Otc 901 Form 2020

What is the Otc 901 Form

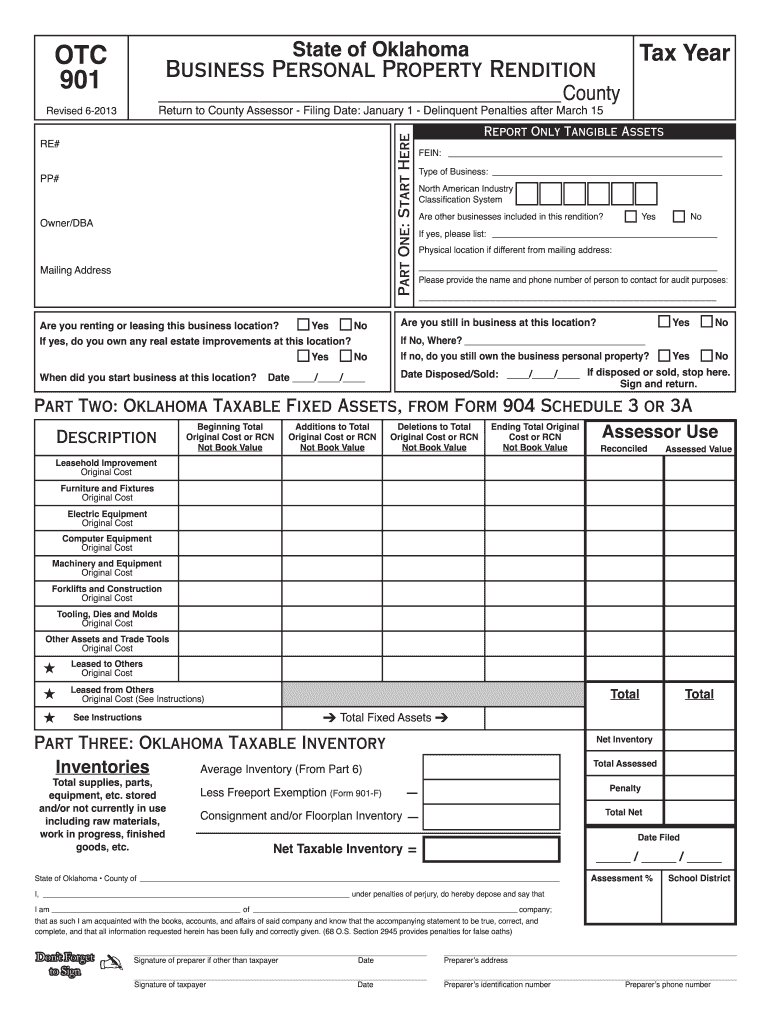

The Otc 901 Form is a specific document used for tax-related purposes in the United States. It is typically associated with the reporting of certain transactions or financial activities. Understanding this form is essential for individuals and businesses to ensure compliance with federal tax regulations. The form collects necessary information that may impact tax liabilities and reporting requirements.

How to use the Otc 901 Form

Using the Otc 901 Form involves a few straightforward steps. First, gather all relevant financial information that pertains to the transactions you need to report. Next, accurately fill out the form, ensuring that all sections are completed as required. After completing the form, review it for accuracy before submission. It is important to retain a copy for your records, as this can be useful for future reference or in the event of an audit.

Steps to complete the Otc 901 Form

Completing the Otc 901 Form requires careful attention to detail. Here are the steps to follow:

- Begin by downloading the latest version of the Otc 901 Form from an official source.

- Fill in your personal or business information, including name, address, and taxpayer identification number.

- Provide details about the transactions you are reporting, ensuring all amounts are accurate.

- Sign and date the form, confirming that all information is true and complete.

- Submit the form according to the guidelines provided, whether online, by mail, or in person.

Legal use of the Otc 901 Form

The legal use of the Otc 901 Form is governed by federal tax laws. To ensure that the form is legally binding, it must be completed accurately and submitted within the designated timeframes. Failure to comply with these regulations can result in penalties or fines. It is crucial to understand the legal implications of the information provided on this form, as it may affect your tax obligations.

Key elements of the Otc 901 Form

Several key elements are essential for the Otc 901 Form to be valid. These include:

- Taxpayer Information: Accurate identification of the taxpayer is necessary.

- Transaction Details: Clear reporting of the transactions involved is critical.

- Signature: The form must be signed by the appropriate individual to validate the information.

- Date: Including the date of completion is important for record-keeping purposes.

Who Issues the Form

The Otc 901 Form is typically issued by the Internal Revenue Service (IRS) or a relevant state tax authority. These agencies provide the necessary guidelines and updates regarding the form's use. It is important to refer to official resources to ensure that you are using the correct version and following the latest instructions for completion and submission.

