Ohio it 1040 Form 2019

What is the Ohio IT 1040 Form

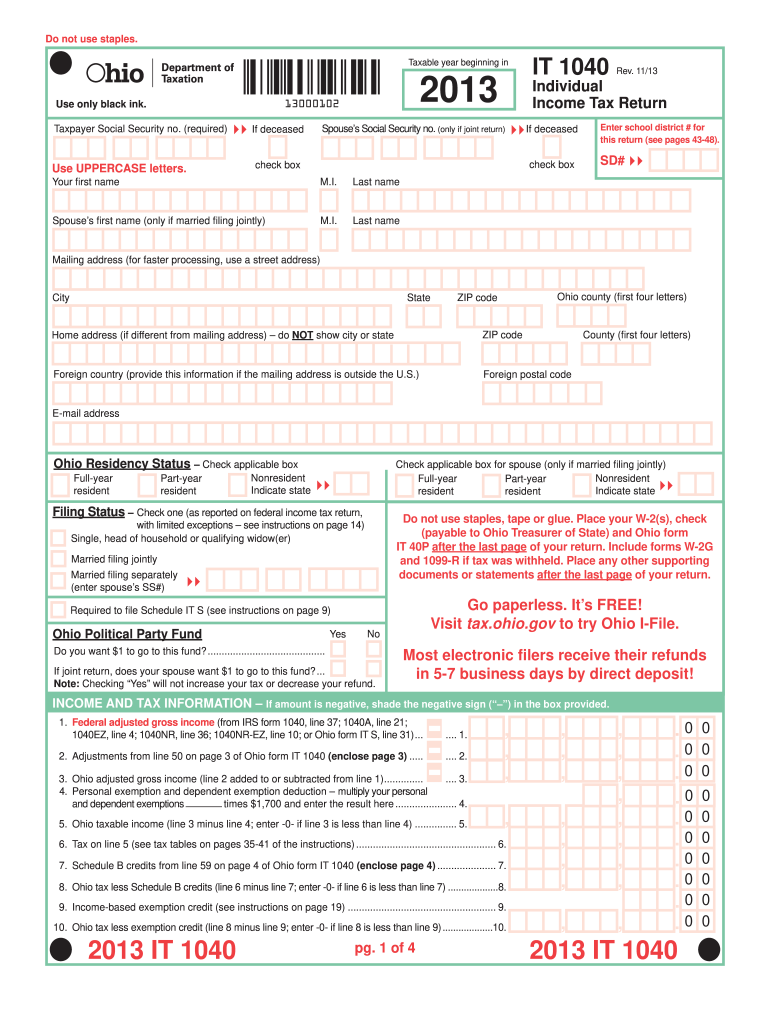

The Ohio IT 1040 Form is a state income tax return used by residents of Ohio to report their income and calculate their tax liability. This form is essential for individuals who earn income within the state, as it ensures compliance with Ohio tax laws. The IT 1040 is designed to capture various sources of income, including wages, salaries, and self-employment earnings. Completing this form accurately is vital for determining the amount of tax owed or any refund due.

How to Use the Ohio IT 1040 Form

Using the Ohio IT 1040 Form involves several steps to ensure all necessary information is accurately reported. First, gather all relevant financial documents, such as W-2s, 1099s, and any other income statements. Next, fill out the form by entering personal information, including your name, address, and Social Security number. Report your total income, deductions, and credits to calculate your taxable income. Finally, submit the form by the specified deadline to avoid penalties.

Steps to Complete the Ohio IT 1040 Form

Completing the Ohio IT 1040 Form requires careful attention to detail. Follow these steps:

- Gather all necessary documents, including income statements and deduction records.

- Fill out your personal information at the top of the form.

- Report your total income from all sources.

- Claim any applicable deductions and credits to reduce your taxable income.

- Calculate your tax liability based on the provided tax tables.

- Sign and date the form, confirming the accuracy of the information provided.

- Submit the completed form by mail or electronically, depending on your preference.

Filing Deadlines / Important Dates

It is crucial to be aware of the filing deadlines associated with the Ohio IT 1040 Form. Typically, the deadline for filing is April 15 of each year, aligning with the federal tax filing deadline. If this date falls on a weekend or holiday, the deadline may be extended to the next business day. Taxpayers should also be aware of any extensions available, which may allow for additional time to file without incurring penalties.

Required Documents

To complete the Ohio IT 1040 Form accurately, several documents are required:

- W-2 forms from employers detailing annual wages.

- 1099 forms for any freelance or self-employment income.

- Records of any additional income, such as rental or investment income.

- Documentation for deductions, including mortgage interest statements and receipts for charitable contributions.

- Any relevant tax credit information that may apply.

Legal Use of the Ohio IT 1040 Form

The Ohio IT 1040 Form is legally binding and must be completed truthfully to avoid penalties. Providing false information on the form can lead to legal repercussions, including fines and potential criminal charges. It is essential to ensure that all information is accurate and that the form is submitted by the deadline to maintain compliance with Ohio tax laws.

