Computer

- How To Sign Michigan Banking Living Will

- Sign Michigan Banking Moving Checklist Mobile

- Sign Maine Banking Limited Power Of Attorney Simple

- Sign Michigan Banking Moving Checklist Free