Quick guide on how to complete otc 901 2011 form

Prepare Otc 901 Form effortlessly on any device

Online document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed paperwork, allowing you to access the correct form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents quickly without delays. Manage Otc 901 Form on any platform using airSlate SignNow’s Android or iOS applications and streamline any document-related process today.

How to modify and electronically sign Otc 901 Form with ease

- Obtain Otc 901 Form and click on Get Form to begin.

- Make use of the tools we provide to fill out your document.

- Highlight important sections of the documents or redact sensitive information using tools that airSlate SignNow specifically offers for this purpose.

- Generate your signature using the Sign tool, which takes moments and carries the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Choose how you would like to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow manages all your document management needs in just a few clicks from any device you prefer. Modify and electronically sign Otc 901 Form and guarantee outstanding communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct otc 901 2011 form

Create this form in 5 minutes!

How to create an eSignature for the otc 901 2011 form

The best way to generate an eSignature for a PDF online

The best way to generate an eSignature for a PDF in Google Chrome

How to create an eSignature for signing PDFs in Gmail

The best way to create an eSignature right from your smartphone

How to create an eSignature for a PDF on iOS

The best way to create an eSignature for a PDF on Android

People also ask

-

What is the Otc 901 Form?

The Otc 901 Form is a document used for submitting certain types of healthcare claims. It is crucial for ensuring that your claims are processed accurately and efficiently. Understanding how to fill out the Otc 901 Form can help prevent delays in reimbursement.

-

How can airSlate SignNow assist with the Otc 901 Form?

airSlate SignNow simplifies the process of completing and submitting the Otc 901 Form. Our platform enables you to fill out the form electronically, sign it, and send it directly to the appropriate parties. This streamlines your workflow and reduces the chances of errors.

-

Is there a cost associated with using airSlate SignNow for the Otc 901 Form?

Yes, airSlate SignNow offers a cost-effective pricing model that ensures you can efficiently manage documents like the Otc 901 Form without breaking the bank. Various subscription plans are available, providing flexibility based on your business needs. This allows businesses of all sizes to access essential eSigning features.

-

What features does airSlate SignNow provide for the Otc 901 Form?

airSlate SignNow offers features such as templates, automated reminders, and secure storage for the Otc 901 Form. You can easily create templates for recurring submissions, ensuring consistency and saving time. Additionally, your documents are securely stored for future reference.

-

Can I integrate airSlate SignNow with other software for managing the Otc 901 Form?

Absolutely! airSlate SignNow offers integrations with various platforms, making it easier to manage the Otc 901 Form alongside your other business tools. Whether you need to connect with CRMs, ERPs, or document management systems, we provide the flexibility to enhance your workflow.

-

What are the benefits of using airSlate SignNow for the Otc 901 Form?

Using airSlate SignNow for the Otc 901 Form brings multiple benefits, including increased efficiency, reduced processing times, and enhanced accuracy. Our easy-to-use interface makes it simple to manage documents, ensuring that you can focus on your core business activities without getting bogged down by paperwork.

-

Is airSlate SignNow secure for handling sensitive information like the Otc 901 Form?

Yes, airSlate SignNow prioritizes security when handling documents such as the Otc 901 Form. We utilize advanced encryption protocols and comply with industry standards to protect your data. Rest assured that your sensitive information is safe throughout the document signing process.

Get more for Otc 901 Form

Find out other Otc 901 Form

- How To Electronic signature Idaho Insurance POA

- Can I Electronic signature Illinois Insurance Last Will And Testament

- Electronic signature High Tech PPT Connecticut Computer

- Electronic signature Indiana Insurance LLC Operating Agreement Computer

- Electronic signature Iowa Insurance LLC Operating Agreement Secure

- Help Me With Electronic signature Kansas Insurance Living Will

- Electronic signature Insurance Document Kentucky Myself

- Electronic signature Delaware High Tech Quitclaim Deed Online

- Electronic signature Maine Insurance Quitclaim Deed Later

- Electronic signature Louisiana Insurance LLC Operating Agreement Easy

- Electronic signature West Virginia Education Contract Safe

- Help Me With Electronic signature West Virginia Education Business Letter Template

- Electronic signature West Virginia Education Cease And Desist Letter Easy

- Electronic signature Missouri Insurance Stock Certificate Free

- Electronic signature Idaho High Tech Profit And Loss Statement Computer

- How Do I Electronic signature Nevada Insurance Executive Summary Template

- Electronic signature Wisconsin Education POA Free

- Electronic signature Wyoming Education Moving Checklist Secure

- Electronic signature North Carolina Insurance Profit And Loss Statement Secure

- Help Me With Electronic signature Oklahoma Insurance Contract