Quick guide on how to complete 2013 ohio it 1040 form

Effortlessly prepare Ohio It 1040 Form on any device

Managing documents online has gained traction among businesses and individuals alike. It offers an ideal eco-friendly substitute for conventional printed and signed documents, as you can access the necessary form and securely store it online. airSlate SignNow equips you with all the resources needed to create, edit, and electronically sign your paperwork swiftly and without holdups. Manage Ohio It 1040 Form on any platform with the airSlate SignNow apps for Android or iOS and enhance any document-related task today.

How to edit and electronically sign Ohio It 1040 Form with ease

- Locate Ohio It 1040 Form and then click Get Form to commence.

- Utilize the tools we offer to complete your document.

- Highlight pertinent sections of your documents or obscure sensitive information with tools that airSlate SignNow specifically provides for that purpose.

- Create your signature with the Sign tool, which takes moments and carries the same legal validity as a traditional ink signature.

- Review the details and click on the Done button to save your modifications.

- Choose how you want to distribute your form: via email, SMS, or invitation link, or download it to your computer.

Forget about losing or misplacing files, tedious document searches, or mistakes that require printing new copies. airSlate SignNow fulfills all your document management requirements in just a few clicks from any device you prefer. Modify and electronically sign Ohio It 1040 Form and ensure excellent communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2013 ohio it 1040 form

Create this form in 5 minutes!

How to create an eSignature for the 2013 ohio it 1040 form

The best way to create an eSignature for your PDF file in the online mode

The best way to create an eSignature for your PDF file in Chrome

The best way to make an eSignature for putting it on PDFs in Gmail

How to make an eSignature from your smartphone

The way to generate an electronic signature for a PDF file on iOS devices

How to make an eSignature for a PDF file on Android

People also ask

-

What is the Ohio IT 1040 Form?

The Ohio IT 1040 Form is the state income tax return form used by residents of Ohio to report their income and calculate their tax liability. It is essential for ensuring compliance with state tax laws. Filing this form accurately helps you avoid penalties and secure any refunds you may be eligible for.

-

How can airSlate SignNow help with the Ohio IT 1040 Form?

airSlate SignNow simplifies the process of eSigning and sending your Ohio IT 1040 Form. Our platform streamlines document management and ensures your forms are securely signed and stored. This means you can focus on filing your taxes without the hassle of paper documents.

-

Is there a cost associated with using airSlate SignNow for the Ohio IT 1040 Form?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs. These plans are cost-effective, providing you with a powerful tool to manage your Ohio IT 1040 Form and other documents. You can choose the plan that best suits your usage and budget.

-

What features does airSlate SignNow offer for managing the Ohio IT 1040 Form?

Our platform includes features like eSignature, document templates, and secure storage, making it easy to handle the Ohio IT 1040 Form. You can also track the signing process, set reminders, and integrate with other tools for a seamless workflow. These features enhance your overall experience and efficiency.

-

What are the benefits of using airSlate SignNow for the Ohio IT 1040 Form?

Using airSlate SignNow for your Ohio IT 1040 Form brings various benefits, including increased efficiency and reduced turnaround time. The intuitive interface allows for quick navigation and fast document preparation. Additionally, your documents are stored securely, ensuring confidentiality and compliance.

-

Can I integrate airSlate SignNow with other applications for my Ohio IT 1040 Form?

Yes, airSlate SignNow supports integration with several popular applications and platforms, which allows you to sync your data and manage your Ohio IT 1040 Form more effectively. This integration capability enhances your workflow and ensures that all your documents are up-to-date and accessible.

-

How secure is airSlate SignNow when handling the Ohio IT 1040 Form?

Security is a priority at airSlate SignNow. Our platform employs advanced encryption and compliance measures to protect your Ohio IT 1040 Form and any sensitive information. You can trust that your documents are safe while being processed and stored on our platform.

Get more for Ohio It 1040 Form

Find out other Ohio It 1040 Form

- eSign New York Government Emergency Contact Form Online

- eSign North Carolina Government Notice To Quit Now

- eSign Oregon Government Business Plan Template Easy

- How Do I eSign Oklahoma Government Separation Agreement

- How Do I eSign Tennessee Healthcare / Medical Living Will

- eSign West Virginia Healthcare / Medical Forbearance Agreement Online

- eSign Alabama Insurance LLC Operating Agreement Easy

- How Can I eSign Alabama Insurance LLC Operating Agreement

- eSign Virginia Government POA Simple

- eSign Hawaii Lawers Rental Application Fast

- eSign Hawaii Lawers Cease And Desist Letter Later

- How To eSign Hawaii Lawers Cease And Desist Letter

- How Can I eSign Hawaii Lawers Cease And Desist Letter

- eSign Hawaii Lawers Cease And Desist Letter Free

- eSign Maine Lawers Resignation Letter Easy

- eSign Louisiana Lawers Last Will And Testament Mobile

- eSign Louisiana Lawers Limited Power Of Attorney Online

- eSign Delaware Insurance Work Order Later

- eSign Delaware Insurance Credit Memo Mobile

- eSign Insurance PPT Georgia Computer